More Acquisitions PLC Update on Proposed Acquisition of Megasteel (5337A)

24 May 2023 - 9:04PM

UK Regulatory

TIDMTMOR

RNS Number : 5337A

More Acquisitions PLC

24 May 2023

24 May 2023

More Acquisitions plc

("More" or the "Company")

Update on Proposed Acquisition of Megasteel

Further to the Company's announcement of 22 May 2023, More

announces a further update regarding the Company's proposed

acquisition of Megasteel Ltd ("Megasteel", the "Acquisition").

The publication earlier this week of the revised terms of the

proposed Acquisition, enabled the Board, in conjunction with its

professional advisers, to engage in detailed conversations with key

More stakeholders to answer any questions and to seek initial

thoughts on the published terms of the revised deal. Following this

exercise, it became clear that broad support existed amongst

shareholders to continue with the proposed Acquisition, with them

making a final decision upon the publication of the final

prospectus and at the subsequent General Meeting.

Following the successful conclusion of this structured

consultation exercise, both the More and Megasteel Boards agreed to

move forward with the Acquisition with a view to completion and

re-listing of the Company, as enlarged by the Acquisition, early in

Q3 2023, on the terms announced on 22 May 2023 and subject to

shareholder approval.

However, certain unsolicited and unprecedented actions by

individuals other than the shareholders directly contacted by the

Company, have now materially and adversely impacted the ability of

the Company to move the transaction forward. In particular, it has

become apparent that parties claiming to be shareholders in More

have approached Megasteel's management and owners directly in

recent days and engaged in abusive and threatening behaviour which

has, understandably, been viewed as totally unacceptable by the

owners of Megasteel.

As reiterated in earlier announcements by More, Megasteel is a

cash flow positive, profitable, business, with a year-end cash

position of over GBP 10 million. There is, and will remain, no

financial or operational imperative for Megasteel to seek a stock

market listing.

It is therefore completely understandable, if entirely

regrettable, that, faced with an unwarranted tirade of abuse and

vitriol directly addressed at them, the Board and owners of

Megasteel yesterday afternoon formally informed the Company that it

was withdrawing from the Acquisition.

The Directors believe that termination of the Acquisition at

this very late stage, after over eight months of successful due

diligence, is not only deeply disappointing but was also entirely

avoidable. But for the completely unacceptable and profoundly

offensive actions of certain individuals, all More shareholders

would shortly have had a chance to individually decide whether or

not to approve the Acquisition.

It is self-evident that shareholders in More have the right to

make their views known to the Company and its professional

advisers, a right which observers will be aware has been properly

and legitimately publicly exercised by a number of Company

stakeholders in recent days. However, aggressive, abusive and

threatening behaviour, targeted directly at Megasteel's owners and

managers, is totally unacceptable.

Following the termination of the Acquisition, it is now the

intention of the Company to lift the suspension in trading of its

shares as soon as practically possible, at which time the Board

will publish full details, inter-alia, of the Company's cash

position.

Rod McIllree, Executive Director of More Acquisitions plc,

said:

"The termination of the proposed Megasteel deal represents a

massive, wasted opportunity; not only for More shareholders, who

have now been deprived of their right to decide on the Acquisition,

and potentially benefit from it, but also for the wider London

stock market. The More Board understands and empathises with

Megasteel's owners, whose first direct 'interaction' with

individuals purporting to be UK small cap investors has proved to

be such a distasteful and unpleasant experience.

The Company will now restart its review process with a view to

identifying other suitable acquisition opportunities for More."

Enquiries:

More Acquisitions plc

Rod McIllree/ Charles Goodfellow

Peterhouse Capital Limited +44 (0)20 7469 0930

Financial Adviser

Narisha Ragoonanthun/ Guy Miller/ Brefo Gyasi

Broker

Lucy Williams/ Duncan Vasey

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDAIMBTMTMTBTJ

(END) Dow Jones Newswires

May 24, 2023 07:04 ET (11:04 GMT)

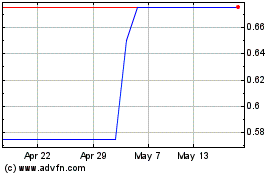

More Acquisitions (LSE:TMOR)

Historical Stock Chart

From Jan 2025 to Feb 2025

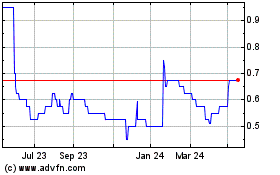

More Acquisitions (LSE:TMOR)

Historical Stock Chart

From Feb 2024 to Feb 2025