TIDMEMAN

RNS Number : 9129A

Everyman Media Group PLC

28 September 2022

28 September 2022

Everyman Media Group PLC

("Everyman" or the "Group")

Interim Results

Strong trading with financial performance expected to at least

meet market expectations for full year and beyond

Everyman Media Group PLC, the independent, premium cinema group,

reports its unaudited interim results for the 26 weeks ended 30

June 2022.

Strong financial performance

-- Revenue of GBP40.7m (H1 2021: GBP7.7m)

-- Adjusted EBITDA(1) of GBP7.5m (H1 2021: GBP1.4m loss)

-- Operating profit of GBP0.8m (H1 2021: GBP7.7m loss)

-- Cash generated from operating activities GBP9.1m (H1 2021: GBP0.3m)

Encouraging strategic and operational progress

-- 300,000 additional admissions (1.8m) vs. H1 2019, a 20% increase

-- 4.5% market share, +1.5% vs. H1 2019

-- Opened five-screen venue in Edinburgh in April 2022

-- Bristol and Birmingham venues refurbished, maintaining high standards and differentiation

Robust financial position

-- Net assets at 30 June 2022 GBP48.2m (H1 2021 GBP44.7m).

-- Cash balance at 30 June 2022 GBP5.9m (H1 2021: GBP1.7m).

-- Net debt (including cash balance) at 30 June 2022 GBP8.6m (H1 2021: GBP11.8m)

-- Significant remaining headroom on facilities at GBP25.5m (H1 2021: GBP26.5m)

Momentum building into the second half

-- Opened a four-screen venue in Egham in September 2022

-- Durham due to open in November 2022; four further venues confirmed for 2023

-- Four venues refurbished post-period end

-- On track to at least meet expectations for the full year

(1) Adjusted for pre-opening costs, acquisition expenses,

depreciation, amortisation, share based payments and costs incurred

directly related to Covid-19 (.) IFRS 16 has been applied.

Alex Scrimgeour, Chief Executive of Everyman Media Group PLC,

said:

"The first half of the financial year has been a period of

progress on all fronts, with healthy admissions growth and robust

spend per head, suggesting we are now back on track following the

turbulence of recent years. Despite reduced film output due to the

effect of low production during the pandemic, we've enjoyed three

of the ten highest-ever box office releases in the past twelve

months.

Looking ahead, we are optimistic about our prospects. We are

confident that film production is back up to full speed and that

the flow of excellent content will be bigger and better going

forward, beginning with an attractive pipeline of new releases over

the remainder of this year and next.

We have started the second half of 2022 in line with

expectations and the outlook for the remainder is promising. The

acceleration of our openings strategy is now well underway and we

are excited about the wealth of opportunities emerging to bolster

and supplement the Everyman brand outside of the core

proposition.

Cinema will always be an important part of the fabric of the UK

as a place to be entertained, and has historically remained as such

during more difficult economic conditions and recession. We are

confident that our unique brand of Everyman hospitality remains as

relevant as ever."

For further information, please contact:

Everyman Media Group plc Tel: 020 3145 0500

Alex Scrimgeour, Chief Executive

Will Worsdell, Finance Director

Canaccord Genuity Limited (NOMAD Tel: 020 7523 8000

and Broker)

Bobbie Hilliam

Georgina McCooke

Alma PR (Financial PR Advisor) Tel: 020 3405 0205

David Ison

Joe Pederzolli

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014 as it forms part of United

Kingdom domestic law by virtue of the European Union (Withdrawal)

Act 2018 (as amended) ("UK MAR").

About Everyman Media Group PLC:

Everyman is the fourth largest cinema business in the UK by

number of venues, and is a premium, high growth leisure brand.

Everyman operates a growing estate of venues across the UK, with an

emphasis on providing first class cinema and hospitality.

