TIDMSNG

RNS Number : 1345N

Synairgen plc

21 September 2023

Synairgen plc

('Synairgen' or the 'Company')

Interim results for the six months ended 30 June 2023

Southampton, UK - 21 September 2023: Synairgen plc (LSE: SNG),

the respiratory company developing SNG001, an investigational

formulation for inhalation containing the immunomodulatory

broad-spectrum antiviral protein interferon beta, today announces

its unaudited interim results for the six months ended 30 June

2023.

Highlights (including post period-end)

Operational

-- Progressing the Company's patient identification strategy

through biomarker and existing clinical data analysis. This will

enable the Company to identify patients at higher risk of disease

progression, including those with deficient innate immune response

and/or high viral load, who might therefore be more likely to

respond to SNG001 in future clinical studies.

-- Conducting non-interventional preparatory work to expand

hospitalised patient populations for potential treatment with

SNG001, which are likely to include: ventilated patients with

confirmed viral pneumonia; and patients who are unable to clear

virus and become persistent viral "shedders", a majority of whom

are immunocompromised. Subject to this preparatory work and

regulatory approval timelines, trials are anticipated to start in

H1 2024.

-- Insights from non-interventional studies and the substantial

body of evidence gathered to date from previous clinical trials

will inform a robust clinical programme for the development of

SNG001.

Financial

-- Cash and deposit balances of GBP14.6 million at 30 June 2023

(30 June 2022: GBP18.0 million; 31 December 2022: GBP19.7 million).

Post period-end receipt of FY 2022 research and development tax

credit of GBP2.4 million.

-- Loss before tax for the six months ended 30 June 2023 was

GBP5.2 million (30 June 2022: GBP14.0 million loss).

o Research and development expenditure for the six months ended

30 June 2023 was GBP3.5 million (30 June 2022: GBP11.1 million) as

expenditure on the Phase 3 SPRINTER trial, substantially completed

in 2022, decreased and manufacturing activities reduced.

o Administrative expenses for the six months ended 30 June 2023

were GBP2.1 million (30 June 2022: GBP2.9 million), with the

reduction being attributable to the pre-commercialisation

activities incurred in 2022.

Richard Marsden, CEO of Synairgen, said: "We are focused on

progressing our method of identifying those individuals most likely

to respond to SNG001 treatment using the large body of data already

gathered through previous trials and new non-interventional

research, which is currently underway. We hope to maximise the

benefits of treatment with SNG001 by targeting patients most likely

to respond to treatment by applying both existing and new

technologies for patient selection in our next trials of SNG001.

This will enable us to focus on the most appropriate patients which

will ultimately lead to trials of SNG001 in more targeted, but

still large, patient populations at high risk of severe

outcomes."

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

For further enquiries, please contact:

Synairgen plc

Media@synairgen.com

Tel: + 44 (0) 23 8051 2800

Cavendish Capital Markets Limited (NOMAD and Joint Broker)

Geoff Nash, Charlie Beeson (Corporate Finance)

Sunila de Silva (ECM)

Tel: + 44 (0) 20 7220 0500

Numis Securities Limited (Joint Broker)

Freddie Barnfield, Duncan Monteith, Euan Brown

Tel: + 44 (0) 20 7260 1000

ICR Consilium (Financial Media and Investor Relations)

Mary-Jane Elliott, Namrata Taak, Lucy Featherstone

Synairgen@consilium-comms.com

Tel: +44 (0) 20 3709 5700

Notes for Editors

Synairgen is a UK-based respiratory company focused on drug

discovery and the development of SNG001 (inhaled interferon beta)

as potentially the first host-targeted, broad-spectrum antiviral

treatment delivered directly into the lungs for severe viral lung

infections.

Millions of people globally are hospitalised every year due to

viral lung infections and there are currently no approved antiviral

therapies for the majority of these patients. Synairgen is

developing SNG001 to address this need.

Synairgen is quoted on AIM (LSE: SNG). For more information

about Synairgen, please see www.synairgen.com .

OPERATIONAL REVIEW

Synairgen is progressing with vital foundational work in

readiness to commence further clinical trials of SNG001 as a broad

spectrum antiviral treatment. This work is based on key learnings

from the COVID-19 pandemic, which have accelerated the development

of new approaches including the broader application of key virus

testing in hospitals for symptomatic patients and the advancement

of technologies that increase understanding of how respiratory

viruses impact the individual, particularly immune system function,

using blood and airway fluid samples.

