Strong year of revenue and profit growth,

supported by international and offshore markets

Hunting PLC (LSE:HTG), the precision engineering group, today

announces its results for the year ended 31 December 2023.

Financial Highlights

- Order book increased by 19% to $565.2m.

- Revenue increased by 28% to $929.1m.

- Non-oil and gas revenue increased 59% from $47.6m to

$75.9m.

- Gross margin improved to 25% from 24%.

- EBITDA, ahead of previous guidance provided, and increased by

98% to $103.0m.

- EBITDA margin of 11% up from 7%.

- $83.1m of previously unrecognised deferred tax assets

recognised at year-end.

- Total dividends declared in the year of 10.0 cents per share,

up from 9.0 cents in 2022.

Commenting on the results Jim Johnson, Chief Executive,

said:

“Hunting has delivered a strong year of growth across most of

its product groups, demonstrating the underlying strength of our

market drivers, with security of supply and affordable energy

remaining key investment themes.

“Our offshore and international businesses have delivered robust

growth as we continue to build a more balanced and diversified

business, underpinned by the strong technology and intellectual

property that makes Hunting a market leader in precision engineered

products across our markets.

“The growth and composition of our record order book

demonstrates how much Hunting has evolved in terms of more diverse

revenue and better visibility on earnings, and provides confidence

in our near and longer-term outlook, as we deliver the Hunting 2030

Strategy.”

Strategic Highlights

- Launch of Hunting’s 2030 Strategy at the Capital Markets Day in

September 2023 which included:

- Leveraging Hunting’s global presence and high-technology

product offering, to drive multiple end-market sales growth.

- Delivering EBITDA margin growth through higher utilisation,

stronger pricing and operating efficiencies.

- Improved shareholder returns, with increased return on capital,

along with an 11% increase in total declared dividends in

2023.

- Driving sector leading technology delivered through innovation

and supported by robust intellectual property.

- Progressing the sustainability agenda with positive trends in

key non-financial metrics.

- Strong progress on revenue diversification with non-oil and gas

sales of $75.9m.

- EBITDA conversion and good cash generation reported with $50.9m

inflow delivered in H2 2023.

Financial Summary

Financial Performance measures as defined by the Group*

2023

2022

Variance

Revenue

$929.1m

$725.8m

+$203.3m

Non-oil and gas revenue

$75.9m

$47.6m

+$28.3m

EBITDA**

$103.0m

$52.0m

+$51.0m

EBITDA margin**

11%

7%

+4pp

Adjusted profit before tax**

$50.0m

$10.2m

+$39.8m

Adjusted diluted earnings per share**

20.3 cents

4.7 cents

+15.6 cents

Free cash flow**

$(0.5)m

$(60.4)m

+$59.9m

Total cash and bank**

$(0.8)m

$24.5m

-$25.3m

Net assets

$957.1m

$846.2m

+$110.9m

ROCE**

6%

1%

+5pp

Final dividend proposed***

5.0 cents

4.5 cents

+0.5 cents

Financial Performance measures as derived from IFRS

2023

2022

Variance

Operating profit

$61.0m

$2.0m

+$59.0m

Profit before tax

$50.0m

$(2.4)m

+$52.4m

Diluted earnings per share

70.0 cents

(2.8) cents

+72.8 cents

Net cash inflow (outflow) from operating

activities

$49.3m

$(36.8)m

+$86.1m

* Adjusted results exclude adjusting items agreed by the Audit

Committee and Board.

** Non-GAAP measure. Please see the 2023 Annual Report and

Accounts pages 239 to 244.

*** Payable on 10 May 2024 to shareholders on the register on 12

April 2024, subject to approval at the Company’s 2024 AGM.

Outlook Statement

The global outlook for energy in the year ahead will be driven

by similar themes to those reported in 2023.

Geopolitical tensions and potential supply disruptions are a

continuing threat to the oil and gas supply/demand balance, and

while commodity prices trended lower in the past year, it is likely

that they will remain in a range that supports sustained activity

levels during 2024.

Offshore market momentum is poised to continue to increase in

the coming years as major development cycles in South America and

South West Africa continue to accelerate.

The North American onshore drilling market is likely to be

stable during 2024, with the US more focused on oil production.

Additional LNG capacity is likely to come on-stream later in the

year, which will support new natural gas drilling in the second

half. Projected growth in international sales should also offset

shifts in US onshore market dynamics.

The Middle East will also likely show a continuation of the

activity levels reported in 2023. Despite the pause in oil

production expansion in Saudi Arabia being announced in recent

weeks, natural gas drilling in-country will continue to grow to

meet local demand, underpinning steady activity levels in the year

ahead.

In India, the Group’s facility is shortly to receive its API

threading licence which will enable premium threading activities to

accelerate. Management sees a positive profit contribution from our

joint venture in 2024, given the growth momentum in-country.