Everyman is redefining cinema. It focuses on venue and

experience as key competitive strengths, with a unique

proposition:

-- Intimate and atmospheric venues, which become a destination in their own right

-- An emphasis on a strong quality food and drink menu prepared in-house

-- A broad range of well-curated programming content, from

mainstream and independent films to theatre and live concert

streams, appealing to a diverse range of audiences

-- Motivated and welcoming teams

For more information visit

http://investors.everymancinema.com/

Chief Executive's Statement

The first half of 2022 was very positive for Everyman despite

the impact of the Omicron outbreak at the beginning of the period,

with Group revenue of GBP40.7m, an increase of GBP11.8m vs. H1

2019. This was the last comparative period where the estate was

open for a full 26 weeks. We welcomed nearly 1.8m customers into

our venues, an increase of 0.3m vs. H1 2019, with our market share

increasing from 3.0% to 4.5% accordingly. This demonstrates that

the appetite for the Everyman offer remains strong, and is

growing.

A number of titles performed particularly well in the period.

Chief among them was Top Gun: Maverick at the end of May, a

long-anticipated sequel to the 1986 original which has now grossed

over GBP80m at the UK Box Office, with Everyman receiving a 5.8%

market share to date. Other strong titles included The Batman in

March and Doctor Strange in the Multiverse of Madness in May.

Post-period end, NT Live: Prima Facie became our most successful

Event Cinema ever, with Everyman taking an incredible 18.2% market

share and the highest number of national admissions. For Where the

Crawdads Sing, we took four of the top five venues nationally, and

a 10.9% market share.

Building our team

In the period, we have bolstered our committed and enthusiastic

team to over 1,200, including key hires in Procurement and Finance

as well as local venue managers to support our growth

ambitions.

Will Worsdell joined the Board as Finance Director in June,

having formerly held senior Finance roles at several leisure and

hospitality businesses, including Head of Commercial Finance at

Côte Brasserie, and will support the Group as we continue to

grow.

Baroness Ruby McGregor-Smith joined the Board as a Non-Executive

Director post-period end on 20 September 2022. Ruby brings a wealth

of experience to Everyman, having formerly been the Chief Executive

of Mitie Group Plc, a strategic outsourcing company. Amongst other

roles, Ruby is the Chair of MindGym Plc, the President of the

British Chambers of Commerce and has also been a non-executive

board member at the Department for Culture, Media and Sport and the

Department for Education.

Enhancing the Everyman experience

We also continue to innovate on the core Everyman offer. In H1

2022 we added a series of multi-venue streaming events in

partnership with AppleTV+, bringing exclusive programming to

Everyman audiences across the country, including a high profile

Q&A with actor Gary Oldman. We put on a strong events calendar,

with - amongst others - opening parties held for both Downton

Abbey: A New Era and Elvis and charity screenings to support those

displaced by the war in Ukraine. We also branched out into

immersive cinema, with events held for Nightmare Alley in January

and, post-period end, for See How They Run. Such events elevate the

Everyman experience further, and once again lead the exhibition

circuit into more ambitious territory.

Post-period end, "Summer in the City" has seen Everyman pop-ups

return to Screen on the Canal at Granary Square, London, The Secret

Garden at The Grove Hotel, Hertfordshire, and, for the first time,

to the iconic courtyard at Somerset House. These open-air venues

have brought the magic of film and the Everyman brand to thousands

of people over the July to September period.

Our food and beverage offer continues to evolve. With a focus on

giving our customers more choice, we have added new vegan items and

sharing dishes to our menus. An estate-wide rollout of new handheld

devices has enabled our customers to order from their seats more

seamlessly and efficiently, and we are seeing the impact of this on

average spends.

Growing the estate

As at 28 September 2022, Everyman currently has 38 cinemas and

129 screens. We opened a new five-screen venue in Edinburgh on 2

April and, most recently, a new four-screen venue in Egham on 23

September.

Demonstrating our continued confidence in Everyman's prospects,

our roll-out pipeline continues, with a new venue due to open in

Durham in November 2022. The pipeline for 2023 is well-developed,

with four further venues confirmed and another two nearing

exchange.

The Board is constantly evaluating new opportunities to grow the

Everyman estate, be that a new build, the conversion of an existing

building or the acquisition of other cinemas, the key consideration

always being that any new venue meets the Board's investment

criteria. The Company is not currently actively evaluating the

acquisition of any portfolio of cinemas.

To maintain our high standards and differentiation against the

market we have continued to invest in our existing estate and, in

the year to 28 September 2022, have fully refurbished our venues in

Bristol, Birmingham, Canary Wharf, Esher and Hampstead.

