TIDMXLM

RNS Number : 9082N

XLMedia PLC

28 September 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain .

28 September 2023

XLMedia PLC

("XLMedia" or the "Group" or the "Company")

Results for the six months ended 30 June 2023

-- Further progress on delivery of strategy

-- Streamlined organisational structure and cost base

-- Delivered growth in core Europe Gaming and Sports brands

XLMedia (AIM: XLM), a leading global digital media company,

announces the unaudited results for the six months ended 30 June

2023.

Continuing business revenues for the Group grew 18% across the

two years from H1 2021 to H1 2023.

To 30 June 2022, the Group's continuing business revenue grew

77% period-on-period including the benefit of the launch of online

sports betting in New York - the fourth largest US state by

population. The period to 30 June 2023 included the successful

launch of online sports betting in Ohio (the seventh most populous

state) but as previously announced this, together with a reduced

level of customer acquisition marketing activity by some operators,

did not match the same period in the prior year, resulting in a

reduction in Group continuing operations revenues of 33% versus H1

2022.

Key Highlights H1 2023

-- The Group's Freebets brand grew revenue 37% led by Freebets.com.

-- The Group's Europe Gaming premium brands Whichbingo and

Nettikasinot both returned to growth, up 38% and 5%

respectively.

-- Sustainable cost savings of $4.0 million delivered in the

period including 14% reduction in headcount.

-- Online sports betting was launched in Ohio in January and Massachusetts in March.

-- Revenue share deals in the US were agreed with bet365, Betway

and Pointsbet enabling the Group to participate in betting profits

generated by customers introduced by XLMedia to these

operators.

-- The successful partnership with Schneps Media for amNY was

extended for a further three years.

-- Disposal of the Group's Personal Finance asset portfolio

realised a total cash consideration of $2.05 million.

Financial Summary

-- Group total revenues of $29.4 million (H1 2022: $44.5 million)

-- Group adjusted EBITDA(1) of $6.5 million (H1 2022: $10.6 million)

-- Continuing business(2) revenues were $27.9 million (H1 2022: $41.9 million)

-- Continuing business adjusted EBITDA was $6.9 million (H1 2022: $11.9 million)

-- Reported profit for the period of $4.7 million (H1 2022: $0.5 million)

-- $7.4 million in cash and short-term deposits as of 30 June 2023

1 Earnings Before interest, Taxes, Depreciation, Amortisation

and excluding share-based payments, impairment, and reorganisation

costs

2 Continuing business is defined as continuing operations

excluding activities or assets that do not form part of the Group's

future operations, for example Casino.se sold in July 2023.

Sports vertical generated first half revenues of $21.4 million -

74% of continuing operations revenues (H1 2022: $34.0 million, H1

2021: $11.7 million)

-- Following growth of 412% in US Sports revenue from H1 2021 to

H1 2022, H1 2023 was down period-on-period to $16.2 million (H1

2022: $ 30.2 million, H1 2022: $ 7.3 million).

-- New regulated markets opened in Ohio in January and

Massachusetts in March, increasing the number of live sports

betting states the Group operates in to 19.

-- The Media Partnership Business (MPB) revenues totalled $12.2

million (H1 2022: $20.5 million, H1 2021: $1.5 million).

-- The Group's partners Cleveland.com in Ohio and MASSlive.com

in Massachusetts were instrumental in driving revenues at state

launch. However, as a result of the late state launch in

Massachusetts after the end of the NFL season, revenues were

significantly lower than expected.

-- Owned and Operated ("O&O") revenues in the US were

impacted by the change in the levels of operator acquisition

marketing spend during the period. While the Group significantly

benefited from the New York launch in H1 2022 (including its

O&O ESNY brand), the New York market saw very limited customer

acquisition activity by operators in H1 2023.

-- The Europe Sports business returned to growth in H1 2023,

with revenues of $4.5 million, excluding residual sub-affiliate

network revenues (H1 2022: $3.8 million).

Gaming revenues stabilised at $7.4 million (H1 2022: $8.4

million, H1 2021: $12.5 million)

-- European operations generated $7.0 million (H1 2022: $8.0

million) with a reduction in tail revenues accounting for the

majority of the decline.

-- New Real Money Players ("RMPs") acquired during the period

grew 9% compared to H1 2022 creating future tail revenues that will

be realised in 2024 and beyond.

-- Whichbingo H1 revenue grew by 38% and RMPs by 28% compared to H1 2022.

