TIDMJLP

RNS Number : 0098S

Jubilee Metals Group PLC

01 November 2023

Jubilee Metals Group PLC

("Jubilee" or "the Company" or "the Group")

Registration number (4459850)

Altx share code: JBL

AIM share code: JLP

ISIN: GB0031852162

Dissemination of a Regulatory Announcement that contains inside

information according to UK Market Abuse Regulations. Not for

release, publication or distribution in whole or in part in, into

or from any jurisdiction where to do so would constitute a

violation of the relevant laws or regulations of such

jurisdiction.

Q1 Operational Report to 30 September 2023

Jubilee Metals Group PLC (AIM: JLP/Altx: JBL), a diversified

leader in metals processing with operations in Africa, is pleased

to announce its first quarter operational report to 30 September

2023 ("Q1 FY2024"). The Group has delivered a strong Q1 operational

performance and remains on track to deliver against the production

guidance for the 2024 financial year ("FY2024").

Operational Highlights

-- Q1 FY2024 production figures achieved were:

o Production of chrome concentrate increased to 336,683 tonnes

(Q4 FY2023: 344,315 tonnes). Chrome production rates are expected

to continue to increase with the additional processing capacity

provided by an additional chrome processing module, completed in

August (the "Thutse Processing Module").

o Inyoni's PGM production increased to 10,113oz (Q4 FY2023:

9,350oz), with no third-party production in the period. The PGM

production rate is expected to further benefit from the increased

feed rate from the Thutse Processing Module operating at design

capacity.

o Copper cathode and copper in concentrate produced was 934

tonnes (Q4 FY2023: 653 tonnes). Project Roan's upgrade which

commenced in September 2023, has necessitated the stoppage of the

feed classification circuit which will disrupt processing at Roan

for 16-weeks until December 2023.

-- Lost Time Frequency Injury Rate (LTFIR) for South Africa

improved to 1.44 (Q4 FY2023: 1.5). While The LTFIR for Zambia

improved to 2.36 (Q4 FY2023: 2.37).

-- The average chrome revenue per tonne of US$85 (Q4 FY2023:

US$86 per tonne) is influenced by the percentage of fixed chrome

margin tonnages processed. The increased margins from the new

partnership agreements are expected to reflect stronger through the

current quarter. The average chrome cost per tonne remained flat at

US$75 (Q4 FY2023: US$74 per tonne).

-- The average PGM revenue per ounce increased to US$1,031 (Q4

FY2023: US$976). Cost remained tightly under control with the

average PGM cash cost per ounce, excluding chrome credits of US$875

(Q4 FY2023: US$855).

-- The average copper revenue per tonne of US$6,588 (Q4 FY2023:

US$6,860 per tonne) reflects the increase of copper sulphide

concentrate sales from the Roan concentrator, while the average

copper cost per tonne increased marginally to US$4,907 (Q4 FY2023:

US$4,802 per tonne).

Project Highlights

South Africa

-- Jubilee has elected to further expand the chrome operational

footprint by an additional 450,000 tonnes per annum feed process

capacity using its existing modular approach.

o The expansion allows for the construction of an additional

chrome process module to be added to the current Thutse

operations.

o The expansion will increase Jubilee's chrome processing

footprint to 9 chrome processing modules and increase the total

chrome processing capacity to 1.7 million per annum.

o The expansion of the chrome processing footprint remains

contingent upon our continuing capital allocation evaluation and

assessment of prospective funding arrangements.

-- The Group continues to advance discussions to conclude a

further Life-Of-Mine ("LOM") partnerships and expand the chrome

operations via the roll-out of additional processing modules as it

targets 2 million tonnes of concentrates per annum in the

future.

Zambia

-- Zambia copper gathered further momentum with the securing of

the first LOM copper ore off-take agreement from an existing mining

company ("Project M"), as opposed to copper tailings offtakes

contracts signed in the past. Project M seeks to replicate the

success of the South African modular chrome expansion roll-out

drive, which seeks to process copper containing ore, deemed as

waste by current or previous operators.

o The copper processing modules will be trialled and tested at

the same in-house development centre in South Africa where the

chrome modules are currently manufactured.

o The copper process modules specifically target the processing

of Run-Of-Mine ("ROM") ore that has not been previously processed,

as opposed to tailings. In many cases, this ROM material has been

rejected to mine waste dumps due to the type of copper

contained.

o Copper processing module designs range from 20,000 to 50,000

tonnes per month feed supply, capable of being delivered and

commissioned within an eight-month period.

o Jubilee holds the capacity to execute 3 modules in parallel at

an estimated capital investment of US$6.5 million per module

(capital estimate based on a 50 000 tonnes per month module).

o Each 20,000 tonnes per month module is expected to produce the

equivalent of 3,000 tonnes per annum of additional cathode.

o Jubilee's project team is expected to complete the selection

of the optimum process module capacity for Project M within the

next 6 weeks with deployment within 8 months following the

conclusion of the capital allocation decision.

