TIDMREDX

RNS Number : 6485Z

Redx Pharma plc

17 May 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 AS IT FORMS PART OF DOMESTIC

LAW IN THE UNITED KINGDOM BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018.

REDX PHARMA PLC

("Redx" or the "Company")

Interim Results for the Six Months Ended 31 March 2023

Focus on progressing industry-leading ROCK portfolio with RXC007

Phase 2a trial on track to deliver topline data Q1 2024 and RXC008

CTA submission expected H2 2023

RXC004 combination modules open for enrolment with topline data

expected H2 2023

Redx funded through significant value inflection points;

evaluating all options to extend cash runway beyond Q1 2024

Alderley Park, UK, 17 May 2023 Redx (AIM:REDX), the

clinical-stage biotechnology company focused on discovering and

developing novel, small molecule, targeted therapeutics for the

treatment of fibrotic disease and cancer announces its unaudited

financial results for the six month period ended 31 March 2023.

Lisa Anson, Chief Executive Officer, Redx Pharma commented:

"During the six months to 31 March 2023 the Company has prioritised

our industry-leading ROCK portfolio where we have made very

significant progress. Our lead asset RXC007, a next-generation

selective ROCK2 inhibitor, is progressing well through a Phase 2a

clinical trial in idiopathic pulmonary fibrosis (IPF), with topline

data expected in Q1 2024. Our first-in-class GI-targeted ROCK

inhibitor, RXC008, is on track for a CTA submission in H2 2023 to

become our second ROCK programme in clinical development. We also

look forward to the important RXC004 Phase 2 combination data due

at the end of 2023 and remain well positioned to deliver multiple

near-term value inflection points."

Operational Highlights:

Advanced RXC007, a next-generation selective ROCK2 inhibitor,

with the commencement of the Phase 2a dose escalation study in

IPF:

-- On 11 October 2022, the first patient was dosed in Phase 2a

IPF study. The study has been approved in 6 European countries with

14 sites open and patient recruitment is progressing well and on

track to deliver topline data Q1 2024;

-- Recruitment into the translational science sub-study opened

in the UK and under an IND in US, with additional nonclinical work

ongoing to support longer dosing durations in the US;

-- On 2 October and 10 November 2022, encouraging preclinical

data were presented at ICLAF and AFDD respectively, supporting

expansion into additional interstitial lung diseases;

-- Post period, an initial safety review in the first eight

patients dosed at 20mg BID confirmed no safety signals to date,

supporting the planned dose escalation;

-- Post period, on 10 May 2023, preclinical data highlighting

potential in cancer-associated-fibrosis were presented at the

Resistant Tumour Microenvironment, Keystone Symposia.

Progressed RXC008, a GI-targeted ROCK inhibitor being developed

as a potential first-in-class treatment for fibrostenotic Crohn's

disease, through IND-enabling studies with a CTA submission planned

in 2023:

-- On 23 November 2022, preclinical data were presented at the

IBD Nordic Conference showing RXC008 can suppress fibrosis in

animal models of GI fibrosis.

Commenced patient recruitment into the combination programme for

RXC004, a small molecule Porcupine inhibitor being developed for

the treatment of Wnt-ligand dependent cancers, which is

investigating the primary efficacy hypothesis to overcome immune

evasion in combination with anti-PD-1:

-- On 10 November 2022, Phase 1 combination data presented at

the Society for Immunotherapy of Cancer Conference (SITC) showed an

acceptable tolerability and PK profile in this patient population

supporting a dose of 1.5mg in combination with an anti-PD-1 in the

Phase 2 trial. The Phase 2 modules of RXC004 in combination with

anti-PD-1 in both PORCUPINE and PORCUPINE2 continue to recruit,

with data expected to report at the end of 2023;

-- On 16 December 2022, a clinical trial collaboration and

supply agreement was announced with MSD (Merck & Co., Inc.) for

the supply of Keytruda(R) [1] (pembrolizumab) for the PORCUPINE2

biliary tract cancer combination module;

-- On 8 March 2023, initial Phase 2 data were reported from the

monotherapy biliary tract cancer (BTC) module, with some patients

experiencing durable clinical benefit. The overall safety and

efficacy profile was in line with the Phase 1 study;

-- All monotherapy modules have now been closed for further

recruitment enabling the single agent profile of RXC004 to be

characterised for future partnership and regulatory discussions,

whilst streamlining the study design to prioritise resources and

patients to combination arms.

Financial Highlights:

-- Cash balance at 31 March 2023 of GBP34.6 million (31 March

2022: GBP31.6 million), sufficient to fund the Company into Q1

2024. The Company is financed to deliver key project milestones

including RXC007 Phase 2a data, RXC008 CTA submission and RXC004

combination data readout;

-- R&D expenses for the period of GBP16.1 million (31 March 2022 GBP12.9 million);

-- Loss for the period of GBP20.8 million (31 March 2022 GBP9.8

million), driven by lower revenue, higher R&D expense and

reverse merger transaction expenses;

-- Post period on 3 April, a recommended all-share business

combination with Jounce Therapeutics, Inc. ("Jounce"), announced on

23 February, was terminated following the withdrawal by the board

of directors of Jounce of its recommendation for the combination,

in favour of an unsolicited all-cash offer from another party,

which the board of directors of Jounce felt to be in the best

interest of Jounce's shareholders;

-- The Company continues to evaluate alternative options to extend cash runway beyond Q1 2024.

As previously announced, the Company will hold a live webcast of

the 2023 interim results presentation at 12pm GMT (7am EST) today.

Attendees can register via the following link:

https://webcast.openbriefing.com/redxpharma-may23/ and the

presentation will be available for replay on the Company's website

at:

https://www.redxpharma.com/investor-centre/presentations-analyst-reports-documents-and-videos/

.

The person responsible for the release of this announcement on

behalf of the Company is Claire Solk, Company Secretary.

