TIDMGFHG

RNS Number : 0793W

Grand Fortune High Grade Limited

17 December 2021

GRAND FORTUNE HIGH GRADE LIMITED

CONSOLIDATED REPORTS AND FINANCIAL STATEMENTS

FOR THE PERIODED 31 OCTOBER 2021

GRAND FORTUNE HIGH GRADE LIMITED

CHAIRMAN'S STATEMENT

FOR THE PERIODED 31 OCTOBER 2021

I am pleased to present the consolidated reports and financial

statements s for the period from 1 May 2021 to 31 October 2021.

During the period, the Group reported a loss of GBP156,975 (loss of

GBP174,815 for the period from 1 May 2020 to 31 October 2020) which

arose from professional fees, rent, wages and general

administration expenses in connection with the ongoing operations

of the Group. As at the date of signing this report the Group has

approximately GBP1.85 Million of cash balances.

Following its listing on the London Stock Exchange on 22 May

2017, the Group has been focused on the development, by organic

growth, of its financial training business in order to satisfy the

significant demand for financial sector specialists in China. To

assist in that development, the Group established a 100% owned

subsidiary in Hong Kong - Grand Fortune High Grade (HK) Limited

which in turn has a 100% owned subsidiary in mainland China - Shen

Zhen Shi Ji Fu Education Information Consulting Co. Ltd. (and the

consolidated financial statements presented herein comprise of the

financial statements of Grand Fortune High Grade Limited, Grand

Fortune High Grade (HK) Limited and Shen Zhen Shi Ji Fu Education

Information Consulting Co. Ltd.).

Grand Fortune High Grade Limited held its shareholder meeting on

5 November 2021. All items proposed were approved by 100% of the

votes cast at the meeting. Following the meeting, the Board of

Directors was comprised of Wong Lee Chun (re-elected), Angus Irvine

(re-elected) and Ko Kwan (elected). Kit Ling Law resigned from the

Board of Directors on 1 June 2021. Ko Kwan was appointed to the

Board of Directors on 1 October 2021, which followed the

resignation of Anthony Wonnacott from the Board of Directors on the

same date.

The past two years have been challenging. The challenges of the

COVID-19 pandemic have had had a devastating effect on the global

economy and on the ability of the Group to offer financial training

courses in person. Despite the Group's best efforts, there has not

been any revenue generated from its financial training business and

the Group has not yet been successful in developing an online

training platform. The implementation and success of the online

training platform remains one of the biggest tests for the

Group.

As the business activities develop, the Group will keep

shareholders advised of its activities. We appreciate the

assistance of our officers, directors and advisors as we work

towards the development of our business.

WONG LEE CHUN

CHIEF EXECUTIVE OFFICER

17 DECEMBER 2021

GRAND FORTUNE HIGH GRADE LIMITED

DIRECTORS' REPORT

FOR THE PERIODED 31 OCTOBER 2021

Directors' report

The directors present their report together with the

consolidated financial statements for the period ended 31 October

2021.

Principal activity and future developments

Grand Fortune High Grade Limited (individually, or collectively

with its subsidiary, Grand Fortune High Grade (HK) Limited ("GFHG

HK") and GFHG HK's wholly owned subsidiary Shen Zhen Shi Ji Fu

Education Information Consulting Co. Ltd. ("Ji Fu Education"), as

applicable, the "Group") is focused on the development, by organic

growth, of its financial training business in order to satisfy the

significant demand for financial sector specialists in China.

Business review and management report

The loss on ordinary activities for the period from 1 May 2021

to 31 October 2021 was of GBP156,975 (loss of GBP174,815 for the

period from 1 May 2020 to 31 October 2020) .

The Group had cash at bank and in hand of GBP1,870,687 at 31

October 2021 . The principal risks and uncertainties that the Group

faces are in developing its financial training business in China,

which is a new market. The Group is aiming to tailor and deliver

courses that are appropriate for the market but there is no

guarantee there will be a sufficient demand for the courses

offered.

The Group has not carried out any activities in the field of

research and development.