-- Project Roan's upgrade currently underway includes the

implementation of a 50,000 tonnes per month processing module,

specifically targeting the previously announced approximate 6-year

offtake agreement of unprocessed copper ROM material discarded as

mined waste.

-- During the period, Jubilee was awarded the Mufulira Slag

project to develop the processing of all historical slag waste from

the smelter operations under a joint venture agreement with Mopani

Copper Mines ("MCM"). The commercial terms of the joint venture are

currently being negotiated and are expected to be finalised once

the sale of MCM is completed which is subject to a well-publicised

formal sale process.

-- Jubilee signed a technology exclusive partnership agreement

for the development and implementation of a copper recovery

solution called Glycine Leaching Technology for the processing of

historical copper tailings with Draslovka Mining Solutions

o The partnership brings together two exceptionally skilled

technical teams to work together on unlock the value from this vast

resource in an environmentally friendly way.

o The partnership specifically targets the processing of copper

and other base metal historical tailings in Zambia with a potential

of extending the work to the Democratic Republic of the Congo.

o The technology partnership with Draslovka builds on the latest

encouraging results achieved from the upscaled extended continuous

trial runs that followed the earlier laboratory batch trials.

o Calculated copper extraction of more than 80% of copper in

tails has been achieved from the continuous Glycine Leaching

Technology trials applying a modified reagent recipe.

o Jubilee's technical services is working closely with the

Draslovka team to unlock the vast potential offered to recover

copper from these low-grade tailings generated from past processing

of copper ROM.

o Jubilee's engineers are currently completing the commercial

review of the tailings recovery project which will inform the

decision to implement further upscaled industrial scale trials.

-- The process development program for the processing of

historical tails continue to show progress with results from the

upscaled extended continuous trial runs confirming the encouraging

results from the earlier laboratory batch trials.

o Calculated copper extraction of more than 80% of copper in

tailing has been achieved from the continuous Glycine Leaching

Technology trials applying a modified reagent recipe.

o Jubilee's engineers are currently completing the commercial

review of the tailings recovery project which will inform the

decision to implement further upscaled industrial scale trials.

Statement from Leon Coetzer, CEO:

"I am pleased to present our operational report for the first

quarter of FY2024. Our robust operational performance was supported

by new long-term supply agreements which allocates higher quality

feed material to our operations, allowing us to better leverage our

current production capacity, and affirm our growth trajectory in

chrome concentrate, PGMs, and copper.

"Jubilee continues to challenge industry norms by breaking

through technical barriers and implementing solutions that extract

value from materials and ore sources that were previously regarded

by others as waste or too complex.

"With the Thutse chrome project performing to expectation and

offering further growth potential with the addition of Jubilee's

9(th) chrome module, we anticipate consistent growth in chrome and

PGMs.

"Our operating presence in Zambia together with the expansion of

our leadership teams have allowed us to solidify our copper

expansion strategy, by implementing key lessons learnt and

integrating the modular expansion of our copper production profile

that has achieved such great success in South Africa.

"Our Zambian strategy is grouped into two categories of copper

materials namely unprocessed copper waste from mining activities

and historical processed copper tailings. Our growth in each of

these categories of copper materials is independently driven. I am

particularly excited by the roll-out of our copper processing

modules specifically targeting the copper waste materials while our

technical team continues their work to unlock the copper value in

historical processed tailings using Glycine Leaching

Technology.

"Safety remains a top priority, as evidenced by the improved

Lost Time Frequency Injury Rate in both South Africa and

Zambia.

"Our upcoming ventures, from the potential expansion of our

chrome operations to our first life-of-mine copper ore off-take

agreement, reinforce our strategic vision. Partnerships with

companies like Mopani Copper Mines and Draslovka underscore our

focus on growth and innovation.

"In conclusion, our improved operational margins across segments

highlight our team's efforts and strategic foresight. I remain

extremely optimistic about Jubilee's future and the trajectory on

which the Company is headed".