For further information, please contact:

Redx Pharma Plc T: +44 (0)162 546 9918

UK Headquarters

Caitlin Pearson, Head of Communications

ir@redxpharma.com

Lisa Anson, Chief Executive Officer

US Office

Peter Collum, Chief Financial Officer

SPARK Advisory Partners (Nominated Adviser) T: +44 (0)203 368 3550

Matt Davis/ Adam Dawes

WG Partners LLP (Joint Broker) T: +44 (0)203 705 9330

Claes Spång/ Satheesh Nadarajah/ David Wilson

Panmure Gordon (UK) Limited (Joint Broker) T: +44 (0)207 886 2500

Rupert Dearden/ Freddy Crossley/ Emma Earl

FTI Consulting T: +44 (0)203 727 1000

Simon Conway/ Ciara Martin

About Redx Pharma Plc

Redx Pharma (AIM: REDX) is a clinical-stage biotechnology

company focused on the discovery and development of novel, small

molecule, targeted therapeutics for the treatment of fibrotic

disease, cancer and the emerging area of cancer-associated

fibrosis, aiming initially to progress them to clinical proof of

concept before evaluating options for further development and

potential value creation. The Company's lead fibrosis product

candidate, the selective ROCK2 inhibitor RXC007, is in development

for interstitial lung disease and commenced a Phase 2a trial for

idiopathic pulmonary fibrosis (IPF) in October 2022, with topline

data expected in Q1 2024. Redx's lead oncology product candidate,

the Porcupine inhibitor RXC004, being developed as a targeted

treatment for Wnt-ligand dependent cancers, is expected to report

combination with anti-PD-1 Phase 2 data during 2023. Redx's third

drug candidate, RXC008, a GI-targeted ROCK inhibitor for the

treatment of fibrostenotic Crohn's disease, is progressing towards

a CTA application at the end of 2023.

The Company has a strong track record of discovering new drug

candidates through its core strengths in medicinal chemistry and

translational science, enabling the Company to discover and develop

differentiated therapeutics against biologically or clinically

validated targets. The Company's accomplishments are evidenced not

only by its two wholly-owned clinical-stage product candidates and

rapidly expanding pipeline, but also by its strategic transactions,

including the sale of pirtobrutinib (RXC005, LOXO-305), a

non-covalent (reversible) BTK inhibitor now approved by the US FDA

for adult patients with mantle cell lymphoma previously treated

with a covalent BTK inhibitor, and AZD5055/RXC006, a Porcupine

inhibitor targeting fibrotic diseases including IPF, which

AstraZeneca is progressing in a Phase 1 clinical study. In

addition, Redx has forged collaborations with Jazz Pharmaceuticals,

which includes JZP815, a pan-RAF inhibitor developed by Redx which

Jazz is now progressing through Phase 1 clinical studies, and an

early stage oncology research collaboration.

To subscribe to Email Alerts from Redx, please visit:

www.redxpharma.com/investor-centre/email-alerts/ .

Chief Executive's Statement

During the six months ended 31 March 2023, we have continued to

execute our core strategy to develop potential best-in-class or

first-in-class therapeutics in areas of high unmet medical

need.

We have prioritised the development of our industry-leading ROCK

portfolio and are particularly excited by the potential of the lead

programme, RXC007, a next-generation selective ROCK2 inhibitor

which is progressing through a Phase 2a clinical trial in IPF. The

ROCK portfolio also includes a potential first-in-class programme,

RXC008, a GI-targeted ROCK1/2 inhibitor which is advancing towards

the clinic as a potential treatment for fibrostenotic Crohn's

disease. RXC004, the Company's lead oncology asset, continues to

recruit patients to the combination modules of the Phase 2

programme and we expect initial topline data by the end of 2023.

Additionally, our discovery pipeline has continued to advance key

research programmes towards our goal of two further INDs by the end

of 2025.

The cash balance at the end of the period of GBP34.6 million

funds our programmes into Q1 2024 and through multiple near-term

value inflection points. During the period, we have rigorously

reviewed our expenses and portfolio to prioritise resources towards

the areas where we see the highest impact on clinical benefit,

commercial returns and value creation for shareholders.

An industry-leading ROCK portfolio

Redx has developed a unique portfolio of multiple distinct

assets targeting Rho-associated protein kinase (ROCK), a known

nodal point for pro-fibrotic signalling central to fibrosis in a

range of fibrotic conditions. Our medicinal chemistry expertise and

deep understanding of the ROCK target has allowed successful

development of these programs through optimising molecular

properties in areas such as exposure, drug-drug interaction and

selectivity.

With RXC007, we have used our medicinal chemistry expertise to

selectively target ROCK2, historically known to be a very

challenging target, for the treatment of interstitial lung disease

(ILD), with an initial focus on IPF where ROCK2 is upregulated.

Taking a different approach with RXC008, we have developed a

GI-targeted ROCK1/2 inhibitor which is in preclinical development

for the treatment of fibrostenotic Crohn's disease. RXC008 is

specifically designed to avoid the potential cardiovascular

side-effects of systemic ROCK1/2 inhibition by being restricted to

the GI tract with any breakthrough rapidly degraded in plasma.

RXC007 - Currently in Phase 2a for IPF, with potential in a

number of other fibrotic conditions

RXC007, a next-generation selective inhibitor of ROCK2 commenced

a Phase 2a trial in IPF in October 2022.

The Phase 2a trial is a randomised, dose escalation study with

and without standard of care agents. Three cohorts, each consisting

of 16 patients with 12 receiving RXC007, will be dosed with an

escalating dose of RXC007, with the key endpoints being safety, PK

profile, changes from baseline in lung function - Forced Vital

Capacity (FVC) and Carbon Dioxide Diffusion Coefficient (DLCO),

changes from baseline in Quantitative Lung Fibrosis Score and

airway volume and resistance on high resolution computerised

tomography (HRCT) scan. The initial dosing period will last for 12

weeks; however, patients may continue for longer if there are no

signs of disease progression or toxicity. The data collected will

inform the potential dose we take forward into a larger Phase 2b

study, which will be powered to detect an efficacy signal based on

the current regulatory endpoint of FVC change over 12 months.

Recruitment into the Phase 2a study is on track with the initial

safety review for the first eight patients, dosed at 20mg BID,

completed with no safety signals to date, enabling recruitment and

dose escalation to continue. The study is currently approved in 6

countries across Europe with 14 active study sites open and with

further sites expected to be active by the end of H1 2023. Based on

current recruitment rates, we expect to report topline data during

Q1 2024, as previously communicated.

