TIDMTHG

RNS Number : 3368V

Terrace Hill Group PLC

12 December 2013

12 December 2013

Terrace Hill Group PLC

("Terrace Hill" or the "group")

FULL YEAR RESULTS DEMONSTRATE TRANSFORMATIONAL YEAR FOR THE

GROUP

Terrace Hill Group plc (AIM: THG), a leading UK property

investment and development group, today announces its results for

the year ended 30 September 2013.

Financial Highlights:

-- EPRA Net Asset Value (NAV) per share increased by 1.7% to

28.8 pence (30 September 2012: 28.3 pence) while EPRA Triple NAV

per share increased by 3.2% to 27.7p (30 September 2012: 26.8p)

-- IFRS Profit before tax including discontinued operations of

GBP6.2 million (30 September 2012: GBP1.8 million)

-- IFRS net assets increased by 10.6% to GBP55.5 million from

GBP50.2 million at 30 September 2012

-- Significant reduction in the group's level of debt and gearing:

- Net debt reduced by 62.9% to GBP17.5 million, from GBP47.2 million at 30 September 2012

- Gearing* percentage of 28.6%, down from 78.2% at 30 September

2012 and 86.0% at 30 September 2011

- Look through net gearing (including its share of joint

ventures and associated undertakings) fell sharply to 29.0%, from

142.1% at 30 September 2012

* As a percentage of EPRA net assets

Operational highlights:

-- Sale of virtually all residential assets, in line with stated

strategy, including a portfolio of 901 residential properties to

the RSL Places for People for GBP68.0 million

-- Significant progress with commercial development programme,

with completion of three foodstore developments in Sunderland,

Sedgefield and Skelton

-- Completion of development at Howick Place, Victoria, in

November 2012, comprising 135,000 sq ft of offices and 25,300 sq ft

of residential apartments. The majority of the residential

apartments either let or sold and the top office floor let as the

UK head office of Giorgio Armani

-- 1,104 room student accommodation development at Mayflower

Halls, Southampton, on track to be delivered for 2014 academic

year. Scheme forward funded by Legal & General Property, which

was attracted to the 38 year lease entered into by the University

of Southampton

-- Resolution to grant planning consent received for a 125,000

sq ft foodstore and retail development in Middlesbrough, which has

been conditionally pre-let to Sainsbury's, a Marston's public

house, a drive through KFC and a coffee outlet

-- Strong pre-letting activity at our planned leisure scheme in

Darlington, with agreements signed with Vue Cinemas, Whitbread and

Prezzo

-- Conditional contract signed with Glasgow City Council to

develop a 35,000 sq ft restaurant led scheme at Broomielaw, on the

river Clyde

Commenting, Robert Adair, chairman of Terrace Hill, said:

"During 2013 we have achieved significant success in delivering

against our strategy, making excellent progress with our

development pipeline, while at the same time positioning the group

strongly for the future by reducing debt and gearing levels and

disposing of almost all of our residential assets. In an

increasingly positive economic environment, we look forward with

confidence and growing optimism."

Philip Leech, chief executive of Terrace Hill, added: "Over the

course of the year we have achieved real momentum within our

development pipeline, both in our core foodstore business as well

as in the leisure, student accommodation and London office sectors.

As the recovery in investor and occupier interest for property

outside of London continues to gain pace, we are well positioned to

utilise our network of regional offices to benefit from that

demand."

For further information, please visit www.terracehill.co.uk, or

contact:

Terrace Hill Group plc +44 (0)20 7631 1666

Robert Adair, chairman

Philip Leech, chief executive

Oriel Securities Limited (Nominated Adviser

and Broker) +44 (0)20 7710 7600

David Arch/Mark Young

FTI Consulting +44 (0)20 7831 3113

Richard Sunderland

Will Henderson terracehill@fticonsulting.com

Nick Taylor

Chairman's statement

I have great pleasure in presenting our financial results for

the year ended 30 September 2013.

The past 12 months have been transformational for the group with

the completion of the sale of the majority of the remaining

residential assets and significant progress with the commercial

development programme.

The group made an IFRS profit before tax including discontinued

operations of GBP6.2 million in the year (2012: GBP1.8 million) and

a pre-tax revenue profit in the year (which is profit before

valuation movements and contributions from associates) of GBP6.4

million compared with GBP11.8 million for the year ended 30

September 2012, the reduction largely due to lower foodstore

profits in the year. The majority of our profits on our Sunderland,

Sedgefield and Skelton foodstore projects were recognised in 2012.

This year the profits were mostly earned in the first half, with

the final elements of profit on the three foodstore developments

and the recognition of profits on the forward funding of our

Southampton student accommodation scheme all happening in the first

half of the year. The group's EPRA Net Asset Value (NAV) increased

by 1.7% to 28.8 pence per share at 30 September 2013 (28.3 pence

per share at 30 September 2012) and our EPRA Triple NAV rose by

3.2% to 27.7 pence per share (26.8 pence per share at 30 September

2012). The EPRA NAV includes adjustments to reflect the market

value of our development properties, where value is above cost and

our EPRA Triple NAV makes an adjustment for goodwill.

In February 2013, we completed the sale of a portfolio of 901

residential properties to the RSL Places for People for GBP68.0

million, which included both wholly owned properties and those held

by our associate, Terrace Hill Residential PLC. The sale price

reflected a discount of less than 1% of carrying value. The group

subsequently bought the remaining properties from Terrace Hill

Residential PLC in a transaction valued at GBP5.3 million, the

majority of which have subsequently been sold to owner occupiers

and investors at prices reflecting a small uplift on their purchase

price. These residential sales have had a meaningful effect on the

group's overall gearing which, due also to the successful

commercial development activities during the year, has fallen to

29.0% at 30 September 2013 on a look-through basis (142.1% at 30

September 2012). We are comfortable with this gearing level.

Our commercial development programme has produced some extremely

good returns over the year. I am also encouraged by the increasing

levels of activity and opportunity in the regions, which plays to

the strengths of our regional office network.

Of particular note has been the completion of the three

foodstore developments in Sunderland, Sedgefield and Skelton as

mentioned above. In aggregate these amounted to a total of 189,000

sq ft of new floor space reflecting a gross development value of

GBP64.5 million. Since the year end we have received a resolution

to grant planning consent for a 125,000 sq ft foodstore and retail

development in Middlesbrough, which has been conditionally pre-let

to Sainsbury's, along with a Marston's public house, a

drive-through KFC and a coffee outlet. We expect to start

construction in spring 2014. Other significant foodstore schemes

are for a 99,653 sq ft store at Herne Bay in Kent, where, after

some delay, we expect to gain consent early next year, a site in

Midsomer Norton in Somerset, with potential for retail, and

residential uses and a smaller foodstore site in Stokesley, North

Yorkshire. Our EPRA NAV at 30 September 2013 includes 0.7 pence per

share in respect of market value adjustments relating to these

developments.

We are constantly evaluating a large number of foodstore

opportunities and despite certain retailers' pronouncements about

restraining large store expansion, we have found there remains good

demand for the optimal sized store in the right location. Our

expertise in this field through our regional offices and strong

track record will continue to sustain our pipeline of developments

in this profitable sector.

