TIDMFRES

RNS Number : 1779H

Fresnillo PLC

26 July 2023

Fresnillo plc

21 Upper Brook Street

London W1K 7PY

United Kingdom

www.fresnilloplc.com

26 July 2023

SECOND QUARTER PRODUCTION REPORT

FOR THE THREE MONTHSED 30 JUNE 2023

Octavio Alvídrez, Chief Executive Officer, said:

"I am pleased to report a solid production performance in the

first half and confirm that our full year guidance is unchanged.

Higher silver production was in part due to the on-going ramp up of

our new Juanicipio mine, which is progressing as planned and we

expect to reach full nameplate capacity in the next quarter. The

continued strong grades and volumes at our Herradura mine, together

with an increased contribution from Saucito, generated an increase

in gold production from the previous half. We were also pleased to

complete the tie-in of the new Pyrites Plant to the national power

grid with the plant moving quickly into operations. Looking ahead,

our focus remains on the safe operation of our mines, with a

particular attention on costs, which continue to be impacted by

inflation and the revaluation of the Mexican peso against the

dollar, while meeting our longer term development objectives."

HIGHLIGHTS

Silver

-- Quarterly attributable silver production of 14.9 moz

(including Silverstream), up 12.9% vs. 1Q23, mainly driven by the

ramp-up of Juanicipio and, to a lesser extent, a higher ore grade

at San Julián Disseminated Ore Body (DOB) and the increase in

volume of ore processed at Saucito, partially offset by the lower

ore grade at Fresnillo.

-- Quarterly and first half attributable silver production

(including Silverstream) increased 3.5% and 1.4% vs. 2Q22 and 1H22

respectively, primarily due to the ramp-up of Juanicipio, partially

offset by the lower ore grade at San Julián (DOB).

Gold

-- Quarterly attributable gold production of 152.4 koz down

11.9% vs. 1Q23 mainly due to the lower volume of ore processed at

Herradura as a result of the temporary suspension of operations

following an illegal stoppage by a very small group of unionised

employees, as reported in May.

-- Quarterly attributable gold production down 4.1% vs. 2Q22

primarily due to the decrease in gold production at Noche Buena,

partly offset by the ramp-up of Juanicipio and increased ore

processed at Saucito.

-- First half attributable gold production increased 5.4% vs.

1H22 mainly due to the increased volume of ore processed and higher

ore grade at Herradura and Saucito, partially compensated for by

the decrease in gold production at Noche Buena.

By-Products

-- Quarterly attributable by-product lead production up 4.7% vs.

1Q23 due to the ramp-up at Juanicipio, partly offset by the lower

ore grade at Saucito and Fresnillo.

-- Quarterly attributable by-product zinc production up 6.4% vs.

1Q23 due to the ramp-up at Juanicipio and the higher volume of ore

processed at Saucito, partly offset by the lower ore grade at

Fresnillo.

-- Quarterly attributable by-product lead production decreased

3.7% vs. 2Q22 due to the lower ore grades at Saucito, and Fresnillo

and lower ore grade and recovery rate at San Julián (DOB), partly

offset by the ramp-up at Juanicipio.

-- Quarterly attributable by-product zinc production decreased

4.2% vs. 2Q22, driven by the lower ore grades at Saucito and San

Juli án (DOB), partly offset by the ramp-up at Juanicipio .

-- First half by-product lead production increased 2.2% vs. 1H22

due to the increased contribution from Juanicipio and higher ore

processed at Fresnillo, partly offset by the lower ore grade at

Saucito.

-- First half by-product zinc production decreased 1.5% vs. 1H22

due to the lower ore grades at Saucito and San Julián (DOB),

mitigated by the increased production at Juanicipio and the higher

ore processed at Fresnillo.