In parallel with the main study, a translational science

sub-study is ongoing to demonstrate the effect on disease

biomarkers. In total, 16 patients will be recruited into this study

and dosed with RXC007 for 28 days, with endpoints including changes

from baseline in blood biomarkers, proteins and genes from

broncho-alveolar lavage (BAL) fluid and BAL-fluid cells and

bronchial epithelial cells. An open IND in the US is allowing

enrolment into the 28-day translational science sub-study with

longer dosing currently under an FDA partial clinical hold pending

the data readout from an ongoing nonclinical study. The requested

data, at clinically relevant doses, is expected later this

year.

Selective ROCK2 inhibition - a novel approach to fibrotic

disease

Treatments for IPF have remained largely stagnant since the 2014

approval of pirfenidone and nintedanib, both of which have been

shown to slow but not halt or reverse the effect of fibrosis, and

which have significant tolerability issues for a large percentage

of patients, limiting their use.

Based on current biological knowledge, targeting downstream

pathways is most likely to be effective in treating clinically

overt disease[2]. ROCK sits downstream of a number of competitor

targets including the TGF-<BETA>, CTGF and LPA pathways, all

of which signal, or partially signal, through ROCK. As a known

nodal point in these signalling cascades, by selectively targeting

ROCK2, RXC007 can act pleiotropically, an important characteristic

of approved antifibrotic compounds.

ROCK2 inhibition is now a commercially validated target with

potential in multiple disease areas, following the FDA approval and

launch of the first drug with this mechanism of action for the

treatment of chronic graft versus host disease (cGvHD).

In addition to the ongoing clinical development plan in IPF,

which accounts for around one third of patients with a significant

lung pathology, we have also generated consistently supportive

preclinical data that highlights the broad potential of

next-generation ROCK2 inhibitors across a number of fibrotic

indications where there remains a significant unmet need.

We presented proof-of-concept data at the International

Colloquium on Lung and Airway Fibrosis (ICLAF) on 2 October 2022

that detailed development work in immune mediated models of cGvHD,

where the underlying disease mechanisms that drive pathology in the

model show similarities to those observed in the lung pathology of

auto-immune driven fibrotic diseases such as systemic sclerosis and

ILD. The data presented showed the pleiotropic, anti-fibrotic

effects of RXC007, which when dosed orally and therapeutically, was

able to significantly reduce skin thickness, fibrosis and collagen

deposition in the skin and lungs.

Beyond lung fibrosis, encouraging data from an ongoing

collaboration with the Garvan Institute of Medical Research (the

"Garvan"), presented at the Antifibrotic Drug Development Summit

(AFDD) on 10 November 2022, showed the potential of Redx's ROCK2

inhibitors in cancer-associated fibrosis, such as that seen in

pancreatic cancer. Post period, on 10 May 2023, preclinical data

showing the effect of RXC007 in an aggressive patient derived

xenograft model of pancreatic ductal adenocarcinoma in combination

with standard of care (SoC) chemotherapy, were presented at the

Resistant Tumour Microenvironment, Keystone Symposia. The data

observed showed a striking increase in survival when RXC007 was

combined with SoC chemotherapy, compared to SoC chemotherapy

alone.

These data add to an extensive preclinical data package which

supports opportunities in multiple fibrotic indications, including

the wider ILD indications being planned for in the future Phase 2b

study. They also support the exploration of RXC007 in

cancer-associated fibrosis, such as that seen in advanced

pancreatic cancer, thereby presenting a novel opportunity in a

disease area with both a high unmet need and the potential for

accelerated development in combination with standard first line

chemotherapy regimens, which we aim to commence early in 2024.

As our RXC007 clinical activities continue to mature, we have

also filed a proposed International Non-proprietary Name (INN),

zelasudil, which we expect to become active in June 2023.

RXC008 - On track for a CTA submission during H2 2023

RXC008 is a potent, oral, small molecule non-systemic

GI-targeted ROCK inhibitor designed to act exclusively in the GI

tract at the site of fibrosis in Crohn's disease. RXC008 is

currently undergoing IND enabling studies to allow the submission

of a Clinical Trial Authorisation (CTA) during H2 2023, which would

allow the commencement of a first-in-man Phase 1 study in 2024.

RXC008 is a potential first-in-class treatment for fibrostenotic

Crohn's disease, for which no therapeutic treatment is currently

available, meaning patients must endure invasive, and often

multiple, surgeries. RXC008 has shown in vivo efficacy in animal

fibrosis models and ex vivo efficacy in human tissue from Crohn's

disease patients.

During the period, results from adoptive transfer and chronic

dextran sulphate sodium (DSS) studies were presented at the

Inflammatory Bowel Disease Nordic (IBD Nordic) Conference in

November 2022. These studies, undertaken in collaboration with

Ghent University, also incorporated the use of non-invasive

magnetic resonance imaging (MRI) texture analysis and histology to

assess reduction in tissue injury and fibrosis, and is something

that we aim to use translationally in our clinical studies moving

forward. Of note, the most compelling preclinical data were seen in

a therapeutic 12-week DSS model with a closely related GI-targeted

ROCK inhibitor, REDX08087, which was able to fully reverse fibrosis

back to baseline levels when the compound was administered orally

once a day from weeks 6 to 12, once fibrosis was established. We

were able to show complete reversal of preformed GI fibrosis as

measured by trichome collagen staining, with this level of

anti-fibrotic effect the strongest we have seen in any of Redx's

fibrosis models and modes of action to date.

RXC004 - primary efficacy hypothesis in combination with

anti-PD-1 expected to read out at the end of 2023 with a view to

partnering for future development

RXC004 is an orally active, once daily, Porcupine inhibitor in

Phase 2 development as a targeted treatment for Wnt-ligand

dependent cancers.

The primary efficacy hypothesis for RXC004 is in combination,

which we are initially exploring clinically with anti-PD-1 therapy,

where it is believed to overcome immune evasion and anti-PD-1

resistance in late-stage hard-to-treat tumour types. However, due

to its mechanism of action, there is further potential to combine

with MAPK pathway inhibitors given the significant co-occurrence of

both BRAF and KRAS mutations in Wnt-ligand dependent tumours, as

well as with chemotherapy.