Events that have occurred since the end of the financial period

are detailed in note 16 to the accounts.

Dividends

The directors do not recommend the payment of a final dividend

for the period.

Directors

The following directors served during the period to 31 October

2021:

KIT LING LAW - CHAIRMAN

WONG LEE CHUN - CHIEF EXECUTIVE OFFICER

ANGUS SIGURD IRVINE - NON-EXECUTIVE DIRECTOR

KO KWAN - NON-EXECUTIVE DIRECTOR

ANTHONY WONNACOTT - NON-EXECUTIVE DIRECTOR

**Kit Ling Law resigned on 1 June 2021

**Ko Kwan commenced serving as a non-executive director on 1

October 2021 which is the same day that Anthony Wonnacott

resigned

Substantial shareholdings

Except for the interests of those persons set out below, the

Directors are not aware of any interest (other than the interests

of the Directors) which, at the date of this document would amount

to 3% or more of Grand Fortune High Grade Limited's issued share

capital:

Name Number of Ordinary Approximate % Holding

Shares

Kit Ling Law 32,339,084 20.21%

Hundred River Ltd. (Wong

Lee Chun) 31,996,100 19.99%

Directors' Remuneration

Directors' emoluments are detailed in Notes 0 and 0 to the

accounts.

Auditors

A resolution re-appointing Crowe U.K. LLP as auditors of the

Group was approved by shareholders at the annual general meeting

held on 5 November 2021.

Going concern

The Group is focused on the development, by organic growth, of a

financial training business in China, and, apart from a small

amount of interest receivable, it currently has no significant

income stream. Until the training business has been adequately

developed and is generating significant revenue, it is therefore

dependent on its cash reserves to fund ongoing costs. At 31 October

2021, the Group's cash position was GBP1,870,687.

After reviewing the Group's budget for the period ending 31

October 2022 and its medium-term plans, the directors have a

reasonable expectation that the Group will have adequate resources

to continue in operational existence for the foreseeable

future.

For this reason, they continue to adopt the going concern basis

in preparing the accounts.

Financial risk management

The Group's financial risk management objective is to minimise,

as far as possible, the Group's exposure to such risk as detailed

in note 14 to the accounts.

Principle Risks and Uncertainties Facing the Group

The principle risks and uncertainties facing the Group are: (1)

The Group's success is dependent on the successful development of a

financial training business in China, and for the period ended 31

October 2021, apart from a small amount of interest receivable, the

Group did not generate any revenue and there are no guarantees that

the Group will develop a training business that will generate

significant revenue to cover the expenses of the Group; and (2)

Until the training business has been adequately developed and

generating revenue, the Group is dependent on its cash reserves to

fund ongoing costs - there are no guarantees that the Group will be

successful in replenishing those cash reserves once depleted.

COVID-19 Risks

The worldwide emergency measures taken to combat the COVID-19

pandemic may continue, could be expanded, and could also be

reintroduced in the future following relaxation. As governments

implement monetary and fiscal policy changes aimed to help

stabilize economies and capital markets, we cannot predict legal

and regulatory responses to concerns about the COVID-19 pandemic

and related public health issues and how these responses may impact

our business. The COVID-19 pandemic, actions taken globally in

response to it, and the ensuing economic downturn has caused

significant disruption to business activities and economies. The

depth, breadth and duration of these disruptions remain highly

uncertain at this time. Furthermore, governments are developing

frameworks for the staged resumption of business activities. As a

result, it is difficult to predict how significant the impact of

the COVID-19 pandemic, including any responses to it, will be on

the global economy and our business.

The impact of COVID-19 has significantly reduced the ability of

the Group to currently provide its training programs in a

face-to-face setting and the ability to provide face-to-face

training programs in the future is uncertain. As a result, the

Group is developing an online training platform for its offered

programs. The implementation and success of this online training

platform is uncertain.

