TIDMMPLF

RNS Number : 5010T

Marble Point Loan Financing Limited

22 July 2022

22 July 2022

The net asset value ("NAV") of Marble Point Loan Financing

Limited ("MPLF") as at the close of business on 30 June 2022 is as

follows:

Share class June 2022 NAV May 2022 NAV per Monthly Change

per Ordinary Ordinary Share in NAV per

Share (1) (1) Share (1)

Ordinary USD 0.5365 USD 0.5758 USD (0.0393)

Shares

-------------- ---------------- ---------------

Performance

-- MPLF's estimated NAV total return was (6.83%) in June,

compared to the total return of the Credit Suisse Leveraged Loan

Index of (2.06%).

-- Secondary loan prices declined in June after their meaningful

leg lower in May, for many of the same reasons we highlighted last

month. Sustained concerns around rising interest rates, inflation,

commodity prices and supply chain issues continue to weigh on

speculative grade debt issuers. Retail loan fund flows remained

negative in June after their first monthly outflow in May since

November 2020, and contributed to selling pressure across the

credit quality spectrum. Amidst inconsistent CLO formation and

demand, retail funds have been the marginal buyer and seller of

loans in recent months.

-- Opportunistic CLO creation has looked to fill in at these

lower loan prices, however CLO liability levels have continued to

widen in parallel with the loan market. In addition, a relatively

thin CLO AAA investor base has contributed to the difficulty in

quickly arranging new deals and fostered a challenging environment

for market participants to navigate.

-- CLO equity valuations for the month were impacted by these

loan market trends, price movements and the inherent financial

leverage associated with CLO equity securities. While the current

loan market default rate remains low, market participants are

evaluating the potential for higher default rates and future credit

losses in portfolios resulting from the many challenges facing

global markets and leveraged issuers in particular. As a result,

the yield demanded for CLO equity securities widened during the

month.

-- As noted last month, in the midst of these volatile markets

Marble Point believes a modicum of principal proceeds will continue

to be generated within the CLOs for reinvestment in new assets at

attractive prices and spreads. S&P/LCD reported $12.8 billion

of loan repayments during June. Despite the mark-to-market

drawdowns in CLO equity securities Marble Point believe CLO

structures are designed to build longer term value during these

periods of loan price declines. The reinvestment option and Marble

Point's experience in actively managing loan portfolios may allow

CLOs to maintain credit quality while building par to mitigate

future credit losses.

-- As at 30 June 2022, none of MPLF's investment vehicles had

exposure to Revlon Consumer Products, the sole S&P/LSTA index

constituent that defaulted in June. The index's lagging 12-month

default rate by notional amount increased to 0.28%.

Market

-- The CSLLI experienced a (2.06%) return in June as the average

price of the index dropped (2.35%), following the decline of

(2.88%) in May. The average indicative bid price of the index

declined to 91.96% at 30 June from 94.31% at 31 May. The weighted

average indicative bid price of MPLF's underlying loans declined to

92.14% at 30 June from 94.50% at 31 May. It is worth noting that on

a relative basis loans have outperformed other credit assets during

a very challenging first half for credit markets. The BoA HY Bond

Index declined over 14% during the past six months compared to the

(4.45%) decline for loans. Floating rate, senior secured loans have

remained resilient through this widespread market volatility.

-- June CLO issuance totaled $12.6 billion across 29 new issue

CLOs. Despite the ongoing global market volatility, several CLO

managers were able to opportunistically bring deals to market to

take advantage of attractive loan entry points. The total 1H 2022

new issue CLO volume was $71.4 billion, slightly lower than the

$83.2 billion total from 1H 2021.

-- Institutional loan volume totaled $16.4 billion in June

according to S&P/LCD. While this is an increase from the $6.1

billion figure in May 2022, it falls far short of the $53.9 billion

monthly average from 2021 and the $37.9 billion average from Q1

2022. Arranging banks and loan issuers have remained patient in

launching new offerings into a market where pricing may need to

widen meaningfully to compete with secondary loan opportunities.

Market participants expect volumes to increase in the second half

of the year with decent M&A and LBO activity that are currently

in the formation stages or awaiting more benign issuance

conditions.

-- Retail loan funds experienced an outflow of approximately

$5.4 billion in June, eclipsing the $4.4 billion outflow in May

which was the first monthly outflow since November 2020 according

to J.P. Morgan. While floating rate loans often benefit from the

increased demand that typically accompanies a rising rate

environment, the inflationary impetus for higher rates and the

resulting fears of a slower economy took precedent in investors'

minds.

-- Since the end of June, the average indicative bid price of

the CSLLI has increased by 0.85% to 92.81% (as at 20 July

2022).

Investment

-- During the month MPLF invested $4.2 million in a loan

accumulation facility ("LAF") in support of the continuing ramp of

assets related to the issuance of Marble Point CLO XXV ("MP25").

