TIDMRQIH

RNS Number : 3010T

R&Q Insurance Holdings Ltd

14 November 2023

R&Q Insurance Holdings Limited

Update on Proposed Sale of Accredited

14 November 2023

On 20 October 2023, R&Q Insurance Holdings Ltd (AIM-RQIH)

("R&Q") announced the proposed Sale of Accredited to Onex

Corporation (the "Announcement"). Capitalised terms used, but not

defined, in this announcement have the meaning given to such terms

in the Announcement. The full announcement can be found here:

https://www.rqih.com/news

As explained in the Announcement, the transaction is conditional

on R&Q shareholder and regulatory approval as well as customary

consents from certain R&Q debt providers. R&Q continues to

work expediently towards satisfying these conditions and closing of

the Sale is expected to occur in late Q1 2024 or early Q2 2024.

In the Announcement, R&Q provided a brief summary of its

future strategy for R&Q Legacy, on the assumption that the Sale

achieves a successful conclusion. Although completion of the Sale

continues to be conditional on the factors noted above, the Board

recognises shareholders' interest in better understanding the

profile of R&Q Legacy as a standalone business. Accordingly,

R&Q today announces the publication of a presentation on

R&Q Legacy (the "Presentation") which can be found on R&Q's

website via the link:

https://www.rqih.com/investors/shareholder-information/investor-presentations/

The Presentation provides further detail on R&Q's envisaged

strategy, market position and financial objectives as a refocused

global legacy company, should the Sale successfully close.

As previously announced, upon closing of the Sale, Jeff Hayman

will act as Chairman and Interim Chief Executive Officer of R&Q

and Paul Bradbrook, currently Chief Accounting Officer of R&Q,

will become Chief Financial Officer of R&Q and a member of the

Board, subject to customary approvals. The Presentation also

outlines R&Q Legacy's wider management team and its significant

collective experience. The management team is excited by the growth

opportunity it sees within R&Q Legacy's addressable market. In

the Presentation, management has set out three strategic priorities

through which it believes R&Q Legacy can deliver growth and

value creation:

-- Grow fee income

-- Reduce expenses

-- Decrease balance sheet volatility

Underpinning these priorities are strategic initiatives

currently underway to de-risk the R&Q Legacy portfolio

including:

-- A possible LPT (Loss Portfolio Transfer) or ADC (Adverse

Development Cover) on certain portfolios

-- The sale of non-core assets

-- The sale, or securitization, of back book legacy liabilities

In the Presentation, R&Q provides an associated plan for the

R&Q Legacy business, although it should be stressed that the

ability of R&Q Legacy to achieve such objectives depends on

many factors, including not least a successful closing of the Sale

and the paydown of R&Q debt. This plan includes that:

-- The refocused business and strategy is expected to deliver

operating profitability by full year 2025

-- Fee income is targeted to be doubled in 2025 compared to H1 2023 annualised

-- Expenses are anticipated to be reduced by 15% to 20% in 2025

relative to an adjusted annualised H1 2023 expense base that

includes certain assumptions around Legacy's standalone cost

structure

-- As R&Q returns to profitability, it will review its

dividend policy, subject to constraints due to relationships with

lenders, regulators and preferred shareholders

The Presentation also outlines R&Q's expectation of $100m+

of cumulative surplus capital to be generated over the next 5 years

as claims payments are made, releasing capital held against

reserves. This is in addition to the estimated $40m - $80m of

additional collateral R&Q will be required to hold against

existing legacy exposure retained by Accredited, which R&Q

expects to be released and available over the next 5+ years as the

underlying exposures are reduced and eliminated.

Jeff Hayman, Chairman of R&Q , said: "We recognise the

importance of giving our shareholders a clear vision around

R&Q's future as a refocused global legacy company, should the

proposed Sale of Accredited to Onex achieve a successful

conclusion. The Presentation further outlines our belief that

R&Q can build significant value as a standalone legacy business

and the clear strategy we have to return the business to operating

profitability, materially reduce balance sheet volatility and

establish a stronger capital position. Building our Reserves Under

Management is an important part of this strategy, and we have also

provided detail on the strength of our management team and their

extensive experience in non-life run-off, our large and addressable

market opportunity and the active nature of our pipeline. We look

forward to continuing to engage with all of our stakeholders."

As stated above, the plan is based on many assumptions,

including shareholder and regulatory approvals of our proposed Sale

and consent from our lenders. A more detailed explanation of the

Sale is included in our announcement of 20 October 2023. The

Presentation should be read in conjunction with that

announcement.

