TIDMCNC

RNS Number : 4289J

Concurrent Technologies PLC

16 August 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN (THE

"ANNOUNCEMENT") IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION

OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN,

OR INTO ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA, THE UNITED

STATES OF AMERICA (OR TO ANY U.S. PERSON), CANADA, JAPAN,

AUSTRALIA, THE REPUBLIC OF SOUTH AFRICA, OR ANY OTHER JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF THAT JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION EU NO. 596/2014, AS

RETAINED AND APPLICABLE IN THE UK PURSUANT TO THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 (AS AMED AND AS MODIFIED FROM TIME TO TIME BY

OR UNDER DOMESTIC LAW). UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN.

16 August 2023

Concurrent Technologies Plc

("Concurrent Technologies" or the "Company")

Proposed Acquisition of Phillips Machine & Welding Company,

Inc

Conditional Placing of 10,000,000 new Ordinary Shares to raise

GBP6.5 million

Proposed Retail Offer of up to 461,538 new Ordinary Shares to

raise up to GBP0.3 million

and

Notice of General Meeting

Concurrent Technologies (AIM: CNC), a world leading specialist

in the design and manufacture of high-end embedded computer

solutions for critical applications, is pleased to announce that it

has entered into a conditional agreement to acquire the entire

issued share capital of Phillips Machine & Welding Company, Inc

("Stryker") for an aggregate consideration of US$3.375 million

(approximately GBP2.64 million) (the "Acquisition"). Prior to

Completion of the Acquisition, the machine shop division of

Phillips Machine & Welding Company, Inc will be transferred out

of the business and, as a result, Concurrent Technologies will own

the Aerospace and Military division.

The Concurrent Technologies directors believe that the

Acquisition will progress the Company's strategic ambitions in the

Systems market, a market comprising of computer systems designed to

operate in harsh and demanding environments typically including

military, aerospace and industrial uses, and anticipated to be

valued at c.US$6.9 billion by 2033. The nature of the Systems

market provides a significant opportunity for future growth for

Concurrent Technologies, and Stryker holds aerospace industry

standard accreditation which is crucial in order to successfully

capture the identified opportunities.

Concurrent Technologies is also pleased to announce that,

primarily to finance the Acquisition, the Company has conditionally

raised total gross proceeds of GBP6.5 million by way of a

conditional placing of a total of 10,000,000 new ordinary shares of

1p each in the Company (the "Placing Shares") at an issue price of

65 pence per share (the "Issue Price") with new and existing

institutional investors (the "Placing").

In addition to the Placing, it is proposed that there will be a

separate conditional retail offer to existing investors via the

Bookbuild platform to raise up to GBP0.3 million (before expenses)

at the Issue Price (the "Retail Offer" and together with the

Placing, the "Fundraising"). A separate announcement will be made

in due course by the Company regarding the Retail Offer and its

terms. Those investors who subscribe for new Ordinary Shares

pursuant to the Retail Offer (the "Retail Offer Shares"), will do

so pursuant to the terms and conditions of the Retail Offer

contained in that announcement. For the avoidance of doubt, the

Retail Offer is not part of the Placing.

The Fundraising is conditional on, inter alia, shareholder

approval of certain resolutions (the "Resolutions") to be proposed

at a general meeting of the Company to be held at 11.00 a.m. BST on

4 September 2023 (the "General Meeting"). Cenkos Securities plc

("Cenkos") is acting as nominated adviser and sole broker in

connection with the Placing and as retail offer coordinator in

relation to the Retail Offer.

Pursuant to the Acquisition, the sellers, Randy Dunn (selling

through his trust nominee company Rose and Crane LLC), Donald

McKenna and Teri McKenna (the "Sellers"), will receive initial cash

consideration of approximately US$1.875 million (approx. GBP1.47

million) and US$1.5 million (approx. GBP1.17 million) by the issue

of 1,807,686 new Ordinary Shares at the Issue Price (the

"Consideration Shares") on Completion. In addition, certain

individuals in the existing Stryker business will be awarded

Concurrent Technologies share options under the existing Company

LTIP.