2Q23 1Q23 % Change 2Q22 % Change 1H23 1H22 % Change

Silver (koz) 14,135 12,337 14.6 13,664 3.4 26,472 26,192 1.1

-------- -------- --------- -------- --------- -------- -------- ---------

Silverstream

(koz) 725 821 (11.7) 692 4.8 1,546 1,440 7.4

-------- -------- --------- -------- --------- -------- -------- ---------

Total Silver

(koz) 14,860 13,158 12.9 14,356 3.5 28,018 27,632 1.4

-------- -------- --------- -------- --------- -------- -------- ---------

Gold (oz) 152,380 173,034 (11.9) 158,960 (4.1) 325,415 308,752 5.4

-------- -------- --------- -------- --------- -------- -------- ---------

Lead (t) 13,994 13,368 4.7 14,535 (3.7) 27,363 26,779 2.2

-------- -------- --------- -------- --------- -------- -------- ---------

Zinc (t) 25,670 24,118 6.4 26,808 (4.2) 49,788 50,533 (1.5)

-------- -------- --------- -------- --------- -------- -------- ---------

Silver Equivalent Basis ([1])

Attributable quarterly silver equivalent ounces of 27.1 moz in

2Q23 (1Q23: 27.0 moz, 2Q22: 27.1 moz) and attributable first half

silver equivalent ounces of 54.1 moz (1H22: 52.3 moz).

SAFETY PERFORMANCE

We are extremely saddened to report a fatal accident at the

Saucito mine in the last week of June. Fresnillo, together with the

authorities, carried out a thorough investigation of the incident

to ensure all lessons can be learned. We continue to reinforce our

safety measures with both contractors and employees with the

objective of strengthening our safety culture throughout the

Company.

2023 OUTLOOK

2023 guidance remains unchanged. Attributable silver production

is expected to be in the range of 57.0 to 64.0 moz (including

Silverstream) while attributable gold production is expected to be

in the range of 590 to 640 koz. Expressed in silver equivalent

ounces (1) , production is expected to be 104 -115 million

ounces.

Cost inflation and the revaluation of the Mexican Peso versus

the US Dollar are expected to continue to impact costs in the

second half of the year following an increase in 1H 23 (See Items

Impacting the Income Statement on page 9).

INTERIM RESULTS

Fresnillo will announce its 2023 Interim Results on 1(st) of

August 2023.

For further information, please visit our website

www.fresnilloplc.com or contact:

FRESNILLO PLC Tel: +44 (0)20 7399 2470

London Office

Gabriela Mayor, Head of Investor

Relations

Mark Mochalski

Mexico City Office Tel: +52 55 52 79 3206

Ana Belem Zárate

POWERSCOURT Tel: +44 (0)7793 858 211

Peter Ogden

MINING OPERATIONS

FRESNILLO MINE PRODUCTION

2Q23 1Q23 % Change 2Q22 % Change 1H23 1H22 % Change

Ore Processed

(t) 667,776 668,366 (0.1) 618,860 7.9 1,336,142 1,194,359 11.9

-------- --------- --------- -------- --------- ---------- ---------- ---------

Production

-------- --------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 3,233 3,557 (9.1) 3,595 (10.1) 6,789 6,609 2.7

-------- --------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 10,997 8,750 25.7 9,668 13.7 19,747 18,148 8.8

-------- --------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 5,321 5,651 (5.8) 5,644 (5.7) 10,972 10,432 5.2

-------- --------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 10,696 12,094 (11.6) 10,758 (0.6) 22,790 20,139 13.2

-------- --------- --------- -------- --------- ---------- ---------- ---------

Ore Grades

-------- --------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 170 184 (7.6) 197 (13.7) 177 189 (6.3)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 0.72 0.57 26.3 0.69 4.3 0.64 0.67 (4.5)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 0.93 1.00 (7.0) 1.10 (15.5) 0.96 1.04 (7.7)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 2.12 2.42 (12.4) 2.46 (13.8) 2.27 2.35 (3.4)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Quarterly silver production decreased 9.1% vs. 1Q23 mainly due

to a lower ore grade as a result of increased dilution and delays

in the preparation of some stopes as long drilling equipment

required additional calibration. Both of these factors have been

addressed through training and increased equipment availability and

no further delays are expected in the second half.

Quarterly silver production decreased 10.1% vs. 2Q22 mainly as a

result of the lower ore grade and lower recovery rate. These

factors were mitigated by the higher volume of ore processed from

the San Alberto, Candelaria, San Ricardo and San Mateo areas.

