TIDMGRID

RNS Number : 7236R

Gresham House Energy Storage Fund

09 November 2021

9 November 2021

Gresham House Energy Storage Fund plc

(the "GRID" or the "Fund")

Quarterly NAV and Factsheet Publication

Gresham House Energy Storage Fund plc (LSE: GRID) (the "Fund")

announces its NAV as at 30 September 2021 was GBP490.0m or 111.91p

per ordinary share.

Financial Highlights

- NAV has increased to GBP490.0m, or 111.91p per share, up 2.02p per share in the quarter.

- From the IPO in November 2018 to the end of September 2021,

the Fund has delivered a share price total return of 42.7% compared

with 16.5% for the FTSE All Share and a NAV Total Return of

31.2%.

- Dividend cover remained healthy at 1.2x notwithstanding the

increased cash balance following GBP100m equity fundraising in

July.

- The portfolio achieved record EBITDA performance during the

quarter with Dynamic Containment generating over 50% of revenues.

Increased power price volatility during September led to a record

monthly EBITDA, driven by trading.

- Volatility, which is remaining high in Q4 2021, is driving

continued record revenue levels, therefore trading is expected to

achieve a larger share of revenues going forward.

- Review of weighted average discount rates: as highlighted in

the Interim Results, the Fund has completed a review of the

discount rates used for valuation purposes. The Board and Manager,

in consultation with its Independent Valuer, have agreed that a

0.25% reduction in discount rate applied to merchant cashflows from

11.10% to 10.85% is appropriate. There is no change to the discount

rate applied to contracted cashflows. Accordingly, the weighted

average discount rate (WADR) for operational assets as at 30

September has therefore dropped to 10.5% from 10.7% at the end of

June.

- Review of valuation methodology for in-construction assets:

following the Investment Policy change in November 20202, the Fund

has acquired several projects at the pre-construction stage from

its target pipeline and is currently putting these projects into

construction. The Board and the Manager have determined that the

appropriate approach is to revalue projects in construction using a

discount rate of WADR+0.5% so long as they are projected to

commission within 9 months. Post-commissioning, the WADR is

applied. This approach will ensure that the revaluation of projects

takes place gradually as they are de-risked and major milestones

are achieved.

- As at 30 September, the blended WADR across all operational

assets (425MW) and in-construction assets (100MW) combined is

10.7%.

Commentary on changes to the NAV

During the quarter, the most significant changes to NAV per

share included:

-- +3.39p due to revaluation of 100MW of projects under

construction (Enderby and West Didsbury)

-- +2.25p from cash generated by the portfolio

-- +1.32p from the reduction in the discount rate on merchant cashflows of 0.25%

-- +0.41p from raising GBP100m in July 2021 at 112p, a premium to the prevailing NAV

-- -1.75p from the payment of dividends

-- -1.93p due to lower revenue forecasts. The Fund's third-party

consultants revised down Dynamic Containment pricing forecasts

following National Grid moving to contracting in four-hourly blocks

in mid-September and announcing reduced demand during certain

blocks, impacting rest-of-2021 and 2022 price and volume forecasts.

Higher trading revenue assumptions offset some of the reduction

although overall revenue forecasts remain below currently

achievable levels.

Portfolio activity & market outlook

- The Fund has seen a lot of activity in the third quarter of

2021 both in terms of transactions and market backdrop.

- The Fund successfully raised equity of GBP100m before expenses

at 112p in early July 2021. This was in addition to the GBP120m

raised in November 2020.

- In September, the Fund signed a GBP180m debt facility which

consists of a GBP150m capex facility and a GBP30m RCF. The facility

carries a cost of 300bps over SONIA on amounts drawn and has a term

of five years allowing the Fund financial flexibility through the

prudent utilisation of this facility.

- The Fund put four projects into construction: Coupar Angus,

Arbroath, Enderby and West Didsbury, totalling 175MW. A further

190MW are expected to follow in Q4 and over 200MW in Q1 2022.

- The Fund continues to develop its pipeline which currently

stands at 852MW. The team is focused on scaling up through adding

new pipeline opportunities to the current batch of projects.

- The market environment has been developing as expected in

terms of rising volatility due to the increasing penetration of

renewables; in the Manager's opinion, this feature of the market is

here to stay and is expected to continue to evolve as more

renewables are deployed, resulting in more supply side

intermittency.

- Natural gas and carbon prices have risen significantly with

the former having the greater impact on electricity prices. We do

not expect these very high prices to last more than a few months.

It is also not expected that a reversal in gas prices will

necessarily result in much lower power price volatility - for

example we witnessed similar volatility in December 2020 and

January 2021 of last winter despite much lower gas prices.

- As mentioned above, we are seeing lower Dynamic Containment

service procurement by National Grid. In moving to four hourly

contracting in mid-September, National Grid can now procure less

during those times of the day when they need less grid support

services. The result is to lower expected prices for Dynamic

Containment due to oversupply, in line with the Manager's prior

expectations.