The Company will today be posting a circular to Shareholders

(the "Circular") detailing the Fundraising and Acquisition and

convening the General Meeting at which the Resolutions will be

proposed. The Circular will be available to view on the Company's

website shortly at https://www.gocct.com/investors/ .

Any term capitalised in this Announcement which is not also

defined shall have the same meaning as in the Circular.

Fundraising Highlights

The net proceeds of the Fundraising will be used primarily to

fund the Acquisition and the Company's strategic ambitions in the

Systems market. The proposed acquisition of Stryker is the first

acquisition since the new leadership team at Concurrent

Technologies has been in place and will materially advance a number

of the key strategic goals of the Company. The balance of the net

proceeds will provide additional liquidity to enable the Company to

be agile in capturing additional growth opportunities as they

arise.

Specifically, the Company intends to use the net proceeds of the

Fundraising as outlined below:

-- Stryker

o Settlement of the cash consideration for the Acquisition;

and

o Future investment to enhance the facilities capabilities and

production capacity of the US facility of Stryker.

-- Investment in Concurrent Technologies' broader Systems capability

o Continued investment in the Company's Systems capabilities

with a view to increasing the technical support infrastructure,

sales infrastructure, and supporting research and development

expertise to enable scaling up of the Systems operations.

-- Working Capital

o Supporting the working capital requirements of the Company

moving forward.

Stryker Acquisition

Stryker has a track record as a supplier to major defence

companies in the USA and including Boeing, Northrop Grumman and

Raytheon. Stryker's capabilities lie in the design and manufacture

of rugged systems which are constructed using plug in cards

("PICs") sourced from Concurrent Technologies and others and which

have the following capabilities:

-- Compute;

-- Storage;

-- Vision;

-- Data processing; and

-- I/O capability.

The Concurrent Technologies management team has identified

Stryker as an ideal acquisition target for this stage of the

Company's strategic development. Stryker was founded in 1973 and

has a long track record of working with defence industry prime

contractors. Stryker holds accreditation to aerospace industry

standards, which is critical to fully access the Systems market,

and complements the existing certification held by Concurrent

Technologies. The Acquisition includes Stryker's 14,000 sq/ft

manufacturing and office facility in California, from which a team

of 20 employees and contractors are engaged providing a permanent

base in the US from which the Company can operate and manufacture.

Accordingly, the Acquisition will significantly enhance the Board's

strategic goal of increasing the Company's US presence with a view

to enhancing both new and existing client relationships and US

market access.

Concurrent Technologies' management team believes that the

acquisition of Stryker will further its strategic ambitions in the

rugged systems market, which was valued at c.$2.3 billion in 2022

and is projected to grow at a compounded annual growth rate of 14.9

per cent to c.$6.9 billion by 2033. Systems generally is a new area

of operations for Concurrent Technologies, with the first revenues

realised in the current financial year ("FY23"). The Board believe

there is a significant opportunity, with the total addressable

market reaching c.$262.9 million in the defence sector alone for

systems in 2020. Having recently announced a significant Systems

contract win, the Board believes this is a key area for growth in

the future and have identified Stryker as an important target in

accelerating this growth.

The management team considers Stryker to be undercapitalised and

has identified a number of areas for investment in the existing

Stryker business which it believes will result in significant

growth in revenue for the acquired business and the enlarged group

as a whole. Concurrent Technologies will utilise its global sales

channels to leverage the Stryker product offering and will also

leverage Stryker's capabilities to increase its Systems market

presence in the short term.

The acquisition of Stryker will enable Concurrent Technologies,

as enlarged by Stryker, to significantly expand its in-house

capability, including the integration of components. Specifically,

the Acquisition will allow Concurrent Technologies to deliver

integrated Systems solutions, including the chassis and power

supply, for which it was previously reliant on the supply chain to

deliver. In addition, this will facilitate the increased

utilisation of the Company's existing PICs in the broader Systems

package.

For the avoidance of doubt, Phillips Machine & Welding

Company, Inc also has a machine shop business which is not subject

to the Acquisition.

Current Trading and Outlook

Concurrent Technologies recently published a trading update for

the six months to 30 June 2023 ("H1 FY23"). This update highlighted

that order intake in H1 FY23 remained strong at GBP14.5 million,

and that the Company had an order backlog of approximately GBP29

million as at 30 June 2023. This performance demonstrates the

significant progress that management has made with strategic

initiatives for growth including accelerated product development,

Systems capability, partnering, and a focus on home markets.