Before commencing further trials of SNG001, and taking into

account our helpful learnings from previous studies, Synairgen is

developing a patient identification strategy applying existing and

new technologies and biomarkers to identify patients whose disease

is being actively driven by virus (high virus load) and/or who are

struggling to mount an effective antiviral response (deficient

innate immune response). The Company believes that these patients

are most likely to demonstrate a response to SNG001, with potential

benefits in respect of future trial size, duration and costings. By

using Synairgen's proposed targeted approach to patient

identification the Company is able to better design studies with

fewer subjects and thus reduce cost and timings for its drug

development.

A study led by the Universities of Southampton and Leicester,

involving over 300 adults hospitalised with viral acute respiratory

illness, reported that higher viral loads were associated with a

prolonged length of stay in the hospital. This suggests that viral

load measured at the point of hospital admission could be used in

clinical trials, and potentially in clinical practice, to predict

those at risk of extended hospitalisation.(1) Building upon this,

Synairgen is exploring the relationship between virus load and

other risk factors which predict poor outcome in hospitalised

patients to inform the development of SNG001 in the hospital

setting.

In addition, the Company is expanding the populations of

interest to include mechanically ventilated patients in ICU with

confirmed viral pneumonia and patients unable to clear virus and

become persistent virus shedders, the majority of whom are

immunocompromised.

The overall patient identification approach should lead to

trials of SNG001 in more targeted, but still large, patient

populations at high risk of deterioration/progression to severe

outcomes.

In the first half of 2023, Synairgen continued this foundational

work to determine the most relevant trials to support its goals.

With respiratory viral infections being responsible for upwards of

three million hospitalisations in the US each year(2) the Company

remains committed to address this significant unmet need. Despite

the great need, there are few therapeutics available to treat the

range of viruses that cause these hospitalisations.

Additionally, Synairgen continued to share findings from its

trials of SNG001 in COVID-19 patients, including at the American

Thoracic Society 2023 conference in May and, post-period end, at

the European Respiratory Society 2023 congress in September. These

conferences are an extremely valuable way to build the Company's

network and showcase the need for a broad-spectrum antiviral.

In summary, Synairgen is continuing to work at pace, partnering

with high quality researchers and collaborators, to ensure it has

the right trial designs, equipped with the right diagnostic tools,

to be able to identify trial participants potentially most likely

to benefit from a broad-spectrum antiviral and SNG001. This work

(including biomarker assessments), together with the substantial

body of evidence gathered from clinical trials with SNG001 to date,

will inform a robust clinical development programme for SNG001. It

is the Company's goal to commence trials as soon as possible,

subject to approval timelines, and within H1 2024.

FINANCIAL REVIEW

Statement of Comprehensive Income

The loss from operations for the six months ended 30 June 2023

(H1 2023) was GBP5.5 million (six months ended 30 June 2022 (H1

2022): GBP14.0 million loss; year ended 31 December 2022 (FY 2022):

GBP20.3 million loss) with research and development expenditure

amounting to GBP3.5 million (H1 2022: GBP11.1 million; FY 2022:

GBP14.9 million) and other administrative expenses GBP2.1 million

(H1 2022: GBP2.9 million; FY 2022: GBP5.4 million).

The reduction in research and development expenditure from

GBP11.1 million to GBP3.5 million is attributable to the lower

expenditure on the Phase 3 SPRINTER trial, which was substantially

completed in 2022, and reduced manufacturing activities.

Other administrative expenditure decreased from GBP2.9 million

in H1 2022 to GBP2.1 million in H1 2023 on account of

pre-commercialisation activities incurred in 2022.

The research and development tax credit decreased from GBP1.6

million in H1 2022 to GBP0.5 million in H1 2023 on account of the

reduced qualifying expenditure and the reduction in the small or

medium enterprises (SME) R&D scheme rates effective as of 1

April 2023.

The loss after tax for H1 2023 was GBP4.7 million (H1 2022:

GBP12.4 million; FY 2022: GBP17.6 million) and the basic loss per

share was 2.36p (H1 2022: 6.16p loss; FY 2022: 8.76p loss).

Statement of Financial Position and Cash Flows

At 30 June 2023, net assets amounted to GBP16.0 million (30 June

2022: GBP24.9 million; 31 December 2022: GBP20.3 million),

including cash and deposit balances of GBP14.6 million (30 June

2022: GBP18.0 million; 31 December 2022: GBP19.7 million). Post

period-end, in August 2023, the tax credit of GBP2.4 million in

respect of FY 2022 was received.

