TIDMAMGO

RNS Number : 4173N

Amigo Holdings PLC

29 September 2021

29 September 2021

Amigo Holdings PLC

("Amigo" or the "Company")

Results of the Annual General Meeting

Amigo Holdings PLC (LSE: AMGO), a leading provider of guarantor

loans in the UK, announces that at the Company's 2021 Annual

General Meeting ("AGM") held earlier today at the Hilton

Bournemouth, Terrace Road, Bournemouth BH2 5EL, all the resolutions

set out in the Notice of Annual General Meeting 2021 were

passed.

In accordance with Listing Rule 9.6.2R, copies of all the

resolutions passed other than resolutions concerning ordinary

business will shortly be submitted to the National Storage

Mechanism.

A summary of the results in respect of each resolution is set

out below.

NUMBER % FOR NUMBER OF % AGAINST NUMBER

OF VOTES VOTES OF VOTES

Resolution FOR AGAINST WITHHELD

----------------------------- ------------------- -------- ---------------------- ---------- -------------------

Receive accounts

for year ended

1 31 March 2021 11,601,496 100.00% - 0.00% 35,766

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

Approve Directors'

Remuneration

2 Report 11,581,496 99.83% 20,000 0.17% 35,766

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

To re-elect Jonathan

3 Roe as a Director 11,616,496 100.00% - 0.00% 20,766

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

To elect Maria

Darby-Walker

4 as a Director 11,606,496 99.91% 11,000 0.09% 19,766

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

To elect Michael

Bartholomeusz

5 as a Director 11,598,424 99.91% 10,000 0.09% 28,838

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

To re-elect Gary

Jennison as a

6 Director 11,617,496 100.00% - 0.00% 19,766

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

To elect Mike

Corcoran as a

7 Director 11,607,496 99.91% 10,000 0.09% 19,766

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

Re-appoint KMPG

8 as auditor 9,899,945 85.22% 1,717,551 14.78% 19,766

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

Authority to

set remuneration

9 of auditor 11,591,090 99.99% 1,406 0.01% 34,766

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

Authority to

increase minimum

10 borrowing limit 10,752,496 92.67% 850,000 7.33% 34,766

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

To ratify action

of the Company

relating to Article

11 95 11,600,090 99.99% 1,406 0.01% 35,766

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

Authority to

make political

12 donations 10,724,166 99.74% 28,330 0.26% 884,766

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

Authority for

Directors to

13 allot shares 11,289,314 97.30% 313,182 2.70% 34,766

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

Dis-application

of pre-emption

14 rights 11,584,171 99.86% 15,919 0.14% 37,172

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

Further dis-application

of pre-emption

15 rights 10,734,171 92.54% 865,919 7.46% 37,172

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

Authority for

the Company to

purchase own

16 ordinary shares 10,446,233 90.03% 1,156,263 9.97% 34,766

--- ------------------------ ------------------- -------- ---------------------- ---------- -------------------

Authority to

call a general

meeting other

than an AGM on

not less than

17 14 days' notice 11,607,496 99.91% 10,000 0.09% 19,766

=== ======================== ------------------- -------- ---------------------- ---------- -------------------

The Board would like to thank shareholders for their engagement

and support ahead of the AGM and throughout the year.

Notes:

1. Votes "for" include proxy appointments which gave discretion

to the Chairman of the GM. A "vote withheld" is not a vote under

English law and is therefore the percentage of voting shares is the

percentage of shares voted and excludes shares on which votes were

withheld.

2. As at 16.30 p.m. on Monday 27 September 2021, being the time

at which a person had to be registered in the Company's register of

members in order to vote at the GM, the number of ordinary shares

of the Company in issue was 475,333,760.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014. The

person responsible for this announcement is Roger Bennett, Company

Secretary.

Company

Amigo Holdings PLC investors@amigo.me

Mike Corcoran Chief Financial Officer

Kate Patrick Head of Investor Relations

Media enquiries Amigoloans@lansons.com

Tom Baldock 07860 101715

Additional information

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of, any securities, or the solicitation of any

vote or approval in any jurisdiction, pursuant to this announcement

or otherwise.

Senior Secured Notes

This announcement constitutes notice by Amigo Luxembourg S.A.

(the "Issuer") to the holders of the Issuer's 7.625% Senior Secured

Notes due 2024 (for the notes issued pursuant to Rule 144A of the

United States Securities Act of 1933, ISIN: XS1533928468 and Common

Code: 153392846; for the notes issued pursuant to Regulation S of

the United States Securities Act of 1933, ISIN: XS1533928625 and

Common Code: 153392862) (the "Notes") issued pursuant to pursuant

to Section 4.03(a)(3) of an indenture dated January 20, 2017 among,

inter alia, the Issuer, the guarantors named therein and U.S. Bank

Trustees Limited, as trustee and security agent. Amigo Holdings PLC

is the indirect parent company of the Issuer. This announcement

shall constitute a "Report" to holders of the Notes.

-ENDS-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGUKSURAUUKUAR

(END) Dow Jones Newswires

September 29, 2021 08:44 ET (12:44 GMT)

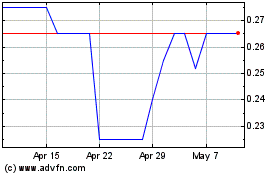

Amigo (LSE:AMGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amigo (LSE:AMGO)

Historical Stock Chart

From Apr 2023 to Apr 2024