TIDMATMA

RNS Number : 2777F

ATLAS Mara Limited

14 July 2021

14 July 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Atlas Mara Limited

( the "Company")

Atlas Mara Announces Successful Restructuring

Key Highlights:

-- Atlas Mara announces execution of a binding debt

restructuring agreement with a significant majority of its

creditors

-- This milestone provides long-term stability for the Company

to implement its strategic review, including its divestment

programme and maintain on-going operations

-- These actions pertain only to the Group's holding company

structure and do not impact the subsidiary banks, whose underlying

performance remains strong

-- Company continues to make progress on completion of previously announced divestitures

Atlas Mara Limited ("Atlas Mara" or the "Company," and including

its subsidiaries, the "Group"), the sub-Saharan African financial

services group, hereby provides an update on the outcome of its

discussions with bilateral lenders and certain principal holders of

the Group's convertible bonds.

The Company is pleased to announce that it has entered into a

support and override agreement with a significant majority of its

creditors in respect of the Company's and ABC Holdings Limited's

("ABCH") financing arrangements (the "Support and Override

Agreement" or "restructuring agreement"). Creditors representing 88

per cent. of the aggregate amount of debt outstanding under the

Company's direct and contingent financial liabilities agreed to

enter the Support and Override Agreement. This includes over 60 per

cent. of the principal holders of the Group's convertible

bonds.

This high level of support from the creditors enables a

long-term stable platform to allow the Company to complete its

strategic review and divestments program. The restructuring

agreement forbears or extends the repayment schedules of the debt

of the Company and ABCH, providing additional time for value

recovery amid the ongoing challenging macroeconomic environment. As

mentioned in prior market announcements, due to impact of the

on-going pandemic and macro challenges faced in the markets in

which it operates, the Company embarked on the process that now

culminates in the execution of this restructuring agreement.

The Support and Override Agreement is focused only on the

Group's holding company structure and does not include the

operating subsidiaries as parties (although they receive certain

benefits from the holding companies being parties). The key terms

of the Support and Override Agreement include:

-- the creditors who are a party to the Support and Override

Agreement (the "Participating Creditors") have agreed to

forbearances in respect of certain events of default under their

relevant facilities while the Support and Override Agreement is

effective including (i) non-payment of amounts due under certain of

the Company's and ABCH's financing agreements, (ii) any

deterioration in the financial or operational performance of the

Group as a result of COVID-19, and (iii) any breach of any

financial covenant under certain of the Company's and ABCH's

financing agreements;

-- the Participating Creditors with direct facilities with the

Company have agreed to forbearances in respect of the maturities of

their facilities to 30 September 2021, with the possibility of

further extension;

-- the Participating Creditors with direct facilities with ABCH

have agreed to waive the maturities of their facilities until 31

December 2022, with the possibility of further extension;

-- proceeds received in respect of the Group's on-going

strategic divestments will be held by Wilmington Trust, acting as

Global Agent, to support repayments of the Company's and ABCH's

creditors in accordance with agreed "waterfall" arrangements;

-- Participating Creditors have agreed to either support, or not

object to, the Company and ABCH proposing a restructuring procedure

if required, including a UK restructuring plan, UK scheme of

arrangement or a scheme of arrangement under Part IX of the British

Virgin Islands Business Companies Act 2004, to ensure that all of

the Company's financial creditors become bound by the terms of the

Support and Override Agreement;

-- the Support and Override Agreement also governs, and provides

a stable framework for, the Company's ongoing liquidity needs -

current projections show that the Support and Override Agreement

will allow the Company to meet its liquidity needs for the duration

of the term of the Support and Override Agreement;

-- the Support and Override Agreement also requires the Company

to consider taking steps to cancel the listing and admission to

trading on the London Stock Exchange of the Company's shares in

order to reduce costs and administrative burden since the listing

does not generate sufficient benefit to the Company, and in the

context of the on-going strategic review. The Company will update

the market regarding any such delisting and the steps required in

order to implement it or other strategic options; and

-- the Support and Override Agreement will terminate either

automatically, or upon notice from certain Participating Creditors,

if specific criteria are not met, such as divestment milestones or

any successful liquidation applications.

The Company remains focused on executing on its strategic review

and divestiture programme, to maximize value for its creditors and

other stakeholders. As previously updated, the Company has entered

into agreements with respect to its assets in Mozambique, Rwanda,

Tanzania, and Botswana, and hereby provides the following updates.

As previously announced, the transaction with respect to its

investment in Mozambique was completed in May 2021. The Company has

secured regulatory approval for the transactions with respects to

its investments in Rwanda and Botswana, and parties are now in the

process of concluding pre-completion conditions. Regulatory

approval is pending with respect to the transaction with respect to

its investment in Tanzania.

In parallel, the Company continues discussions with certain

creditors with smaller claims and who are not currently party to

the Support and Override Agreement. Further, the Company is

robustly contesting TLG's liquidation application, which the

Company believes is without merit and not in the best interests of

the Company's creditors nor TLG itself. As demonstrated by the

Support and Override Agreement, the Company continues to have

support from a significant majority of its creditors and intends to

continue working towards the successful implementation of its

restructuring and divestiture programme in order to maximise value

for the benefit of its creditors as a whole, and other

stakeholders, and as previously announced, recognizing that there

is a risk of insufficient value for shareholders if the Company is

unable to do so.

As previously updated, these actions pertain only to the Group's

holding company structure and do not impact the subsidiary banks,

which operations continue in the ordinary course. The Company will

update the market with any further material developments in respect

of the strategic review including the on-going divestments, the TLG

application, and the Support and Override Agreement.

Contact Details:

Investors

Kojo Dufu, +1 212 883 4330

Media

Apella Advisors, +44(0) 7818 036 579

Anthony Silverman

About Atlas Mara

Atlas Mara Limited (LON: ATMA) is a financial institution listed

on the London Stock Exchange. For more information, visit

www.atlasmara.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRFLFIRDTISLIL

(END) Dow Jones Newswires

July 14, 2021 12:13 ET (16:13 GMT)

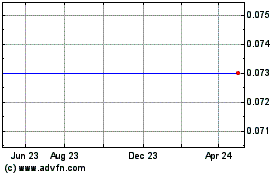

Atlas Mara (LSE:ATMA)

Historical Stock Chart

From Dec 2024 to Jan 2025

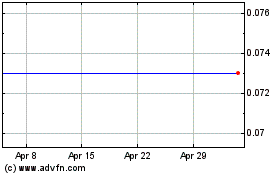

Atlas Mara (LSE:ATMA)

Historical Stock Chart

From Jan 2024 to Jan 2025