Corporate governance

Due to the size and nature of the Group, it does not comply with

the UK Corporate Governance Code. However, it has adopted corporate

governance procedures as are appropriate for the size and nature of

the Group and the size and composition of the Board. These

corporate governance procedures have been selected with due regard

to for the provisions of the UK Corporate Governance Code insofar

as is appropriate. A description of these procedures is set out

below:

-- Due to the nature and size of the Group, it does not have

separate audit, remuneration and nomination committees. The Board

as a whole will instead review risk, compliance, and nominations

matters, as well as the Board's size, structure, and composition,

taking into account the interests of the Shareholders and the

performance of the Group. Once the Group has achieved sufficient

growth, the Board intends to put in place audit, remuneration and

nomination committees.

-- One-third of Directors (or, where their number is not

divisible by three, the nearest number not exceeding one-third)

will be required to retire and seek re-elections on an annual

basis.

Directors' responsibility statement

The Directors are responsible for preparing the management

report, annual report and the non-statutory consolidated financial

statements in accordance with the Disclosure and Transparency Rules

of the United Kingdom's Financial Conduct Authority ("DTR") and

with International Financial Reporting Standards ("IFRS") as

adopted by the European Union.

International Accounting Standard 1 requires that consolidated

financial statements present fairly for each financial year the

Group's consolidated financial position, consolidated financial

performance and consolidated cash flows. This requires the faithful

representation of transactions, other events and conditions in

accordance with the definitions and recognition criteria for the

assets, liabilities, income and expenses set out in the

International Accounting Standards Board's "Framework for the

Preparation and Presentation of Financial Statements".

In virtually all circumstances, a fair representation will be

achieved by compliance with all IFRS. Directors are also required

to:

- make judgments and accounting estimates that are reasonable and prudent;

- state whether applicable accounting standards have been

followed, subject to any material departures disclosed and

explained in the financial statements;

- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Group will continue

in business;

- select suitable accounting policies and then apply them consistently;

- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable, and

understandable information; and

- provide additional disclosures when compliance with the

specific requirements in IFRS is insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the Group's consolidated financial position and

financial performance.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Group's

transactions and disclose with reasonable accuracy at any time the

financial position of the Group. They are also responsible for

safeguarding the assets of the Group and hence for taking

reasonable steps for the prevention and detection of fraud and

other irregularities.

The maintenance and integrity of the Grand Fortune High Grade

Limited website is the responsibility of the Directors; work

carried out by the auditors does not involve the consideration of

these matters and, accordingly, the auditors accept no

responsibility for any changes that may have occurred in the

accounts since they were initially presented on the website.

Legislation in the Cayman Islands governing the preparation and

dissemination of the accounts and the other information included in

annual reports may differ from legislation in other

jurisdictions.

The directors confirm, to the best of their knowledge that:

-- the consolidated financial statements, prepared in accordance

with the relevant financial reporting framework, give a true and

fair view of the consolidated assets, liabilities, financial

position and profit or loss of the Group;

-- the consolidated financial statements include a fair review

of the development and performance of the business and the

consolidated financial position of the Group, together with a

description of the principal risks and uncertainties that it faces;

and

-- the annual report and consolidated financial statements,

taken as a whole, are fair, balanced and understandable and provide

the information necessary for shareholders to assess the Group's

performance, business model and strategy.

By order of the board

"Wong Lee Chun"

CHIEF EXECUTIVE OFFICER

17 DECEMBER 2021

GRAND FORTUNE HIGH GRADE LIMITED

FOR THE PERIODED 31 OCTOBER 2021

CONSOLIDATED FINANCIAL STATEMENTS

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

1 May 2021 1 May 2020

Note to 31 October to 31 October

2021 2020

GBP GBP

Revenue - -

Administrative expenses 4 (157,028) (175,012)

Operating Loss (157,028) (175,012)

Finance income 53 197

Loss before tax (156,975) (174,815)

Taxation 5 - -

Total comprehensive loss for

the period attributable to

the equity holders of the Group (156,975) (174,815)

Loss per Ordinary Share:

Basic and diluted (pence) 6 (0.10) (0.11)

The notes to the consolidated financial statements form an integral

part of these consolidated financial statements.