First half silver production increased 2.7% vs. 1H22 mainly as a

result of the increase in volume of ore processed, partly offset by

the lower ore grade and recovery rate.

Mine development rates increased quarter on quarter to an

average of 3,288m per month in 2Q23 (1Q23: 3,105m per month),

primarily due to the higher productivity of the unionised

personnel.

Quarterly by-product gold production increased 25.7% vs. 1Q23

mainly driven by the higher ore grade.

Quarterly by-product gold production increased 13.7% vs. 2Q22

mainly due to the increased volume of ore processed and higher ore

grade.

First half by-product gold production increased 8.8% vs. 1H22

primarily as a result of the higher volume of ore processed, partly

offset by the lower ore grade.

The silver ore grade in 2023 is expected to remain in the range

of 185-205 g/t, while the gold ore grade is expected to remain in

the range of 0.50-0.70 g/t.

The tie in of the Pyrites Plant to the national grid at

Fresnillo was completed in 2Q23 and commissioning began immediately

with ramp up of production expected in 2H23.

SAUCITO MINE PRODUCTION

2Q23 1Q23 % Change 2Q22 % Change 1H23 1H22 % Change

Ore Processed (t) 562,962 471,959 19.3 512,739 9.8 1,034,921 1,008,158 2.7

-------- --------- --------- -------- --------- ---------- ---------- ---------

Production

-------- --------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 3,006 2,804 7.2 3,043 (1.2) 5,811 5,781 0.5

-------- --------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 18,702 21,378 (12.5) 16,785 11.4 40,080 33,172 20.8

-------- --------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 3,950 4,301 (8,2) 5,180 (23.7) 8,251 9,444 (12.6)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 7,001 5,991 16.9 8,367 (16.3) 12,993 15,665 (17.1)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Ore Grades

-------- --------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 188 207 (9.2) 205 (8.3) 197 199 (1.0)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 1.31 1.77 (26.0) 1.31 0.0 1.52 1.30 16.9

-------- --------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 0.84 1.07 (21.5) 1.19 (29.4) 0.95 1.09 (12.8)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 1.62 1.68 (3.6) 2.12 (23.6) 1.65 1.97 (16.2)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Quarterly silver production increased 7.2% vs. 1Q23 mainly

driven by the increase in volume of ore processed from the Central

area, following the lower availability of scalers and haulage

equipment at the West and Central areas in 1Q23 and part of 2Q23.

This was partly offset by the lower ore grade as a result of the

aforementioned lower availability of equipment, which delayed mine

preparation and limited operational flexibility. We continued

working on increasing the availability of equipment and improving

the productivity of our personnel and expect to further increase

volumes of ore processed in 2H23.

Quarterly and first half silver production remained at similar

levels vs. 2Q22 and 1H22, as higher volumes of ore processed were

offset by the aforementioned lower ore grade.

Quarterly by-product gold production decreased 12.5% vs. 1Q23

mainly driven by a lower ore grade, partially mitigated by the

higher volume of ore processed.

Quarterly by-product gold production increased 11.4% vs. 2Q22

primarily driven by the higher volume of ore processed.

First half by-product gold production increased 20.8% vs. 1H22

as a result of the higher ore grade and increase in volume of ore

processed.

Mine development rates increased quarter on quarter to an

average of 3,069m per month in 2Q23 (1Q23: 2,975m per month; 1H22:

2,436m per month), primarily due to the higher productivity of the

unionised personnel.

Full year 2023 silver ore grade is estimated to remain between

190-210 g/t, while the gold ore grade is estimated to continue to

be around 1.20-1.40 g/t.