-- Nettikasinot H1 revenue grew by 5% and RMPs by 16% compared to H1 2022.

-- The Group did not own or operate a dedicated North America

gaming site in the period. Gaming revenues earned from gaming pages

on O&O sports betting sites in legalised online gaming states

in the US generated revenues in H1 2023 of $0.4 million (H1 2022:

$0.4 million).

Disposals

The Group announced the sale of the loss-making Personal Finance

business in H1 2023 for a total cash consideration of $2.05

million. Revenues for the Personal Finance business in the period

prior to sale were $0.6 million (H1 2022: $0.8 million) at a $0.4

million loss.

Cash

After earnout payments of $3.4 million in respect of prior

period acquisitions and payments of $2.8 million in corporate tax

in Israel for the period 2016 to 2020, cash stood at $7.4 million

at 30 June 2023.

Post period end

-- Post period end, on 12 July 2023, we announced the disposal

of three of the Group's Europe Gaming domains and associated

websites, Casino.se, Casino.gr and Casino.pt, for a total upfront

cash consideration of $4.0 million, representing a 4.7 times

multiple on revenue.

-- Online sports betting in Kentucky launches today and the Group has prepared accordingly.

-- XLMedia is focused on capitalising on its substantial

southeast footprint, with North Carolina expected to launch in Q1

2024 , as well as additional launches in Maine and Vermont in

2024.

-- New Media Partnerships signed with Atlanta

Journal-Constitution and WRAL.com, the latter in preparation for

the launch of online sports betting in North Carolina in 2024.

Outlook

-- The Group is now focussed on Sport and Gaming, principally in

regulated markets, in North America and Europe, having exited

declining, non-core activities.

-- Europe Sports revenues are expected to grow year on year,

following growth in H1 2023, and strong revenue trends running into

H2.

-- The new NFL season remains a critical element in delivering

management's expectations. In particular the launch of Kentucky and

the return to market of one of our largest operator clients

following its own betting rebranding.

-- The strong growth trends in our premium Europe gaming brands,

Whichbingo and Nettikasinot, are also core to delivering

management's full year expectations.

-- Actions to reduce the Group's cost base during the period will provide further benefit in H2.

As a result, the Group expects full year adjusted EBITDA to be

broadly in line with management expectations.

As noted previously, the Group's performance will continue to

benefit from period revenue spikes resulting from new online sports

betting state launches in the US, however the timing, number and

scale of launches will vary significantly.

David King, Chief Executive Officer of XLMedia, commented:

"Having pivoted the Group into a North American, sport-led

business in 2020 and 2021, XLMedia is well placed to participate in

the long-term growth of online sports betting. However, as

previously noted, the Group's overall growth will not be linear

while the affiliate revenues in North America remain principally a

one-off introductory fee and the timing and scale of new state

launches impact period-to-period comparisons. We are working to

develop more revenue share relationships with operators in the US,

while also successfully building our recurring revenues in Europe,

providing a solid base for future growth."

Investor webcasts

A results webcast will be made available at

https://www.xlmedia.com/investors/webcasts/ on Thursday, 28

September 2023 from 10.00 a.m. (BST).

An additional presentation will be held on Tuesday, 3 October

2023 at 1.00 p.m. (BST) and hosted on the Investor Meet Company

platform.

Questions can be submitted pre-event via your Investor Meet

Company dashboard up until 9.00 a.m. the day before the meeting or

at any time during the live presentation. Investors who already

follow XLMedia on this platform will automatically be invited.

Participants can sign-up for free and add to meet XLMedia via : Investor webcast

For further information, please contact:

XLMedia plc ir@xlmedia.com

David King, Chief Executive Officer via Vigo Consulting

Caroline Ackroyd, Chief Financial Officer

www.xlmedia.com

Vigo Consulting Tel: 020 7390 0233

Jeremy Garcia / Fiona Hetherington /

Kendall Hill

www.vigoconsulting.com

Cavendish Securities plc (Nomad and Tel: 020 7397 8900

Joint Broker)

Giles Balleny / Callum Davidson

www.cavendish.com

About XLMedia

XLMedia (AIM: XLM) is a leading global digital media company

that creates compelling content for highly engaged audiences and

connects them to relevant advertisers.

The Group manages a portfolio of premium brands with a primary

emphasis on Sports and Gaming in regulated markets. XLMedia brands

are designed to reach passionate people with the right content at

the right time.