The Company has seen the continued easing of the global supply

chain shortages that had suppressed revenues in H1 FY23, albeit the

supply chain remained below historical norms. Lead times for

certain components had increased to c.40 weeks in 2022, and this is

now anticipated to reduce to less than 25 weeks from Q4 2023 for

certain components. This is a significant improvement; however,

management is monitoring supply chains carefully and managing the

Company's inventory levels in a prudent manner to enable the

delivery of the order backlog.

Accordingly, cash management continues to be an area of focus

for the Company with the working capital employed in the business

remaining higher than would be optimal for the Company's stage of

development but will normalise with the Company's continued

growth.

Management has identified a number of additional opportunities

in the Systems marketplace that are expected to start being

realised in H2 FY23. This will represent a new revenue stream for

the Company and the addition of Stryker will further enable the

Company's expansion in this sector. Overall, the business has

evolved over the past 18 months and the Company is now working on

more than 20 design win opportunities, a marked change in the

previously identified opportunity set.

Miles Adcock, CEO of Concurrent Technologies plc, commented:

"We are excited to announce the conditional acquisition of

Stryker and the accompanying Fundraising. Over the course of the

past 18 months the Board has taken the decision to invest in the

existing Concurrent Technologies platform to provide the base for

future growth and the Stryker acquisition continues this investment

by materially enhancing our capabilities within the Systems

market.

Whilst the supply chain issues still require careful management,

the Company is extremely well placed for the future. Trading in the

first half of FY23 delivered record revenues for equivalent

periods, with expectations for the full year exceeding all historic

results despite having to perform against the backdrop of shortages

of specific microchip components that has been a headwind for the

business for over 12 months. However, as recent component

deliveries have demonstrated, through continued careful management

we are successfully navigating these challenges.

The proceeds from the Fundraising will enable us to further

develop and build on our existing position in the market whilst

funding the Company in the delivery of our substantial order book.

Exciting times are ahead with the conditional acquisition of

Stryker bringing a depth of talent and capability into Concurrent

Technologies.

We are delighted with the support of a number of our existing

shareholders and are pleased to welcome new institutional investors

onto the register."

Enquiries:

Concurrent Technologies Plc

Miles Adcock, CEO

Kim Garrod, CFO +44 (0)1206 752626

SEC Newgate (Financial PR)

Bob Huxford +44 (0)20 3757 6880

Alice Cho

Matthew Elliot concurrent@secnewgate.co.uk

Cenkos Securities Plc (NOMAD

& Broker)

Neil McDonald +44 (0)131 220 9771

Peter Lynch +44 (0)131 220 9772

Background to and reasons for the Fundraising and

Acquisition

Concurrent Technologies is a leading specialist in the design,

manufacture and supply of innovative high-end embedded computer

products aimed at a wide base of customers within the defence,

telecommunications, aerospace, transport, scientific and industrial

markets.

Since the appointment of the current management team, there has

been a significant investment of capital into positioning the

Company for growth despite the ongoing challenges being navigated

in the global supply chains. This investment has been focused on

the Company's capabilities and inventory levels, with a focus on

R&D, the Systems market and growth in its home markets of the

US and UK.

The Company and management team are committed to an investment

in the Systems business. Having invested in specialist expertise in

FY22 and engaging in business development dialogue with potential

partners and customers, new initial orders were received in H2

FY22. This led to the signing of a new partnership agreement with

EIZO Rugged Solutions in December 2022 and a reseller agreement

with Alpha Data Parallel Systems Ltd in March 2023. In June 2023,

Concurrent Technologies announced the most significant Systems

contract win to date, an order worth in excess of GBP1 million in

total revenue with a FTSE 250 counterparty. The launch of Iris, a

Dual Enclave Switch Card, was announced in August 2023 which acts

as the system keystone to provide secure, high bandwidth switch

connections between each PIC, critical in ensuring they work

together in the most effective way possible. This further

demonstrates the Systems capabilities progression that Concurrent

Technologies is delivering to the market.