Supported by this and third party equity capital, the total amount

of ramped assets in the LAF was $86.0 million as at 30 June

2022.

MPLF's June 2022 Monthly Report is available on its website: www.mplflimited.com

Enquiries:

Marble Point Loan Financing Limited

Investor Relations

T: +44 (0) 20 7259 1500

E: ir@mplflimited.com

Website: www.mplflimited.com

Corporate Broker :

Stifel Nicolaus Europe Limited

T: +44 (0) 20 7710 7600

(1) NAV figures are provided for informational purposes only and

are unaudited, estimated by Marble Point Credit Management LLC

("Marble Point"), the investment manager of MPLF, and subject to

adjustment. Marble Point estimates MPLF's NAV on a monthly basis as

at the end of each month. Estimates with respect to a date falling

on a calendar quarter end are subject to revision when the

quarterly NAV is determined. NAV is calculated as the sum of the

value of MPLF's investment portfolio, any cash or cash equivalents

and other assets less liabilities. NAV is reduced by the amount of

a dividend to the extent the ex-dividend date occurs during the

period presented. NAV total return figures shown are estimated,

unaudited and subject to adjustment and reflect the net total NAV

return, inclusive of dividends, for the periods shown and as from

MPLF's admission to the Specialist Fund Segment of the main market

of the London Stock Exchange on 13 February 2018, after taking into

account applicable listing and offering costs and pre-admission

profits and loss. Monthly and cumulative performance figures are

non-annualised and such results reflect the deductions of

applicable management fees and expenses at the underlying

investment levels.

(2) Figures shown for effective yield are estimated, unaudited,

subject to change and based on the analysis of Marble Point Credit

Management LLC, the investment manager of MPLF, as at the Closing

Date. The estimated effective yield is provided for illustrative

purposes only. The actual effective yield, as recorded by MPLF or

other entity holding the investment may vary over time.

Past performance is not indicative or a guarantee of future

performance.

This release contains inside information.

About Marble Point Loan Financing

Marble Point Loan Financing Ltd. (LSE Ticker: MPLF LN (USD);

MPLS LN (GBX)) is a Guernsey-domiciled closed-ended investment

company. MPLF's investment objective is to generate stable current

income and grow net asset value by earning a return on equity in

excess of the amount distributed as dividends.

MPLF is invested in a diversified portfolio of US dollar

denominated, broadly syndicated floating rate senior secured

corporate loans owned via collateralised loan obligations ("CLOs")

and related vehicles managed by Marble Point Credit Management

LLC.

About Marble Point Credit Management LLC

Marble Point Credit Management LLC ("Marble Point") is a

specialist asset manager focused exclusively on leveraged loans.

Marble Point was founded by Thomas Shandell in partnership with

Eagle Point Credit Management, a leading investor in CLO

securities.

IMPORTANT INFORMATION

Marble Point Loan Financing Limited (the "Company") is a

closed-ended investment company incorporated in Guernsey with its

ordinary shares ("Shares") admitted to trading on the Specialist

Fund Segment of the Main Market of the London Stock Exchange

(ticker: MPLF.LN). The Company is invested in a diversified

portfolio of US dollar denominated, broadly syndicated floating

rate senior secured corporate loans via CLOs, loan accumulation

facilities and other vehicles managed by Marble Point Credit

Management LLC ("Marble Point") or its affiliates. Marble Point is

an investment adviser registered with the U.S. Securities and

Exchange Commission.

This document is provided for informational purposes only and

does not constitute an offer to sell any Shares, notes or other

securities (collectively, "Securities") issued by the Company or a

solicitation of an offer to purchase any such Securities in the

United States, Australia, Canada, the Republic of South Africa,

Japan or any other jurisdiction. This document may not be relied

upon, and should not be used, for the purpose of making any

investment decision. This document and the information and views

included herein do not constitute investment advice or a

recommendation or an offer to enter into any transaction with the

Company or any of its affiliates. Any recipient of this document

should make such investigations as it deems necessary to arrive at

an independent evaluation of any investment and should consult its

own legal counsel and financial, actuarial, accounting, regulatory

and tax advisers to evaluate any such investment. This document has

been issued by the Company and is the sole responsibility of the

Company.

The Securities have not been and will not be registered under

the U.S. Securities Act of 1933, as amended, or with any securities

regulatory authority of any state or other jurisdiction of the

United States and may not be offered or sold in the United States

to, or for the account or benefit of, U.S. persons unless they are

registered under applicable law or exempt from registration. The

Company has not been and will not be registered under the U.S.

Investment Company Act of 1940, and investors will not be entitled

to the benefits of such Act.