PYRITES PLANT (PHASE I)

2Q23 1Q23 % Change 2Q22 % Change 1H23 1H22 % Change

Pyrite Concentrates

Processed (t) 27,892 27,952 (0.2) 33,326 (16.3) 55,844 65,690 (15.0)

------- -------- --------- ------- --------- ------- ------- ---------

Production

------- -------- --------- ------- --------- ------- ------- ---------

Silver (koz) 127 111 14.4 126 0.8 238 277 (14.1)

------- -------- --------- ------- --------- ------- ------- ---------

Gold (oz) 331 270 22.6 422 (21.6) 601 932 (35.5)

------- -------- --------- ------- --------- ------- ------- ---------

Ore Grades

------- -------- --------- ------- --------- ------- ------- ---------

Silver (g/t) 207 177 16.9 160 29.4 192 176 9.1

------- -------- --------- ------- --------- ------- ------- ---------

Gold (g/t) 1.58 1.31 20.6 1.21 30.6 1.44 1.40 2.9

------- -------- --------- ------- --------- ------- ------- ---------

CIÉNEGA MINE PRODUCTION

2Q23 1Q23 % Change 2Q22 % Change 1H23 1H22 % Change

Ore Processed (t) 261,253 240,148 8.8 280,526 (6.9) 501,401 563,094 (11.0)

-------- --------- --------- -------- --------- -------- -------- ---------

Production

-------- --------- --------- -------- --------- -------- -------- ---------

Gold (oz) 8,132 9,302 (12.6) 8,917 (8.8) 17,434 18,907 (7.8)

-------- --------- --------- -------- --------- -------- -------- ---------

Silver (koz) 1,010 980 3.1 1,069 (5.5) 1,991 2,485 (19.9)

-------- --------- --------- -------- --------- -------- -------- ---------

Lead (t) 756 748 1.1 758 (0.3) 1,504 1,684 (10.7)

-------- --------- --------- -------- --------- -------- -------- ---------

Zinc (t) 919 1,002 (8.3) 1,245 (26.2) 1,921 2,596 (26.0)

-------- --------- --------- -------- --------- -------- -------- ---------

Ore Grades

-------- --------- --------- -------- --------- -------- -------- ---------

Gold (g/t) 1.06 1.30 (18.5) 1.08 (1.9) 1.18 1.14 3.5

-------- --------- --------- -------- --------- -------- -------- ---------

Silver (g/t) 141 147 (4.1) 138 2.2 144 159 (9.4)

-------- --------- --------- -------- --------- -------- -------- ---------

Lead (%) 0.47 0.47 0.0 0.43 9.3 0.47 0.47 0.0

-------- --------- --------- -------- --------- -------- -------- ---------

Zinc (%) 0.67 0.77 (13.0) 0.79 (15.2) 0.72 0.82 (12.2)

-------- --------- --------- -------- --------- -------- -------- ---------

Quarterly gold production decreased 12.6% vs. 1Q23 mainly due to

a lower ore grade as a result of increased dilution in narrower

veins. This was partly mitigated by the higher volume of ore

processed due to the timely preparation of stopes and increase in

development rate resulting from the increased availability of

equipment.

Quarterly gold production decreased 8.8% vs. 2Q22 mainly due to

the lower volume of ore processed in accordance with the mine plan,

and lower ore grade.

First half gold production decreased 7.8% vs. 1H22 mainly due to

the lower volume of ore processed in accordance with the mine plan,

partly mitigated by the higher ore grade.

Quarterly silver production increased 3.1 vs. 1Q23 as a result

of the higher volume of ore processed which more than compensated

for the lower ore grade.

Quarterly silver production decreased 5.5% vs. 2Q23 mainly as a

result of the lower volume of ore processed in accordance with the

mine plan, partly mitigated by the higher ore grade.

First half silver production decreased 19.9% vs. 1H22 due to the

decrease in volume of ore processed and lower ore grade as a result

of the increased dilution and the delay in the preparation of a

stope with higher silver ore grades.

The gold and silver ore grades for 2023 are estimated to remain

in the ranges of 1.0-1.1 g/t and 150-160 g/t respectively.