The Phase 2 development programme consists of two studies,

PORCUPINE, evaluating RXC004 as both monotherapy and in combination

with an anti-PD-1 checkpoint therapy, nivolumab (OPDIVO(R)[3] -

Bristol Myers Squibb) , in genetically selected MSS mCRC; and

PORCUPINE2, as monotherapy in genetically selected pancreatic

cancer and as monotherapy and in combination with anti-PD-1

therapy, pembrolizumab (KEYTRUDA(R)[4]) in unselected Biliary Tract

Cancer (BTC). The objective of the Phase 2 programme is to provide

an initial assessment of the efficacy and safety of RXC004.

During the period, we presented enabling Phase 1 combination

data at the Society for Immunotherapy of Cancer (SITC) Conference

in November 2022, which confirmed the selection of 1.5mg as the

dose to take forward and duly supported the decision to open

enrolment into the Phase 2 combination modules. Recruitment into

the Phase 2 combination modules of the RXC004 programme is ongoing

and we expect to report topline data at the end of 2023. Given the

highest potential opportunity to develop RXC004 is in combination,

following these data read outs Redx aims to seek a partner to

develop RXC004 more broadly in combination with other agents.

On 8 March 2023, the first data from the Phase 2 programme were

announced from 16 previously treated patients enrolled in the

advanced unselected BTC monotherapy arm of the PORCUPINE2 study,

the primary endpoint of which was progression free survival at six

months. The initial data showed some patients received durable

clinical benefit from RXC004, consistent with clinical activity

seen in the earlier Phase 1 trial, which Redx believes is notable

given few drugs have received regulatory approval as single agents

in this treatment setting. The data also showed that the safety

profile of RXC004 in this module was consistent with that reported

in Phase 1. Whilst an encouraging demonstration of potential for

RXC004's contribution to efficacy in a combination therapy, the

overall results were not sufficient to support the further

development by Redx of RXC004 as a monotherapy in BTC.

The emerging single agent profile of RXC004 with the BTC

monotherapy data reported to date is showing modest clinical

benefit and supportive of the primary efficacy hypothesis in the

combination setting. In light of this, and the fact that it has

taken longer than initially anticipated to identify patients in the

genetically selected pancreatic and MSS mCRC monotherapy modules, a

trend that has been evidenced across the industry landscape, we

have made the decision to close further patient recruitment for all

monotherapy. This will enable us to prioritise both patient

recruitment and resources into the combination modules which we

expect to report at the end of 2023 as planned.

Discovery Engine - Progressing towards two further INDs by end

of 2025

Our approach to discovery has historically been to select

biologically or clinically validated targets where we believe our

capabilities can solve historical challenges, including those

associated with resistance, dosing and pharmacokinetics,

tolerability or drug-drug interactions. This approach is evidenced

both with RXC007 which we believe has the potential to be a

best-in-class molecule, as well as the recent US FDA approval of

Jaypirca(TM) (pirtobrutinib), during the period. Pirtobrutinib , a

non-covalent (reversible) BTK inhibitor, was originally discovered

and developed by Redx[5] and is the first Redx-discovered molecule

to receive a marketing authorisation.

We continue to progress towards our goal of two further INDs by

the end of 2025 and have a pipeline of undisclosed research

programmes ongoing. The most advanced of these is the Discodin

Domain Receptor (DDR) programme. DDRs are receptor tyrosine kinases

containing a discoidin homology domain in their extracellular

region and which act as non-integrin collagen receptors. There are

two DDR receptors, DDR1 and DDR2, and DDR expression is increased

in many fibrotic diseases. DDRs have recently gained traction as

new druggable targets with the potential to treat multiple fibrotic

conditions, including kidney fibrosis. Redx has generated

compelling preclinical data on REDX12271, a novel, potent,

selective and orally active DDR1 inhibitor, in chronic kidney

disease models, which were presented at the American Society of

Nephrology Kidney Week (ASN) in November 2022. The data presented

showed that selective inhibition of DDR1 with REDX12271 reduces

inflammation and fibrosis in prophylactic Murine Unilateral

Ureteral Obstruction (UUO) models, and to our knowledge this is the

first example of selective inhibition of DDR1 with a small molecule

giving rise to efficacy in mouse UUO models.

Finance

Our cash balance at the end of the period of GBP34.6 million

provides funding into Q1 2024 and enables the delivery of several

significant value inflection points , including Phase 2a data in

IPF. The increase in our R&D expenditure to GBP16.1 million (31

March 2022: GBP12.9 million) results from the expansion of our

clinical trial activities. Although no milestones from partnerships

were received during the period, the revenue reported of GBP2.3

million is as a result of the revenue recognition from our ongoing

collaboration with Jazz Pharmaceuticals. Driven by higher R&D

expenses and lower revenue for the period, in addition to one-time

reverse merger transaction expenses, the Loss from Operations of

GBP20.8 million was higher than the comparative period (31 March

2022: GBP9.8 million).

Management remain highly focused on efficiently allocating

resources, including conducting a detailed prioritisation review of

all programmes and expenses, to ensure delivery of important value

inflection points. The Board and management continue to explore all

financing and other strategic options to extend the cash runway in

the best interests of all our shareholders.

Outlook

During the period under review, we continued to advance our

clinical and preclinical programmes towards significant value

inflection points, with a focus on our industry-leading ROCK

portfolio. We remain very enthused by the data to date from our

clinical portfolio, and the overall momentum within our pipeline.

Whilst disappointed that the announced merger with Jounce did not

complete, we remain well positioned to deliver multiple near-term

value inflection points. Redx retains the foundations for longer

term success and shareholder value creation and our Board will

continue to explore all options to secure the funding required to

further enable this. I look forward to reporting our progress in

due course.

I would like to take this opportunity to thank our employees who

continue to drive the success of the Company through their talent

and commitment, as well as our partners and collaborators who

augment our ability to deliver these potential drugs to patients,

and our shareholders who have continued to show strong support for

the Company.