The principal elements of the GBP5.1 million reduction in cash

and deposit balances during H1 2023 (H1 2022: GBP15.8 million

reduction; FY 2022: GBP14.2 million reduction) were:

-- Cash used in operations GBP5.3 million (H1 2022: GBP15.8

million outflow; FY 2022: GBP23.4 million outflow);

-- Research and development tax credits received of GBPnil (H1

2022: GBPnil; FY 2022: GBP9.1 million); and

-- Interest received GBP0.3 million (H1 2022: GBPnil; FY 2022: GBP0.1 million).

The other significant changes in the statement of financial

position were:

-- Current tax receivable: 30 June 2023: GBP2.9 million; 30 June

2022: GBP10.6 million; 31 December 2022: GBP2.4 million on account

of the lower research and development tax credit receivable. As

noted above, the 2022 tax credit of GBP2.4 million was received in

August 2023.

-- Trade and other payables: 30 June 2023: GBP2.7 million; 30

June 2022: GBP4.6 million; 31 December 2022: GBP3.3 million, in

line with the reduction in the level of operating expenditure.

The Company's cash resources are sufficient to cover its plans

to design and establish data from an observational study and two

investigator-led/Synairgen-sponsored Phase 2 clinical trials,

including manufacture of active and placebo for use in these

trials. Regardless of the outcome of these activities, which are

uncertain, the Company's available resources are sufficient to

cover existing committed costs and the estimated costs of these

activities until at least 30 September 2024, being a period of at

least twelve months from the date of this report and, for this

reason, the financial statements have been prepared on a going

concern basis.

Change of Name of Nominated Adviser and Joint Broker

The Company also announces that its Nominated Adviser and Joint

Broker has changed its name to Cavendish Capital Markets Limited

following completion of its own corporate merger.

References

1 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7112535/

2 IQVIA market research Q4 2022; Sources. US CDC, HCUP, IQVIA

Claims Data, PubMed; data on file

Consolidated Statement of Comprehensive Income

for the 6 months ended 30 June 2023

Unaudited Unaudited Audited

Six months Six months

ended 30 ended 30 Year

June June ended 31

2023 2022 December

2022

Notes GBP000 GBP000 GBP000

Research and development expenditure (3,463) (11,106) (14,936)

Other administrative expenses (2,051) (2,903) (5,364)

Total administrative expenses

and loss from operations (5,514) (14,009) (20,300)

Finance income 300 24 207

Loss before tax (5,214) (13,985) (20,093)

Tax credit 2 466 1,579 2,448

Loss and total comprehensive

loss for the period (4,748) (12,406) (17,645)

-------------------------------------- ---------- ------------ ------------ ----------

Loss per ordinary share 3

Basic and diluted loss per ordinary

share (pence) (2.36)p (6.16)p (8.76)p

-------------------------------------------------- ------------ ------------ ----------

Consolidated Statement of Changes in Equity

for the 6 months ended 30 June 2023

Share Share Merger Retained

Capital premium reserve deficit Total

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January 2022 2,013 125,245 483 (90,741) 37,000

------------------------------ --------- --------- --------- ---------- ---------

Loss and total comprehensive

loss for the period - - - (12,406) (12,406)

------------------------------ --------- --------- --------- ---------- ---------

Transactions with

equity holders of

the Group

Issue of ordinary

shares 1 - - - 1

Recognition of share-based

payments - - - 323 323

------------------------------ --------- --------- --------- ---------- ---------

1 - - 323 324

------------------------------ --------- --------- --------- ---------- ---------

At 30 June 2022 2,014 125,245 483 (102,824) 24,918

------------------------------ --------- --------- --------- ---------- ---------

Loss and total comprehensive

loss for the period - - - (5,239) (5,239)

Transactions with

equity holders of

the Group

Recognition of share-based

payments - - - 596 596

At 31 December 2022 2,014 125,245 483 (107,467) 20,275

------------------------------ --------- --------- --------- ---------- ---------

Loss and total comprehensive

loss for the period - - - (4,748) (4,748)

Transactions with

equity holders of

the Group

Recognition of share-based

payments - - - 437 437

At 30 June 2023 2,014 125,245 483 (111,778) 15,964

------------------------------ --------- --------- --------- ---------- ---------

Consolidated Statement of Financial Position

as at 30 June 2023

Unaudited Unaudited Audited

30 30 31

June June December

2023 2022 2022

GBP000 GBP000 GBP000

Assets

Non-current assets

Intangible assets 92 48 44

Property, plant and equipment 42 130 86

134 178 130

------ --------------- ------------ ----------

Current assets

Current tax receivable 2,881 10,634 2,415

Trade and other receivables 1,060 710 1,308

Other financial assets -

bank deposits 4,000 - 3,750

Cash and cash equivalents 10,631 18,022 15,926

------------------------------------------ --------------- ------------ ----------