SAN JULIÁN MINE PRODUCTION

2Q23 1Q23 % Change 2Q22 % Change 1H23 1H22 % Change

Ore Processed Veins

(t) 274,505 283,752 (3.3) 289,821 (5.3) 558,257 583,966 (4.4)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Ore Processed DOB

(t) 527,898 522,260 1.1 535,326 (1.4) 1,050,158 1,076,326 (2.4)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Total production

at San Julián

-------- --------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 10,259 12,033 (14.7) 11,748 (12.7) 22,292 23,433 (4.9)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 3,596 3,412 5.4 4,328 (16.9) 7,008 7,968 (12.0)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Production Veins

-------- --------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 9,325 11,139 (16.3) 10,865 (14.2) 20,464 21,710 (5.7)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 1,168 1,312 (11.0) 1,175 (0.6) 2,480 2,235 11.0

-------- --------- --------- -------- --------- ---------- ---------- ---------

Production DOB

-------- --------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 934 894 4.5 883 5.8 1,828 1,723 6.1

-------- --------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 2,428 2,100 15.6 3,152 (23.0) 4,528 5,733 (21.0)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 2,062 1,855 11.2 2,325 (11.3) 3,917 3,933 (0.4)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 4,020 3,755 7.1 5,368 (25.1) 7,775 10,093 (23.0)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Ore Grades Veins

-------- --------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 1.11 1.28 (13.3) 1.22 (9.0) 1.20 1.22 (1.6)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 146 158 (7.6) 138 5.8 152 131 16.0

-------- --------- --------- -------- --------- ---------- ---------- ---------

Ore Grades DOB

-------- --------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 0.09 0.09 0.0 0.09 0.0 0.09 0.08 12.5

-------- --------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 165 146 13.0 213 (22.5) 156 193 (19.2)

-------- --------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 0.50 0.46 8.7 0.51 (2.0) 0.48 0.45 6.7

-------- --------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 1.03 0.96 7.3 1.29 (20.2) 0.99 1.20 (17.5)

-------- --------- --------- -------- --------- ---------- ---------- ---------

SAN JULIÁN VEINS

Quarterly silver and gold production decreased 11.0% and 16.3%

vs. 1Q23, respectively due to the lower ore grade and to a lesser

extent, the decreased volume of ore processed as a result of lower

availability of bolting and shotcreting equipment, which delayed

access to the San Atanasio vein with higher ore grades.

Quarterly gold production decreased 14.2 vs. 2Q22 mainly due to

the lower ore grade and decreased volume of ore processed for the

reasons mentioned above.

Quarterly silver production remained flat vs. 2Q22 as the higher

ore grade offset the lower volume of ore processed.

First half silver production increased 11.0% vs. 1H22 mainly due

to the higher ore grade at San Antonio, Ultima Tierra and Elisa

stopes, partly offset by the lower volume of ore processed.

First half gold production decreased 5.7% vs. 1H22 mainly due to

the decrease in volume of ore processed and lower ore grade.

Additional bolting equipment is expected to arrive in 3Q23,

which will contribute to the normalisation of mining cycles.

We continue to expect the 2023 silver and gold ore grades to

average 130-140 g/t and 1.20-1.30 g/t, respectively.

SAN JULIÁN DISSEMINATED ORE BODY (DOB)

Quarterly silver production increased 15.6% vs. 1Q23 mainly as a

result of accessing the higher ore grade areas as planned.

Quarterly and first half silver production decreased 23.0% and

21.0% vs. 2Q22 and 1H22 respectively, mainly due to the expected

lower ore grade in the areas in the periphery of the ore body and

structural geological features which slowed down the long hole

drilling cycles.

We continue to expect the 2023 silver ore grade to be in the

range of 130-140 g/t.

HERRADURA TOTAL MINE PRODUCTION

2Q23 1Q23 % Change 2Q22 % Change 1H23 1H22 % Change

Ore Processed

(t) 5,219,844 6,485,710 (19.5) 5,301,678 (1.5) 11,705,553 9,518,276 23.0

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Total Volume

Hauled (t) 21,445,659 29,223,867 (26.6) 31,548,611 (32.0) 50,669,525 64,333,382 (21.2)

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Production

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Gold (oz) 83,037 106,832 (22.3) 83,043 0.0 189,869 160,644 18.2

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Silver (koz) 136 208 (34.6) 169 (19.5) 344 387 (11.1)

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Ore Grades

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Gold (g/t) 0.76 0.73 4.1 0.67 13.4 0.74 0.68 8.8

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Silver (g/t) 1.33 1.72 (22.7) 1.49 (10.7) 1.55 1.83 (15.3)

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Quarterly gold production decreased 19.5% vs. 1Q23 mainly driven

by the lower volume of ore processed as a result of the temporary

suspension of operations following an illegal stoppage by a very

small group of unionised employees, as reported in May. This was

partly mitigated by the higher ore grade.