The Company's Systems capabilities are now able to service

significantly enhanced opportunities, addressing the bulk of a

niche within the rugged systems market that was estimated in 2022

to be worth c.$2.3 billion and growing to be worth c.US$6.9 billion

in 2033.

Details of the Fundraising and Placing Agreement

Details of the Placing

The Company has conditionally raised gross proceeds of GBP6.5

million through the placing of 10,000,000 Placing Shares at the

Issue Price with new and existing institutional investors. The

Issue Price represents a discount of 11 per cent. to the closing

price on 15 August 2023 of 73 pence per share (being the latest

practicable date prior to date of this Announcement).

In addition, certain of the Company's directors intend to

participate in the Placing at the Issue Price.

Name of Director Number of Placing Total Ordinary Total interest

Shares acquired Shares following in the enlarged

the Fundraising issued share capital

================== ================== ================== ======================

Mark Cubitt 50,000 70,000 0.082%

================== ================== ======================

Miles Adcock 61,538 61,538 0.072%

================== ================== ======================

Kim Garrod 15,000 15,000 0.018%

================== ================== ======================

Nat Edington 30,000 30,000 0.035%

================== ================== ======================

Pursuant to the placing agreement between the Company and Cenkos

dated 16 August 2023 (the " Placing Agreement "), Cenkos has

conditionally placed the Placing Shares with certain new and

existing institutional investors.

The Placing has not been underwritten by Cenkos or any other

party.

The Fundraising and Acquisition are conditional, with both being

conditional upon, inter alia, the passing by Shareholders of the

Resolutions at the General Meeting to provide authority for the

issue of the Placing Shares, Retail Offer Shares and Consideration

Shares (together, the "New Ordinary Shares"). For the avoidance of

doubt, Completion of the Acquisition is expected to take place

after the Placing, and the Placing is not conditional on the

Acquisition. In the unlikely event that the Placing is completed

and completion of the Acquisition does not then take place, the

Directors will assess the Group's ongoing funding needs and the

best use of the proceeds of the Fundraising, including for other

acquisition opportunities, taking account of Shareholders' best

interests.

The New Ordinary Shares, when issued, will be credited as fully

paid and will rank pari passu in all respects with the Company's

then existing Ordinary Shares, including the right to receive

dividends and other distributions declared on or after the date of

issue.

Application will be made to the London Stock Exchange for the

New Ordinary Shares to be admitted to trading on AIM ("Admission").

It is anticipated that Admission will become effective, and that

dealings in the New Ordinary Shares will commence at 8.00 a.m. BST

on 5 September 2023. The Placing is conditional, in so far as

concerns the Placing Shares upon, among other things, the passing

of the Resolutions, Admission becoming effective, and the Placing

Agreement not being terminated in accordance with its terms prior

to Admission.

For the avoidance of doubt, if the Placing Agreement is

terminated prior to Admission then neither the Fundraising nor the

Acquisition will occur.

Details of the Retail Offer

The Company values its retail Shareholder base and believes that

it is appropriate to provide its existing retail Shareholders

resident in the United Kingdom the opportunity to participate in

the Retail Offer.

The Company is therefore making the Retail Offer available in

the United Kingdom through the participating financial

intermediaries which will be listed, subject to certain access

restrictions, on the following website:

https://www.bookbuild.live/deals/G61JD1/authorised-intermediaries .

Cenkos will be acting as retail offer coordinator in relation to

this Retail Offer (the "Retail Offer Coordinator").

Existing retail Shareholders can contact their broker or wealth

manager ("intermediary") to participate in the Retail Offer. In

order to participate in the Retail Offer, each intermediary must be

on-boarded onto the BookBuild platform, have an active trading

account with the Retail Offer Coordinator and have been approved by

the Retail Offer Coordinator as an intermediary in respect the

Retail Offer, and agree to the final terms and conditions of the

Retail Offer, which regulate, the conduct of the Retail Offer on

market standard terms and provide for the payment of commission to

any intermediary that elects to receive a commission and/or fee (to

the extent permitted by the FCA Handbook Rules) from the Retail

Offer Coordinator (on behalf of the Company).