GRAND FORTUNE HIGH GRADE LIMITED

FOR THE PERIODED 31 OCTOBER 2021

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At as As at

Note 31 October 2021 31 October 2020

GBP GBP

Assets

Current assets

Other receivables 7 - -

Cash and cash equivalents 1,870,687 2,267.429

Total assets 1,870,687 2,267,429

Equity and liabilities

Capital and reserves

Share capital 10 4,311,700 4,311,700

Share Based Payment Reserve 11 - -

Accumulated losses (2,447,513) (2,066,271)

Total equity attributable to

equity holders of the Group 1,864,187 2,245,429

Current liabilities

Amounts owing to Directors 12 6,500 18,500

Other payables 8 - 3,500

Total liabilities 6,500 22,000

Total equity and liabilities 1,870,687 2,267,429

The notes to the consolidated financial statements form an

integral part of these consolidated financial statements.

This report was approved by the board and authorised for issue

on 17 December 2021 and signed on its behalf by;

"Wong Lee Chun" - Chief Executive Officer

GRAND FORTUNE HIGH GRADE LIMITED

FOR THE PERIODED 31 OCTOBER 2021

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Based

Note Share Payment Accumulated

Capital Reserve Losses Total

GBP GBP GBP GBP

Balance as at 30 April 2018 4,311,700 646,637 (1,604,283) 3,354,054

Balance on 30 April 2018 4,311,700 646,637 (1,604,283) 3,354,054

Loss for the year after taxation - - (518,387) (518,387)

Total comprehensive balances 4,311,700 646,637 (2,122,670) 2,835,667

Balance as at 30 April 2019 4,311,700 646,637 (2,122,670) 2,835,667

Balance on 30 April 2019 4,311,700 646,637 (2,122,670) 2,835,667

Loss for the year after taxation - - (415,423) (415,423)

Total comprehensive balances 4,311,700 646,637 (2,538,093) 2,420,244

Balance as at 30 April 2020 4,311,700 646,637 (2,538,093) 2,420,244

Balance on 30 April 2020 4,311,700 646,637 (2,538,093) 2,420,244

Loss for the period after

taxation (399,083) (399,083)

Share Based Payments 11 (646,637) 646,637 -

Total comprehensive balances 4,311,700 - (2,290,539) 2,021,161

Balance as at 30 April 2021 4,311,700 - (2,290,539) 2,021,161

Balance on 30 April 2021 4,311,700 - (2,290,539) 2,021,161

Loss for the period after

taxation (156,975) (156,975)

Total comprehensive balances 4,311,700 - (2,447,513) 1,864,187

Balance as at 31 October

2021 4,311,700 - (2,447,513) 1,864,187

The share capital comprises the Ordinary Shares of Grand Fortune

High Grade Limited.

Accumulated losses represent the aggregate retained loss of

Grand Fortune High Grade Limited since incorporation.

The notes to the consolidated financial statements form an

integral part of these consolidated financial statements.

GRAND FORTUNE HIGH GRADE LIMITED

FOR THE PERIODED 31 OCTOBER 2021

CONSOLIDATED CASH FLOW STATEMENT

1 May 2021 1 May 2020

to 31 October to 31 October

2021 2020

GBP GBP

Cash flows from operating activities

Loss for the period before taxation (156,975) (174,815)

Share based payment charge - -

Finance income (53) (197)

Adjustments for non-cash items:

Share based payment charge - -

Foreign currency loss/(gain) (9,695) 4,309

Working capital adjustments:

Decrease in other receivables - -

(Decrease)/Increase in other payables (27,000) (9.302)

Foreign currency loss/gain (Bank

Charges) 9,695 (4,309)

Net cash used in operating activities (184,028) (184,314)

Cash flows from investing activities

Interest received 53 197

Net cash flow from investing activities 53 197

Cash flows from financing

Receipt of Director's loan - -

Proceeds from the issue of Ordinary

Shares - -

Net cash inflow from financing

activities 0 0

Increase in cash (183,975) (184,117)

Cash and cash equivalents, beginning

of the period 2,054,661 2,451,546

Cash and cash equivalents, end

of the period 1,870,687 2,267,429

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. General Information

Grand Fortune High Grade Limited is incorporated under the laws

of the Cayman Islands under the Companies Law. Grand Fortune High

Grade Limited was incorporated on 10 November 2015 as an exempted

company. Grand Fortune High Grade Limited 's registered number is

305700 and its registered office is at Willow House, Cricket

Square, PO Box 709, Grand Cayman KY1-1107, Cayman Islands.