Quarterly gold production remained flat vs. 2Q22 as the higher

ore grade in the sulphides was offset by the lower recovery rates

in the pads as the cycle was impacted by the temporary suspension

of activities.

First half gold production increased 18.2% vs. 1H22 mainly

driven by the increased volume of ore processed and higher ore

grade in the sulphides and positive variations with the geological

model. The aforementioned factors were partly offset by the lower

recovery rate driven by the temporary suspension and the slower

pace of irrigation.

As part of its regular processes, the Group compares the ore

grades placed on the pads to the quantities of metal recovered

through the leaching process to evaluate the appropriateness of the

estimated recovery. Recovery estimates are then refined based on

actual results over time and when new information becomes

available. As a result of this, the mine updated its estimate of

the recoverable remaining gold content in leaching pads, resulting

in an increase of 30.7 thousand ounces of gold as at 1 January

2023.

The adjusted production costs were impacted by the increase in

waste material hauled charged to costs, rather than capitalised,

despite the 28.9% decrease in the total volume of waste material

hauled (capitalised and charged to costs). This is because in 1H22

the stripping ratio for the main component of the Herradura mine of

c. 7.3 was significantly higher than the prevailing stripping ratio

for the life of the mine (LOM) of this component (under IFRIC 20

stripping costs above the average LOM stripping ratio are

capitalised), this higher stripping ratio was due to the need to

prepare and gain access to the mineral benches; whereas in 1H23 the

3.4 stripping ratio was below the prevailing stripping ratio for

LOM of this component, thus registering all the stripping as cost

in the income statement.

The gold ore grade in 2023 is estimated to be in the range of

0.65-0.75 g/t.

NOCHE BUENA TOTAL MINE PRODUCTION

2Q23 1Q23 % Change 2Q22 % Change 1H23 1H22 % Change

Ore Processed

(t) 799,290 1,711,348 (53.3) 2,594,599 (69,2) 2,510,639 4,384,077 (42.7)

---------- ----------- --------- ---------- --------- ---------- ----------- ---------

Total Volume

Hauled (t) 1,829,412 6,595,264 (72.3) 8,105,466 (77.4) 8,424,676 13,283,655 (36.6)

---------- ----------- --------- ---------- --------- ---------- ----------- ---------

Production

---------- ----------- --------- ---------- --------- ---------- ----------- ---------

Gold (oz) 14,801 11,078 33.6 25,234 (41.3) 25,878 47,103 (45.1)

---------- ----------- --------- ---------- --------- ---------- ----------- ---------

Silver (koz) 4 4 0.0 6 (33.3) 8 14 (42.9)

---------- ----------- --------- ---------- --------- ---------- ----------- ---------

Ore Grades

---------- ----------- --------- ---------- --------- ---------- ----------- ---------

Gold (g/t) 0.45 0.48 (6.3) 0.53 (15.1) 0.47 0.57 (17.5)

---------- ----------- --------- ---------- --------- ---------- ----------- ---------

Silver (g/t) 0.20 0.15 33.3 0.22 (9.1) 0.17 0.26 (34.6)

---------- ----------- --------- ---------- --------- ---------- ----------- ---------

Quarterly gold production increased 33.6% vs. 1Q23 mainly due to

a higher recovery rate at the leaching pads, partly offset by the

decreased volume of ore processed and lower ore grade following the

mine closure process which started in May.

Quarterly and first half gold production decreased 41.3% and

45.1% vs. 2Q22 and 1H22, respectively as a result of the decrease

in the volume of ore processed and lower ore grade due to the

previously mentioned factors, partially mitigated by the higher

recovery rate at the leaching pads.

The final 2023 gold ore grade was 0.47 g/t as no additional

volumes will be deposited.