Elsewhere in the regions we are seeing increased activity,

particularly in the leisure and student accommodation sectors. At

Southampton we are on programme to complete our GBP91.0 million

pre-let and forward funded 1,104 student room scheme which we are

due to handover to the University next summer. We have also been

appointed the preferred developer of a 450 room student scheme in

another south coast town.

Demand from leisure operators is strong and in Darlington, where

we expect planning to be granted before the end of the year, we

have pre-let part of our planned leisure scheme to Vue Cinemas,

Whitbread and Prezzo. We have also entered into a conditional

contract with Glasgow City Council to develop a restaurant led

scheme of 35,000 sq ft at Broomielaw, fronting the Clyde, and we

are close to conditionally acquiring another leisure site in a

North West town.

In central London, our development at Howick Place in Victoria,

which we carried out in association with Doughty Hanson, is

attracting letting interest and we have let the top floor to

Giorgio Armani for its UK head office. With the rapid increase in

the capital values of office and residential space in London we

expect to see good returns to us from this GBP170.0 million

mixed-use development. Our other exposure in Central London is a

29,000 sq ft retail and office development in Mayfair, on the

corner of Conduit Street and Savile Row, where we act as

development managers for the owners. Our performance related

remuneration on this scheme is likely to exceed our initial

expectations as this area of the London market continues to attract

strong investor and occupier interest.

It is apparent that the Central London market is now attracting

investors from most corners of the globe and this has led to a

highly competitive market with escalating values. Whilst we are

finding it hard to compete for new opportunities in this

environment, we continue to assess situations where we believe we

can add value.

It is very clear to me that the group is now well positioned for

growth. The sale of the residential assets has allowed us to focus

on our core strength of commercial development and reduce our

gearing while strengthening our balance sheet. As the overall

economy starts to improve we are seeing increased activity across

sectors and regions, which plays to our particular strengths of

cross sector skills and our regional presence. We will give

increasing attention to building up an investment portfolio which

will provide recurring income to help cover our administrative

costs.

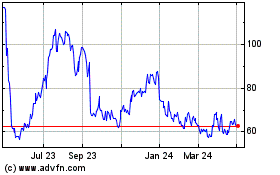

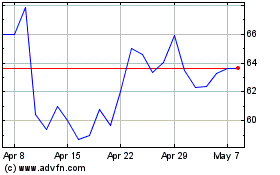

The re-rating of our share price, which has recently traded

above our EPRA NAV, is a pleasing indication that investors are

beginning to recognise the strength of our business and underlying

value, and with the reduction in financial gearing and improved

financial performance, we expect shortly to recommence payment of

dividends.

Finally, I would like to thank all who have helped the group

during this transformational period, especially the hard working

directors and staff who always work with great skill and

enthusiasm.

Robert F M Adair

Chairman

12 December 2013

Strategic report

Introduction

The group strategic report provides a review of the development

and performance of the business for the financial year, discusses

the group financial position at the year end and explains the

principal risks and uncertainties facing the business and how we

manage those risks. We also outline the group's business model and

strategy.

Business model and strategy

Our business is focused on commercial property development,

which we execute through our five offices in key areas of the UK.

We have property professionals in these offices whose expertise and

detailed knowledge of their local markets gives us a competitive

edge over those without such coverage. We pursue our commercial

property development activity in a risk controlled but

opportunistic way, which has proved to be resilient and profitable

over the last 20 years.

We limit risk in our development activity by typically entering

into conditional site purchases, pre-letting agreements, forward

fundings and joint ventures. In this way our capital commitment to

any one project is limited while careful structuring of the

agreements that we enter into ensures that our exposure and return

is commensurate with the risks we take.

Our main areas of development are currently foodstores, central

London offices and regional opportunities.

Foodstores

We have built a recognised expertise in out of town foodstore

development since 2008, having completed deals involving seven

stores with a total area of over 500,000 sq ft and an estimated

gross development value of over GBP180 million. Our historic

success in this sector has been due to several factors, but

especially our local knowledge gained through our regional offices

and our excellent relationships with the food retailers.

There has been much written and spoken recently of the reduction

in food retailers' appetite for growing the number of large format

stores and their shift towards expanding their portfolio of

convenience stores whilst also reducing their capital expenditure.

Notwithstanding this we remain successful in using our knowledge to

help retailers meet their new store needs, in particular as most

have gaps in their geographic coverage that they want to fill. We

are cognisant of the impact that the internet has on how people

shop and in light of this, we continue to source the optimal size

stores in the right locations for our foodstore clients. Our

ability to navigate national and local planning policy remains a

core skill of the group and is a key driver of demand from the food

retailers. The food retailers' reduction in capital expenditure

means that they are more likely to lease than own their new stores,

which also increases their requirement for external help from

developers.

Our financial model for developing foodstores has typically been

to conditionally acquire sites. While this results in us sharing

some land value accretion with the landowner, it also reduces our

risk and exposure significantly and allows us to pursue more

transactions simultaneously than would be the case if we acquired

sites outright. We then use our expertise in securing pre-let

agreements with the food retailers and obtaining planning consent.

Neither of these activities is straightforward, but our significant

experience gives us a competitive advantage. When we have secured

the pre-let and planning consent we typically enter into forward

funding agreements with investors who are attracted to the

bond-like income that these leases typically generate.

We have a number of foodstore opportunities underway that are

discussed later.

Central London offices

The group has a long track record of successful office

development in Central London with nine schemes completed over the

past 12 years, representing approximately 350,000 sq ft and GBP290

million of gross development value.

We typically acquire sites in joint venture with equity-rich

partners who recognise and want our expertise. We structure these

joint ventures so that our returns are boosted by extra returns

over agreed hurdles and through development and project management

fees.

The Central London office property investment market has been

characterised recently by the weight of overseas capital which is

relatively indifferent to the immediate returns available from such

investment. This has had the effect of pushing up prices to very

high levels, making it more difficult for us to secure

opportunities. In addition, especially in the West End, supply is

very constrained due to geography and planning restrictions

resulting in increasing rents which underpin values.

Our response to this has been to appraise office opportunities

for refurbishment and changes of use, with the conversion of

outdated office buildings to residential or hotel use being a

recurring theme. During the last year we have bid on several such

opportunities but have frequently been outbid by the overseas

investors noted above. However, we remain confident of securing

such opportunities in the near future and believe that the returns

available to us justify our continued presence in this market. We

have two such schemes in place at the moment, described in more

detail later.

Regional opportunities

The group's regional office network gives it advanced and

knowledgeable insight into regional markets and opportunities. Over

more than 20 years the group has a track record of commercial

development in the office, retail and industrial sectors in the

regions. We believe that the regional markets are now recovering

from the recent deep recession in several aspects.

During the recession, investor and occupational demand for

offices slumped resulting in yields increasing to double figures.

This in turn made development unviable with the result that in many

areas as the markets recover there is a shortage of new office

stock.

Investor demand, particularly from those looking for return

(rather than capital security) is increasing and this is having the

effect of pushing values up in the regions. According to CBRE,

yields have reduced for good secondary offices from around 9.0% at

the peak to 8.0% in November 2013. These improved yields make

office development more viable. In addition, occupier demand is

returning which will translate into increased rents in the more

established office markets.

We are also focused on two other areas where we believe there

are opportunities for us: student accommodation and leisure.