Lisa Anson

Chief Executive Officer

Consolidated Statement of Comprehensive Loss

Unaudited Unaudited Audited

Half Year Half Year Year to 30

to 31 March to 31 March September

2023 2022 2022

Note GBP000 GBP000 GBP000

Revenue 2 2,311 8,353 18,690

Research and Development

expenses (16,097) (12,913) (28,563)

General and Administrative

expenses (4,747) (5,314) (10,229)

Reverse merger expenses 3 (2,395) - -

Exchange (losses)/gains on

translation (441) 409 2,297

Other operating income 915 625 1,539

------------ ------------ ----------

Loss from operations (20,454) (8,840) (16,266)

Finance income 5 704 8 187

Finance expense 5 (897) (850) (1,725)

------------ ------------ ----------

Loss before taxation (20,647) (9,682) (17,804)

Income tax 6 (119) (81) (201)

------------ ------------ ----------

Loss attributable to owners

of Redx Pharma Plc (20,766) (9,763) (18,005)

Other comprehensive (loss)

/ income

Items that may subsequently

be reclassified to profit

or loss

Exchange difference from

translation of foreign operations (5) 8 31

Total comprehensive loss

for the period attributable

to owners of Redx Pharma

Plc (20,771) (9,755) (17,974)

============ ============ ==========

Pence Pence Pence

Loss per share

From continuing operations

- basic & diluted 7 (6.2) (3.5) (6.1)

Consolidated Statement of Financial Position

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 2022 2022

Note GBP000 GBP000 GBP000

Assets

Property, plant and equipment 2,370 3,047 2,699

Intangible assets 397 403 400

Total non-current assets 2,767 3,450 3,099

--------- --------- ------------

Trade and other receivables 8 5,445 4,881 5,498

Current tax 26 26 26

Cash and cash equivalents 34,610 31,583 53,854

Total current assets 40,081 36,490 59,378

--------- --------- ------------

Total assets 42,848 39,940 62,477

--------- --------- ------------

Liabilities

Current liabilities

Trade and other payables 9 6,546 5,678 5,958

Contract liabilities 10 2,582 11,044 4,893

Borrowings 11 16,526 - 15,731

Lease liabilities 649 599 623

Total current liabilities 26,303 17,321 27,205

Non-current liabilities

Borrowings 11 - 14,971 -

Lease liabilities 1,619 2,268 1,951

Total liabilities 27,922 34,560 29,156

--------- --------- ------------

Net assets 14,926 5,380 33,321

========= ========= ============

Equity

Share capital 12 3,349 2,753 3,349

Share premium 99,501 66,299 99,501

Share-based payment 10,431 6,746 8,199

Capital redemption reserve 1 1 1

Exchange translation reserve 55 37 60

Convertible note reserve 3,524 3,524 3,524

Retained deficit (101,935) (73,980) (81,313)

Equity attributable to shareholders 14,926 5,380 33,321

========= ========= ============

Consolidated Statement of Changes in Equity

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

Capital Exchange

Share Share Share-based redemp'n translation Convertible Retained Total

capital premium payment reserve reserve note reserve deficit equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Movements by half

year

At 30 September

2021 2,753 66,299 4,752 1 29 3,524 (64,226) 13,132

--------- --------- ----------- --------- ------------ ------------- --------- ---------

Loss for the period - - - - - - (9,763) (9,763)

Other comprehensive

income - - - - 8 - - 8

--------- --------- ----------- --------- ------------ ------------- --------- ---------

Total comprehensive

loss for the

period - - - - 8 - (9,763) (9,755)

Transactions with

owners in their

capacity as owners

Share-based

compensation - - 2,003 - - - - 2,003

Release of share

options lapsed

in the period - - (9) - - - 9 -

At 31 March 2022 2,753 66,299 6,746 1 37 3,524 (73,980) 5,380

Loss for the period - - - - - - (8,242) (8,242)

Other comprehensive

income - - - - 23 - - 23

--------- --------- ----------- --------- ------------ ------------- --------- ---------

Total comprehensive

loss for the

period - - - - 23 - (8,242) (8,219)

Transactions with

owners in their

capacity as owners

Issue of ordinary

shares 596 33,972 - - - - - 34,568

Transaction costs

on issue of

ordinary

shares - (770) - - - - - (770)

Share-based

compensation - - 2,362 - - - - 2,362

Release of share

options lapsed

in the period - - (909) - - - 909 -

At 30 September

2022 3,349 99,501 8,199 1 60 3,524 (81,313) 33,321

Loss for the period - - - - - - (20,766) (20,766)

Other comprehensive

loss - - - - (5) - - (5)

--------- --------- ----------- --------- ------------ ------------- --------- ---------

Total comprehensive

loss for the

period - - - - (5) - (20,766) (20,771)

Transactions with

owners in their

capacity as owners

Share-based

compensation - - 2,376 - - - - 2,376

Release of share

options lapsed

in period - - (144) - - - 144 -

At 31 March 2023 3,349 99,501 10,431 1 55 3,524 (101,935) 14,926

========= ========= =========== ========= ============ ============= ========= =========

Consolidated Statement of Cash Flows

Unaudited Unaudited Audited

Half Year Half Year Year to 30

to 31 March to 31 March September

2023 2022 2022

GBP000 GBP000 GBP000

Net cash flow from operating

activities

Loss for the period (20,766) (9,763) (18,005)

Adjustments for:

Income tax 119 81 201

Finance costs (net) 193 842 1,538

Depreciation and amortisation 496 438 886

Share based compensation 2,376 2,003 4,365

Profit on disposal of assets - - (13)

Movements in working capital

(Increase) / decrease in trade

and other receivables and contract

assets (545) 8,694 7,631

(Decrease) / increase in trade

and other payables and contract

liabilities (1,723) 278 (5,593)

Cash (used in) / generated by

operations (19,850) 2,573 (8,990)

Tax credit received 582 8 333

Interest received 601 8 187

------------ ------------ ----------

Net cash (used in) / generated

by operations (18,667) 2,589 (8,470)

------------ ------------ ----------

Cash flows from investing activities

Sale of property, plant and equipment - - 21

Purchase of property, plant and

equipment (164) (158) (262)

Net cash used in investing activities (164) (158) (241)

------------ ------------ ----------

Cash flows from financing activities

Proceeds of share issues - - 34,568

Share issue costs - - (770)

Payment of lease liabilities (408) (408) (816)

