Caspian Sunrise plc Operational Update and Dividend Declaration (2807F)

04 November 2022 - 6:00PM

UK Regulatory

TIDMCASP

RNS Number : 2807F

Caspian Sunrise plc

04 November 2022

Caspian Sunrise PLC

("Caspian Sunrise", the "Company" or the "Group")

Operational Update and Dividend Declaration

The Board of Caspian Sunrise are pleased to update the market on

operations, the creation of a new oil trading division and the

declaration of the Company's maiden dividend.

Operations

BNG

Deep Wells

The Company remains encouraged by the strong oil shows from Deep

Well 802. Following an extensive cementing exercise we are now

preparing to drill a side-track from a depth of 2,416 meters to a

depth of 3,900 meters to target the first interval of interest from

which the oil encountered to date has flowed. If successful and

based on current timings we expect to test the well before the end

of the year.

Once the rig in use at Deep Well 802 becomes available it will

be used at Deep Well A5 to seek to remove the remaining stuck pipe

and then to drill a side-track from a depth of 3,970 meters

targeting the oil-bearing interval at a depth of 4,335 which

previously produced at the rate of in excess of 1,000 barrels of

oil per day (' bopd')..

Work is also planned to resume drilling at Deep Well A7 from a

depth of 2,175 meters as rigs and crews become available.

Work using horizontal drilling which has proved successful at

several of the MJF shallow wells is planned for the New Year at

existing Deep Wells A6 and 801 at a depth of approximately 4,400

meters.

At Deep Well A8 the intention is that the well be plugged and

abandoned.

Shallow wells

Work to bring wells 141 and 142 back into production is expected

to resume in Q1 2023.

A new shallow well, Well 155, is expected to spud before the end

of the year with a planned Total depth of 2,500 meters, once again

use a horizontal drilling approach.

Work is also planned in H1 2023 to drill the first shallow well

at the South Yelemes structure since it was awarded a full

production licence.

Production

Production continues at the rate of approximately 2,400

bopd.

As wells 141 and 142 come back into production the near-term

production expectations are that production volumes return to

levels seen earlier in the year.

Prices

The $25-30 per barrel discount for oil sent through Russian

pipelines together with taxes still set at the full Brent price

makes selling oil to the international market less attractive than

selling domestically and to direct to local refineries, where the

net price achieved is approximately $35 per barrel. Consequently,

all output is currently being sold domestically.

Oil trading

The Group has also formed a wholly owned oil trading subsidiary

to take advantage of changes in the regulations, which become

effective from 1 January 2023, and which for the first time will

allow the Group to sell its own production direct to international

and domestic buyers. This is expected to increase the net price

received by between $5 and $10 per barrel.

Dividends

The Board is pleased to announce the declaration of the

Company's first dividend.

It has been long held objective that the Group commences regular

dividend payments. This

initial dividend will total $1.13 million (GBP1 million) and

will be paid as follows:

Dividend: 0.0444 pence/share

Ex-Dividend Date: 17 November 2022

Record Date: 18 November 2022

Payment Date: 16 December 2022

The size of the first dividend is indicative of the levels to be

expected in the future. The Board intends that the future dividends

will be paid on a monthly basis, based on the higher of GBP1

million per month or a pay-out ratio of broadly 35-40% of free

cashflows.

Qualified person

Mr. Assylbek Umbetov, a member Association of Petroleum

Engineers, has reviewed and approved the technical disclosures in

this announcement.

Contacts

Caspian Sunrise PLC

Clive Carver

Executive Chairman +7 727 375 0202

WH Ireland, Nominated Adviser & Broker

James Joyce +44 (0) 207 220 1666

James Bavister

Andrew de Andrade

This announcement has been posted to:

www.caspiansunrise.com/investors

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBKNBDOBDDDDK

(END) Dow Jones Newswires

November 04, 2022 03:00 ET (07:00 GMT)

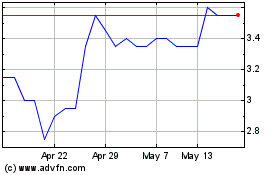

Caspian Sunrise (LSE:CASP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Caspian Sunrise (LSE:CASP)

Historical Stock Chart

From Jan 2024 to Jan 2025