Demand for new student accommodation from universities is strong

as they compete to attract new students and therefore need to

replace older stock. The experiences from our project at

Southampton (described in more detail later) have led us to find a

number of new opportunities and our established skills in dealing

with the planning issues that accompany such developments are

attractive to the universities.

The leisure sector is one that has proved robust through the

recession and schemes centred around cinemas and restaurant chains

have been able to able to attract customers who appreciate the

value for money such schemes offer them. We believe our development

and planning skills are particularly valuable here because, in

order to make these schemes work, it is often necessary to

demonstrate to planners and prospective tenants that we can create

an attractive scheme with an appropriate tenant mix. We are

currently working on one such scheme and have a number of others

under review.

Operational review

Foodstores

During 2013 we completed three foodstore schemes in the North

East of England at Sunderland, Sedgefield and Skelton. The stores

at Sunderland and Sedgefield are leased to Sainsbury's and were

forward funded by third parties and developed by the group. The

store at Skelton was sold to Asda which now trades from there.

We have four new sites in the planning process, as follows:

Middlesbrough - we submitted a planning application in August

2013 for a 125,000 sq ft foodstore for Sainsbury's along with a

public house for Marston's, a KFC and a coffee outlet. In November

we were very pleased to receive a "minded to grant" decision from

the Council and we have recently heard that the Secretary of State

will not call it in. We expect this scheme to be attractive to

funding institutions and hope to be on site commencing construction

by the middle of 2014.

Herne Bay, Kent - we submitted a planning application for this

c100,000 sq ft Sainsbury's store in November 2012 and expect the

application to be heard early in 2014. We are confident of

receiving consent and, if successful hope to be on site by the

middle of 2014.

Midsomer Norton - we entered into a conditional contract to

acquire a 12.2 acre former industrial site on the edge of Midsomer

Norton in 2012. We are master planning a redevelopment of this site

to provide a mix of uses including a foodstore and residential

area. We are negotiating the pre-letting of the foodstore with a

retailer and intend to sell the residential element to a

housebuilder following the grant of planning permission.

Stokesley, North Yorkshire - we entered into a conditional

contract to acquire 5.2 acres on the edge of this historic market

town in July 2013 and are in detailed discussions with a food

retailer for a 25,000 sq ft store.

We have decided not to appeal the refusal of planning consent at

the St Austell site and changing occupier requirements at Prestwich

have led us to abandon the original scheme, although we are working

on a proposition for an alternative site in the town.

We continue to appraise a large number of other foodstore sites

and are confident of securing new opportunities in the near

future.

Central London offices

The development at Howick Place, Victoria completed in November

2012. The development comprises 135,000 sq ft of offices and 25,300

sq ft of residential apartments. The majority of the residential

apartments have either been let or sold and the top office floor

has now been let as the UK head office of Giorgio Armani. Interest

in the remaining floors is strong and we expect to conclude further

lettings shortly. We have carried out this development in

association with Doughty Hanson.

We act as development manager for a prestigious new office and

retail development on the corner of Conduit Street and Savile Row

in London's Mayfair. This will be a 29,000 sq ft scheme and

construction has now started. Office and retail rents have grown

strongly during 2013 and we expect this trend to continue and be

reflected in rents achieved at this well-placed development. We

expect the returns from this development to exceed our original

expectations.

Regional opportunities

Our 1,104 room student accommodation scheme at Mayflower Halls,

Southampton is progressing well with the last of three buildings

expected to be topped out by the end of January 2014. Fitting out

of the rooms has already commenced and we are on track to deliver

this scheme to the university in readiness for the commencement of

the 2014 academic year. As noted previously, this development is

being forward funded by Legal & General Property, which was

attracted to the 38 year lease entered into by the University of

Southampton.

Our leisure scheme at Darlington is progressing well. This

scheme will include a nine screen cinema operated by Vue Cinemas,

an 80 bedroom hotel operated by Whitbread and six restaurants.

Terms have been agreed on four of the restaurant units and we

expect our planning application to be heard in December 2013.

During the year we acquired an agreement with Glasgow City

Council for the development of four restaurant units on the bank of

the Clyde, close to the central business district of Glasgow. The

scheme has planning consent and we are receiving strong interest

from operators who want exposure at this well located site.

Our industrial scheme at Christchurch is now virtually complete,

with the construction of a second 60,000 sq ft warehouse for Kondor

having reached practical completion in November 2013 and the last

remaining plots either sold or under offer.

Business review - Finance

Financial results and Net Asset Value

The group's EPRA NAV increased by 1.7% in the year ended 30

September 2013 to GBP61.3 million (28.8 pence per share) from

GBP60.3 million (28.3 pence per share) at 30 September 2012. The

group's IFRS NAV also increased by 10.6% in the year to GBP55.5

million (26.2 pence per share) from GBP50.2 million at 30 September

2012.

EPRA NAV is a Key Performance Indicator for the group as it

reflects the market value of our development properties and is

therefore a better indicator of the true value of the group,

whereas the IFRS NAV includes those properties at the lower of cost

and net realisable value.

During the year, the increase in our EPRA NAV resulted

principally from the following:

-- 0.3 pence per share increase from operations;

-- 0.9 pence per share increase resulting from the part release

of our provision for financial guarantee for debts of an

associate;

-- 0.4 pence per share decrease resulting from movement in the

value of our development properties;

-- 0.5 pence per share decrease arising from the movement in

value and sales of our residential investment properties;

and

-- 0.2 pence per share increase in other movements including

tax and share-based payments.

The group's EPRA Triple NAV, which takes into account any tax

payable on profits arising if all the group's properties were sold

at the values used for EPRA NAV and the write off of goodwill ,

increased by 3.2% to GBP58.9 million (27.7 pence per share) from

GBP57.1 million (26.8 pence per share) at 30 September 2012.

Statement of comprehensive income

Revenue for the year ended 30 September 2013 includes:

1. recognition of revenue under construction contracts and

related site sales of GBP44.5 million in respect of our

sites at Sunderland, Skelton, Sedgefield, Southampton and

Christchurch;

2. rental income of GBP2.2 million in respect of commercial

properties; and

3. rental income of GBP0.5 million in respect of residential

properties.

Rental income of GBP1.1 million and related costs of GBP1.6

million are included in revenue and direct costs in respect of the

group's head office in London, where it owns a head lease.

Direct costs include directly attributable costs in respect of

those revenue items mentioned above and a net charge of GBP0.9

million relating to the write off or provision in respect of

various properties. In particular we have written off our costs of

GBP0.6 million on the projects at Prestwich and St Austell which we

are no longer pursuing.

The gross profit includes GBP12.5 million in respect of our

sites at Sunderland, Skelton, Sedgefield, Southampton and

Christchurch.

Administrative expenses for the year ended 30 September 2013

amounted to GBP6.1 million (2012: GBP4.7 million). The increase is

largely due to increased variable remuneration costs.

