TIDMADVT

RNS Number : 6296V

Advancedadvt Limited

05 December 2023

5 December 2023

AdvancedAdvT Limited

Proposed cancellation of the Company's Ordinary Shares from the

Official List and proposed admission to trading on AIM

AdvancedAdvT Limited (LSE: ADVT, the "Company") intends to

request the Financial Conduct Authority ("FCA") to cancel the

standard listing of the ordinary shares of the Company (the

"Shares") on the Official List and to request the London Stock

Exchange to cancel the admission to trading of the Shares on the

main market (the "Cancellation").

The Company will apply for the admission of the Shares to

trading on the AIM market ("AIM") of the London Stock Exchange

("Admission"), such that Cancellation and Admission will take place

simultaneously.

Vin Murria , AdvancedAdvT's Executive Chairperson, said

"We are switching our listing to AIM and expect to have our

shares trading again on 10 January 2024. AIM provides a more

suitable regulatory environment for a business of our size and

structure as well as offering flexibility with regard to corporate

transactions, and will provide access to a broader pool of

institutional and other investors.

"The management's experience, expertise and proven track record,

together with GBP95m of cash and assets plus supportive

shareholders, position us extremely well to execute on our growth

strategy in a rapidly growing and evolving AI and digitally led

landscape.

"We recently acquired four businesses with notably strong

recurring revenues and have created an initial platform on which we

can rapidly scale, innovate and build both organically and

inorganically.

"Our two platforms, business/data and compliance solutions and

human capital management platforms, provide us with a strong and

solid foundation to capitalise on the anticipated rapid market

growth and increasing AI, digital transformation, data analytics

and business intelligence requirements across these sectors, whilst

also expanding our presence in adjacent markets, geographies and

digital sectors.

"Forecasts indicate that the business solutions, human capital

management and digital transformation markets are anticipated to

experience double-digit growth rates extending through 2030."

Core specialisms

On 31 July 2023, the Company completed the acquisition of five

software businesses from Capita plc for a combined enterprise value

of approximately GBP33 million in cash.

In the year ended 31 December 2022, these businesses generated a

total revenue of approximately GBP35 million, with approximately 74

per cent. of the revenue being recurring or from

Software-as-a-Service (SaaS).

Four of these businesses operate across two fundamental business

transformational areas: business/data and compliance, and human

capital management. Through these core specialisms, the Company

delivers innovative software solutions and a platform that enables

businesses and organisations to succeed in today's dynamic

landscape whilst providing an enabler for, Artificial Intelligence

("AI"), digital transformation, data analytics and business

intelligence.

-- Business Solutions ( Integrated Business Software and

Solutions Limited ): provision of financial management software

solutions and services. Innovative software solutions allows

organisations to achieve their financial and e-Business strategies

by driving transformational changes.

Its solutions can be hosted in both the private and public cloud

and are trusted by more than 150 public, health and private

organisations in the UK and Ireland. The use of AI, digital

transformation, data analytics and business intelligence software

are expected to be highly valuable to these markets.

-- Data&Compliance (CHKS Limited): one of the leading

providers of AI driven healthcare intelligence compliance and

benchmarking software to address the governance, risk and

compliance needs of its healthcare customers.

Its UK based tech-enabled solutions of accreditation,

benchmarking and coding services play a role in transforming

healthcare services, knowledge sharing and best practice to the

healthcare industry globally.

-- Human Capital Management ( R etain International Software

Limited ): an industry leading global AI centric resource planning

and talent management software and service provider. Its solutions

integrate with leading enterprise resource planning systems and are

trusted by some of the largest global consultancies to deliver

effective management and allocation of resources; optimise

utilisation and productivity, and enable efficient cost management,

financial and staff planning tasks.

-- Human Capital Management ( Workforce Management Software

Limited ): a workforce management software provider, with

well-established UK presence and embedded relationships across 300+

clients. Its ability to handle highly complex payroll calculations

delivering a gross number through it comprehensive time and

attendance and access control solutions provide real-time employee

tracking with tangible efficiency benefits.