Performance Review

The Group uses the key performance indicators of Admissions, Box

Office Average Ticket Price and Food & Beverage Spend per Head

to monitor the progress of the Group's activities.

26 weeks 26 weeks 26 weeks

ended ended ended

30 June 2022 1 July 2021 4 July 2019

(26 weeks (6 weeks (26 weeks open)

open) open)

Admissions 1,771,064 284,245 1,475,425

Box Office Average Ticket GBP11.09 GBP11.18 GBP11.27

Price*

Food & Beverage Spend GBP8.96 GBP8.88 GBP6.95

per Head*

* Average ticket price has been adjusted to reflect the

reduction in VAT from 20% to 12.5% in H1 2022 (until 1 April 2022)

and from 20% to 5% in H1 2021.

**Spend per head has been adjusted to reflect the reduction in

VAT from 20% to 12.5% across certain items in H1 2022 (until 1

April 2022), and from 20% to 5% in H1 2021. Deliveroo income has

also been removed to enable like for like comparison with H1

2019.

Admissions

Admissions continued to gather positive momentum in the first

half of 2022. Comparison to the same period in 2021 is challenging

due to government-mandated closure of all venues until 17(th) May

last year. However, admissions increased by 20% vs. the first half

of 2019, driven by organic growth and the opening of nine new

venues in the intervening period.

On a non-VAT adjusted basis, Box Office revenue increased by 22%

vs. the first half of 2019 and Everyman was the only national

operator in growth, with the broader UK cinema industry

experiencing a 20% decline. This shows that appetite for the

Everyman experience continues to grow and that customers are

returning to our cinemas in greater numbers.

Average Ticket Price and Spend per Head

With the VAT benefit removed, Spend per Head increased by 28.9%

when compared to the same period in 2019, driven by continued

investment in our menu and technology, giving our customers more

choice and enabling quicker and more efficient service to

seats.

The fall in average ticket price, whilst modest at 1.5%, has

been driven by the opening of nine new venues between H1 2019 and

the end of the period. With some exceptions, new venues open in

lower pricing tiers, which can temporarily reduce average ticket

price until those venues mature. Since H1 2019 we have also opened

more venues outside of London, where ticket prices are typically

lower.

Outlook

We continue to be optimistic about the future. As we move

through the second half, with encouraging admissions levels to date

and a strong film slate anticipated in Q4, we remain on track to at

least meet expectations for the full year. The economic backdrop at

present is characterised by uncertainty, but we believe our

premium, differentiated offering and strong balance sheet stand us

in good stead.

We remain confident in our offering and our ability to continue

to grow sales, innovate and expand, and look forward to welcoming

more and more customers to an Everyman over time.

Alex Scrimgeour

Chief Executive

28 September 2022

Finance Director's Statement

26 Weeks 26 Weeks 26 Weeks

Ended 30 Ended 1 July Ended 4 July

June 2022 2021 2019

GBP000 GBP000 GBP000

Revenue 40,718 7,652 28,924

Gross Profit 25,462 4,752 17,848

----------- -------------- --------------

Gross Profit Margin 62.5% 62.1% 61.7%

Government Support 155 3,233 -

Administrative Expenses (24,780) (16,143) (16,250)

Operating Profit / (Loss) 837 (7,658) 1,598

----------- -------------- --------------

Financial Expenses (1,635) (1,528) (1,153)

Profit / (Loss) Before

Taxation (798) (9,186) 445

----------- -------------- --------------

Tax Credit / (Charge) - 132 115

Profit / (Loss) For the

Period (798) (9,054) 560

=========== ============== ==============

Adjusted EBITDA* 7,502 (1,407) 6,631

=========== ============== ==============

*Adjusted EBITDA refers to Operating Profit adjusted for the

removal of depreciation, amortisation, profit / loss on disposal of

fixed assets, pe-opening expenses, lease termination costs,

impairment charges and share-based payment expenses.

Revenue and Operating Profit

Group revenue in H1 2022 was GBP40.7m compared to GBP7.7m in the

same period last year and GBP28.9m in the first six months of 2019,

due to the upward trajectory of admissions and the opening of nine

new venues between H1 2019 and the end of the period.