Net cash (used in) / generated

by financing activities (408) (408) 32,982

------------ ------------ ----------

Net (decrease) / increase in cash

and equivalents (19,239) 2,023 24,271

Cash and cash equivalents at

the beginning of the period 53,854 29,552 29,552

Foreign exchange difference (5) 8 31

Cash and cash equivalents at

the end of the period 34,610 31,583 53,854

============ ============ ==========

Reconciliation of changes in liabilities arising from financing

activities

Unaudited Unaudited Audited

Half Year Half Year Year to 30

to 31 March to 31 March September

2023 2022 2022

GBP000 GBP000 GBP000

IFRS16 Lease liability

Balance b/fwd 2,574 3,149 3,149

Payment of lease liabilities (408) (408) (816)

Interest on lease liabilities 102 126 241

Balance c/fwd (disclosed

as current and non-current

lease liabilities) 2,268 2,867 2,574

============ ============ ==========

Convertible loan notes

Balance b/fwd 15,731 14,247 14,247

Interest 795 724 1,484

Balance c/fwd (disclosed

as current borrowings) 16,526 14,971 15,731

============ ============ ==========

Notes to the Interim Results

1. Basis of preparation and accounting policies

1.01 Description of Group and approval of the consolidated interim financial statements

Redx Pharma Plc ("Redx" or the "Company") is a limited liability

company incorporated and domiciled in the UK. Its shares are quoted

on AIM, a market operated by The London Stock Exchange. The

principal activity of the Group is drug discovery, preclinical

development and licensing.

The Group's consolidated interim financial statements are

presented in pounds sterling, which is the Group's presentational

currency, and all values are rounded to the nearest thousand

(GBP000) except where indicated otherwise.

The consolidated interim financial statements were approved by

the Board of Directors on 16 May 2023.

1.02 Basis of preparation

The Group's consolidated interim financial statements, which are

unaudited, consolidate the results of Redx Pharma Plc and its

subsidiary undertakings made up to 31 March 2023. The Group's

accounting reference date is 30 September.

The financial information contained in these interim financial

statements does not constitute statutory accounts as defined in

section 434 of the Companies Act 2006. It does not therefore

include all of the information and disclosures required in the

annual financial statements. The financial information for the six

months ended 31 March 2023 and 31 March 2022 is unaudited.

The information for the period ended 30 September 2022 has been

extracted from the statutory accounts for the year ended 30

September 2022, prepared in accordance with UK adopted

International Accounting Standards in conformity with the

requirements of the Companies Act 2006. The statutory accounts were

approved by the Board on 19 December 2022 and delivered to the

Registrar of Companies. The audited financial statements of the

Group in respect of the year ended 30 September 2022 received an

unqualified audit opinion and did not contain a statement under

section 498(2) or (3) of the Companies Act 2006. The audit report

included a reference to a material uncertainty that might cast

significant doubt over the Group's ability to continue as a going

concern, to which the auditors drew attention by way of emphasis

without qualifying their report.

1.03 Significant accounting policies

The accounting policies used in the preparation of the financial

information for the six months ended 31 March 2023 are in

accordance with the recognition and measurement criteria of UK

adopted International Accounting Standards ("IAS") in conformity

with the requirements of the Companies Act 2006 and are consistent

with those adopted in the annual statutory financial statements for

the year ended 30 September 2022.

While the interim financial information included has been

prepared in accordance with the recognition and measurement

criteria of UK adopted International Financial Reporting Standards

("IFRS"), the interim financial statements do not include

sufficient information to comply with IFRS.

1.04 Segmental information

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The Board of Directors and the Chief Financial Officer are together

considered the chief operating decision-maker and as such are

responsible for allocating resources and assessing performance of

operating segments.

The Directors consider that there are no identifiable business

segments that are subject to risks and returns different to the

core business. The information reported to the Directors for the

purposes of resource allocation and assessment of performance is

based wholly on the overall activities of the Group.

The Group has therefore determined that it has only one

reportable segment.

1.05 Going concern

As part of their going concern review the Directors have

followed the guidelines published by the Financial Reporting

Council entitled "Guidance on the Going Concern Basis of Accounting

and Reporting on Solvency Risks - Guidance for directors of

companies that do not apply the UK Corporate Governance Code". The

Directors have also taken into account recent FRC guidance for

companies in relation to going concern and Covid-19.

The Group is subject to a number of risks similar to those of

other development stage pharmaceutical companies. These risks

include, amongst others, generation of revenues in due course from

the development portfolio and risks associated with research,

development, testing and obtaining related regulatory approvals of

its pipeline products. Ultimately, the attainment of profitable

operations is dependent on future uncertain events which include

obtaining adequate financing to fulfil the Group's commercial and

development activities and generating a level of revenue adequate

to support the Group's cost structure.

The Board have adopted the going concern basis in preparing

these accounts after assessing the Group's cash flow forecasts and

principal risks.

At 31 March 2023 the Group held GBP34.6 million of cash and cash

equivalents. The Group has a history of recurring losses from

operations, including a net loss of GBP20.8 million for the six

months ended 31 March 2023 and an accumulated deficit of GBP101.9

million at that date. In addition, operational cash outflows

continue to be driven by the ongoing focus on the research,

development and clinical activities to advance the programmes

within the Group's pipeline. The Group recorded a net decrease in

cash and cash equivalents of GBP19.2 million for the six months

ended 31 March 2023.

As part of its approval of the Group's interim financial

statements for the six months ended 31 March 2023, the Board

concluded that the Group holds sufficient cash and cash equivalents

to provide a cash runway into February 2024 at currently budgeted

levels and timings of expenditure and also on the assumption that

the Group's convertible loans will be converted into equity of the

Group, or that there will be an extension of the term of those

convertible loans (see further discussion below).

In undertaking the going concern review, the Board has reviewed

the Group's cash flow forecasts to 31 May 2024 (the going concern

period). Accounting standards require that the review period covers

at least 12 months from the date of approval of the financial

statements, although they do not specify how far beyond 12 months a

Board should consider. Further funding is required under the

Board's long-term plan to continue to develop its product

candidates and conduct clinical trials, and the Group requires

significant further finance within this period, and is exploring a

number of different options to raise the required funding. Given

these plans and requirements, a review period of 12 months is

considered appropriate.