18,572 29,366 23,399

------ --------------- ------------ ----------

Total assets 18,706 29,544 23,529

------------------------------------------ --------------- ------------ ----------

Liabilities

Current liabilities

Trade and other payables (2,742) (4,626) (3,254)

Total liabilities (2,742) (4,626) (3,254)

------------------------------------------ --------------- ------------ ----------

Total net assets 15,964 24,918 20,275

------------------------------------------ --------------- ------------ ----------

Equity

Capital and reserves attributable

to equity holders of the

parent

Share capital 2,014 2,014 2,014

Share premium 125,245 125,245 125,245

Merger reserve 483 483 483

Retained deficit (111,778) (102,824) (107,467)

------------------------------------------ --------------- ------------ ----------

Total equity 15,964 24,918 20,275

------------------------------------------ --------------- ------------ ----------

Consolidated Statement of Cash Flows

for the 6 months ended 30 June 2023

Unaudited Unaudited Audited

Six months Six months Year

ended 30 ended 30 ended 31

June June December

2023 2022 2022

GBP000 GBP000 GBP000

Cash flows from operating

activities

Loss before tax (5,214) (13,985) (20,093)

Adjustments for:

Finance income (300) (24) (207)

Depreciation of property, plant

& equipment 45 47 93

Amortisation 5 5 9

Share-based payment charge 437 323 919

Cash flows from operations before

changes in working capital (5,027) (13,634) (19,279)

Decrease in trade and other receivables 242 825 289

Decrease in trade and other payables (512) (3,012) (4,384)

----------------------------------------------- -------------- -------------- ------------

Cash used in operations (5,297) (15,821) (23,374)

Tax credit received - - 9,088

----------------------------------------------- -------------- -------------- ------------

Net cash used in operating activities (5,297) (15,821) (14,286)

----------------------------------------------- -------------- -------------- ------------

Cash flows from investing activities

Interest received 307 19 140

Purchase of intangible assets (54) - -

Purchase of property, plant and

equipment (1) (4) (6)

Other financial assets - bank deposits

New deposits (4,000) - (3,750)

Deposit maturities 3,750 - -

Net cash generated from/(used

in) investing activities 2 15 (3,616)

----------------------------------------------- -------------- -------------- ------------

Cash flows from financing activities

Proceeds from issuance of ordinary

shares - 1 1

Net cash generated from financing

activities - 1 1

----------------------------------------------- -------------- -------------- ------------

Decrease in cash and cash equivalents (5,295) (15,805) (17,901)

Cash and cash equivalents at beginning

of period 15,926 33,827 33,827

----------------------------------------------- -------------- -------------- ------------

Cash and cash equivalents at end

of period 10,631 18,022 15,926

----------------------------------------------- -------------- -------------- ------------

Notes to the Interim Financial Information

for the six months ended 30 June 2023

1. Basis of preparation

Basis of accounting

The condensed financial statements have been prepared using

accounting policies consistent with international accounting

standards. While the financial figures included in this half-yearly

report have been computed in accordance with international

accounting standards applicable to interim periods, this

half-yearly report does not contain sufficient information to

constitute an interim financial report as that term is defined in

IAS 34. They do not include all disclosures that would otherwise be

required in a complete set of financial statements and should be

read in conjunction with the 31 December 2022 Annual Report. The

financial information for the half years ended 30 June 2023 and 30

June 2022 does not constitute full financial statements and both

periods are unaudited.

The accounting policies applied in the preparation of this

interim financial information are consistent with those used in the

financial statements for the year ended 31 December 2022 and those

expected to apply for the financial year to 31 December 2023. The

Group has not early adopted any standard, interpretation or

amendment that has been issued but is not yet effective.

Financial information

The financial information for the year ended 31 December 2022

does not constitute the full statutory accounts for that period.

The Annual Report and Financial Statements for the year ended 31

December 2022 have been filed with the Registrar of Companies. The

Independent Auditor's Report on the Annual Report and Financial

Statements for the year ended 31 December 2022 was unqualified, did

not draw attention to any matters by way of emphasis, and did not

contain a statement under 498(2) or 498(3) of the Companies Act

2006.

Financial information is published on the Company's website in

accordance with legislation in the United Kingdom governing the

preparation and dissemination of financial information, which may

vary from legislation in other jurisdictions. The maintenance and

integrity of the Company's website is the responsibility of the

directors. The directors' responsibility also extends to the

ongoing integrity of the financial information contained

therein.