Across Asia Pacific, traditional energy demand as well as energy

transition initiatives will continue to drive growth, with

geothermal opportunities being captured as market activity

increases, particularly in the Philippines and Indonesia.

For Hunting, the Group’s OCTG product group should deliver

another year of growth, as activity in South America continues to

increase, coupled with stable activity in the US and Canada. Our

EMEA OCTG operations will continue to support projects in Brazil,

while in Asia Pacific, larger tenders continue to be announced,

which should lead to new orders being secured. Hunting’s

Perforating Systems business will continue to roll-out its leading

technology to clients across North America, while continuing to

grow internationally where markets such as Argentina present good

opportunities due to reduced import tariffs being announced.

Our Subsea Spring and Stafford businesses should also deliver a

further year of strong results as orders for ExxonMobil and other

major operators across South America continue to be progressed. The

Enpro business should also support this growth profile given the

orders secured in the second half of 2023.

Hunting will continue to drive its non-oil and gas

diversification through the Advanced Manufacturing businesses.

Momentum remains strong, with opportunities in aerospace and

defence being pursued, supporting our 2030 strategic

objectives.

In summary, the Board sees a further year of growth ahead, given

our diverse, international product offering, with management

remaining comfortable with current market guidance.

Operational and Corporate Highlights - Delivering on the

Hunting 2030 Strategy

Record $91m OCTG contract award with Cairn Oil and

Gas

- On 30 May 2023, the Company announced a record contract that

management estimates to be worth up to $91m with Cairn Oil and Gas,

Vedanta Limited, for the supply of Hunting’s SEAL-LOCK XDTM premium

connection along with OCTG.

Continued launch of new technology and innovative

products

- The Group continues to develop and introduce new technology to

clients. Research and development initiatives focus on increasing

in-field safety, while also delivering completion efficiencies and

lowering drilling and development costs for clients. With

approximately one-third of North American horizontal wells relying

exclusively on oriented perforating techniques, Hunting launched

the H-4 Perforating System™ during the year, first to the US

onshore and then in Q4 2023 to customers in Canada.

Expansion into high growth Indian energy markets

- In Q2 2023, the Company completed the construction and

commissioning of its new threading facility at Nashik Province,

India, with its joint venture partner, Jindal SAW Ltd. The official

opening of the facility took place in September 2023. Hunting’s

precision engineered premium connection technology will be applied

to Jindal SAW’s premium seamless casing and tubing.

Strong growth in Subsea businesses

- The Subsea Technologies operating segment was formed on 1

January 2023. The segment completed a number of significant orders

in the year, especially in Guyana, as investment in offshore

projects increased. Revenue increased 43% to $98.6m, with an EBITDA

margin of 14% compared to 5% in 2022. The Spring business had a

number of material order wins for its titanium stress joints in the

year for floating production, storage and offloading vessels in

Guyana and the Turkish area of the Black Sea. The segment ended the

year with an order book of $152.2m, including a strong backlog for

Enpro.

Enhanced strategic supply channels for OCTG to support energy

transition strategy

- On 5 June 2023, the Company announced a ten-year strategic

alliance with Zhejiang Jiuli Hi-Tech Metals Co. Ltd (“Jiuli”), for

the supply of corrosion resistant alloys (“CRA”) for OCTG,

geothermal and carbon capture and storage (“CCUS”) applications.

The partnership brings together Hunting’s SEAL-LOCKTM premium

connection technology with Jiuli’s CRA, such as duplex/super duplex

and high nickel-based alloys, for downhole casing and production

tubing applications, which meet some of the harshest well

conditions in the traditional oil and gas industry as well as the

emerging CCUS and geothermal markets.

Entered new marketing, manufacturing and technology

partnership to expand product offering

- On 13 July 2023, Hunting announced a collaboration agreement

with CRA-Tubulars B.V., to further develop the Company’s presence

in energy transition markets. The collaboration provides the

Company with access to novel titanium composite tubing technology,

which is showing strong potential in CCUS project

applications.

Continued restructuring to increase operational efficiencies

and returns on capital

- Hunting is continuing to drive stronger internal operational

efficiencies throughout its global footprint, which will lower our

operating costs and lower our carbon footprint. During the year,

Hunting Titan closed its Oklahoma City operating site and

transferred the manufacture of perforating systems to the Group’s

Pampa, Texas, and Monterrey, Mexico, facilities. A distribution

centre has been retained in Oklahoma City to continue to service

clients in the Mid-Continent Region of the US.

- Within the EMEA operating segment, the manufacturing and

assembly operations of the Group’s main well testing site are to be

transferred from the Netherlands to Dubai in 2024, which will lead

to the closure of a facility at Velsen-Noord, with activities in

the Netherlands to be merged into a single location.