Additionally, in July 2020 the Chancellor introduced a temporary

reduced rate of VAT for the hospitality sector, from which Everyman

was able to benefit. In H1 2022 the reduced rate of VAT was 12.5%,

until 31 March 2022, at which point the standard rate of VAT

resumed. For the entirety of H1 2021 the reduced rate of VAT was

5%.

The table below shows revenue adjusted for the removal of the

VAT benefit in each relevant period.

26 Weeks 26 Weeks 26 Weeks

Ended 30 Ended 1 July Ended 4 July

June 2022 2021 2019

GBP000 GBP000 GBP000

VAT-adjusted Revenue 39,788 6,830 28,924

Box Office 19,645 3,178 16,629

Food & Beverage 16,358 2,524 10,261

Other 3,785 1,128 2,034

The temporary reduced rate of VAT resulted in a GBP0.9m revenue

benefit in H1 2022 and a GBP0.8m revenue benefit in H1 2021.

With the VAT benefit removed, like-for-like Box Office and Food

& Beverage revenue increased by 2.1% vs. the same period in

2019.

Gross Profit Margin in H1 2022 was 62.5%, or 61.7% with the

aforementioned VAT benefit removed. This is consistent with prior

years.

We received significantly less government support in the period,

the only contribution being GBP0.2m in the form of the Omicron

Hospitality and Leisure Grant. In 2021 we received GBP2.8m from the

Coronavirus Job Retention Scheme and GBP0.9m in the form of

Coronavirus Business Support Grants.

Administrative Expenses increased from GBP16.3m in H1 2019 to

GBP24.8m in H1 2022. This is commensurate with the increase in

venues: 28 were open at the end of H1 2019 and 37 at the end of H1

2022. Our largest cost increase was Labour (a GBP4m increase vs. H1

2019), driven by the aforementioned new openings, a larger Head

Office team to support the growing business and an 21% increase in

National Living Wage from the beginning of H1 2019 to the end of H1

2022 driving pay increases for our teams.

Utilities costs were GBP0.9m during the period (H1 2019:

GBP0.6m), increasing in line with the growing estate. A significant

proportion of utilities contracts are fixed until October 2023.

Net finance costs

The Group's net bank interest payable was GBP288k in H1 2022, a

GBP38k increase on the same period last year, as a result of the

higher base rate and increased loan commitment fees due to the

GBP10m extension of the facility in March 2021.

The Group's finance charge in H1 2022 was GBP1.4m (H1 2021

GBP1.3m) and is interest charges relating to the unwinding of the

IFRS 16 lease liability in the period.

Share based payments

The share-based payment expense for the period was GBP784k (H1

2021: GBP1,129k) reflecting share option incentives provided to the

Group's management and employees.

Cash flows

Net cash generated in operating activities was GBP9.1m (H1 2021:

GBP0.3m; year ended 30 December 2021: GBP12.2m). The net cash

inflow for the period was GBP1.7m (H1 2021: GBP1.3m; year ended 30

December 2021: GBP3.8m). This is largely represented by capital

expenditure of GBP7.5m relating to build costs for new venues,

existing venue refurbishment and new systems to support the growing

business.

Cash held at the end of the period was GBP5.9m (1 July 2021:

GBP1.7m, 30 December 2021: GBP4.2m). The cash held will be invested

in the continuing development and expansion of the Group's

business.

The Group has access to a GBP40m facility of which GBP14.5m was

drawn at the end of the period.

The Board does not recommend the payment of a dividend at this

stage of the Group's development.

Capital Expenditure

During the period, the Group opened a new five-screen venue in

Edinburgh, on 2 April 2022. Post-period end, the Group opened a new

four-screen venue in Egham, on 23 September 2022. We are on track

to open a four-screen venue in Durham in November 2022, and six

further venues in 2023.

The Group continues to invest in its existing estate to maintain

high standards and differentiation against the wider market. During

the period we refurbished our venues in Bristol and Birmingham and,

post-period end, in Canary Wharf, Esher and Hampstead.