Any expenses incurred by any intermediary are for its own

account. Investors should confirm separately with any intermediary

whether there are any commissions, fees or expenses that will be

applied by such intermediary in connection with any application

made through that intermediary pursuant to the Retail Offer.

The Retail Offer will be open to eligible investors in the

United Kingdom at 8.00 a.m. on 16 August 2023. The Retail Offer is

expected to close at 4.30 p.m. on 24 August 2023. Investors should

note that financial intermediaries may have earlier closing times.

The Retail Offer may close early if it is oversubscribed.

To be eligible to participate in the Retail Offer, applicants

must be a customer of one of the participating intermediaries

listed on the above website, resident in the United Kingdom and, as

at the date of this Announcement or prior to placing an order for

Retail Offer Shares, Shareholders in the Company, which may include

individuals aged 18 years or over, companies and other bodies

corporate, partnerships, trusts, associations and other

unincorporated organisations.

The Company reserves the right to scale back any order at its

discretion. The Company reserves the right to reject any

application for subscription under the Retail Offer without giving

any reason for such rejection.

It is vital to note that once an application for Retail Offer

Shares has been made and accepted via an intermediary, it cannot be

withdrawn.

The Retail Offer is conditional, inter alia , upon the Placing

becoming unconditional and Admission taking effect.

The Retail Offer is an offer to subscribe for transferable

securities, the terms of which ensure that the Company is exempt

from the requirement to issue a prospectus under Regulation (EU)

2017/1129 as it forms part of UK law by virtue of the European

Union (Withdrawal) Act 2018 (as amended and as modified from time

to time by or under domestic law). The aggregate total

consideration for the Retail Offer will not exceed EUR8 million (or

the equivalent in pounds Sterling) and therefore the exemption from

the requirement to publish a prospectus, set out in section 86(1)

FSMA, will apply.

As set out above, a separate announcement will be made shortly

by the Company regarding the Retail Offer and its terms.

Acquisition Agreement

Pursuant to the Acquisition Agreement, Concurrent Technologies

Inc, a wholly owned subsidiary of the Company (the "Buyer"), has

conditionally agreed to acquire all of the issued and outstanding

shares in common stock in Phillips Machine & Welding Company,

Inc from the Sellers for an aggregate consideration of

approximately US$3.375 million (approximately GBP2.64 million) as

further detailed below. Prior to Completion the Sellers shall cause

Stryker to transfer Stryker's machine shop division out of Stryker,

such that at Completion Stryker shall not own the machine shop

division or any of its assets. In the year to 31 December 2022,

Stryker delivered US$1.86 million (approximately GBP1.46 million)

in revenue and incurred a loss of US$536k after tax. The Board

believes that there were one-off costs incurred during this period

which negatively impacted the profitability of the business and,

further, that there are clearly defined synergies and opportunities

to scale the Stryker business via the facilitation of Concurrent

Technologies global sales channels and access to capital.

Consideration

Subject to satisfying all of the conditions to Completion, the

total purchase price of approximately US$3.375 million will be

payable by Concurrent Technologies as consideration for the

Acquisition. The consideration will be satisfied as follows:

Upfront cash consideration* US$1.875 million (approx.

GBP1.47 million)

Allotment and issue of the Consideration US$1.500 million (approx.

Shares GBP1.17 million)

----------------------------------------- --------------------------

Total Consideration US$3.375 million (approx.

GBP2.64 million)

*The cash consideration is subject to adjustment if the

aggregate of actual cash, indebtedness, transaction expenses and

working capital differs from estimates provided three days before

closing.

In addition, Randy Dunn and Donald McKenna will be awarded

Concurrent Technologies share options under the existing Company

LTIP.

Conditions to Completion

Completion is conditional on, among other things, the Company

being in receipt of the Fundraising proceeds (the

"Conditions").

If the Conditions have not been met or waived (either by the

Buyer or the sellers as applicable) on or before 30 September 2023

(or such date as the buyer and the Sellers may agree) ("Acquisition

Long Stop Date") the Acquisition Agreement will terminate.

Undertakings of the Sellers up to Completion

The Acquisition Agreement contains certain undertakings given by

the Sellers to the Buyer restricting the conduct of the business

and affairs of Stryker during the period between the date of

execution of the Acquisition Agreement and Completion.