The Group's objective is to take advantage of opportunities to

establish a financial training business.

This financial information has been prepared in accordance with

IFRS as adopted by the European Union ("EU"). The standards have

been applied consistently during the period under review.

2. Accounting Policies

Basis of preparation

The principal accounting policies adopted by the Group in the

preparation of the financial information are set out below.

The financial information has been presented in pound sterling,

being the functional currency of the Group.

The financial information has been prepared in accordance with

International Financial Reporting Standards as adopted by the

European Union ("IFRS"), including interpretations made by the

International Financial Reporting Interpretations Committee (IFRIC)

issued by the International Accounting Standards Board (IASB). The

standards have been applied consistently.

Standards and interpretations issued but not yet applied

A number of new standards and amendments to standards and

interpretations have been issued but are not yet effective and, in

some cases, have not yet been adopted by the European Union. The

directors do not expect that the adoption of these standards will

have a material impact on the consolidated financial statements of

the Group in future periods.

.

Going concern

The Group is focused on the development, by organic growth, of a

financial training business in China, and, apart from a small

amount of interest receivable, it currently has no income stream.

Until the training business has been adequately developed and is

generating revenue, it is therefore dependent on its cash reserves

to fund ongoing costs. At 31 October 2021, the Group's cash

position was GBP1,870,687 .

After reviewing the Group's budget for the period ending 31

October 2022 and its medium-term plans, the directors have a

reasonable expectation that the Group will have adequate resources

to continue in operational existence for the foreseeable future. In

making this assessment, the directors have considered current and

developing impact on the business as a result of the COVID-19

virus. Whilst this has had an immediate impact on the Group's

operations and the Group's ability to offer financial training

courses in person, the Group is developing an online training

platform for its offered programs. The directors are aware that the

implementation and success of the online training platform remains

one of the biggest tests for the Group, in particular if the

current situation with COVID-19 becomes prolonged and in person

training is not possible or limited.

The financial information does not include any adjustments that

would result if the Group were unable to continue as a going

concern.

Taxation

The tax currently payable is based on the taxable profit for the

period. Taxable profit differs from net profit as reported in the

income statement because it excludes items of income or expense

that are taxable or deductible in other periods and it further

excludes items that are never taxable or deductible. The Group's

liability for current tax is calculated using tax rates that have

been enacted or substantively enacted by the balance sheet

date.

Financial instruments

Financial assets and financial liabilities are recognised on the

consolidated statement of financial position when the Group becomes

a party to the contractual provisions of the instrument.

Financial assets

Under IFRS 9, financial assets are measured at amortised cost or

fair value through other comprehensive income ("FVOCI") depending

on the business model and contractual cash flow characteristics.

The classification depends on the basis on which assets are

measured and if either criteria is not met, then the financial

assets are held at fair value through profit or loss ("FVPL").

The Group holds cash and cash equivalents at amortised cost.

As at the consolidated balance sheet date, the Group did not

have any financial assets measured at FVPL or FVOCI.

Financial liabilities and equity instruments

Classification as debt or equity

Financial liabilities and equity instruments issued by the Group

are classified according to the substance of the contractual

arrangements entered into and the definitions of a financial

liability and an equity instrument.

Equity instruments

An equity instrument is any contract that evidences a residual

interest in the assets of the Group after deducting all of its

liabilities. Equity instruments are recorded at the proceeds

received, net of direct issue costs.

Financial liabilities

All financial liabilities are measured at amortised cost and are

subsequently measured at amortised cost, where applicable, using

the effective interest method, with interest expense recognised on

an effective yield basis.