Capital investment during the period was GBP6.7m, of which

GBP5.6m was on venues. The remainder related to infrastructure and

head office costs to support the continued growth of the business.

Key projects during the period included new handheld devices and

kitchen screens in venues, to improve the speed, efficiency and

accuracy of our food & beverage offer to customers.

Will Worsdell

Finance Director

28 September 2022

26 weeks 26 weeks Year

ended ended ended

30 June 1 July 30 December

2022 2021 2021

Note GBP000 GBP000 GBP000

Revenue 3 40,718 7,652 49,027

Cost of Sales (15,256) (2,900) (18,129)

--------- --------- ------------

Gross profit 25,462 4,752 30,898

--------- --------- ------------

Covid-19 government support 155 3,733 3,800

Impairment of goodwill, property,

plant and machinery - - 2,504

Administrative expenses (24,780) (16,143) (39,363)

--------- --------- ------------

Operating profit/(loss) 837 (7,658) (2,161)

--------- --------- ------------

Financial expenses (1,635) (1,528) (3,255)

--------- --------- ------------

Profit/(Loss) before taxation (798) (9,186) (5,416)

Tax credit/(charge) 4 - 132 (14)

--------- --------- ------------

Profit/(Loss) for the period (798) (9,054) (5,430)

Other comprehensive income for the

period - - 69

--------- --------- ------------

Total comprehensive profit/(loss)

for the period (798) (9,054) (5,361)

--------- --------- ------------

Basic loss per share (pence) 5 (0.88) (9.99) (5.96)

--------- --------- ------------

Diluted loss per share (pence) 5 (0.88) (9.99) (5.96)

--------- --------- ------------

All amounts relate to continuing

activities.

Non-GAAP measure: adjusted EBITDA

Adjusted EBITDA 7,502 (1,407) 8,281

Before:

Depreciation and amortisation (5,671) (5,248) (11,727)

Exceptional items (215) - -

Costs related to Covid 19 - (265) -

Covid 19 related rent concessions - 411 -

Disposal of property, plant and equipment - (8) -

Pre-opening expenses 5 (12) (147)

Impairment of fixed assets - - 2,504

Share-based payment expense (784) (1,129) (1,072)

Operating profit/(loss) 837 (7,658) (2,161)

----------------------------------------------------- --------- ---------

Consolidated balance sheet at 30 June 2022 (unaudited)

Registered in England

and Wales

08684079

30 June *Restated 30 December

1 July

2022 2021 2021

GBP000 GBP000 GBP000

Assets

Non-current assets

Property, plant and equipment 84,923 78,825 81,848

Right-of-use assets 59,449 55,261 58,593

Intangible assets 9,283 9,188 8,906

Deferred tax assets - 145 -

Trade and other receivables 173 265 177

--------- ---------- -------------

153,828 143,684 149,524

--------- ---------- -------------

Current assets

Inventories 662 470 711

Trade and other receivables 3,877 2,944 5,649

Cash and cash equivalents 5,903 1,665 4,240

--------- ---------- -------------

10,442 5,079 10,600

--------- ---------- -------------

Total assets 164,270 148,763 160,124

--------- ---------- -------------

Liabilities

Current liabilities

Other interest-bearing loans

and borrowings 252 48 119

Other provisions - - 393

Trade and other payables 17,133 11,822 15,994

Lease liabilities 2,985 2,981 2,633

20,370 14,851 19,139

--------- ---------- -------------

Non-current liabilities

Other interest-bearing loans

and borrowings 14,500 13,500 12,500

Other payables - 8 -

Other provisions 1,066 1,010 1,118

Lease liabilities 80,112 74,724 79,147

95,678 89,242 92,765

--------- ---------- -------------

Total liabilities 116,048 104,093 111,904

--------- ---------- -------------

Net assets 48,222 44,670 48,220

--------- ---------- -------------

Equity attributable to owners

of the Company

Share capital 9,118 9,223 9,117

Share premium 57,112 57,064 57,097

Merger reserve 11,152 11,152 11,152

Other reserve 83 (6) 83

Retained earnings (29,243) (32,763) (29,229)