- In January 2024, further consolidation of our footprint and

cost base in the UK continued as the Enpro operations were

transferred to the existing Badentoy, Aberdeen facility.

- During H1 2023, the Group has completed a disposal process of

all but one of its US onshore and offshore oil and gas producing

assets, which are held by Hunting’s wholly owned subsidiary, Tenkay

Resources, Inc (“Tenkay”). The Group has negotiated the transfer of

the majority of the non-producing assets and respective future plug

and abandonment liabilities, which have reduced Hunting’s possible

exposure to future decommissioning costs.

Group Results Narrative

For access to narrative on the Group’s results (incorporating

the Company Chair’s and Chief Executive’s Statements, Outlook,

Market Analysis, Product Line and Segmental Review and Group

Financial Review) for the year ended 31 December 2023 please click

on the following link.

http://www.rns-pdf.londonstockexchange.com/rns/8690E_1-2024-2-28.pdf

Financial Statements and Notes to the Accounts

For access to the Financial Statements and Notes to the Accounts

for the year ended 31 December 2023 please click on the following

link.

http://www.rns-pdf.londonstockexchange.com/rns/8690E_2-2024-2-28.pdf

Listing Rules / Disclosure Guidance and Transparency Rules

Information

For access to Hunting’s Key Performance Indicators, Business

Model and Strategy, ESG and Sustainability, Risk Management

(including Principal Risks), and the Statement of the Directors’

Responsibilities for the year ended 31 December 2023, please click

on the following link.

http://www.rns-pdf.londonstockexchange.com/rns/8690E_3-2024-2-28.pdf

Page number references refer to the full Annual Report when

available.

The linked documents provide access to all major financial and

operational disclosures contained in the Group’s 2023 Annual Report

and Accounts. The complete 2023 Annual Report and Accounts will be

published on 14 March 2024 and can then be accessed at

www.huntingplc.com.

The financial information set out in the above links does not

constitute the Company’s statutory accounts for the years ended 31

December 2023 or 31 December 2022, but is extracted from those

accounts. Statutory accounts for 2022 have been delivered to the

Registrar of Companies and those for 2023 will be delivered in due

course. The auditor has reported on those accounts; their reports

were unqualified, did not draw attention to any matter by way of

emphasis without qualifying their report and did not contain

statements under s498(2) or (3) of the Companies Act 2006. Whilst

the financial information included in this preliminary announcement

has been computed in accordance with International Financial

Reporting Standards, this announcement does not itself contain

sufficient information to comply with IFRS.

Analyst Briefing and Webcast

Hunting PLC will host an analyst briefing and webcast at the

offices of CMS Cannon Place, 78 Cannon St, London EC4N 6AF on 29

February 2024 commencing at 9:00a.m. GMT. Attendees should arrive

by 8:45a.m. to clear building security in good time.

The live webcast can be accessed by copying and pasting the

following link into your browser:

https://stream.buchanan.uk.com/broadcast/65b93d2f6371e5b884f62831

Analysts and investors wishing to participate in a Q&A

session can do so by submitting questions via the chat function of

the webcast and these will be addressed by management during the

live webcast. If you have any queries relating to this then please

email hunting@buchanan.uk.com.

Notes to Editors:

About Hunting PLC

Hunting is a global engineering group that provides

precision-engineered equipment and premium services, which add

value for our customers. Established in 1874, it is a premium

listed public company traded on the London Stock Exchange. The

Company maintains a corporate office in Houston and is

headquartered in London. As well as the United Kingdom, the Company

has operations in China, Indonesia, Mexico, Netherlands, Norway,

Saudi Arabia, Singapore, United Arab Emirates and the United States

of America.

The Group reports in US dollars across five operating segments:

Hunting Titan; North America; Subsea Technologies; Europe, Middle

East and Africa (“EMEA”); and Asia Pacific.

Hunting PLC’s Legal Entity Identifier is

2138008S5FL78ITZRN66.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240229335201/en/

For further information please contact: Hunting PLC Jim

Johnson, Chief Executive Bruce Ferguson, Finance Director

lon.ir@hunting-intl.com Tel: +44 (0) 20 7321 0123

Buchanan Ben Romney Barry Archer Tel: +44 (0) 20 7466

5000

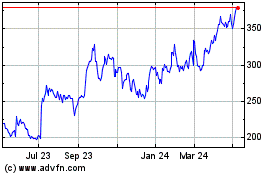

Hunting (LSE:HTG)

Historical Stock Chart

From Nov 2024 to Dec 2024

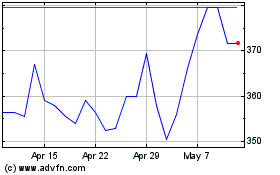

Hunting (LSE:HTG)

Historical Stock Chart

From Dec 2023 to Dec 2024