On 21 November 2023, the Company entered into an agreement for

the sale of Synaptic Software Ltd ("Synaptic"), one of the five

businesses acquired from Capita plc, to Fintel IQ Limited (the

"Disposal") in order to enable the business to have a more

strategically aligned owner. Synaptic provides a technology

solution platform with research and compliance tools for the retail

financial sector. The Disposal and receipt of the net GBP3.5

million cash consideration is conditional upon, inter alia, the

approval of the change of ownership by the FCA.

Strategy

The Group's strategy is centred around backing sectors

characterised by long term AI, digital transformation, data

analytics and business intelligence trends, that are in early

stages of adoption and set to transform the workplace for

professionals for the next few decades.

Embracing a long-term perspective, the aim is to build a lasting

and thriving business. This thinking shapes how investment is

deployed on both M&A and within the platform businesses, in

order to develop relationships with clients and partners and with a

strategy centred around business and digital transformation and

continuous improvement.

This strategy revolves around evaluating high-quality businesses

in the pipeline, based on a set of key characteristics. These

characteristics align with the management team's vision and will

enable businesses to consistently generate long-term value. The

Company seeks businesses with:

-- high recurring revenue streams and good forward visibility;

-- sticky customer retention;

-- mission critical products and services;

-- sectors with high barriers to entry;

-- opportunities for both organic and inorganic growth;

-- strong cash generation; and

-- highly fragmented industries with opportunities for consolidation.

The Directors believe that the acquisitions embody these

characteristics and offer opportunities to expand the product

offerings to deliver against their existing and future client needs

and an opportunity to build on digitisation trends.

The Company will continue in its pursuit of opportunities where

a blend of management expertise, enhanced operational performance,

increased investment capital, and a targeted approach to

acquisitions can enable growth and value creation for stakeholders.

Growth opportunities may manifest within the existing acquired

businesses or potential target businesses and their core markets,

new territories and adjacent sectors.

Financing resources

As of 30 November 2023, the Company has approximately GBP78

million of cash available to fund further acquisitions, investment

and working capital. The Company will receive additional cash

proceeds following completion of the Disposal, conditional upon,

inter alia, the approval of the change of ownership by the FCA.

Management's track record

The Directors have significant experience executing transactions

using listed acquisition vehicles on the London Stock Exchange and

have successfully completed a vast array of M&A transactions on

and off London's capital markets. The Company plans to strengthen

the Board at the time of the Admission.

The management team boasts substantial experience in the

software and services sector, having invested in and operated a

range of high-performing businesses. The team have successfully

driven operational excellence within these enterprises, leading to

consistent organic growth. Moreover, it has a proven track record

of targeted and accretive mergers and acquisitions in the software

sector.

Market opportunity

The use of AI, digital transformation, data analytics and

business intelligence.

Across all sectors, businesses have increasingly embraced or are

embracing AI and digitalisation to optimise their insights,

processes, operations, and engagement. Implementing these

technologies and developing a digital transformation strategy is

vital for businesses pursuing growth, efficiency, and long-term

success. Sectors and businesses with the highest level of AI and

digitalisation tools have significant opportunity for productivity

growth.

While the potential of digital transformation and use of AI and

digitalisation tools is now recognised, the adoption of new AI and

digital strategies by businesses and consumers was, until recently,

somewhat limited by various barriers, including companies'

willingness to invest in and embrace these technologies. However,

the global restrictions imposed by the Covid-19 pandemic have

shattered these barriers and compelled businesses to become more

agile, resulting in a remarkable acceleration of digital

transformation.

Despite cost-cutting measures implemented due to the pandemic,

organisations have increased their spending on digital

transformation as they rapidly adapt their business models.

Harnessing technology has led to the reshaping of multiple aspects

of business operations, from internal processes and workflows to

customer interactions and business models.

The Directors believe that the current macroeconomic environment

presents a substantial investment opportunity in companies

well-positioned to harness the structural changes arising from this

unprecedented acceleration of AI and digitalisation.