--------- ---------- -------------

Total equity 48,222 44,670 48,220

--------- ---------- -------------

*see Note 2 for details of restatement

Consolidated statement of changes in equity for the period ended

30 June 2022 (unaudited)

Share Share Merger Other Retained Total

capital Premium reserve Reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 31 December

2021 9,117 57,097 11,152 83 (29,229) 48,220

Loss for the period - - - - (798) (798)

Shares issued in the

period 1 15 - - - 16

Share-based payments - - - - 784 784

Total transactions with

owners of the parent 1 15 - - 784 800

-------- -------- --------- -------- ----------- --------

Balance at 30 June

2022 9,118 57,112 11,152 83 (29,243) 48,222

-------- -------- --------- -------- ----------- --------

Balance at 1 January

2021 *restated 9,110 57,038 11,152 (6) (24,871) 52,423

Loss for the period - - - - (9,054) (9,054)

Retranslation of foreign

currency - - - - 33 33

Shares issued in the

period 113 26 - - - 139

Share- based payments - - - - 1,129 1,129

Total transactions with

owners of the parent 113 26 - - 1,129 1,268

-------- -------- --------- -------- ----------- --------

Balance at 1 July 2021 9,223 57,064 11,152 (6) (32,763) 44,670

-------- -------- --------- -------- ----------- --------

*see Note 2 for details of restatement

Consolidated cash flow statement for the period ended 30 June

2022 (unaudited)

30 June 1 July 30 December

2022 2021 2021

Note GBP000 GBP000 GBP000

Cash flows from operating activities

(Loss) for the period (798) (9,054) (5,430)

Adjustments for:

Financial expenses 1,635 1,528 3,255

Income tax credit 4 - (132) 14

--------- --------- ------------

Operating loss 837 (7,658) (2,161)

--------- --------- ------------

Depreciation and amortisation 5,671 5,248 11,727

Impairment of goodwill, property,

plant and equipment and right-of-use

assets - - (2,504)

Gains on derecognition of lease (99) - -

contract

Loss on disposal of property, plant

and equipment - 8 488

Rent concessions - (411) (701)

Equity-settled share-based payment

expenses 784 1,129 1,072

--------- --------- ------------

7,193 (1,684) 7,921

Changes in working capital

Decrease/(increase) in inventories 48 (89) (326)

Decrease/(increase) in trade and

other receivables 1,026 (49) (2,844)

Increase in trade and other payables 1,108 2,124 7,067

(Decrease)/increase in provisions (242) - 384

--------- --------- ------------

Net cash / (used in) generated from

operating activities 9,133 302 12,202

Cash flows from investing activities

Acquisition of property, plant and

equipment (6,839) (777) (7,391)

Acquisition of intangible assets (654) (277) (422)

Net cash used in investing activities (7,493) (1,054) (7,813)

--------- --------- ------------

Cash flows from financing activities

Proceeds from the issuance of ordinary

shares 17 50 20

Proceeds from the exercise of share

options - - 66

Proceeds from bank borrowings 2,000 6,000 6,000

Repayment of bank borrowings - (1,500) (2,500)

Lease payments - interest (1,386) (1,257) (2,587)

Lease payments - capital (1,620) (956) (1,526)

Landlord capital contributions 1,300 - 500

Interest paid (288) (248) (519)

--------- --------- ------------

Net cash generated/(used in) from

financing activities 23 2,089 (546)

--------- --------- ------------

Exchange gain on cash and cash equivalents - - 69

Cash and cash equivalents at the

beginning of the period 4,240 328 328

Net increase in cash and cash equivalents 1,663 1,337 3,843

Cash and cash equivalents at the

end of the period 5,903 1,665 4,240

--------- --------- ------------

Notes to the financial statements

1 General information

Everyman Media Group PLC and its subsidiaries (together, 'the

Group') are engaged in the ownership and management of cinemas

in the United Kingdom. Everyman Media Group PLC (the Company)

is a public company limited by shares domiciled and incorporated

in England and Wales (registered number 08684079). The address

of its registered office is Studio 4, 2 Downshire Hill, London

NW3 1NR.

2 Basis of preparation and accounting

policies

These condensed interim financial statements of the Group for

the period ended 30 June 2022 have been prepared using accounting

policies consistent with UK adopted International Accounting Standards.