The net result of the developments above is that higher

volatility is expected to underpin trading revenues while the

frequency response market is now in saturation much of the time. As

such, the Manager is expecting trading revenues to represent over

50% of revenues in 2022, with total revenues expected to remain

robust. The Manager remains confident, given its strong technical

capabilities and large scale operating portfolio, to be able to

capture significant revenues from this evolving market

environment.

Project Location MW Acquisition date

Staunch Staffordshire 20 November 2018

----------------- ---- ---------------------

Rufford Nottinghamshire 7 November 2018

----------------- ---- ---------------------

Lockleaze Bristol 15 November 2018

----------------- ---- ---------------------

Littlebrook Kent 8 November 2018

----------------- ---- ---------------------

Roundponds Wiltshire 20 November 2018

----------------- ---- ---------------------

Wolverhampton West Midlands 5 August 2019

----------------- ---- ---------------------

Glassenbury Kent 40 December 2019

----------------- ---- ---------------------

Cleator Cumbria 10 December 2019

----------------- ---- ---------------------

Red Scar Lancashire 49 December 2019

----------------- ---- ---------------------

Bloxwich West Midlands 41 Operational - Q3

2020

----------------- ---- ---------------------

Thurcroft South Yorkshire 50 Operational - Q4

2020

----------------- ---- ---------------------

Wickham Market Suffolk 50 Operational - Q4

2020

----------------- ---- ---------------------

Tynemouth North Tyneside 25 Operational - Q1

2021

----------------- ---- ---------------------

Glassenbury Extension Kent 10 Operational - Q1

2021

----------------- ---- ---------------------

Nevendon Essex 10 Operational - Q1

2021

----------------- ---- ---------------------

Port of Tyne Tyneside 35 Operational - Q1

2021

----------------- ---- ---------------------

Byers Brae West Lothian 30 Operational - Q2

2021

----------------- ---- ---------------------

Total Portfolio 425

---- ---------------------

Project Location MW Target Commissioning

----------------- ---- ---------------------

Enderby Leicester 50 Q1 2022

----------------- ---- ---------------------

West Didsbury Manchester 50 Q1 2022

----------------- ---- ---------------------

Melksham East Swindon 100 H1 2022

& West

----------------- ---- ---------------------

Coupar Angus Co. Perth 40 Q1 2022

----------------- ---- ---------------------

Arbroath Co. Angus 35 Q1 2022

----------------- ---- ---------------------

Penwortham Preston 50 H2 2022

----------------- ---- ---------------------

Grendon Northampton 100 H2 2022

----------------- ---- ---------------------

Monet's Garden North Yorkshire 50 Q1 2023

----------------- ---- ---------------------

Lister Drive Merseyside 50 Q1 2023

----------------- ---- ---------------------

Project E2 West Yorkshire 150 Q1 2023

----------------- ---- ---------------------

Stairfoot South Yorkshire 40 Q1 2022

----------------- ---- ---------------------

Project B West Yorkshire 87 H2 2022

----------------- ---- ---------------------

Project Y York, N. 50 H2 2022

Yorks.

----------------- ---- ---------------------

Total Pipeline 852

---- ---------------------

The factsheet for the period ended 30 September 2021 is

available here .

For further information, please contact:

Gresham House New Energy

Ben Guest +44 (0) 20 3837 6270

Jefferies International Limited

Stuart Klein

Gaudi Le Roux +44 (0) 20 7029 8000

KL Communications

Charles Gorman

Camilla Esmund

Alex Hogan +44 (0) 20 3995 6673

JTC (UK) Limited as Company Secretary

Christopher Gibbons +44 (0)203 846 9774

About the Company and the Manager:

Gresham House Energy Storage Fund plc seeks to provide investors

with an attractive and sustainable dividend over the long term by

investing in a diversified portfolio of utility-scale battery

energy storage systems (known as BESS) located in Great Britain,

Northern Ireland, and the Republic of Ireland. In addition, the

Company seeks to provide investors with the prospect of capital

growth through the re-investment of net cash generated in excess of

the target dividend in accordance with the Company's investment

policy.

Gresham House Asset Management is the FCA authorised operating

business of Gresham House plc, a London Stock Exchange quoted

specialist alternative asset manager. Gresham House is committed to

operating responsibly and sustainably, taking the long view in

delivering sustainable investment solutions.

www.greshamhouse.com

Definition of Utility-scale battery Storage Systems

Utility-scale battery storage systems are the enabling

infrastructure that will support the continued growth of renewable

energy sources such as wind and solar, essential to the UK's stated

target to reduce carbon emissions. They store excess energy

generated by renewable energy sources and then release that stored

energy back into the grid during peak hours when there is increased

demand for it.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVEANFPESLFFFA

(END) Dow Jones Newswires

November 09, 2021 02:00 ET (07:00 GMT)

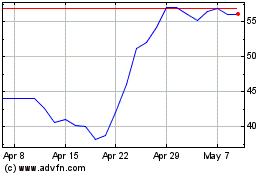

Gresham House Energy Sto... (LSE:GRID)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gresham House Energy Sto... (LSE:GRID)

Historical Stock Chart

From Apr 2023 to Apr 2024