Chief Executive Review

Introduction

The first half of 2023 has seen us make further strides in

building a new XLMedia, implementing our strategy to rebuild our

European business while expanding our footprint in North America,

delivering revenue growth for the continuing business of 18% from

H1 2021 through to H1 2023.

In Europe, by focussing on our premium brands we have delivered

growth following a number of periods of significant decline.

In the US, our largest market, as the regulated markets develop

we have seen spend by some operators move towards building a more

steady profit profile rather than maximising short-term market

share. Following the growth of 412% in our US Sports revenue in H1

2022, the change in operator behaviour together with the more

modest scale of state launches in 2023 has resulted in a reduction

in revenues against H1 2022.

Our focus in the US remains one of developing revenue share

arrangements with operators. Over time this will enable the

business to participate in betting profits, increasing recurring

revenues and reducing volatility in revenues caused by state

launches.

The rationalisation and simplification program continued into H1

2023 with the closure or sale of non-core assets and the further

reduction in headcount by 14 % rationalised technology services and

tools as well as substantially reducing the number of licenses

across key platforms.

In the period, total continuing operations revenues were $28.8

million, while adjusted EBITDA was $6.9 million.

Divisional Summary

Sports - North America

The opening of the Ohio online sports betting market provided a

good start to the year. The subsequent launch of online sports

betting in Massachusetts after the end of the NFL season resulted

in disappointing revenue results and this, combined with changes to

the pattern of operator acquisition spending - particularly around

the Superbowl - led to a decline in revenues when compared to the

412% growth in North America Sports revenues from H1 2021 to

2022.

The Group now operates in 19 states and we are well prepared for

today's launch of online sports betting in Kentucky.

Across all the states where we operate, either through O&O

sites or through Media Partner sites, we continue to offer

high-quality national and local sports coverage and sports betting

content with an emphasis on building engagement and trust with

users. Our exclusive sports betting content for Media Partners

offers relevant information for fans and participants in those

states where betting is permitted. Audience engagement is an

essential element of our strategy to participate in betting profits

through revenue share in the future.

In H1 2023 we have focussed on growing traffic in Sports Betting

Dime in particular, our national sports betting affiliate site with

the objective of building high intent audiences, supporting both

new customer acquisition, up 13% against the comparable period in

2022, but also revenue share when that becomes available, with

total unique visitors up 120% period-on-period.

In H1 2023, we also saw our revenue diversification program

expanded into Daily Fantasy Sports, which is legal in most US

states. After initially launching with one operator, we have

expanded to two, and will soon expand to a third. Current revenues

are principally being driven by our Saturday Down South brand with

its extensive reach across southern states.

In August 2023, we announced a new media partnership with

WRAL.com based in North Carolina, which has legalised online sports

betting and is expected to launch in Q1 2024. We will provide

highly engaging sports betting content while also managing

commercial deals with regulated sportsbook operators and executing

proven monetisation strategies.

In September, we announced new media partnership with Atlanta

Journal-Constitution (AJC), a high-quality news and sport brand,

based in Georgia but with an exceptional and well-established

national reputation and extensive digital footprint. This exclusive

agreement will enable AJC to capture new revenue streams whilst

providing their readership with a new content offering. The

partnership also allows the Group to immediately reach AJC's

national readership in currently legal live sports betting markets,

and also provides the Group with access to AJC's readership in

Georgia should the state legalise sports betting in the medium

term.

And while we are always looking to find new high quality

partners in new states, we have extended our successful amNY

partnership with Schneps Media for a further three years.

Sports - Europe

Following a challenging in period in our Europe Sports business

in previous years, Freebets.com (our premium Europe and UK sports

betting marketing brand) led the division back to growth, with

revenues up 50% against H1 2022, benefiting in part from the

redirection of Freebets.co.uk as part of the rationalisation

programme. First time depositors were up 36%. Europe Sports

revenues are mostly hybrid deals with revenues made up of a small

upfront customer acquisition payment followed by ongoing

participation in betting profits from those customers. Revenue

share from new hybrid deal customers will continue into H2 2023 and

beyond, and form part of our recurring revenues.

Growth in recurring revenues is a key strand in the strategy to

grow overall revenues and reduce seasonality and volatility.

The Europe Sports business delivered revenues of $4.5 million

excluding residual sub-affiliate network revenues. (H1 2022: $3.8

million). In the period we successfully expanded our horse racing

offering, with particular success around major events including the

Cheltenham Festival, the Grand National and Royal Ascot - all

finding new customers - while the English Premier league season

continues to drive acquisition.