The same accounting policies, presentation and methods of computation

are followed in the condensed set of financial statements as applied

in the Group's latest audited financial statements for the year

ended 30 December 2021.

The financial statements presented in this report have been prepared

in accordance with IFRSs applicable to interim periods. However,

as permitted, this interim report has been prepared in accordance

with the AIM Rules for Companies and does not seek to comply with

IAS34 "Interim Financial Reporting".

These condensed interim financial statements have not been audited,

do not include all of the information required for full annual

financial statements and should be read in conjunction with the

Group's statutory consolidated annual financial statements for

the year ended 30 December 2021. The auditor's opinion on these

financial statements was unqualified, did not draw attention to

any matters by way of emphasis and did not contain a statement

under s498(2) or s498(3) of the Companies Act 2006.

Going Concern

As part of the adoption of the going concern basis, Everyman continues

to consider the uncertainty caused by the macroeconomic environment.

The Group's financing arrangements include a GBP30m rolling credit

facility (RCF), and a government-backed Coronavirus Large Business

Interruption Loan Scheme ("CLBILS") of GBP10m, both repayable

on or before 15 January 2024. As at 30 June 2022 the Group had

drawn GBP14.5m of this facility and had cash of GBP5.9m, therefore

the net debt position was GBP8.6m, with the undrawn facility at

GBP25.5m.

The facility has leverage and fixed cover charge covenants, and

previous liquidity and EBITDA covenants ended on 31 May 2022.

The Board has reviewed forecast scenarios and is confident that

the business can continue to operate with sufficient headroom.

These forecasts consider scenarios in which there is no further

growth in admissions beyond 2022 levels and include realistic

assumptions around wage increases and inflation. Utilities contracts

are fixed until October 2023 for the majority of venues.

In light of this, the Board consider it appropriate to adopt the

going concern basis of accounting in preparing the financial statements.

Restatement of accounting for leases

Restatement of prior As previously Restatement Restatement Restated

year reported numbers reported 1 2 1 July

1 July 2021

2021

GBP'000 GBP'000 GBP'000 GBP'000

-------------- ------------ ------------ ---------

Balance Sheet

Right-of-use assets 54,368 893 - 55,261

Current Lease liabilities (3,057) 50 26 (2,981)

Non-current Lease liabilities (73,556) (1,168) - (74,724)

Trade and other payables (11,832) 10 - (11,822)

Trade and other receivables 2,928 16 - 2,944

Retained earnings (32,590) (199) 26 (32,763)

-------------- ------------ ------------ ---------

Net Assets and Total

Equity 44,843 (199) 26 44,670

-------------- ------------ ------------ ---------

Restatement 1

The previously reported results have been restated in respect

of two leases as follows:

Canary Wharf

An assumption was made that rent would increase from March 2020,

however, this was not the case. As a result, the opening lease

liability and right of use asset required amendment, as the discounted

cashflows were greater than actually payable.

Correcting this led to a reduction in the right of use asset of

GBP223,000 with a corresponding decrease in the lease liability

of GBP344,000 and increase in retained earnings of GBP160,000.

This also gave rise to a decrease in depreciation charge of GBP45,000

and decrease in finance charge of GBP24,000. An adjustment to

the gain on concession was made to reduce the gain by GBP21,000.

Chelmsford

Implicit in the lease is a contractual 2.5% compound increase

in rent every 5 years. This meets the definition of an in-substance

fixed payment and so should be accounted for when discounting

the future cash flows upon recognition of the lease.

Accounting for this amendment has led to an increase in right

of use asset of GBP1,174,000 with a corresponding increase of

GBP1,462,000 to the lease liability and a decrease in retained

earnings of GBP197,000. This also gave rise to an increase in

depreciation charge of GBP103,000 and an increase in finance charge

of GBP107,000.

The net impact of both adjustments in Restatement 1 is a reduction

in Group profit across 2019 and 2020 of GBP199,000.

Restatement 2

After finalisation of the prior period financial statements there

was a change to the Practical Expedient for rental concessions

to include those effecting lease payments up to 30 June 2022.

The original practical expedient was limited to arrangements that

impacted rent payments up to 30 June 2021. This meant that some

concessions that had previously been treated as modifications

could now be accounted for using the Practical Expedient.

