TIDMHAT

RNS Number : 2307B

H&T Group PLC

29 September 2022

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT IS

RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE, TRANSMISSION,

DISTRIBUTION OR FORWARDING DIRECTLY OR INDIRECTLY, IN WHOLE OR IN

PART, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, THE REPUBLIC

OF SOUTH AFRICA, JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH

PUBLICATION, TRANSMISSION, RELEASE, DISTRIBUTION OR FORWARDING

WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014 (WHICH

FORMS PART OF DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 ("UK MAR"). ON PUBLICATION OF THIS

ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION

IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

THIS ANNOUNCEMENT IS FOR INFORMATIONAL PURPOSES ONLY, AND DOES

NOT CONSTITUTE OR FORM PART OF ANY OFFER OR INVITATION TO SELL OR

ISSUE, OR ANY SOLICITATION OF AN OFFER TO PURCHASE OR SUBSCRIBE

FOR, ANY SECURITIES OF H&T GROUP PLC.

THIS ANNOUNCEMENT AMOUNTS TO A FINANCIAL PROMOTION FOR THE

PURPOSES OF SECTION 21 OF THE FINANCIAL SERVICES AND MARKETS ACT

2000 ("FSMA") AND HAS BEEN APPROVED BY PRIMARYBID LIMITED WHICH IS

AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY (FRN

779021).

29 September 2022

H&T Group PLC

("H&T", the " Company " or the "Group" )

Retail Offer by PrimaryBid

-- H&T announces a retail offer via PrimaryBid;

-- The Issue Price for the Retail Offer Shares is 425 p per

Retail Share, representing a discount of 4.3 percent to the closing

price on 28 September 2022;

-- Investors can access the Retail Offer by visiting

www.primarybid.com and downloading the PrimaryBid mobile app;

-- Investors can also take part through PrimaryBid's extensive

network of retail brokers, wealth managers and investment

platforms. Subscriptions through these partners can be made from

tax efficient savings vehicles such as ISAs or SIPPs, as well as

General Investment Accounts (GIAs);

-- Both the Placing Shares and Retail Offer Shares will be sold at the Issue Price;

-- There is a minimum subscription of GBP250 per investor in the Retail Offer;

-- No commission is charged by PrimaryBid on applications to the Retail Offer.

Retail Offer

H&T ( LON : HAT) is pleased to announce, a conditional offer

for subscription via PrimaryBid (the "Retail Offer") of new

ordinary shares of 5 pence each ("Ordinary Shares") in the Company

("Retail Offer Shares") at an issue price of 425 pence per new

Ordinary Share (the "Issue Price"), being a discount of 4.3 per

cent to the closing price on 28 September 2022. The Company is also

conducting a placing of new Ordinary Shares (the "Placing Shares")

at the Issue Price by way of an accelerated bookbuild process (the

"Placing", together with the Retail Offer, the "Capital Raising")

as announced earlier today.

The Capital Raising is conditional on the new Ordinary Shares to

be issued pursuant to the Capital Raising being admitted to trading

on AIM ("Admission"). Admission is expected to be take place at

8.00 a.m. on or around 4 October 2022 . The Retail Offer will not

be completed without the Placing also being completed.

The Company will use the funds raised for certain expansion

opportunities, including:

-- Growing the pledge book;

-- Funding expansion of store estate through the opening of up

to a further 20 new stores in 2023.

Reason for the Retail Offer

The Company values its retail investor base and is therefore

pleased to provide private and other investors the opportunity to

participate in the Retail Offer by applying through the PrimaryBid

mobile app available on the Apple App Store and Google Play.

Investors may also be able to subscribe to the Retail Offer using

their ISAs, SIPP or GIA by contacting their retail broker, wealth

manager or investment platform. PrimaryBid does not charge

investors any commission for these services.

Brokers wishing to offer their customers access to the Retail

Offer, and future PrimaryBid transactions, should contact

partners@primarybid.com.

The Retail Offer, via the PrimaryBid mobile app, will be open to

individual and institutional investors following the release of

this announcement. The Retail Offer is expected to close no later

than 7 p.m. on 29 September 2022 . The Retail Offer may close early

if it is oversubscribed.

The Company and Shore Capital reserves the right to scale back

any order at its discretion. The Company and PrimaryBid reserve the

right to reject any application for subscription under the Retail

Offer without giving any reason for such rejection.

No commission is charged to investors on applications to

participate in the Retail Offer made through PrimaryBid. It is

vital to note that once an application for new Ordinary Shares has

been made and accepted via PrimaryBid, an application cannot be

withdrawn.