Going Concern

The directors have prepared financial forecasts to estimate the

likely cash requirements of the Company over the period to 30

September 2024, given its stage of development and lack of

recurring revenues. In preparing these financial forecasts, the

directors have made certain assumptions with regards to the timing

and amount of future expenditure over which they have control. The

directors have taken a prudent view in preparing these

forecasts.

The Company's available resources at the date of this report are

sufficient to cover the Company's plans to design and establish

data from an observational study and two

investigator-led/Synairgen-sponsored Phase 2 clinical trials,

including manufacture of active and placebo for use in these

trials. Regardless of the outcome of these activities, which are

uncertain, the Company's available resources are sufficient to

cover existing committed costs and the estimated costs of these

activities until at least 30 September 2024.

Notes to the Interim Financial Information

for the six months ended 30 June 2023 (continued)

1. Basis of preparation (continued)

Going concern (continued)

After due consideration of these forecasts and current cash

resources, the directors consider that the Company has adequate

financial resources to continue in operational existence for the

foreseeable future (being a period of at least twelve months from

the date of this report) and, for this reason, the financial

statements have been prepared on a going concern basis.

Approval of financial information

The 30 June 2023 interim financial information was approved by a

committee of the Board of Directors on 20 September 2023.

2. Tax credit

The tax credit of GBP466,000 (six months ended 30 June 2022:

GBP1,579,000; year ended 31 December 2022: GBP2,448,000) comprises

an estimate of the research and development tax credit receivable

in respect of the current period.

The deferred tax assets have not been recognised as there is

uncertainty regarding when suitable future pro ts against which to

offset the accumulated tax losses will arise. There is no

expiration date for the accumulated tax losses.

3. Loss per ordinary share

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 30 31

June June December

2023 2022 2022

Loss attributable to

equity holders of the

Company (GBP000) (4,748) (12,406) (17,645)

Weighted average number

of ordinary shares in

issue (000) 201,345 201,345 201,360

Basic and diluted loss

per share (pence) (2.36) (6.16) (8.76)

The loss attributable to shareholders and the weighted average

number of ordinary shares for the purposes of calculating the

diluted loss per ordinary share are identical to those used for

basic loss per share. This is because the exercise of share options

would have the effect of reducing the loss per ordinary share and

is therefore antidilutive. At 30 June 2023 there were 18,119,156

options outstanding (30 June 2022: 8,477,640 options outstanding;

31 December 2022: 14,450,882 options outstanding).

INDEPENT REVIEW REPORT TO SYNAIRGEN PLC

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2023 is not prepared, in all material respects, in accordance

with the London Stock Exchange AIM Rules for Companies.

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2023 which comprises the Consolidated

Statement of Comprehensive Income, the Consolidated Statement of

Changes in Equity, the Consolidated Statement of Financial

Position, the Consolidated Statement of Cash Flows and the related

notes 1 to 3.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the

Company are prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this half-yearly financial report is not in accordance

with UK adopted International Accounting Standard 34, "Interim

Financial Reporting".

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the Company to cease to continue as a going concern.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the London Stock Exchange AIM

Rules for Companies which require that the half-yearly report be

presented and prepared in a form consistent with that which will be

adopted in the Company's annual accounts having regard to the

accounting standards applicable to such annual accounts.

In preparing the half-yearly financial report, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

rules of the London Stock Exchange AIM Rules for Companies for no

other purpose. No person is entitled to rely on this report unless

such a person is a person entitled to rely upon this report by

virtue of and for the purpose of our terms of engagement or has

been expressly authorised to do so by our prior written consent.

Save as above, we do not accept responsibility for this report to

any other person or for any other purpose and we hereby expressly

disclaim any and all such liability.

BDO LLP

Chartered Accountants

Southampton , UK

Date: 20 September 2023

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUAUBUPWPUU

(END) Dow Jones Newswires

September 21, 2023 02:00 ET (06:00 GMT)

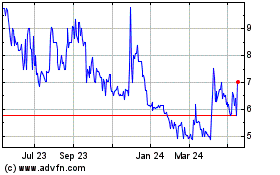

Synairgen (LSE:SNG)

Historical Stock Chart

From Oct 2024 to Nov 2024

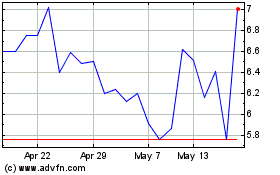

Synairgen (LSE:SNG)

Historical Stock Chart

From Nov 2023 to Nov 2024