Derecognition of financial liabilities

The Group derecognises financial liabilities when, and only

when, the Group's obligations are discharged, cancelled or they

expire.

Foreign currencies

Profit and loss account transactions denominated in foreign

currencies are translated into sterling and recorded at the rate of

exchange ruling at the date of the transaction. Monetary assets and

liabilities denominated in foreign currencies are retranslated at

the rate of exchange ruling at the balance sheet date.

All differences are taken to the profit and loss account.

Cash and cash equivalents

The Group considers any cash on short-term deposits and other

short-term investments to be cash equivalents.

Leases/Rentals

The only leases the Group has entered into are short term

leases. As permitted by IFRS 16 the Group has taken advantage of

the exemption not to apply the requirements of IFRS 16 to short

term leases and is recognising the expense in profit and loss

evenly over the lease contract. The total expense incurred on short

term leases is disclosed as rental expenses in note 4 to these

financial statements.

Segment Information

In the Directors' opinion, the Group has only one operating

segment - the development and operation of financial training

courses in China. The internal and external reporting is on a

consolidated basis with transactions between Group companies

eliminated on consolidation. Therefore, the financial information

of the single segment is the same as set out in the consolidated

statement of comprehensive income, the consolidated statement of

changes in equity and the consolidated statement of financial

position and cash flows.

3. Critical accounting estimates and judgement

The preparation of the financial information in conformity with

IFRS requires the Directors to make estimates and assumptions that

affect the reported amounts of income, expenditure, assets, and

liabilities. Estimates and judgements are continually evaluated,

including expectations of future events to ensure these estimates

remain reasonable.

The estimates and associated assumptions are based on historical

experience and various other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis of making the judgements about carrying values of assets and

liabilities that are not readily apparent from other sources.

Actual results may differ from these estimates.

4. Administrative expenses

1 May 2021 1 May 2020

to 31 October to 31 October

2021 2020

GBP GBP

Directors Remuneration 58,000 69,000

Directors Remuneration (adjustment) - 198

Key Management personnel 3,248 3,521

Rental Expenses 1,144 2,080

Salaries/Wages 44,422 42,866

Office/General Expenses 2,477 9.588

Legal and Professional Fees 55,786 41,330

Bank Charges 1,645 2,210

Foreign currency (gain) /

loss (9,695) 4,309

157,028 175,012

5. Taxation

Grand Fortune High Grade Limited is incorporated in the Cayman

Islands. The operations of Grand Fortune High Grade Limited are,

with the exception of regulatory filings, outside of the Cayman

Islands. Accordingly, the costs and revenues of Grand Fortune High

Grade Limited are subject to Cayman Islands taxation legislation

where the prevailing taxation rate is 0%.

As GFHG HK is incorporated in Hong Kong it is subject to Hong

Kong taxation legislation and as Ji Fu Education is incorporated in

China it is subject to China taxation legislation . Any revenue

earned by GFHG HK would be subject to Hong Kong taxation and any

revenue earned by Ji Fu Education would be subject to China

taxation. It is the intention of the Group to attempt to offset any

revenue against historic costs incurred where such revenue is

earned and a taxation reduction on such future revenue may be

available. As the Group's expenses exceeded its revenue for the

period ended 31 October 2021, it has not accrued any tax amount

payable.

6. Loss per Ordinary Share

The calculation for earnings per Ordinary Share (basic and

diluted) for the relevant period is based on the profit after

income tax attributable to equity holder is as follows:

1 May 2021 1 May 2020

to 31 October to 31 October

2021 2020

Loss attributable to equity

holders (GBP) (156,975) (174,815)

Weighted average number of

Ordinary Shares 160,000,000 160,000,000

Earnings per share (pence) (0.10) (0.11)

7. Other receivables

None

8. Other payables

None

9. Key management personnel

Zhao Zhijun, the management director of GFHG HK, is considered a

key management personnel and below is the remuneration that was

paid in the periods below.