For further information on PrimaryBid or the procedure for

applications under the Retail Offer , visit www.PrimaryBid.com or

email PrimaryBid at enquiries@primarybid.com.

The new Ordinary Shares will be issued free of all liens,

charges and encumbrances and will, when issued and fully paid, rank

pari passu in all respects with the Company's existing Ordinary

Shares.

H &T Group plc

Chris Gillespie, Chief Executive

Diane Giddy, Chief Financial Officer +44(0)20 8225 2700

PrimaryBid Limited enquiries@primarybid.com

Fahim Chowdhury/ James Deal

Shore Capital , Nominated Advisor and Broker

S tephane Auton/Iain Sexton (Corporate Advisory)

Guy Wiehahn/ Chloe Booker- Triolo (Corporate

Broking) +44(0)20 7408 4090

+44(0)20 3405 0205

Alma PR (Public Relations) handt@almapr.co.uk

Sam Modlin

Andy Bryant

Lily Soares Smith

Details of the Retail Offer

The Company highly values its retail investor base which has

supported the Company alongside institutional investors over

several years. Given the longstanding support of retail

shareholders, the Company believes that it is appropriate to

provide retail and other interested investors the opportunity to

participate through the Retail Offer. The Company is therefore

making the Retail Offer available exclusively through

PrimaryBid.

The Retail Offer is offered under the exemptions against the

need for a prospectus in accordance with the Prospectus Regulation

Rules. Accordingly, the Company is not required to publish (and has

not published) a prospectus in connection with the Retail Offer as

it falls within the exemption set out in section 86(1)(e) and 86(4)

of FSMA. As such, there is no need for approval of the same by the

Financial Conduct Authority. The Retail Offer is not being made

into any jurisdiction where it would be unlawful to do so.

There is a minimum subscription of GBP250 per investor under the

terms of the Retail Offer which is open to existing shareholders

and other investors subscribing via the PrimaryBid mobile app.

For further details please refer to the PrimaryBid website at

www.PrimaryBid.com . The terms and conditions on which the Retail

Offer is made, including the procedure for application and payment

for new Ordinary Shares, is available to all persons who register

with PrimaryBid.

Investors should make their own investigations into the merits

of an investment in the Company. Nothing in this announcement

amounts to a recommendation to invest in the Company or amounts to

investment, taxation or legal advice.

It should be noted that a subscription for new Ordinary Shares

and investment in the Company carries a number of risks. Investors

should consider the risk factors set out on www.PrimaryBid.com and

the PrimaryBid mobile app before making a decision to subscribe for

new Ordinary Shares. Investors should take independent advice from

a person experienced in advising on investment in securities such

as the new Ordinary Shares if they are in any doubt.

This announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notices" section of this announcement.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com .

IMPORTANT NOTICES

This Announcement has been issued by and is the sole

responsibility of the Company.

No action has been taken by the Company , PrimaryBid or any of

their respective affiliates, or any person acting on its or their

behalf that would permit an offer of the Retail Offer Shares or

possession or distribution of this Announcement or any other

offering or publicity material relating to such Retail Offer Shares

in any jurisdiction where action for that purpose is required.

Persons into whose possession this Announcement comes are required

by the Company to inform themselves about , and to observe , such

restrictions.

No prospectus will be made available in connection with the

matters contained in this Announcement and no such prospectus is

required (in accordance with the Prospectus Regulation Rules) to be

published. Persons needing advice should consult a qualified

independent legal adviser, business adviser, financial adviser or

tax adviser for legal, financial, business or tax advice.

This Announcement and the information contained herein, is

restricted and is not for publication, release or distribution,

directly or indirectly, in whole or in part, in or into the United

States of America, its territories and possessions, any state of

the United States or the district of Columbia (collectively, the

"United States"), Australia, Canada, Japan, the Republic of South

Africa or any other jurisdiction in which such publication, release

or distribution would be unlawful. Further, this Announcement is

for information purposes only and is not an offer of securities in

any jurisdiction. This Announcement has not been approved by the

London Stock Exchange, nor is it intended that it will be so

approved.

Persons distributing this Announcement must satisfy themselves

that it is lawful to do so. This Announcement is for information

purposes only and shall not constitute or form part of any offer to

issue or sell, or the solicitation of an offer to acquire, purchase

or subscribe for, any securities in the United States, Australia,

Canada, Japan, the Republic of South Africa or any other

jurisdiction in which the same would be unlawful. Any failure to

comply with this restriction may constitute a violation of the

securities laws of such jurisdictions. No public offering of the

Retail Offer Shares is being made in any such jurisdiction.