General Meeting

The Board is seeking the approval of Shareholders at the General

Meeting to allot the New Ordinary Shares.

The Notice of General Meeting, details of which are provided

above, will be set out at the end of the Circular.

The Fundraising is conditional, inter alia, on the passing of

the Resolutions by Shareholders at the General Meeting. If either

of the Resolutions are not passed at the General Meeting, the

Fundraising will not proceed and the Acquisition will not

complete.

Expected Timetable of Principal Events

Announcement of the Fundraising and 16 August 2023

Acquisition and posting of the Circular

Announcement of the Retail Offer 16 August 2023

Announcement of the result of the Retail 25 August 2023

Offer

Latest time and date for receipt of 11.00 a.m. on 2 September

Form of Proxy or CREST proxy appointment 2023

for the General Meeting

General Meeting 11.00 a.m. on 4 September

2023

Results of General Meeting announced 4 September 2023

Admission effective and dealings in 5 September 2023

the Placing Shares, Retail Offer Shares

and Consideration Shares expected to

commence on AIM

Where applicable, expected date for within 10 Business Days

dispatch of definitive share certificates following Admission

for Placing Shares, Retail Offer Shares

and Consideration Shares to be held

in certificated form

Completion of the Acquisition 6 September 2023

Each of the times and dates refer to London (UK) time and are

subject to change by the Company (with the agreement of Cenkos),

in which case details of the new times and dates will be notified

to the London Stock Exchange and the Company will, if appropriate,

make an announcement through a Regulatory Information Service.

Certain of the events in the above timetable are conditional

upon, inter alia, the approval of the Resolutions to be proposed

at the General Meeting.

Note to Editors:

About Concurrent Technologies Plc

Concurrent Technologies Plc develops and manufactures high-end

embedded Plug In Cards and Systems for use in a wide range of high

performance, long life cycle applications within the

telecommunications, defence, security, telemetry, scientific and

aerospace markets, including applications within extremely harsh

environments. The processor products feature Intel(R) processors,

including the latest generation embedded Intel(R) Core(TM)

processors, Intel(R) Xeon(R) and Intel Atom(TM) processors. The

products are d esigned to be compliant with industry specifications

and support many of today's leading embedded Operating Systems. The

products are sold world-wide.

For more information on Concurrent Technologies Plc and its

products please visit www.gocct.com .

All trademarks, registered trademarks and trade names used in

this Announcement are the property of their respective owners.

Details of the person discharging managerial responsibilities

1. / person closely associated

a) Name Mark Cubitt

------------------------------- ----------------------------------

Reason for the Notification

2.

-------------------------------------------------------------------

a) Position/status Non-Executive Chairman

------------------------------- ----------------------------------

b) Initial notification/amendment Initial notification

------------------------------- ----------------------------------

Details of the issuer, emission allowance market participant,

3. auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name Concurrent Technologies Plc

------------------------------- ----------------------------------

b) LEI 213800422HXP2X6UPD94

------------------------------- ----------------------------------

Details of the transaction(s): section to be repeated for

4. (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

-------------------------------------------------------------------

a) Description of the Ordinary shares of 1 pence each

Financial instrument,

type of instrument

------------------------------- ----------------------------------

Identification code GB0002183191

------------------------------- ----------------------------------

b) Nature of the Transaction Acquisition of Placing Shares

------------------------------- ----------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

-------------------------------

65 pence 50,000 ordinary shares

------------------------------- ---------- ----------------------

d) Aggregated information N/A - Single Transaction

Aggregated volume

price

------------------------------- ----------------------------------

e) Date of the transaction 16 August 2023

------------------------------- ----------------------------------

f) Place of the transaction AIM, London Stock Exchange

------------------------------- ----------------------------------

Details of the person discharging managerial responsibilities

1. / person closely associated

a) Name Miles Adcock

------------------------------- ----------------------------------

Reason for the Notification

2.