Production guidance for the 2024 financial year

-- 1.45 million tonnes of chrome concentrate

-- 42,000 PGM ounces

-- 5,850 tonnes of copper, weighted to the second half of the

financial year, given limited production in Q2

Quarterly Operational Performance

QUARTERLY OPERATIONAL PERFORMANCE (UNAUDITED)

Quarter Quarter % change

ended 30 ended 30

September June 2023

2023 (Q1 (Q4 FY2023)

Unit FY2024)

---------- ----------- ------------- ---------

KEY UNITS OF PRODUCTION

---------- ----------- ------------- ---------

Chrome Concentrate Tonnes 336,683 344,315 (2%)

---------- ----------- ------------- ---------

PGM s

---------- ----------- ------------- ---------

- Inyoni Oz 10,113 9,350 8%

---------- ----------- ------------- ---------

- Third party Oz - 3,439 (100%)

---------- ----------- ------------- ---------

- Total PGM ounces Oz 10,113 12,789 (21%)

---------- ----------- ------------- ---------

Copper cathode and copper in concentrate Tonnes 934 653 43%

---------- ----------- ------------- ---------

UNIT REVENUE

---------- ----------- ------------- ---------

Revenue per chrome tonne US$/t 85 86 (1%)

---------- ----------- ------------- ---------

Revenue per PGM ounce US$/oz 1,031 976 6%

---------- ----------- ------------- ---------

Revenue per copper tonne US$/t 6,588 6,860 (4%)

---------- ----------- ------------- ---------

UNIT COSTS

---------- ----------- ------------- ---------

Cost per chrome tonne US$/t 75 74 1%

---------- ----------- ------------- ---------

Cost per PGM ounce (excluding chrome

credits) US$/oz 875 855 2%

---------- ----------- ------------- ---------

Cost per copper tonne US$/t 4,907 4,802 2%

---------- ----------- ------------- ---------

OPERATIONAL MARGIN

Gross profit margin per chrome

tonne % 12.7% 13.5% (6%)

Gross profit margin per PGM ounce % 15.2% 12.3% 23%

---------- ----------- ------------- ---------

Gross profit margin per copper

tonne % 25.5% 19.5% 31%

---------- ----------- ------------- ---------

EXCHANGE RATES

---------- ----------- ------------- ---------

Average presentation currencies US$/GBP 1.27 1.25 1%

---------- ----------- ------------- ---------

Average functional currency South

Africa ZAR/ US$ 18.63 18.65 0%

---------- ----------- ------------- ---------

Average functional currency Zambia ZMW/ US$ 19.50 18.82 4%

---------- ----------- ------------- ---------

Investor Calendar

Details Dates

Second Quarter Operational Report Second week of February

2024

------------------------

Interim results for the period ended Second week of March

31 December 2023 2024

------------------------

Third Quarter Operational Report Second week of May 2024

------------------------

Fourth Quarter Operational Report Second week of August

2024

------------------------

Audited results for the year ended Second week of October

30 June 2024 2024

------------------------

Annual General Meeting Second week of November

2024

------------------------

1 November 2023

For further information please contact:

Jubilee Metals Group PLC Tel: +27 (0) 11 465 1913

Leon Coetzer (CEO) / Neal Reynolds

(CFO)

PR & IR Adviser - Tavistock Tel: +44 (0) 20 7920 3150

Jos Simson/ Gareth Tredway

Nominated Adviser - SPARK Advisory Tel: +44 (0) 20 3368 3555

Partners Limited

Andrew Emmott/ James Keeshan

Joint Broker - Berenberg Tel: +44 (0) 20 3207 7800

Matthew Armitt/ Jennifer Lee/ Detlir

Elezi

Joint Broker - WHIreland Tel: +44 (0) 20 7220 1670/

Harry Ansell/ Katy Mitchell +44 (0) 113 394 6618

JSE Sponsor - Questco Corporate Tel: +27 (0) 11 011 9207

Advisory Proprietary Limited

Alison McLaren

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKDBKOBDKDDK

(END) Dow Jones Newswires

November 01, 2023 03:05 ET (07:05 GMT)

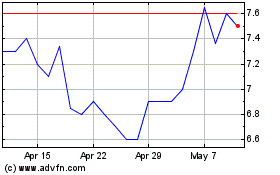

Jubilee Metals (LSE:JLP)

Historical Stock Chart

From Apr 2024 to May 2024

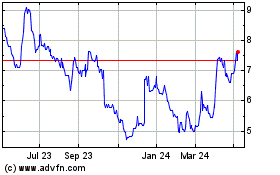

Jubilee Metals (LSE:JLP)

Historical Stock Chart

From May 2023 to May 2024