The Board has identified and assessed downside risks and

mitigating actions in its review of the Group's cash flow

forecasts. The potential requirement to repay the convertible loan

notes and the ability of the Group to raise further capital are

both circumstances outside the control of the Directors.

Accordingly, the downside risks include severe but plausible

scenarios where external fund raising is not successful, where the

Group underperforms against the business plan, and where the

convertible loan notes are recalled rather than converted or

extended. Mitigating actions include the delay of operating

expenditure for research activities and restriction of certain

discretionary expenditure including capital expenditure. In the

event that the convertible loan notes are not converted or

extended, the stated mitigating actions would be insufficient such

that the Group would need to raise additional capital within the

going concern period and this is outside of the control of the

Directors. Similarly, converting or extending the convertible loan

notes would not provide sufficient free cash flow to allow the

Group to meet its liabilities for at least 12 months from the date

of approval of these financial statements. Based on these

conditions, the Group has concluded that the need to raise further

capital and the potential need to repay the convertible loan notes

represent material uncertainties regarding the Group's ability to

continue as a going concern.

Notwithstanding the existence of the material uncertainties, the

Board believes that the adoption of the going concern basis of

accounting is appropriate for the following reasons:

-- the Directors consider it highly unlikely that the

convertible loan notes will be repaid in August 2023 given that the

conversion price of 15.5p represents a significant discount to the

open market price of Redx Pharma Plc share capital. This discount

is around 52% when compared to the share price at 11 May 2023.

-- the Directors do not currently expect the convertible loan

notes to be recalled in August 2023.

-- based on plans and discussions with its advisors and

investors the Directors have an expectation that further funding

will be obtained.

-- the Group has a track record and reasonable near-term

visibility of meeting expectations under its collaboration

agreements and receiving milestone payments which have the

potential to increase the Group's cash runway but are not included

in the Directors' assessment given they are outside the control of

management .

-- the Group retains the ability to control capital and other

discretionary expenditure and lower other operational spend.

There can be no assurance that the convertible loan notes will

be converted or extended rather than recalled. If the loan notes

are not converted or extended, the Group may not have sufficient

cash flows to support its current level of activities beyond the

maturity date. While the Group has successfully accessed equity and

debt financing in the past, there can be no assurance that it will

be successful in doing so now or in the future. In the event the

loan notes are recalled, or additional financing is not secured,

the Group would need to consider:

-- new commercial relationships to help fund future clinical

trial costs (i.e., licensing and partnerships); and/or

-- reducing and/or deferring discretionary spending on one or

more research and development programmes; and/or

-- restructuring operations to change its overhead structure.

The Group's future liquidity needs, and ability to address those

needs, will largely be determined by the success of its product

candidates and key development and regulatory events and its

decisions in the future. Such decisions could have a negative

impact on the Group's future business operations and financial

condition.

The accompanying financial statements do not include any

adjustments that would be required if they were not prepared on a

going concern basis. Accordingly, the financial statements have

been prepared on a basis that assumes the Group will continue as a

going concern and which contemplates the realization of assets and

satisfaction of liabilities and commitments in the ordinary course

of business.

2. Revenue

Unaudited Unaudited Audited

Half year Half year Year to 30

to 31 March to 31 March September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Revenue from milestones on

scientific programmes - 6,684 10,693

Revenue from research collaboration 2,311 701 6,852

Revenue from research and

preclinical development services - 968 1,145

2,311 8,353 18,690

============= ============= ===========

3. Reverse merger expenses

On 23 February 2023 the Group announced a unanimously

recommended business combination with Jounce Therapeutics , Inc.

("Jounce"). Work continued on the project until, following an

unsolicited cash offer for its shares, the board of directors of

Jounce withdrew its recommendation for the combination on 27 March

2023 in favour of an acquisition by another party. Given the nature

and materiality of the expense, it has been disclosed separately

within the Consolidated Statement of Comprehensive Loss. No further

expense is expected, and the proposed transaction formally lapsed

on 3 April 2023.

4. Share-based compensation

Share options have been issued to certain Directors and staff,

and the charge arising is shown below. The fair value of the

options granted has been calculated using a Black-Scholes

model. 17,570,779 of the options granted are subject to performance

conditions based on scientific, clinical and commercial milestones.

There are no further conditions attached to the vesting of

other options other than employment service conditions.

Unaudited Unaudited Audited

Half Year Half Year Year to 30

to 31 March to 31 March September

2023 2022 2022

Number Number Number

Outstanding at the beginning

of the period 36,560,098 33,577,104 33,577,104

Options granted and vested

in period - - -

Options exercised in period - - (1,558,297)

Options surrendered and lapsed

in period (1,283,758) (616,667) (2,283,709)

Options granted and vesting

in future periods 7,300,000 2,100,000 6,825,000

Outstanding at the end of

the period 42,576,340 35,060,437 36,560,098

============= ============= ============

GBP000 GBP000 GBP000

Charge to Statement of Comprehensive

Loss in period 2,376 2,003 4,365

============= ============= ============

Assumptions used were an option life of 5 years, a risk free

rate of 0.6% - 9.4% and no dividend yield. Other inputs were:

* Volatility 111% - 141%

* Share price at date of grant in a range between 25p

and 81p

* Exercise price in a range between 15.5p and 81p

* Weighted average fair value of each option in a range

between 21.8p and 69.2p

At 31 March 2023, a total of 6,948,168 options were vested.