As the group has substantially exited from the residential

investment property activity, the results attributable to this have

been treated as discontinued operations and the prior year

comparison restated. The group reported a profit on these

discontinued operations for the year ended 30 September 2013 of

GBP0.6 million (2012: loss of GBP5.7 million). This profit was

achieved after having written off goodwill of GBP0.8 million that

had been previously recognised in respect of the residential

activities of the group and writing back GBP1.8 million of a

provision that had been made in earlier years in respect of the

group's bank guarantee exposure to the bank that had lent to

Terrace Hill Residential PLC. While the sale prices achieved on the

property sales were at around our carrying value, we had to write

off costs attributable to associated finance facilities and

incurred selling costs. As reported in the interim statement, the

group's associate, Terrace Hill Residential PLC, sold the majority

of its assets in the spring this year and subsequently sold the

remaining assets, valued at GBP5.3 million, to the group in May.

This facilitated a favourable negotiation with the bank that had

lent to its associate such that the group's exposure under its bank

guarantee was settled at GBP4.2 million, which was financed by the

parent company with a short term loan from the bank of which GBP0.7

million was outstanding at the year end.

The group has been successful in disposing of the properties it

bought from Terrace Hill Residential PLC. At the year end, GBP1.3

million of such properties remained to be sold of which GBP0.7

million had been sold by the end of November 2013. The properties

sold during the financial year achieved prices in excess of the

purchase price. The group entered into arrangements with its

co-shareholder in Terrace Hill Residential PLC whereby any profits

or losses arising on the disposal of these properties would be

shared equally with its co-shareholder. At 30 September 2013 the

group had provided GBP0.1 million in respect if these

arrangements.

Finance income less finance costs from continuing operations

amounted to GBP0.9 million (2012: GBP1.1 million). Finance income

less finance costs for discontinued operations amounted to GBP0.7

million (2012: GBP0.5 million). The group paid GBP1.5 million of

interest in the year of which GBP0.4 million was in respect of

projects where work is currently underway and which has been

capitalised.

The group's tax charge for the period of GBP1.3 million (2012:

charge of GBP0.06 million) reflects principally the restatement of

our deferred tax asset to current rates of corporation tax, the

utilisation of losses reflected in the deferred tax asset to

shelter tax profits arising on the property sales noted above and

recognition of other tax losses in the deferred tax asset.

Balance sheet

The group's IFRS net assets at 30 September 2013 were GBP55.5

million, an increase of 10.6% on the amount reported at 30

September 2012 of GBP50.2 million. Investment properties fell

substantially from GBP15.2 million at 30 September 2012 to GBP0.2

million at 30 September 2013 due principally to the sale of the

majority of the wholly owned residential investment properties

during the year as reported earlier. The sale of the investment

properties also resulted in the release of GBP0.8 million of

goodwill attributed to the residential sector. The deferred tax

asset of GBP5.2 million is lower than 2012 due to losses being

utilised in the year and partially offset by previously

unrecognised losses recognised due to increased certainty that they

will be utilised in future years. Development properties fell from

GBP70.3 million at 30 September 2012 to GBP58.2 million at 30

September 2013 principally due to the sale of the Southampton

student accommodation site to Legal & General Property as part

of its forward funding of that project. Trade and other receivables

have reduced by GBP2.7 million to GBP14.6 million at 30 September

2013 due principally to amounts included at 30 September 2012 in

respect of the three foodstores (Sunderland, Skelton and

Sedgefield) having been received during the year. At 30 September

2013, there is GBP6.6 million due under the funding agreement for

the Southampton student accommodation project. Trade and other

payables have reduced from GBP16.5 million at 30 September 2012 to

GBP8.9 million at 30 September 2012, reflecting the GBP6.0 million

guarantee over the debts of its associate that has now been

fulfilled or released to the income statement as noted above. Other

movements are due to amounts included at 30 September 2012 in

respect of the three foodstores that have been satisfied in the

year.

The group regards its gearing level as a Key Performance

Indicator and is pleased that its gearing has improved considerably

during the year. Net debt as a percentage of EPRA net assets was

28.6% at 30 September 2013 compared with 78.2% at 30 September

2012. The quantum of net debt has also reduced significantly to

GBP17.5 million at 30 September 2013 from GBP47.2 million at 30

September 2012. The group's look through net gearing, which

includes its share of the net debt in those joint ventures and

associated undertakings in which it has ongoing liabilities, fell

substantially from 142.1% at 30 September 2012 to 29.0% at 30

September 2013 with the group's net debt, including its share of

joint ventures and associated undertakings as above, also falling

sharply, from GBP85.7 million at 30 September 2012 to GBP17.8

million at 30 September 2013. The reasons for these substantial

improvements are that firstly, the group completed three foodstore

developments during the year, secondly, entered into the forward

funding of the Southampton student accommodation scheme and lastly,

sold the vast majority of the residential properties both wholly

owned and in the group's associate, Terrace Hill Residential PLC.

Net debt and gearing have increased slightly since the half year as

the group bought in the last residential properties owned by

Terrace Hill Residential PLC as noted above which were financed

largely by a bank loan of GBP4.2 million and the residual liability

under a guarantee in respect of the associate's bank facility was

discharged and financed by another loan.

Financial resources and capital management

The group funds itself through its share capital, cash and debt

facilities. As the group has not raised new share capital for some

time, the group focuses its attention on the management of its cash

and debt position. The group is not subject to externally imposed

capital requirements and meets its objectives for managing its

capital by ensuring that it operates within the constraints imposed

by the availability of cash and debt and by ensuring that it meets

the various financial covenants that apply to its debt. The group

regards its gearing ratios as key ratios for the purposes of

managing its financial resources and the 24-month cash forecast as

a key management tool.

Our net debt reduced in the period by GBP29.7 million and our

gross debt by GBP27.0 million for the reasons mentioned above. The

most significant cash outflows were in relation to development

expenditure on our active development projects and our

administrative expenses.

We have achieved a number of re-financings during the year. In

particular, we have re-financed one loan of GBP14.8 million for a

further two years and which now matures on 30 September 2015.

The average maturity of group debt is now 19 months (2012: 12.5

months) with a weighted average margin of 3.25% (2012: 3.3%). The

maturity of joint ventures and associated undertaking debt is now

18.4 months (2012: 19.9 months) with a weighted average margin of

3.5% (2012: 2.9%), represented by one loan.

We have noticed a significant increase in the appetite of banks

to lend to development groups, concentrating on projects which are

pre-let or pre-sold, with loan to value or loan to cost ratios

approaching more normal levels and competition among banks is

returning. It is refreshing to be able to write about such matters

after several years of very difficult times and we expect to be

able to take advantage of the current market conditions.

The group continues to monitor interest rates closely and

continues to believe that the risk of rates rising in the short

term is limited although greater than before as the economy

improves. With the group's bank debt at relatively low levels and

with specific debt strategies in place for that debt, the group has

not entered into any interest rate hedging agreements and

consequently continues to benefit from the very low current LIBOR

rates. The joint venture and associated undertaking debt loan is

not hedged.

The group also monitors its cash resources and future cash flows

very closely through its comprehensive 24-month rolling cash

forecast. The group regularly updates the cash forecast and stress

tests the underlying assumptions to ensure that the group has

sufficient resources to execute its strategy for the foreseeable

future.

Summary of debt position

September 2013 September

2012

-------------------------------------------------------- -----------

Net debt GBP17.5m GBP47.2m

Net gearing 28.6% 78.2%

Net debt including share of joint venture GBP17.8m GBP85.7m

and associated undertaking debt

Total net gearing 29.0% 142.1%

Loan to value 28.3% 49.2%

-------------------------------------------- ---------- -----------

The net gearing and loan to value percentages shown above are in

relation to our EPRA NAV. The majority of joint venture and

associated undertaking debt is of limited recourse to the

group.

