Ashtead Group Plc - Launches new share buyback programme

11 December 2024 - 6:00PM

UK Regulatory

Ashtead Group Plc - Launches new share

buyback programme

PR Newswire

LONDON, United Kingdom, December 11

THIS

ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE AN OFFER

FOR

SALE OF ANY SECURITIES OR AN OFFER OR INVITATION TO PURCHASE ANY

SECURITIES IN ANY

JURISDICTION

OR A SOLICITATION OF ANY VOTE OR APPROVAL.

NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION (DIRECTLY OR INDIRECTLY)

IN WHOLE OR IN PART

IN,

INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE

RELEVANT

LAWS OR REGULATIONS OF THAT JURISDICTION.

11 December 2024

Ashtead

Group plc

Launches

new share buyback programme of up to USD 1.5

billion

Pursuant

to the disclosure by Ashtead Group plc (the "Company")

in the second quarter results announcement on 10 December

concerning the launch of a new share buyback programme of up to

$1.5bn over 18 months, Ashtead Group

plc (the "Company")

announces that it has entered into an arrangement with Barclays

Bank PLC, acting through its Investment Bank ("Barclays").

The arrangement allows Barclays to purchase, together with any

other ordinary shares in the Company (the "Shares")

purchased on the Company's behalf pursuant to this buyback

programme, up to (a) in accordance with the terms of the Company's

current buyback authority granted by shareholder resolution dated

4 September 2024, 65,551,091 Shares

up to and including the date of the next AGM; and (b) following the

expiry of such current buyback authority, the aggregate number of

Shares authorised to be purchased by the Company under any

subsequent buyback authority granted during the arrangement (which

in any event shall be less than 15% of the relevant class of the

Company's equity shares at the date of such authority). These share

purchases will be made by Barclays acting as riskless principal and

in accordance with the arrangement, and they shall be made

independently of and uninfluenced by the Company.

Any share

purchases effected pursuant to the arrangement will be subject to

the terms of the arrangement with Barclays and in any case will be

effected in a manner consistent with both the general authority

vested in the Company to repurchase shares and the United Kingdom

Listing Rules, which require that the maximum price paid be limited

to be no more than the lower of (i) 105 per cent of the average

middle market closing price of the Company's ordinary shares for

the five business days before the purchase is made, and (ii) the

higher of the price of the last independent trade and the highest

current independent bid on the trading venue where the purchase is

carried out.

Following

the purchase of the Shares, they will be placed into treasury. The

sole purpose of these share purchases is to reduce the Company's

share capital.

Further

enquiries:

|

Will

Shaw

|

Ashtead

Group plc

|

+44 (0)20

7726 9700

|

|

Sam

Cartwright

|

H/Advisors

Maitland

|

+44 (0)20

7379 5151

|

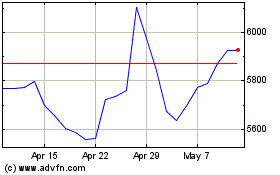

Ashtead (LSE:AHT)

Historical Stock Chart

From Nov 2024 to Dec 2024

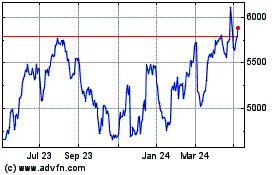

Ashtead (LSE:AHT)

Historical Stock Chart

From Dec 2023 to Dec 2024