5. Finance income and expense

Unaudited Unaudited Audited

Half Year Half Year Year to 30

to 31 March to 31 March September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Finance income

Bank and other short-term

deposits 704 8 187

704 8 187

============= ============= ===========

Finance expense

Loan interest 795 724 1,484

Interest on lease liabilities 102 126 241

897 850 1,725

============= ============= ===========

6. Income tax

Unaudited Unaudited Audited

Half Year Half Year Year to

to to 30 September

31 March 31 March 2022

2023 2022

GBP'000 GBP'000 GBP'000

Current income tax

Corporation tax 119 81 199

Amounts in respect of previous

periods - - 2

Income tax charge per the income

statement 119 81 201

========= ========= =============

7. Loss per Share

Basic loss per share is calculated by dividing the net income

for the period attributable to ordinary equity holders by

the weighted average number of ordinary shares outstanding

during the period. In the case of diluted amounts, the denominator

also includes ordinary shares that would be issued if any

dilutive potential ordinary shares were issued following exercise

of share options. The basic and diluted calculations are based

on the following:

Unaudited Unaudited Audited

Half Year Half Year Year to 30

to 31 March to 31 March September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Loss for the period attributable

to the owners of the Company (20,766) (9,763) (18,005)

============

Number Number Number

Weighted average number of

shares

- basic & diluted 334,911,458 275,282,205 294,182,774

============ ============ ===========

Pence Pence Pence

Loss per share - basic & diluted (6.2) (3.5) (6.1)

============ ============ ===========

The loss and the weighted average number of shares used for

calculating the diluted loss per share are identical to those

for the basic loss per share. This is because the outstanding

share options would have the effect of reducing the loss per

share and would therefore not be dilutive under IAS 33 Earnings

per Share.

8. Trade and other receivables

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Trade receivables - 356 12

VAT recoverable 667 815 909

Prepayments and other receivables 4,675 3,634 4,577

Accrued income 103 76 -

---------- ---------- -------------

5,445 4,881 5,498

========== ========== =============

Included within prepayments other receivables at March 2022,

September 2022 and March 2023 is an o ther receivable of GBP0.6

million which is due after more than one year.

9. Trade and other payables

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Trade payables 2,181 2,201 2,792

Employee taxes and social

security 268 224 250

Other payables 31 9 18

Accruals 4,066 3,244 2,898

---------- ---------- -------------

6,546 5,678 5,958

========== ========== =============

10. Contract liabilities

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Contract liabilities 2,582 11,044 4,893

=========== ========== =============

Reconciliation

Balance b/fwd 4,893 4,318 4,318

Contract asset debtor received - 7,427 7,427

Transfer to revenue (2,311) (701) (6,852)

2,582 11,044 4,893

=========== ========== =============

The contract liability relates to a single research collaboration

contract.

11. Borrowings

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Convertible loan notes

Current 16,526 - 15,731

Non-current - 14,971 -

16,526 14,971 15,731

============= ============ ===============

On 4 August 2020 Redx Pharma Plc issued convertible loan notes

with a value of GBP22.2m. No interest is payable during the

first 3 years, thereafter it is payable at a maximum rate

equal to the US prime rate at that time. The notes are convertible

into Ordinary shares of Redx Pharma Plc, at any time at the

option of the holder, or repayable on the third anniversary

of the issue. The conversion rate is 1 Ordinary share for

each GBP0.155 of convertible loan note held. The convertible

loan notes are secured by a fixed and floating charge over

all the assets of the Group.

As of 31 March 2023, an aggregate of GBP17.1 million in principal

amount was outstanding under the convertible loan notes. This

equates to 110,288,887 Ordinary shares at GBP0.155 per share.

The remaining gross principal of GBP17.1 million has been

discounted at the effective interest rate determined on initial

measurement, resulting in a discounted liability of GBP16.5

million (March 2022 GBP15.0 million, September 2022: GBP15.7

million).

12. Share capital

Unaudited Unaudited Audited

Half Year Half Year Year to 30

to 31 March to 31 March September

2023 2022 2022

Number Number Number

Number of shares in issue

In issue at 1 October 334,911,458 275,282,205 275,282,205

Issued for cash - - 58,070,956

Exercise of share options - - 1,558,297

------------- ------------- ------------

334,911,458 275,282,205 334,911,458

GBP'000 GBP'000 GBP'000

Share capital at par, fully

paid

Ordinary shares of GBP0.01 3,349 2,753 3,349

============= ============= ============

13. Post period end events

On 3 April 2023, Redx Pharma Plc confirmed the formal lapse of

the proposed business combination with Jounce Therapeutics, Inc.

All cost relating to the transaction had been incurred prior to 31

March 2023 and are disclosed within these interim results.

FURTHER INFORMATION FOR SHAREHOLDERS

AIM: REDX

Company number: 07368089

Investor website: http://redxpharma.com/investors

Registered office: Block 33, Mereside, Alderley Park, Macclesfield,

SK10 4TG

Directors: Dr Jane Griffiths (Chair)

Lisa Anson (CEO)

Peter Presland (Non-Executive Director)

Dr Bernhard Kirschbaum (Non-Executive Director)

Sarah Gordon Wild (Non-Executive Director)

Dr Thomas Burt (Non-Executive Director)

Natalie Berner (Non-Executive Director)

Dr Rob Scott (Non-Executive Director)

Company Secretary: Claire Solk

END

[1] KEYTRUDA(R) is a registered trademark of Merck Sharp &

Dohme LLC, a subsidiary of Merck & Co., Inc., Rahway, NJ,

USA

[2]

https://invivo.pharmaintelligence.informa.com/IV147701/Harbingers-For-IPF-Drug-Development?utm_source=dailyem&utm_medium=email&utm_term=&utm_campaign=&utm_medium=email&utm_source=sfmc&utm_campaign=In+Vivo+Daily+(Tues+-+Fri)&utm_id=4641751&sfmc_id=204119729

[3] OPDIVO(R) is a registered trademark of Bristol-Myers Squibb

Company

[4] KEYTRUDA(R) is a registered trademark of Merck Sharp &

Dohme LLC, a subsidiary of Merck & Co., Inc., Rahway, NJ,

USA

[5] The asset was subsequently sold outright to Loxo Oncology,

now part of Eli Lilly, Redx has no remaining economic interest

Jaypirca (TM) is a trademark owned by or licensed to Eli Lilly and

Company, its subsidiaries, or affiliates

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FQLLFXELEBBD

(END) Dow Jones Newswires

May 17, 2023 02:00 ET (06:00 GMT)

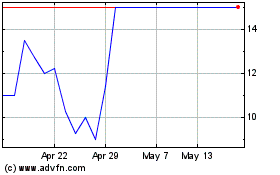

Redx Pharma (LSE:REDX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Redx Pharma (LSE:REDX)

Historical Stock Chart

From Dec 2023 to Dec 2024