These structural changes have profoundly impacted the way people

live, work, and consume, as well as how businesses operate, engage

with customers, and conduct sales. Consequently, businesses

embracing digital transformation, offering AI and digital

solutions, software, and services that enable and support its

strategy are expected to experience sustained demand for their

products.

Background

The Company was formed on 31 July 2020 for the purpose of

effecting a merger, share exchange, asset acquisition, share or

debt purchase, reorganisation or similar business combination with

one or more businesses. The Company was admitted to trading on the

standard listing segment of the Official List of the London Stock

Exchange on 4 December 2020.

The Company's objective is to generate attractive long-term

returns for shareholders and to enhance value by supporting

sustainable organic growth, acquisitions and other performance

improvements within the acquired companies.

On 5 January 2022, the Company made an investment in M&C

Saatchi in contemplation of a proposed merger, purchasing 12

million ordinary shares in M&C Saatchi for a price of GBP2 per

share. The executive chairperson of the Company, Vin Murria OBE,

owned 15,237,985 ordinary shares in M&C Saatchi and was at the

time a non-executive director on its board. This resulted in the

combined holdings of Vin Murria OBE and the Company representing

approximately 22.3 per cent. of the issued share capital of M&C

Saatchi. On 17 May 2022, the Company announced its firm intention

to make an offer for M&C Saatchi by way of a contractual

offer.

On 14 June 2022, the Company published the final offer document

in respect of the final offer for the issued and to be issued share

capital of M&C Saatchi not already owned by the Company. After

a prolonged process, the Company announced on 30 September 2022

that it had not received sufficient acceptances and the final offer

lapsed.

Cancellation and Admission

Pursuant to Listing Rule 5.2.8, the Company is required to give

at least 20 business days' notice of the intended Cancellation.

Therefore, it is intended that the Cancellation will become

effective from 8.00 a.m. (London time) on Wednesday 10 January

2024, such that the last day of trading of the Shares (with ISIN

VGG0103J1075) on the London Stock Exchange would be Tuesday 9

January 2024.

Admission is expected to take place, and dealings in Shares are

expected to commence on AIM, at 8.00 a.m. on Wednesday 10 January

2024.

Any change to the times and dates mentioned above will be

notified to shareholders by an announcement through a Regulatory

Information Service.

An AIM Admission Document will be available on the Company's

website at www.advancedadvt.com shortly before Admission.

Singer Capital Markets Advisory LLP will be appointed Nominated

Adviser to the Company upon Admission.

Enquiries:

AdvancedAdvT Limited

Vin Murria c/o Meare Consulting

Singer Capital Markets (Broker) Tel: 020 7496 3000

Philip Davies / Asha Chotai /

Sam Butcher

KK Advisory (Investor Relations) Tel: 020 7039 1901

Kam Bansil

Meare Consulting

Adrian Duffield Tel: 07990 858548

Further information on the Company can be found on its website

at www.advancedadvt.com . Neither the content of the Company's

website, nor the content on any website accessible from hyperlinks

on its website or any other website, is incorporated into, or forms

part of, this announcement nor, unless previously published by

means of a recognised information service, should any such content

be relied upon in reaching a decision as to whether or not to

acquire, continue to hold, or dispose of, securities in the

Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFSDFWLEDSELE

(END) Dow Jones Newswires

December 05, 2023 02:00 ET (07:00 GMT)

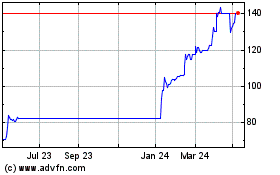

Advancedadvt (LSE:ADVT)

Historical Stock Chart

From Jan 2025 to Feb 2025

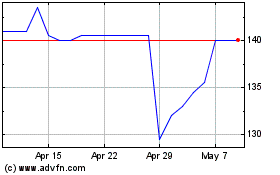

Advancedadvt (LSE:ADVT)

Historical Stock Chart

From Feb 2024 to Feb 2025