Debt expiry profile

On balance sheet Off balance

sheet*

GBPm GBPm

------------------------------------------------ -------------

Bank loans and overdraft repayable in 7.4 -

one year

Bank loans repayable in more than one

year 18.7 0.3

---------------------------------------- ------ -------------

Total 26.1 0.3

---------------------------------------- ------ -------------

*Group share

Summary of loan to value ratios of group property

September 2013 September

2012

-------------------------------- -----------

Commercial property 29.0% 52.2%

Residential property -% 76.7%

Total 28.3% 49.2%

----------------------- ------- -----------

Calculation of EPRA NAV and EPRA Triple NAV (unaudited)

30 September 2013 30 September 2012

-------------------------- ------------------------------------- -------------------------------------

Number Number

of shares Pence of shares Pence

GBP'000 000s per share GBP'000 000s per share

-------------------------- --------- ------------ ------------ --------- ------------ ------------

Audited Net Asset

Value 55,549 211,971 26.21 50,213 211,971 23.69

Revaluation of property

held as current

assets 5,711 10,026

Shares to be issued

under the LTIP 12 595 12 595

-------------------------- --------- ------------ ------------ --------- ------------ ------------

EPRA NAV 61,272 212,566 28.82 60,251 212,566 28.35

Increase % 1.7%

Goodwill (2,365) (3,188)

-------------------------- --------- ------------------------------------- --------------------------

EPRA Triple NAV 58,907 212,566 27.71 57,063 212,566 26.85

-------------------------- --------- ------------ ------------ --------- ------------ ------------

Increase % 3.2%

-------------------------- ------------------------------------- -------------------------------------

The principal risks and uncertainties facing the business, and

how we manage those risks, are set out below:

Risk Description Mitigant Change in year

Strategy Implementing The group board meets No change.

a strategy quarterly to consider This process is

inconsistent strategy and review unchanged from

with the market progress against objectives. last year and we

environment, The chairman and directors believe we have

skillset and use both their market the right strategy

experience knowledge and experience setting procedure

of the business to ensure consistency in place to deliver

with these objectives. robust returns

to investors.

------------------------ --------------------------------- ----------------------------

Market and A deterioration Detailed financial appraisals No change.

economic in the market are undertaken to determine Our ability to

Risk in which we the benefit to the group analyse appraisals

operate resulting of each development. and robustly challenge

in a negative These are flexed and them has resulted

impact on various scenarios are in optimum capital

our results modelled to establish allocation.

or financial the financial outcome

condition on a worst-case basis.

Collapse of Detailed counterparty No change.

a funding credit due diligence Our various funding

partner is undertaken prior partners are financially

to entering into a financing strong.

arrangement with a party.

Our legal agreements

are binding but also

flexible.

------------------------ --------------------------------- ----------------------------

Development Paucity of The group is geographically No change.

new business diverse with regional We have a strong

opportunities offices and strong local pipeline of future

connections to facilitate developments.

new business opportunities.

Failure or The group has a wealth No change.

delays in of experience in gaining We have dealt with

obtaining consent within desired all planning issues

planning consent timescales. Our local in a timely manner.

office network ensures

we have direct knowledge

of local planning authorities

and consultants, to

develop products matching

local needs.

Construction Our in-house project One foodstore was

delivery delays- management team use handed over eight

The risk that their experience to weeks late due

we may become ensure that timescales to a construction

financially have sufficient contingency issue. Careful

liable for and that risks are transferred documentation of

delays due to contractors. contractual arrangements

to unforeseen ensured we did

circumstances not suffer financially.

Counterparty Detailed counterparty No change.

risk- contractor due diligence is undertaken No contractors

insolvency prior to the contractor we have used have

or bankruptcy selection process. gone into receivership

or become bankrupt

during the year.

Construction Our in-house project No change.

cost inflation management team are All contracts were

responsible for negotiating fixed during the

fixed price construction year.

contracts.

Letting risk We pre-let wherever No change.

possible, but in developments All foodstores

where this is not possible, have been pre-let

we include a market and the group has

driven void period and enjoyed good letting

tenant incentives in success in its

the financial appraisals. other developments.

Our local offices have

close relationships

with local and national

agents to ensure lettings

success.

Reputational The group has an excellent Improvement.

risk reputation from being Our reputation

in existence for over has been enhanced

quarter of a century this year following

and benefits from the on from the disposal

transparency arising of our residential

from an AIM-listing. portfolio and subsequent

deleveraging.

------------------------ --------------------------------- ----------------------------

Completed Devaluation Our in-house asset management No change.

and let buildings due to lower team ensure that buildings

rental rates, are kept in good condition,

increased thereby minimising the

voids, yield risk of devaluation.

shift and

building condition

------------------------ --------------------------------- ----------------------------

Financial Solvency The group's net worth No change.

position is monitored The group has managed

on a monthly basis and its liquidity well

stress-tested, to determine during the year

the extent by which benefitting from

assets exceed liabilities the timely receipts

and to assess the likelihood of cash from disposing

of converting these of foodstores.

assets into cash. There have been

no unanticipated

interest costs

and the group has

been proactive

in discussing refinancing

with banks.

----------------------------

Liquidity The group maintains

a rolling, stress-tested

cashflow forecast as

a key management tool,

to ensure funds are

available when required.

----------------------------

Interest rate Our in-house treasury

team model various scenarios

including interest rate

shocks, to ascertain

the optimal mix of fixed

to floating rate debt.

Refinancing Banks are approached

well in advance of debt

maturity in order to

refinance debt.

Covenant breach Covenants are reported

regularly to banks and

the board. Modelling

is undertaken to determine

the impact on covenants

as part of the group's

regular decision making

process.

------------------------ --------------------------------- ----------------------------

Personnel Attracting We offer a competitive No change.

and retaining remuneration package There have been

the right which includes both no problems with

people short and long-term regards to recruiting

incentives. or retaining personnel.

We have short reporting

lines and delegate authority

to ensure all staff

feel they are contributing

to the success of the

group.

Succession The group has a small No change.

planning- head-count and as a No issues to report.

over-reliance result personnel work

on key people in project-teams, where

knowledge is shared.

Health and Our contractors are No change.

safety- the compliant with relevant No issues to report.

risk of damage legislation. The group

or death resulting also carries appropriate

in delays insurance.

and cost

------------------------ --------------------------------- ----------------------------

Environment Not compliant Our developers are up Improvement.

with customer to date with both legislation The group has plans

requirements and customer requirements in place to address

or legislation and the group uses specialist new legislation.

environmental consultants

where necessary. We

endeavour to achieve

BREEAM rating of not

less than "very good"

for all new developments.

------------------------ --------------------------------- ----------------------------

Regulatory The risk of The executive directors Improvement.

reduced profitability and senior management We are confident

due to legislation are active participants that the group

in relevant bodies who has adequate plans

represent the industry in place to proactively

to legislators. manage new legislation.