JUANICIPIO - ATTRIBUTABLE

2Q23* 1Q23* % Change 2Q22** % Change 1H23* 1H22** % Change

Ore Processed

(t) 211,522 124,333 70.1 86,279 145.2 335,855 167,751 100.2

--------- --------- --------- ------- --------- -------- -------- ---------

Production

--------- --------- --------- ------- --------- -------- -------- ---------

Silver (koz) 2,954 1,260 134.4 1,328 122.4 4,214 2,672 57.7

--------- --------- --------- ------- --------- -------- -------- ---------

Gold (oz) 5,958 3,392 75.6 3,143 89.6 9,351 6,412 45.8

--------- --------- --------- ------- --------- -------- -------- ---------

Lead (t) 1,905 813 134.3 628 203.3 2,718 1,286 111.4

--------- --------- --------- ------- --------- -------- -------- ---------

Zinc (t) 3,034 1,275 138.0 1,071 183.3 4,309 2,041 111.1

--------- --------- --------- ------- --------- -------- -------- ---------

Ore Grades

--------- --------- --------- ------- --------- -------- -------- ---------

Silver (g/t) 498 363 37.2 567 (12.2) 448 582 (23.0)

--------- --------- --------- ------- --------- -------- -------- ---------

Gold (g/t) 1.25 1.08 15.7 1.49 (16.1) 1.18 1.53 (22.9)

--------- --------- --------- ------- --------- -------- -------- ---------

Lead (%) 1.05 0.74 41.9 0.91 15.4 0.94 0.92 2.2

--------- --------- --------- ------- --------- -------- -------- ---------

Zinc (%) 1.92 1.44 33.3 1.73 11.0 1.74 1.73 0.6

--------- --------- --------- ------- --------- -------- -------- ---------

* Includes ore processed as part of the initial tests during the

commissioning of the Juanicipio plant and ore processed at the

Fresnillo and Saucito beneficiation plants.

** Ore processed at the Fresnillo and Saucito beneficiation

plants.

Attributable quarterly silver and gold production increased vs.

1Q23 due to the ramp-up following the commissioning completed in

1Q23. Full nameplate capacity is expected to be reached by 3Q23. As

previously reported, ore will continue to be processed at the

nearby Saucito and Fresnillo plants if required.

SILVERSTREAM

Quarterly Silverstream production decreased 11.7% vs. 1Q23 due

to the decreased volume of ore processed and lower recovery rate,

partly mitigated by a higher ore grade.

Quarterly Silverstream production increased 4.8% vs. 2Q22 mainly

due to a higher ore grade, partially compensated for by the

decreased volume of ore processed and lower recovery rate.

First half Silverstream production increased 7.4% vs. 1H22 as a

result of the increase in volume of ore processed and higher ore

grade.

Silver production in 2023 is estimated to be in the range of

2.5-3.5 moz.

ITEMS IMPACTING THE INCOME STATEMENT

Adjusted production costs in 1H23 were impacted by:

1. The 10.2% average revaluation of the Mexican peso vs. the US

dollar from $20.28 per US dollar in 1H22 to $18.21 per US dollar in

1H23, which is expected to have an adverse effect of c. US$45

million.

2. Ongoing cost inflation of 6.2%, excluding the effect of the

revaluation of the Mexican peso vs. US dollar, which is expected to

have a negative impact of c. US$40 million.

3. An increase in waste material hauled at Herradura charged to

costs, rather than capitalised, despite the 28.9% decrease in the

total volume of waste material hauled (capitalised and charged to

costs), with an expected impact of approximately US$20 million,

(See Herradura page 7) .

In addition, cost of sales is expected to be impacted by a

decrease in inventories both at Juanicipio as a result of the start

up of the beneficiation plant, enabling additional volumes to be

processed and the stockpile to be reduced, and at Noche Buena as it

approached the end of its mine life. This, together with the

favourable effect of the reassessment of the gold inventories at

Herradura (See Herradura page 7) , resulted in an estimated

reduction in inventories of c. US$25 million in 1H23.