The Retail Offer Shares have not been and will not be registered

under the US Securities Act of 1993, as amended (the "Securities

Act") , or under the securities laws of any State or other

jurisdiction of the United States, and may not be offered , sold or

resold, directly or indirectly , in or into the United States

except pursuant to an exemption from, or in a transaction not

subject to, the registration requirements of the Securities Act and

in compliance with any applicable securities laws of any State or

any other jurisdiction of the United States.

Certain statements contained in this Announcement constitute

"forward-looking statements" with respect to the financial

condition, performance, strategic initiatives, objectives, results

of operations and business of the Company. All statements other

than statements of historical facts included in this Announcement

are, or may be deemed to be, forward-looking statements. Without

limitation, any statements preceded or followed by or that include

the words "targets", "plans", "believes", "expects", "aims",

"intends", "anticipates", "estimates", "projects", "will", "may",

"would", "could" or "should", or words or terms of similar

substance or the negative thereof, are forward-looking statements.

Forward-looking statements include statements relating to the

following: (i) future capital expenditures, expenses, revenues,

earnings, synergies, economic performance, indebtedness, financial

condition, dividend policy, losses and future prospects; and (ii)

business and management strategies and the expansion and growth of

the Company's operations. Such forward-looking statements involve

risks and uncertainties that could significantly affect expected

results and are based on certain key assumptions. Many factors

could cause actual results, performance or achievements to differ

materially from those projected or implied in any forward-looking

statements. The important factors that could cause the Company's

actual results, performance or achievements to differ materially

from those in the forward-looking statements include, among others,

the macroeconomic and other impacts of a pandemic , economic and

business cycles , geopolitical developments , the terms and

conditions of the Company's financing arrangements, foreign

currency rate fluctuations, competition in the Company's principal

markets, acquisitions or disposals of businesses or assets and

trends in the Company's principal industry. Due to such

uncertainties and risks, you are cautioned not to place undue

reliance on such forward-looking statements, which speak only as of

the date hereof. In light of these risks, uncertainties and

assumptions, the events described in the forward-looking statements

in this Announcement may not occur. The forward-looking statements

contained in this Announcement speak only as of the date of this

Announcement. The Company , its Directors, their respective

affiliates and any person acting on their behalf each expressly

disclaim any obligation or undertaking to update or revise publicly

any forward-looking statements, whether as a result of new

information, future events or otherwise, unless required to do so

by applicable law or regulation, the UK MAR, the rules of the

London Stock Exchange or the Financial Conduct Authority.

This Announcement does not constitute a recommendation

concerning any subscriber's investment decision with respect to the

Retail Offer. The price of shares and any income expected from them

may go down as well as up and subscribers may not get back the full

amount invested upon disposal of the shares. Past performance is no

guide to future performance. The contents of this Announcement are

not to be construed as legal, business, financial or tax advice.

Each subscriber or prospective subscriber should consult his, her

or its own legal adviser, business adviser, financial adviser or

tax adviser for legal, financial, business or tax advice.

The Retail Offer Shares to be issued or sold pursuant to the

Retail Offer will not be admitted to trading on any stock exchange

other than the AIM Market of the London Stock Exchange.

No statement in this Announcement is intended to be a profit

forecast, and no statement in this Announcement should be

interpreted to mean that earnings per share of the Company for the

current or future financial years would necessarily match or exceed

the historical published earnings per share of the Company.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into or forms part of this Announcement.

This Announcement has been prepared for the purposes of

complying with applicable law and regulation in the United Kingdom

and the information disclosed may not be the same as that which

would have been disclosed if this Announcement had been prepared in

accordance with the laws and regulations of any jurisdiction

outside the United Kingdom.

If you are in any doubt about the contents of this Announcement

you should consult your stockbroker, bank manager, solicitor,

accountant or other financial adviser.

The Company has taken all reasonable care to ensure that the

facts stated in this Announcement are true and accurate in all

material respects, and that there are no other facts the omission

of which would make misleading any statement in the document,

whether of facts or of opinion. The Company accepts responsibility

accordingly.

It should be remembered that the price of securities and the

income from them can go down as well as up.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEASNNALSAEFA

(END) Dow Jones Newswires

September 29, 2022 11:47 ET (15:47 GMT)

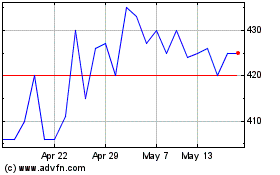

H&t (LSE:HAT)

Historical Stock Chart

From Jan 2025 to Feb 2025

H&t (LSE:HAT)

Historical Stock Chart

From Feb 2024 to Feb 2025