------------------------ --------------------------------- ----------------------------

Approved by the board

P A J Leech J M Austen

Director Director

12 December 2013

Consolidated statement of comprehensive income

For the year ended 30 September 2013

Year ended Year ended

30 September 30 September

2013 2012

Notes GBP'000 GBP'000

---------------------------------------------------------- ------- --------------- ---------------

Revenue 2 48,486 65,899

Direct costs (35,913) (51,743)

---------------------------------------------------------- ------- --------------- ---------------

Gross profit 12,573 14,156

Administrative expenses 5 (6,074) (4,747)

Loss on disposal of investment properties (35) -

Impairment of joint venture and associated undertakings 12 - (219)

Loss on revaluation of investment properties 11 - (500)

---------------------------------------------------------- ------- --------------- ---------------

Operating profit 6,464 8,690

Finance income 4 204 251

Finance costs 4 (1,096) (1,277)

Share of joint venture and associate undertakings

post tax profit/(loss) 12 43 (200)

---------------------------------------------------------- ------- --------------- ---------------

Profit before tax 5,615 7,464

---------------------------------------------------------- ------- --------------- ---------------

Tax 6 (1,271) (58)

---------------------------------------------------------- ------- --------------- ---------------

Profit from continuing operations 4,344 7,406

---------------------------------------------------------- ------- --------------- ---------------

Profit/(loss) from discontinued operations 8 586 (5,664)

---------------------------------------------------------- ------- --------------- ---------------

Total comprehensive income 4,930 1,742

---------------------------------------------------------- ------- --------------- ---------------

Profit/(loss) attributable to:

Equity holders of the parent from continuing

operations 4,344 7,406

Equity holders of the parent from discontinued

operations 586 (5,664)

---------------------------------------------------------- ------- --------------- ---------------

4,930 1,742

---------------------------------------------------------- ------- --------------- ---------------

Total comprehensive income attributable to:

Equity holders of the parent from continuing

operations 4,344 7,406

Equity holders of the parent from discontinued

operations 586 (5,664)

---------------------------------------------------------- ------- --------------- ---------------

4,930 1,742

---------------------------------------------------------- ------- --------------- ---------------

Basic earnings per share from continuing operations 7 2.06p 3.51p

Diluted earnings per share from continuing operations 7 2.05p 3.50p

---------------------------------------------------------- ------- --------------- ---------------

Total basic earnings per share 7 2.34p 0.83p

Total diluted earnings per share 7 2.33p 0.82p

---------------------------------------------------------- ------- --------------- ---------------

The notes form part of these financial statements.

Consolidated balance sheet

At 30 September 2013

30 September 30 September

2013 2012

Notes GBP'000 GBP'000

--------------------------------------------- ------- -------------- --------------

Non-current assets

Investment properties 11 162 15,178

Property, plant and equipment 10 95 145

Investments in equity accounted associates

and joint venture 12 1,000 1,000

Other investments 12 4,279 4,279

Intangible assets 9 2,365 3,188

Deferred tax assets 17 5,213 6,467

--------------------------------------------- ------- -------------- --------------

13,114 30,257

--------------------------------------------- ------- -------------- --------------

Current assets

Development properties 13 58,200 70,284

Trade and other receivables 14 14,573 17,251

Cash and cash equivalents 8,644 5,999

--------------------------------------------- ------- -------------- --------------

81,417 93,534

--------------------------------------------- ------- -------------- --------------

Total assets 94,531 123,791

--------------------------------------------- ------- -------------- --------------

Non-current liabilities

Bank loans 16 (18,745) (12,466)

Deferred tax liabilities 17 (867) (851)

--------------------------------------------- ------- -------------- --------------

(19,612) (13,317)

--------------------------------------------- ------- -------------- --------------

Current liabilities

Trade and other payables 15 (8,937) (10,537)

Other payables - guarantee 15 - (6,011)

Current tax liabilities (3,049) (3,014)

Bank overdrafts and loans 16 (7,384) (40,699)

--------------------------------------------- ------- -------------- --------------

(19,370) (60,261)

--------------------------------------------- ------- -------------- --------------

Total liabilities (38,982) (73,578)

--------------------------------------------- ------- -------------- --------------

Net assets 55,549 50,213

--------------------------------------------- ------- -------------- --------------

Equity

Called up share capital 19 4,240 4,240

Share premium account 20 18,208 18,208

Own shares 20 (609) (609)

Capital redemption reserve 20 849 849

Merger reserve 20 7,088 7,088

Retained earnings 20 25,773 20,437

--------------------------------------------- ------- -------------- --------------

Total equity 55,549 50,213

--------------------------------------------- ------- -------------- --------------

The financial statements were approved by the board and

authorised for issue on 12 December 2013 and were signed on its

behalf by:

P A J Leech J M Austen

Director Director

Consolidated statement of changes in equity

At 30 September 2013

Capital

Share Share Own redemption Merger Retained

capital premium shares reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ---------- ---------- ---------- ------------- ---------- ----------- ----------

Balance at 30 September 2011 4,240 43,208 (609) 849 7,088 (6,642) 48,134

Total comprehensive income

for the year - - - - - 1,742 1,742

Share-based payments - - - - - 337 337

Capital reduction - (25,000) - - - 25,000 -

------------------------------ ---------- ---------- ---------- ------------- ---------- ----------- ----------

Balance at 30 September 2012 4,240 18,208 (609) 849 7,088 20,437 50,213

------------------------------ ---------- ---------- ---------- ------------- ---------- ----------- ----------

Total comprehensive income

for the year - - - - - 4,930 4,930

Share-based payments - - - - - 406 406

Balance at 30 September 2013 4,240 18,208 (609) 849 7,088 25,773 55,549

------------------------------ ---------- ---------- ---------- ------------- ---------- ----------- ----------

Consolidated cash flow statement

For the year ended 30 September 2013

Year ended Year ended

30 September 30 September

2013 2012

GBP'000 GBP'000

----------------------------------------------------------- --------------- ---------------

Cash flows from operating activities

Profit before taxation 6,201 1,800

Adjustments for:

Finance income (215) (261)

Finance costs 1,808 1,768

Share of joint venture and associated undertakings post

tax loss 43 200

(Release of)/provision for financial guarantee for debts

of associate (1,811) 5,094

Depreciation charge 47 59

Impairment charge 823 148

Loss on revaluation of investment properties 11 530

Impairment of associated undertakings - 219

Loss on disposal of investment properties 271 570

Loss on sale of tangible fixed assets 11 -

Share-based payments 406 337

----------------------------------------------------------- --------------- ---------------

Cash flows from operating activities before change in

working capital 7,595 10,464

Decrease in property inventories 12,432 3,289

Decrease/(increase) in trade and other receivables 2,635 (7,334)

Decrease in trade and other payables (5,800) (3,475)

----------------------------------------------------------- --------------- ---------------

Cash generated from operations 16,862 2,944

Finance costs paid (1,887) (4,380)

Finance income received 215 261

Tax received/(paid) 36 (59)

----------------------------------------------------------- --------------- ---------------

Net cash flows from operating activities 15,226 (1,234)

----------------------------------------------------------- --------------- ---------------

Investing activities

Sale of investment property and tangible fixed assets 14,744 5,115

Purchase of property, plant and equipment (18) (28)

----------------------------------------------------------- --------------- ---------------

Net cash flows from investing activities 14,726 5,087

----------------------------------------------------------- --------------- ---------------

Financing activities

Borrowings drawn down 2,744 10,426

Borrowings repaid (30,212) (19,824)