As at As at

31 October 31 October

2021 2020

GBP GBP

Zhao Zhijun 3,428 3,521

The Directors are also considered the key management personnel

and the following directors' remuneration was accrued in the

periods below.

As at As at

31 October 31 October

2021 2020

GBP GBP

Wong Lee Chun 18,000 18,000

Angus Irvine 21,000 21,000

Ko Kwan - -

Kit Ling Law 1,500 9,000

Anthony Wonnacott 17,500 21,000

58,000 69,000

10. Share capital

As at As at

31 October 31 October

2021 2020

GBP GBP

160,000,000 Ordinary Shares 4,311,700 4,311,700

4,311,700 4,311,700

11. Share based payments

The Group has recognized NIL in respect of share-based payment

amounts in each of the periods ended 31 October 2021 and 31 October

2020.

On 17 May 2017 Grand Fortune High Grade Limited entered into

warrant agreements with each of Alice Lau, Vincent Poon, Wai Man

Hui and Cornhill Capital Limited conferring the right to subscribe

for 4,800,000 Ordinary Shares each (a total of 19,200,000 Ordinary

Shares) as remuneration for assistance with the admission on the

London Stock Exchange. Each Warrant Agreement is in an identical

form and confers the right to subscribe for Ordinary Shares at

GBP0.10. The Warrants were conditional on admission on the London

Stock Exchange (which was completed on 22 May 2017) and can be

exercised at any time until 22 May 2020 (see Note 17).

The following table summarizes the Group's outstanding

warrants:

Period Ended Share Based Period Ended Share Based

31 October Payment 31 October Payment

2020 Charge 2020 Charge

GBP GBP

Opening Position - - 19,200,000 646,637

-------------- -------------------- -------------------- -------------------

Granted - - - -

-------------- -------------------- -------------------- -------------------

Exercised - - - -

-------------- -------------------- -------------------- -------------------

Expired - - 19,200,000 (646,637)

-------------- -------------------- -------------------- -------------------

Closing Position - - - -

-------------- -------------------- -------------------- -------------------

The aggregate fair value of the Warrants was estimated at

GBP646,637 (fair value of individual warrant was GBP0.0337) using

the Black-Scholes valuation model with the following assumptions:

expected volatility of 50%, risk-free interest rate of 0.1799% and

an expected life of 3 years. Calculation of volatility involves

significant judgement by the Directors. Volatility number was

estimated based on the range of 36-month end volatilities of the

main market index.

12. Amounts owing to Directors

As at As at

31 October 31 October

2021 2020

GBP GBP

Directors Fees 6,500 18,500

6,500 18,500

The above Directors fees payable relates to directors'

remuneration between 1 May 2018 and the respective periods listed

above. As of 31 October 2021, the only amounts owing to Directors

are the amounts for fees accrued for October 2021 as all other

outstanding amounts were paid during the period ended 31 October

2021.

13. Financial instruments

As at As at

31 October 31 October

2021 2020

Financial assets GBP GBP

Loans and receivables

Cash and cash equivalents 1,870,687 2,267,429

Total financial assets 1,870,687 2,267,429

Financial liabilities at amortised

cost

Amounts owing to Directors 6,500 18,500

Other payables - 3,500

Total financial liabilities 6,500 22,000

14. Financial risk management

The Group uses a limited number of financial instruments,

comprising cash and amounts owing to Directors, which arise

directly from operations. The Group does not trade in financial

instruments.

General objectives, policies and processes

The Directors have overall responsibility for the determination

of the Group's risk management objectives and policies. Further

details regarding these policies are set out below:

Currency risk

As the Group operates internationally, its exposure to foreign

exchange risk relates to transactions and balances that are

denominated in currencies other than GBP. The Directors manage the

Group's exposure to currency risk by operating foreign currency

bank accounts, being GBP, HKD, RMB and USD. It is the Directors'

view that the size and complexity of the Group's trade does not

warrant financial hedging arrangements currently, although this

view will be regularly reviewed as the Group develops.