Accounting for the relevant concessions using the practical expedient

gave rise to a decrease in the group lease liability of GBP26,000.

Gain on concessions was increased by GBP26,000, which is the net

impact to Group profit in 2020 for Restatement 2.

3 Revenue 26 weeks 26 weeks Year ended

ended ended 30

30 June 1 July December

2022 2021 2021

GBP000 GBP000 GBP000

Film and entertainment 20,234 3,631 25,150

Food and beverages 16,699 3,643 20,360

Other income 3,785 378 3,517

------------- ------------ --------------

40,718 7,652 49,027

------------- ------------ --------------

In the 26-week period ended 30 June 2022, GBP0.2m Other

Operating Income was received (H1 2021: GBP3.7m). This consisted of

Omicron Hospitality & Leisure Grant.

4 Taxation 26 weeks 26 weeks Year ended

ended ended 30

30 June 1 July December

2022 2021 2021

GBP000 GBP000 GBP000

Current tax - - -

Adjustments in prior years - - -

------------ --------- -----------

- - -

Deferred tax (credit)/expense

Origination and reversal of temporary

differences (18) 104 416

Adjustments in respect of prior years 18 25 (101)

Effect of tax rate change - (261) (301)

Deferred tax not previously recognised - - -

------------ --------- -----------

Total tax (credit)/charge - (132) 14

------------ --------- -----------

The reasons for the difference between the actual tax charge

for the period and the standard rate of corporation tax in the

United Kingdom applied to the loss for the period are as follows:

Reconciliation of effective 26 weeks 26 weeks Year ended

tax rate ended ended 30

30 June 2 July December

2022 2021 2021

GBP000 GBP000 GBP000

(Loss) before taxation (798) (9,186) (5,416)

Tax at the UK corporation tax rate of

19% (152) (1,745) (1,029)

Permanent differences (expenses not

deductible for tax purposes) 463 422 750

Deferred tax not previously (433) - -

recognised

Impact of difference in overseas tax

rates 1 - 1

De-recognition of losses - 1,885 605

Other short term timing differences 3 31 -

Effect of change in expected future

statutory rates on deferred tax 104 (261) (217)

Impact of a drop in share-based payments

intrinsic value (4) (489) 5

Adjustment in respect of previous periods 18 25 (101)

------------ --------- -----------

Total tax (credit)/charge - (132) 14

------------ --------- -----------

5 Earnings per 26 weeks 26 weeks Year

share ended ended ended

30 June 1 July 30

December

2022 2021 2021

GBP000 GBP000 GBP000

Profit/(Loss) used in calculating basic

and diluted earnings per share (798) (9,054) (5,430)

Number of shares (000's)

Weighted average number of shares for

the purpose of basic earnings per share 91,177 90,597 91,129

------------ --------- -----------

Number of shares (000's)

Weighted average number of shares for

the purpose of diluted earnings per

share 91,177 90,597 91,129

------------ --------- -----------

Basic earnings per share

(pence) (0.88) (9.99) (5.96)

------------ --------- -----------

Diluted earnings per share

(pence) (0.88) (9.99) (5.96)

------------ --------- -----------

Basic earnings per share amounts are calculated by dividing net

profit/(loss) for the period attributable to Ordinary equity

holders of the parent by the weighted average number of Ordinary

shares outstanding during the year.

The Company has 6.9m potentially issuable shares (H1 2021: 7.5m)

all of which relate to the potential dilution from the Group's

share options issued to the Directors and certain employees and

contractors, under the Group's incentive arrangements. In the

current period these options are anti-dilutive as they would

reduce the loss per share and so haven't been included in the

diluted earnings per share.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEDFUWEESELU

(END) Dow Jones Newswires

September 28, 2022 02:02 ET (06:02 GMT)

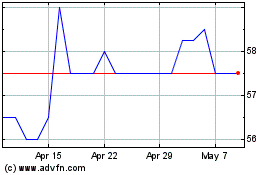

Everyman Media (LSE:EMAN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Everyman Media (LSE:EMAN)

Historical Stock Chart

From Jan 2024 to Jan 2025