Ends

Enquiries to: R&Q Insurance Holdings Ltd Tel: +44 (0)20 7780 5850

Jeff Hayman

William Spiegel

Tom Solomon

Fenchurch Advisory Partners LLP (Financial Adviser) Tel: +44 (0)20 7382

2222

Kunal Gandhi

Brendan Perkins

John Sipp

Richard Locke

Tihomir Kerkenezov

Barclays Bank PLC (Financial Adviser and Joint Broker) Tel: +44 (0)20

7632 2322

Gary Antenberg

Richard Bassingthwaighte

Grant Bickwit

Howden Tiger (Financial Adviser) Tel : +44 (0)20 7398 4888

Rob Bredahl

Leo Beckham

Deutsche Numis (Nominated Adviser and Joint Broker) Tel : +44 (0)20 7260

1000

Charles Farquhar

Giles Rolls

FTI Consulting Tel: +44 (0)20 3727 1051

Tom Blackwell

Notes to Editors:

About R&Q

R&Q is a global non-life specialty insurance company. We

operate two core businesses: Program Management and Legacy

Insurance. Both these businesses are leaders in their respective

markets.

Our approach is to deploy our origination and underwriting

capabilities, alongside our licensed and rated carriers in the US,

EU, and the UK, to generate attractive fee returns in Program

Management and Legacy Insurance.

Legal Entity Identifier (LEI): 2138006K1U38QCGLFC94

Website: www.rqih.com

Forward-Looking Statements

This announcement contains forward-looking statements with

respect to R&Q and its industries, that reflect its current

views with respect to future events and financial performance.

Statements that are not historical facts, including statements

about R&Q's beliefs, plans or expectations, are forward-looking

statements. These statements are based on current plans, estimates

and expectations, all of which involve risk and uncertainty.

Statements that include the words "expect," "intend," "plan,"

"believe," "project," "anticipate," "may", "could" or "would" or

similar statements of a future or forward-looking nature identify

forward-looking statements. Actual results may differ materially

from those included in such forward-looking statements and

therefore you should not place undue reliance on them.

A non-exclusive list of the important factors that could cause

actual results to differ materially from those in such

forward-looking statements includes: (a) changes in the size of

claims relating to natural or man-made catastrophe losses due to

the preliminary nature of some reports and estimates of loss and

damage to date; (b) trends in rates for property and casualty

insurance and reinsurance; (c) the timely and full recoverability

of reinsurance placed by R&Q with third parties, or other

amounts due to R&Q; (d) changes in the projected amount of

ceded reinsurance recoverables and the ratings and credit

worthiness of reinsurers; (e) actual loss experience from insured

or reinsured events and the timing of claims payments being faster

or the receipt of reinsurance recoverables being slower than

anticipated; (f) increased competition on the basis of pricing,

capacity, coverage terms or other factors such as the increased

inflow of third party capital into reinsurance markets, which could

harm R&Q's ability to maintain or increase its business volumes

or profitability; (g) greater frequency or severity of claims and

loss activity than R&Q's underwriting, reserving or investment

practices anticipated based on historical experience or industry

data; (h) changes in the global financial markets, including the

effects of inflation on R&Q's business, including on pricing

and reserving, increased government involvement or intervention in

the financial services industry and changes in interest rates,

credit spreads, foreign currency exchange rates and future

volatility in the world's credit, financial and capital markets

that adversely affect the performance and valuation of R&Q's

investments, financing plan and access to such markets or general

financial condition; (i) changes in ratings, rating agency policies

or practices; (j) the potential for changes to methodologies,

estimations and assumptions that underlie the valuation of

R&Q's financial instruments that could result in changes to

investment valuations; (k) changes to R&Q's assessment as to

whether it is more likely than not that it will be required to

sell, or has the intent to sell, available-for-sale debt securities

before their anticipated recovery; (l) the ability of R&Q's

subsidiaries to pay dividends; (m) the potential effect of

legislative or regulatory developments in the jurisdictions in

which R&Q operates, such as those that could impact the

financial markets or increase their respective business costs and

required capital levels, including but not limited to changes in

regulatory capital balances that must be maintained by operating

subsidiaries and governmental actions for the purpose of

stabilising the financial

markets; (n) the actual amount of new and renewal business and

acceptance of products and services, including new products and

services and the materialisation of risks related to such products

and services; (o) changes in applicable tax laws, tax treaties or

tax regulations or the interpretation or enforcement thereof; (p)

the effects of mergers, acquisitions, divestitures and

retrocession.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBIBDBSUBDGXX

(END) Dow Jones Newswires

November 14, 2023 02:00 ET (07:00 GMT)

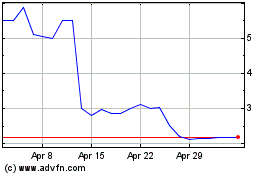

R&q Insurance (LSE:RQIH)

Historical Stock Chart

From Nov 2024 to Dec 2024

R&q Insurance (LSE:RQIH)

Historical Stock Chart

From Dec 2023 to Dec 2024