Interim Results

26 August 2008 - 4:00PM

UK Regulatory

RNS Number : 8785B

Alba Mineral Resources PLC

26 August 2008

Alba Mineral Resources plc

("Alba" or "the Company" and collectively with its subsidiary companies "the Group")

Half Yearly Report - 31 May 2008

CHAIRMAN'S STATEMENT

Introduction

The highlight of Alba Mineral Resources' exploration in the last six months was the discovery of potentially economic concentrations of

uranium in northern Mauritania; this was notified to the market 7 July 2008. In addition to the seven uranium permits held in northern

Mauritania, the Company, through its partially-owned subsidiary Mauritania Ventures Limited (MVL), has also applied for five exploration

permits in the south of the country. The permits currently under application are for iron oxide-copper-gold (IOCG) mineralization.

The Group also holds a large and diverse portfolio of mineral properties in Scotland (nickel-copper and gold), Ireland (gold and

base-metals) and Sweden (nickel-copper). The projects are at different stages of development and range from early exploration targets to

more advanced drill-ready projects.

Results for the Period

The Group made a loss attributable to equity holders of the parent for the period, after taxation, of �156,711. The basic and diluted

loss per share was 0.18 pence. The Group had cash balances of �86,203 at the period end.

Review of Activities

Our activities in the first half of the year have been primarily focused in Mauritania. On 7 July 2008 we announced that MVL had located

visible uranium mineralization and had been awarded a further two exploration permits. Ground-based exploration work carried out in February

2008 confirmed the presence of uranium mineralisation containing potentially economic uranium grades of up to 0.092% U3O8 (See note 4).

Fieldwork carried out on the IOCG permits in southern Mauritania confirmed the presence of copper and gold in existing showings.

A second exploration programme was undertaken in April 2008 and the findings from this programme will be reported in detail when the

laboratory results are available.

Outlook

The Group, although now focused as a uranium and nickel junior explorer, will continue to evaluate additional cost effective projects

and proposals that the Board believes have the potential to add value to the Group. The Board believes it is developing not only a strong

portfolio of primary projects, but also a series of supplementary exploration projects. The rationale behind this approach is to limit the

Group's risk on a particular commodity or the political or climatic restrictions associated with a particular geographical area.

As announced 1 August 2008 the Company successfully completed a �50,000 fund raising. The Company is still seeking to raise further

funds in the near term and will work with joint venture partners where possible as the need for funds is ongoing and is under constant

review. Our exploration programmes can only be financed within our financial constraints. Part of this review process will also focus on the

existing licences and permits and properties, which if it is felt do not fit with the Group's profile going forward will be surrendered.

Mike Nott

25 August 2008

Chairman

UNAUDITED CONSOLIDATED INCOME STATEMENT

Unaudited Unaudited

6 months ended 6 months ended

31 May 2008 31 May 2007

� �

Revenue - -

Cost of sales - -

Gross profit - -

Administrative expenses (160,249) (213,053)

Operating loss (160,249) (213,053)

Investment revenue 909 4,123

Loss before taxation (159,340) (208,930)

Taxation (note 2) - -

Loss for the period (159,340) (208,930)

Attributable to:

Equity holders of the parent (156,711) (207,320)

Minority interest (2,629) (1,610)

Loss for the period (159,340) (208,930)

Loss per ordinary 1p share (note 3)

- basic and diluted 0.18 pence 0.3 pence

UNAUDITED CONSOLIDATED BALANCE SHEET

Unaudited Unaudited

31 May 2008 31 May 2007

� �

Non-current assets

Intangible assets - deferred exploration costs 1,049,895 802,732

Intangible assets - goodwill 67,614 122,934

Property, plant and equipment 4,959 11,084

1,122,468 936,750

Current assets

Trade and other receivables 99,317 82,860

Cash and cash equivalents 86,203 155,092

185,520 237,952

Total assets 1,307,988 1,174,702

Current liabilities

Trade and other payables (285,576) (184,010)

Borrowings (152,030) (60,005)

Total liabilities (437,606) (244,015)

Net assets 870,382 930,687

Equity and liabilities

Share capital 880,701 666,201

Share premium account 908,400 790,133

Merger reserve 200,000 200,000

Other reserve (509) (509)

Profit and loss account (1,152,933) (766,246)

Equity attributable to equity holders of the parent 835,659 889,579

Minority interest 34,723 41,108

Total equity and liabilities 870,382 930,687

UNAUDITED CONSOLIDATED CASH FLOW STATEMENT

Unaudited Unaudited

6 months ended 6 months ended

31 May 2008 31 May 2007

� �

Net cash used in operating activities (91,178) (155,471)

Investing activities

Interest received 909 4,123

Purchase of intangible assets (239,237) (193,791)

Purchase of property, plant and equipment - (7,337)

Net cash used in investing activities (238,328) (197,005)

Financing activities

Proceeds from issue of share capital - -

Borrowings 92,025 -

Net cash generated from financing activities 92,025 -

Net decrease in cash and cash equivalents (237,481) (352,476)

Cash and cash equivalents at the beginning of the period 323,684 507,568

Cash and cash equivalents at the end of the period 86,203 155,092

Operating loss (160,249) (213,053)

Depreciation and amortisation 20,715 19,132

Intangible asset write offs - -

Decrease in trade and other receivables 1,375 75,202

Increase/(decrease) in trade and other payables 46,981 (36,752)

Net cash used in operating activities (91,178) (155,471)

NOTES

1. Basis of preparation

The Group consolidates the financial statements of the Company and its subsidiary undertakings.

The financial information has been prepared under the historical cost convention in accordance with International Financial Reporting

Standards (IFRSs). This is the first financial period that the Group has adopted IFRSs. This did not result in any material amendment to the

Group*s accounting policies or the results previously presented.

The financial information set out in this half-yearly report does not constitute statutory accounts as defined in Section 240 of the

Companies Act 2005.

2. Taxation

No charge for corporation tax for the period has been made due to the expected tax losses available.

3. Loss per share

Basic loss per share is calculated by dividing the loss attributable to ordinary shareholders of �156,711 (May 2007: �207,320; November

2007: �437,296) by the weighted average number of shares of 88,070,100 (May 2007: 66,620,100; November 2007: 67,673,662) in issue during the

period. The diluted loss per share calculation is identical to that used for basic loss per share as the exercise of warrants would have the

effect of reducing the loss per ordinary share and therefore is not dilutive under the terms of Financial Reporting Standard 22 *Earnings

Per Shares*.

4. Uranium content of samples

Samples collected in Mauritania contain uranium concentrations up to 783 parts per million (ppm), which is equivalent to 0.092% U3O8.

Economic low-grade uranium deposits typically contain between 300 and 20,000 ppm uranium. Using the average uranium price of $65 per pound

for May 2008, one tonne of the above uranium-bearing rock from Mauritania would contain $132 worth of uranium. As a broad comparator, if

this was expressed as gold equivalents it would represent a grade of 4.7 g/t.

For further information contact:

Alba Mineral Resources plc Mike Nott, Chairman Tel: +44 (0) 20 7495 5326

Dowgate Capital Advisers Ltd Liam Murray, Tel: +44 (0) 20 7492 4777

Nominated Advisor

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UURKRWARWURR

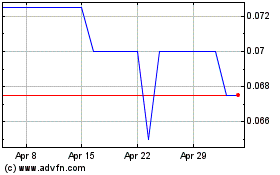

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Feb 2024 to Feb 2025