----------------------------------------------------------- --------------- ---------------

Net cash flows from financing activities (27,468) (9,398)

----------------------------------------------------------- --------------- ---------------

Net increase/(decrease) in cash and cash equivalents 2,484 (5,545)

Cash and cash equivalents at 1 October 2012 5,998 11,543

----------------------------------------------------------- --------------- ---------------

Cash and cash equivalents at 30 September 2013 8,482 5,998

----------------------------------------------------------- --------------- ---------------

Cash at bank and in hand 30 September 2013 8,644 5,999

Bank overdraft at 30 September 2013 (162) (1)

----------------------------------------------------------- --------------- ---------------

Cash and cash equivalents at 30 September 2013 8,482 5,998

----------------------------------------------------------- --------------- ---------------

1 Accounting policies

Basis of preparation

The financial information set out in this announcement does not

constitute the group's statutory accounts for the year ended 30

September 2013 under the meaning of s434 Companies Act 2006, but is

derived from those accounts. Statutory accounts for the year ended

30 September 2013 have been reported on by the Independent

Auditors. Their report was unqualified, did not draw attention to

any matters by way of emphasis, and did not contain a statement

under s498(2) or s498(3) of the Companies Act 2006. The statutory

accounts for the year ended 30 September 2013, prepared under IFRS,

will be delivered to the Registrar in due course.

The comparative financial information set out in this

announcement does not constitute the group's statutory accounts for

the year ended 30 September 2012 under the meaning of s434

Companies Act 2006, but is derived from those accounts. Statutory

accounts for the year ended 30 September 2012 have been reported on

by the Independent Auditors. Their report was unqualified, did not

draw attention to any matters by way of emphasis, and did not

contain a statement under s498(2) or s498(3) of the Companies Act

2006. Statutory accounts for the period ended 30 September 2012

have been filed with the Registrar of Companies

Changes in accounting policies

The group has not adopted any new or amended IFRS and IFRIC

interpretations in the year.

New standards and interpretations not applied

IASB and IFRIC have issued the following standards and

interpretations relevant to the group. These standards and

interpretations are mandatory for accounting periods beginning on

or after the date of these financial statements and will become

effective for future reporting periods.

IAS 19 Employee Benefits

IAS 27 Consolidated and Separate Financial statements

IAS 28 Investments in Associates and Joint Ventures

IAS 32 Financial Instruments: Presentation

IAS 36 Impairment of Assets

IAS 39 Financial Instruments: recognition and Measurement

IFRS Financial Instruments: Disclosures

7

IFRS Financial Instruments

9

IFRS Consolidated Financial statements

10

IFRS Joint Arrangements

11

IFRS Disclosure of Interests in Other Entities

12

IFRS Fair Value Measurement

13

None of the new standards and interpretations noted above, which

are effective for accounting periods beginning on or after 1

October 2013 and which have not been adopted early, are expected to

have a material effect on the group's future financial

statements.

2 Revenue

2013 2012

GBP'000 GBP'000

----------------------------------------------- ---------- ----------

Development sales and construction contracts 45,121 62,583

Rents receivable 2,162 2,451

Project management fees and other income 1,203 865

----------------------------------------------- ---------- ----------

48,486 65,899

----------------------------------------------- ---------- ----------

Construction contracts

2013 2012

----------------------------------- ------ ------

Number of construction contracts 5 4

----------------------------------- ------ ------

GBP'000 GBP'000

------------------------------------ ---------- ----------

Revenue on construction contracts 28,687 47,004

Costs of construction contracts (21,197) (33,141)

------------------------------------ ---------- ----------

Profit on construction contracts 7,490 13,863

------------------------------------ ---------- ----------

Construction contract revenue is recognised in the accounts in

line with contract stage of completion determined as the proportion

of total estimated development costs incurred at the reporting

date. No advances or retentions have been received for construction

contracts.

Development sales

2013 2012

GBP'000 GBP'000

---------- ---------- ----------

Revenue 16,434 15,579

---------- ---------- ----------

3 Segmental information

The operating segments are identified on the basis of internal

financial reports about components of the group that are regularly

reviewed by the chief operating decision maker (which in the

group's case is its Executive board comprising the three Executive

directors) in order to allocate resources to the segments and to

assess their performance. The internal financial reports received

by the group's Executive board contain financial information at a

group level as a whole and there are no reconciling items between

the results contained in these reports and the amounts reported in

the financial statements.

The group operates in two principal segments, being commercial

property development and investment and residential property

investment. The commercial segment includes foodstores, central

London office developments and regional developments. The group

does not operate outside the UK. The residential property

investment segment has been treated as discontinued. More detail is

given in note 8.

Unallocated Unallocated

Residential Commercial items Total Residential Commercial items Total

2013 2013 2013 2013 2012 2012 2012 2012

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------- ----------

Statement of comprehensive income

Revenue 5,144 48,486 - 53,630 1,066 65,899 - 66,965

Direct costs (4,598) (35,913) - (40,511) (407) (51,743) - (52,150)

----------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------- ----------

Gross profit 546 12,573 - 13,119 659 14,156 - 14,815

Administrative

expenses - - (6,074) (6,074) - - (4,747) (4,747)

Goodwill

impairment (823) - - (823) (148) - - (148)

Loss on

disposal

of investment

properties (236) (35) - (271) (570) - - (570)

Impairment of

associated

undertakings

and joint

venture - - - - - (219) - (219)

Provision for

financial

guarantee

over debts of

associate 1,811 - - 1,811 (5,094) - - (5,094)

Loss on

revaluation

of investment

properties (11) - - (11) (30) (500) - (530)

----------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------- ----------

Operating

profit/(loss) 1,287 12,538 (6,074) 7,751 (5,183) 13,437 (4,747) 3,507

Net finance

costs (701) (892) - (1,593) (481) (1,033) 7 (1,507)

Share of

results

of joint

venture

before tax - 43 - 43 - (200) - (200)

Profit before

tax from

continuing

operations - 11,689 (6,074) 5,615 - 12,204 (4,740) 7,464

----------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------- ----------

Profit before

tax from

discontinued

operations 586 - - 586 (5,664) - - (5,664)

----------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------- ----------

Profit before

tax 586 11,689 (6,074) 6,201 (5,664) 12,204 (4,740) 1,800

----------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------- ----------

The segmental results that are monitored by the board include

all the separate lines making up the segmental IFRS operating

profit. This excludes central overheads and taxation which are not

allocated to operating segments.

During the year, three major commercial customers generated

GBP34,652,000 of revenue. Each of these represented 10% or more of

the total revenues. The amounts were GBP9,242,000, GBP7,785,000 and

GBP17,625,000.

In the year ended 30 September 2012, there were four major

commercial customers that generated GBP54,751,000 of revenue. Each

of these represented 10% or more of the total revenues. The amounts

were GBP9,826,000, GBP26,256,000, GBP8,896,000 and

GBP9,773,000.

