Dods Group PLC Trading Statement (5706N)

21 January 2019 - 6:00PM

UK Regulatory

TIDMDODS

RNS Number : 5706N

Dods Group PLC

21 January 2019

The information contained within this announcement (the

"Announcement") is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014. Upon the publication of this Announcement via

Regulatory Information Service, this inside information is now

considered to be in the public domain.

21 Jan 2019

Dods Group plc

("Dods" or "the Group")

Trading Update

Dods, a leading business intelligence, data, events, media and

training company, issues the following trading update.

Trading performance

The Group has experienced challenging trading conditions in the

UK over the past three months given its political and policy focus

in both the UK and Europe. Whilst trading in October and November

was broadly in line with our expectations, December closed

significantly behind in response to unprecedented political

uncertainty.

With fourth quarter revenues forecast to be lower than

anticipated, against a backdrop of increased costs of delivery due

to long lead time contracts, the Group has revised its expectations

for the current financial year. The Board now expects significantly

lower than forecasted adjusted EBITDA and a loss before tax

(excluding non-cash impairments) for the year ending 31st March

2019.

With lower than expected new product revenues and contribution

from the 30% Associate investment of GBP1.7m in the previous year,

the Board is undertaking a review of the software, infrastructure,

product offering, investments and intangibles to assess any further

impairment impact for the year.

The Group continues to hold material cash reserves and has no

debt. As at 31st December 2018 the Group held GBP7.3m cash at bank,

including restricted cash of GBP1.27m.

Outlook

The Board is cognisant that the current hiatus in political

decision making could continue to adversely affect our business

beyond the current financial year end. With this in mind we remain

focused on deploying the Company's robust balance sheet to generate

growth through potential merger and/or acquisitions in related

market sectors whilst continuing to preserve and invest in the

Group's heritage brand and assets.

Whilst the market is challenging, the Board remains confident

that, in conjunction with potential investments, the Group is

capable of sustainable profit streams in the longer term.

For further information, please contact:

Dods Group Plc

Simon Presswell- CEO 020 7593 5500

Nitil Patel- CFO

Cenkos

Nicholas Wells 020 7397 8900

Mark Connelly

Callum Davidson

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTUROARKKAAUUR

(END) Dow Jones Newswires

January 21, 2019 02:00 ET (07:00 GMT)

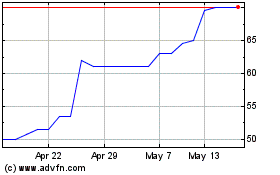

Merit (LSE:MRIT)

Historical Stock Chart

From Apr 2024 to May 2024

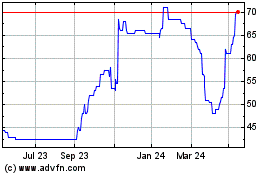

Merit (LSE:MRIT)

Historical Stock Chart

From May 2023 to May 2024