The table below illustrates the hypothetical sensitivity of the

Group's consolidated statement of financial position to a 10%

increase and decrease in the GBP/HKD, GBP/USD and GBP/RMB exchange

rates at the year-end date. The sensitivity rate of 10% represents

the directors' assessment of a reasonably possible change, based on

historic volatility.

Period Ended Period Ended

31 October 31 October

2021 2020

GBP GBP

------------------------------------------------- -------------------- --------------------

GBP Increases by 10%

HKD portion of Cash and cash equivalents (37,818) (24,971)

USD portion of Cash and cash equivalents (6,579) (7,960)

RMB portion of Cash and cash equivalents (1,449) (4,663)

------------------------------------------------- -------------------- --------------------

GBP Decreases by 10%

HKD portion of Cash and cash equivalents 46,221 30,520

USD portion of Cash and cash equivalents 8,041 9,729

RMB portion of Cash and cash equivalents 1,771 5,699

Period end exchange rates applied in the above analysis are HKD

10.83480 (2020 - HKD 10.0336), USD 1.39549 (2020 - USD 1.29421) and

RMB 8.75894 (2020 - RMB 8.65494).

Credit risk

Credit risk is the risk that a counter party will not meet its

obligations under a contract, leading to a financial loss. The

Group had cash and cash equivalents of GBP1,870,687 as at 31

October 2021. The credit risk from its liquid funds is limited as

the counter parties are banks with high credit ratings which have

not experienced any losses in such accounts.

Liquidity risk

Liquidity risk arises from the Directors' management of working

capital. It is the risk that the Group will encounter difficulty in

meeting its financial obligations as they fall due.

The Directors' policy is to ensure that the Group will always

have sufficient cash to allow it to meet its liabilities when they

become due. To achieve this aim, the Directors seek to maintain a

cash balance sufficient to meet expected requirements.

The Directors have prepared cash flow projections on a monthly

basis through to 31 October 2022. At the end of the period under

review, these projections indicated that the Group expected to have

sufficient liquid resources to meet its obligations under all

reasonably expected circumstances.

15. Capital risk management

-

The Directors' objectives when managing capital are to safeguard

the Group's ability to continue as a going concern in order to

provide returns for Shareholders and benefits for other

stakeholders and to maintain an optimal capital structure to reduce

the cost of capital. Historically, the Group had been financed by

equity and Directors' loans. In the future, the capital structure

of the Group is expected to consist of equity attributable to

equity holders of the Group, comprising issued share capital and

reserves.

16. Subsequent events

None

17. Related party transactions

During the year ended 30 April 2020, Grand Fortune High Grade

Limited entered into an employment agreement with Derek Law. Derek

Law is a related party by virtue of being the brother of Kit Ling

Law (a significant shareholder and former member of the Board of

Directors of Grand Fortune High Grade Limited). Under the terms of

the employment agreement, Derek Law was employed on a continuous

basis as an Executive Deputy Director of Grand Fortune High Grade

Limited effective 1 December 2019 and entitled to a monthly salary

of HKD 20,000 and a monthly housing allowance of HKD 5,000.

All other amounts owing to directors relate to directors'

remuneration accrued between May 2018 and the period ended 31

October 2021, see note 9 and 0 for a summary.

18. Ultimate controlling party

As at 31 October 2021, the Group did not have any one

identifiable controlling party.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BXBDDXXBDGBR

(END) Dow Jones Newswires

December 17, 2021 08:39 ET (13:39 GMT)

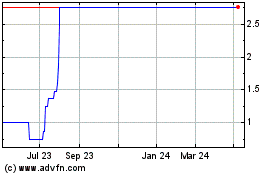

Grand Fortune High Grade (LSE:GFHG)

Historical Stock Chart

From Jan 2025 to Feb 2025

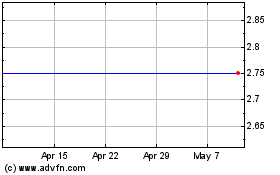

Grand Fortune High Grade (LSE:GFHG)

Historical Stock Chart

From Feb 2024 to Feb 2025