Further to the disclosures that the Company has previously made

regarding the stoppage of operations at Soledad-Dipolos, the

Company has identified certain suspected illegal extraction of gold

content at its leaching pads. The Company estimates a loss of

approximately 20 thousand ounces of gold content and consequently

will recognise a write off of c. US$22 million regarding the

Soledad-Dipolos gold contents in inventory, which will be presented

as other expenses in the Interim Consolidated Income Statement. The

Company is taking relevant actions so that the illegal leaching

activities be ceased as soon as possible. The Company does not

currently expect any further losses of this inventory to be

significant.

We have front loaded 2023 exploration spend, with c. US$97

million in 1H23. The FY guidance of US$175 million remains

unchanged.

The Silverstream effect is expected to have an adverse impact of

c. US$17 million mainly due to the lower forward silver price as at

30 June 2023 and a decrease in silver reserves at the Sabinas

mine.

ABOUT FRESNILLO PLC

Fresnillo plc is the world's largest primary silver producer and

Mexico's largest gold producer, listed on the London and Mexican

Stock Exchanges under the symbol FRES.

Fresnillo plc has eight operating mines, all of them in Mexico -

Fresnillo, Saucito, Juanicipio, Ciénega, Herradura,

Soledad-Dipolos(1) , Noche Buena and San Julián (Veins and

Disseminated Ore Body) and four advanced exploration projects -

Orisyvo, Rodeo, Guanajuato and Tajitos as well as a number of other

long term exploration prospects.

Fresnillo plc has mining concessions and exploration projects in

Mexico, Peru and Chile.

Fresnillo plc has a strong and long tradition of exploring,

mining, a proven track record of mine development, reserve

replacement, and production costs in the lowest quartile of the

cost curve for silver.

Fresnillo plc's goal is to maintain the Group's position as the

world's largest primary silver company and Mexico's largest gold

producer.

(1) Operations at Soledad-Dipolos are currently suspended.

FORWARD-LOOKING STATEMENTS

Information contained in this announcement may include

'forward-looking statements'. All statements other than statements

of historical facts included herein, including, without limitation,

those regarding the Fresnillo Group's intentions, beliefs or

current expectations concerning, amongst other things, the

Fresnillo Group's results of operations, financial position,

liquidity, prospects, growth, strategies and the silver and gold

industries are forward-looking statements. Such forward-looking

statements involve risk and uncertainty because they relate to

future events and circumstances. Forward-looking statements are not

guarantees of future performance and the actual results of the

Fresnillo Group's operations, financial position and liquidity, and

the development of the markets and the industry in which the

Fresnillo Group operates, may differ materially from those

described in, or suggested by, the forward-looking statements

contained in this document. In addition, even if the results of

operations, financial position and liquidity, and the development

of the markets and the industry in which the Fresnillo Group

operates are consistent with the forward-looking statements

contained in this document, those results or developments may not

be indicative of results or developments in subsequent periods. A

number of factors could cause results and developments to differ

materially from those expressed or implied by the forward-looking

statements including, without limitation, general economic and

business conditions, industry trends, competition, commodity

prices, changes in regulation, currency fluctuations (including the

US dollar and Mexican Peso exchanges rates), the Fresnillo Group's

ability to recover its reserves or develop new reserves, including

its ability to convert its resources into reserves and its mineral

potential into resources or reserves, changes in its business

strategy and political and economic uncertainty.

Note: financials disclosed in this statement are unaudited

[1] Au:Ag ratio of 80:1

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRFELLLXDLBBBL

(END) Dow Jones Newswires

July 26, 2023 02:00 ET (06:00 GMT)

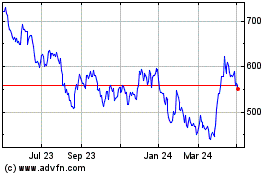

Fresnillo (LSE:FRES)

Historical Stock Chart

From Mar 2024 to Apr 2024

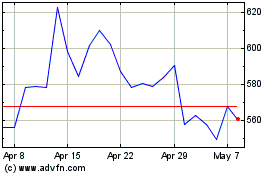

Fresnillo (LSE:FRES)

Historical Stock Chart

From Apr 2023 to Apr 2024