-------------------------------------------------------------------

a) Position/status Chief Executive Officer

------------------------------- ----------------------------------

b) Initial notification/amendment Initial notification

------------------------------- ----------------------------------

Details of the issuer, emission allowance market participant,

3. auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name Concurrent Technologies Plc

------------------------------- ----------------------------------

b) LEI 213800422HXP2X6UPD94

------------------------------- ----------------------------------

Details of the transaction(s): section to be repeated for

4. (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

-------------------------------------------------------------------

a) Description of the Ordinary shares of 1 pence each

Financial instrument,

type of instrument

------------------------------- ----------------------------------

Identification code GB0002183191

------------------------------- ----------------------------------

b) Nature of the Transaction Acquisition of Placing Shares

------------------------------- ----------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

-------------------------------

65 pence 61,538 ordinary shares

------------------------------- ---------- ----------------------

d) Aggregated information N/A - Single Transaction

Aggregated volume

price

------------------------------- ----------------------------------

e) Date of the transaction 16 August 2023

------------------------------- ----------------------------------

f) Place of the transaction AIM, London Stock Exchange

------------------------------- ----------------------------------

Details of the person discharging managerial responsibilities

1. / person closely associated

a) Name Kim Garrod

------------------------------- ----------------------------------

Reason for the Notification

2.

-------------------------------------------------------------------

a) Position/status Chief Financial Officer

------------------------------- ----------------------------------

b) Initial notification/amendment Initial notification

------------------------------- ----------------------------------

Details of the issuer, emission allowance market participant,

3. auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name Concurrent Technologies Plc

------------------------------- ----------------------------------

b) LEI 213800422HXP2X6UPD94

------------------------------- ----------------------------------

Details of the transaction(s): section to be repeated for

4. (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

-------------------------------------------------------------------

a) Description of the Ordinary shares of 1 pence each

Financial instrument,

type of instrument

------------------------------- ----------------------------------

Identification code GB0002183191

------------------------------- ----------------------------------

b) Nature of the Transaction Acquisition of Placing Shares

------------------------------- ----------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

-------------------------------

65 pence 15,000 ordinary shares

------------------------------- ---------- ----------------------

d) Aggregated information N/A - Single Transaction

Aggregated volume

price

------------------------------- ----------------------------------

e) Date of the transaction 16 August 2023

------------------------------- ----------------------------------

f) Place of the transaction AIM, London Stock Exchange

------------------------------- ----------------------------------

Details of the person discharging managerial responsibilities

1. / person closely associated

a) Name Nat Edington

------------------------------- ----------------------------------

Reason for the Notification

2.

-------------------------------------------------------------------

a) Position/status Non-Executive Director

------------------------------- ----------------------------------

b) Initial notification/amendment Initial notification

------------------------------- ----------------------------------

Details of the issuer, emission allowance market participant,

3. auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name Concurrent Technologies Plc

------------------------------- ----------------------------------

b) LEI 213800422HXP2X6UPD94

------------------------------- ----------------------------------

Details of the transaction(s): section to be repeated for

4. (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

-------------------------------------------------------------------

a) Description of the Ordinary shares of 1 pence each

Financial instrument,

type of instrument

------------------------------- ----------------------------------

Identification code GB0002183191

------------------------------- ----------------------------------

b) Nature of the Transaction Acquisition of Placing Shares

------------------------------- ----------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

-------------------------------

65 pence 30,000 ordinary shares

------------------------------- ---------- ----------------------

d) Aggregated information N/A - Single Transaction

Aggregated volume

price

------------------------------- ----------------------------------

e) Date of the transaction 16 August 2023

------------------------------- ----------------------------------

f) Place of the transaction AIM, London Stock Exchange

------------------------------- ----------------------------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQDGGDISDBDGXU

(END) Dow Jones Newswires

August 16, 2023 02:00 ET (06:00 GMT)

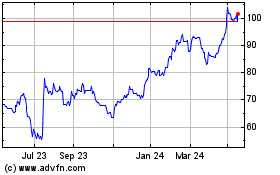

Concurrent Technologies (LSE:CNC)

Historical Stock Chart

From Nov 2024 to Dec 2024

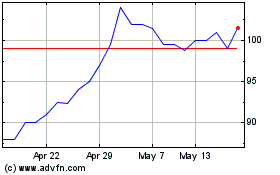

Concurrent Technologies (LSE:CNC)

Historical Stock Chart

From Dec 2023 to Dec 2024