The information shown herein is estimated, unaudited, for

background purposes only, representative as of the dates specified

herein, subject to adjustment and not purported to be full or

complete. Nothing herein shall be relied upon as a representation

as to the current or future performance or portfolio holdings of

the Company or any strategy or investment vehicle. Certain

information presented herein has been obtained from third party

sources and is believed to be reliable. However, neither the

Company nor Marble Point represents that the information contained

in this document (including third party information) has been

independently verified or is accurate or complete, and it should

not be relied upon as such. Index information, if any, has been

provided for illustration purposes only. Any such information does

not reflect the effect of transaction costs, management fees or

other costs which would reduce returns. An investor cannot invest

directly in an index.

There is no guarantee that any of the goals, targets or

objectives described in this document will be achieved. The

investment strategies of the Company may not be suitable for all

investors and are not intended to constitute a complete investment

program. Neither Marble Point nor the Company makes any

representation or warranty (express or implied) with respect to the

information contained herein (including, without limitation,

information obtained from third parties) and each of them expressly

disclaims any and all liability based on or relating to the

information contained in, or errors or omissions from, these

materials; or based on or relating to the use of these materials;

or any other written or oral communications transmitted to the

recipient or any of its affiliates or representatives in the course

of its evaluation of the information herein.

Any of the views or opinions expressed herein are current views

and opinions only and may be subject to change. Statements made

herein are as of the date of this document and should not be relied

upon as of any subsequent date. All information is current as of

the date of this document and is subject to change without

notice.

Past performance is not a reliable indicator of current of

future results. The value of investments may go down as well as up

and investors may not get back any of the amount invested. The

value of investments designated in another currency may rise and

fall due to exchange rate fluctuations in respect of the relevant

currencies. Adverse movements in currency exchange rates can result

in a decrease in return and a loss of capital.

A Note on the Use of Indices as Benchmarks. The indices shown

have not been selected to represent a benchmark for MPLF's

performance, but rather to allow for comparison of MPLF's returns

to those of known, recognized and/or similar indices. The Credit

Suisse Leveraged Loan Index (CSLLI) tracks the investable universe

of the U.S. leveraged loan market. The ICE BofAML US High Yield

Index (ICE BAML HYI) tracks the performance of USD-denominated

below investment grade corporate bonds publically issued in the

U.S. domestic market. The Standard & Poor's 500 Index (S&P

500) tracks the performance of U.S. public equity markets and is

based on the market capitalization of 500 large companies having

common stock listed on NYSE or NASDAQ. The performance of any index

is not an exact representation of any particular investment as you

cannot invest directly in an index.

A Note on Forward Looking Statements. This document includes

forward-looking statements. Forward-looking statements include all

matters that are not historical facts. Actual results may differ

materially from any results projected in the forward-looking

statements and are subject to risks and uncertainties. Such

statements are based on current expectations, involve known and

unknown risks, a reliance on third parties for information, and

other factors that may cause actual results to differ materially

from the anticipated results expressed or implied by such

forward-looking statements. The Company and Marble Point caution

readers not to place undue reliance on such statements. Neither the

Company nor Marble Point undertakes, and each specifically

disclaims, any obligation or responsibility, to update any

forward-looking statements to reflect occurrences, developments,

unanticipated events or circumstances after the date of such

statement. Actual results may differ materially from the Company's

and/or Marble Point's expectations and estimates.

None of the Company, Marble Point or any of their respective

parent or subsidiary undertakings, or the subsidiary undertaking of

any such parent undertakings, or any of such person's respective

partners, shareholders, directors, members, officers, affiliates,

agents, advisors or representatives shall have any liability

whatsoever (in negligence or otherwise) for any loss howsoever

arising from any information or opinions presented or contained in

this document nor shall they accept any responsibility whatsoever

for, or make any warranty, express or implied, as to the truth,

fullness, accuracy or completeness of the information in this

document (or whether any information has been omitted from the

document) or any other information relating to the Company, Marble

Point or their respective subsidiaries or associated companies, in

any form whatsoever, howsoever transmitted or made available or for

any loss howsoever arising from any use of this document or its

contents or otherwise arising in connection therewith. This shall

not affect any liability any such person may have which may not be

excluded under applicable law or regulation.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVBSGDRUDDDGDD

(END) Dow Jones Newswires

July 22, 2022 13:30 ET (17:30 GMT)

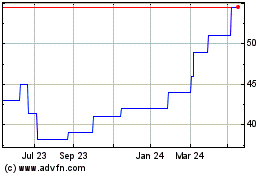

Marble Point Loan Financ... (LSE:MPLS)

Historical Stock Chart

From Dec 2024 to Jan 2025

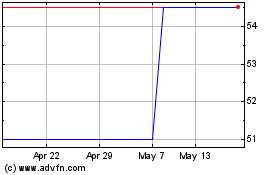

Marble Point Loan Financ... (LSE:MPLS)

Historical Stock Chart

From Jan 2024 to Jan 2025