Unallocated Unallocated

Residential Commercial items Total Residential Commercial items Total

2013 2013 2013 2013 2012 2012 2012 2012

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------- ----------

Balance

sheet

Investment

properties 162 - - 162 12,928 2,250 - 15,178

Property,

plant and

equipment - - 95 95 - 17 128 145

Investments

-

associates

and joint

venture - 1,000 - 1,000 - 1,000 - 1,000

Other

investments - 4,279 - 4,279 - 4,279 - 4,279

Intangible

assets - 2,365 - 2,365 823 2,365 - 3,188

Deferred tax

assets - - 5,213 5,213 - - 6,467 6,467

-------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------- ----------

162 7,644 5,308 13,114 13,751 9,911 6,595 30,257

-------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------- ----------

Development

properties 1,273 56,927 - 58,200 - 70,284 - 70,284

Trade and

other

receivables 24 14,549 - 14,573 231 17,020 - 17,251

Cash 145 8,499 - 8,644 493 5,506 - 5,999

-------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------- ----------

1,442 79,975 - 81,417 724 92,810 - 93,534

-------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------- ----------

Borrowings - (26,129) - (26,129) (9,987) (43,178) - (53,165)

Trade and

other

payables (285) (8,652) - (8,937) (6,515) (10,033) - (16,548)

Current tax - - (3,049) (3,049) - - (3,014) (3,014)

Deferred tax

liabilities - - (867) (867) - - (851) (851)

-------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------- ----------

(285) (34,781) (3,916) (38,982) (16,502) (53,211) (3,865) (73,578)

-------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------- ----------

Net assets 1,319 52,838 1,392 55,549 (2,027) 49,510 2,730 50,213

-------------- ------------- ------------ ------------- ---------- ------------- ------------ ------------- ----------

4 Finance costs and finance income

2013 2012

GBP'000 GBP'000

------------------------------------------------------------- ---------- ----------

Interest payable on borrowings 1,452 1,890

Interest capitalised (356) (613)

------------------------------------------------------------- ---------- ----------

Finance costs 1,096 1,277

------------------------------------------------------------- ---------- ----------

Interest receivable from cash deposits and other financial

assets 204 251

------------------------------------------------------------- ---------- ----------

Finance income 204 251

------------------------------------------------------------- ---------- ----------

Interest is capitalised at the same rate as the group is charged

on the respective borrowings. There were no interest rate swaps

during the year.

5 Administrative expenses

Is arrived at after charging:

2013 2012

GBP'000 GBP'000

---------------------------------------------------- ---------- ----------

Depreciation of property, plant and equipment 47 59

Impairment of goodwill 823 148

Loss on disposal of property, plant and equipment 11 -

Operating lease charges - rent of properties 1,400 1,393

Share-based payment remuneration 406 337

Fees paid to BDO LLP in respect of:

- audit of the group 100 119

Other services:

- audit of subsidiaries and associates 35 35

- audit-related assurance services 25 35

- non-audit services 32 40

---------------------------------------------------- ---------- ----------

6 Tax on profit on ordinary activities

(a) Analysis of charge in the year

2013 2012

GBP'000 GBP'000

---------------------------------------------------- ---------- ----------

Current tax

UK corporation tax on profit for the period - -

Adjustment in respect of prior periods - (36)

---------------------------------------------------- ---------- ----------

Total current tax - (36)

---------------------------------------------------- ---------- ----------

Deferred tax

Impact of rate change 361 222

Origination and reversal of temporary differences 910 (128)

---------------------------------------------------- ---------- ----------

Total deferred tax charge 1,271 94

---------------------------------------------------- ---------- ----------

Total tax charge 1,271 58

---------------------------------------------------- ---------- ----------

(b) Factors affecting the tax charge for the year

The tax assessed for the period is lower than the standard rate

of corporation tax in the UK of 23.5% (2012: 25%). The differences

are explained below:

2013 2012

GBP'000 GBP'000

---------------------------------------------------------------- ---------- ----------

Profit before tax from continuing and discontinued operations 6,201 1,800

---------------------------------------------------------------- ---------- ----------

Plus joint venture and associates - 200

---------------------------------------------------------------- ---------- ----------

Profit attributable to the group before tax 6,201 2,000

---------------------------------------------------------------- ---------- ----------

Profit multiplied by the average rate of UK corporation

tax of 23.5% (2012: 25%) 1,457 500

Disallowables 321 (181)

Other temporary differences (1,085) (447)

Impact of rate change 361 222

---------------------------------------------------------------- ---------- ----------

1,054 94

Adjustments in respect of prior periods 217 (36)

---------------------------------------------------------------- ---------- ----------

Total tax charge 1,271 58

---------------------------------------------------------------- ---------- ----------

(c) Associates and joint venture

The group's share of tax on the associates and joint venture is

GBPNil (2012: GBPNil).

7 Earnings per ordinary share

The calculation of basic earnings per ordinary share is based on

a profit of GBP4,930,000 (2012: GBP1,742,000) and on 210,951,299

(2012: 210,951,299) ordinary shares, being the weighted average

number of shares in issue during the year.

The calculation of diluted earnings per ordinary share for 2013

is based on earnings of GBP4,930,000 (2012: GBP1,742,000) and on

211,545,352 (2012: 211,426,546) ordinary shares being the weighted

average number of shares in issue during the period adjusted to

allow for the issue of ordinary shares in connection with a share

award.

8 Discontinued operations

The post tax gain/(loss) on disposal of discontinued operations

was determined as follows:

2013 2012

GBP'000 GBP'000

------------------------------------ ---------- ----------

Revenue 5,144 1,066

Expenses other than finance costs (3,857) (6,249)

Finance costs (701) (481)

Profit/(loss) for the year 586 (5,664)

------------------------------------ ---------- ----------

Earnings per share from discontinued operations

2013 2012

------------------------------------ ------- ---------

Basic earnings/(loss) per share 0.28p (2.68)p

Diluted earnings/(loss) per share 0.28p (2.68)p

------------------------------------ ------- ---------

Statement of cash flows

2013 2012

GBP'000 GBP'000

---------------------------------------- ---------- ----------

Operating activities (701) (481)

Investing activities 12,590 5,367

Financing activities (12,237) (4,486)

---------------------------------------- ---------- ----------

Net cash from discontinued operations (348) 400

---------------------------------------- ---------- ----------

9 Intangible fixed assets - goodwill

GBP'000

----------------------- ---------

Cost

At 1 October 2011 5,997

----------------------- ---------

At 1 October 2012 5,997

----------------------- ---------

At 30 September 2013 5,997

----------------------- ---------

Impairment

At 1 October 2011 (2,661)

Charge for the year (148)

----------------------- ---------

At 1 October 2012 (2,809)

Charge for year (823)

----------------------- ---------

At 30 September 2013 3,632

----------------------- ---------

At 30 September 2013 2,365

----------------------- ---------

At 30 September 2012 3,188

----------------------- ---------

Impairment tests for goodwill

Goodwill arising on acquisition is allocated to the group's

cash-generating units identified according to business

activity.

2013 2012

GBP'000 GBP'000

------------------------ ---------- ----------

Commercial properties 2,365 2,365

Investment properties - 823

------------------------ ---------- ----------

2,365 3,188

------------------------ ---------- ----------

The value of goodwill allocated to the investment activity is

directly related to a number of residential units held. As these

units are disposed of an impairment charge is made. During the

period the vast majority of properties were sold and an amount of

GBP823,000 was charged to the consolidated statement of

comprehensive income.

The recoverable amount of goodwill allocated to commercial

property activities has been determined from value-in-use