Gaming - Europe

The Group's Europe Gaming vertical as a whole generated revenue

of $7.0 million (H1 2022: $8.0 million). The trading performance of

the three EU gaming assets sold in July 2023 is included and

represents c.$0.3 million in the results.

Following its restructuring in 2022, the Group's Europe Gaming

vertical (casino and bingo) is trading marginally ahead of

management expectations. RMPs grew 9% year-on-year in the period as

the rebuilding of the gaming business continued while creating

future tail revenues. In the short-term, the decline in historical

tail revenues continues to impact period-on-period growth, however

the business expects to return to overall growth.

-- WhichBingo , the second largest gaming brand in the

portfolio, grew revenue in H1 2023 by 38% period-on-period and grew

RMPs by 28% period-on-period. H1 2023 was the strongest performing

half year ever.

-- Nettikasinot , the largest gaming brand in the portfolio,

grew revenue in H1 2023 by 5% against H1

2022 and grew RMPs 16% during the same period.

Together, WhichBingo and Nettikasinot now contribute approaching

half the Gaming revenues in the period.

Disposals

In late 2022 the Group announced the intention to sell the

loss-making Personal Finance business, and completed the sale of

these assets in H1 2023 for a total gross cash consideration of

$2.05 million. Revenues for the Personal Finance business in the

period prior to sale were $0.6 million (H1 2022: $0.8 million) at a

$0.4 million loss.

Personal Finance business was written down to zero in 2022. As a

result of the sale, the asset was written back to the amount

equivalent to the disposal proceeds creating no profit or loss on

the disposal before transaction related costs.

Post period end, on 12 July 2023, we announced the disposal of

three of the Group's Europe Gaming domains and associated websites,

Casino.se, Casino.gr and Casino.pt, for a total upfront cash

consideration of $4.0 million, representing a 4.7 times multiple on

full year revenues. The Group will continue to operate its Gaming

business in the Swedish and other Europe markets and then launched

Kasino.se, a new site focused on the Swedish market.

Operations and People

H1 2023 saw XLMedia complete the removal of a layer of

management across all divisions resulting in more direct engagement

between managers and operational staff, and the leadership

team.

As part of the transformation program, we have exited non-core

activities sub-affiliate network and the Blueclaw agency and

completed the sale of the loss-making Personal Finance

business.

The management of Europe Sport and Gaming were brought together

under the leadership of Karen Tyrrell, Chief People and Operations

Officer.

The Group continued to focus on its program to streamline

technology and replace legacy technology. We have launched our

Dynamic Offer Engine, a proprietary ad serving technology, enabling

us to automate and optimise conversion rates from new sports

betting promotions and offers while trialing using new AI tools to

enhance content creation.

Total cost savings achieved in H1 2023 were $4.0 million,

including the 14% reduction in headcount.

Cash

In 2020 and 2021, the Group pivoted to a US Sport led business,

making three substantial acquisitions, CBWG, Sports Betting Dime

("SBD") and Saturday Down South ("SDS"). While the SBD acquisition

was financed through an equity raise, the CBWG and SDS acquisitions

have earnout and deferred payments payable in 2023 and 2024. Cash

payments of $3.4million were made in H1 with a further $4.0 million

payable in H2, and an additional $7.5 million due in 2024.

Cash generated by the business must first be utilised on

acquisition payments, restructuring costs and the bespoke

technology replacement program (capex). Expenditure on capex has

reduced in the period by $0.5 million, while restructuring costs

reduced period-on-period by $2.0 million.

Currently there is no external debt financing in the business

however we are currently evaluating implementing a revolving credit

facility for working capital purposes.

Board Changes

Earlier in the year, Richard Rosenberg and Jonas Mårtensson

indicated their intention to step down as Directors of the Group.

Mr. Mårtensson stepped down from the Board at the end of June while

Mr. Rosenberg will step down at the end of this month having

ensured a smooth transition of his responsibilities.

In addition, in line with the Group's focus on cost reduction,

and as reported in our Annual Report, the Board agreed to implement

a reduction of 15% in the level of fees paid to the remaining

Non-Executive Directors (including the Chair) with effect from 1

April 2023.

Summary

The spike in revenue in H1 2022 and the resulting comparable

period decline masks the growth in revenues from H1 2021 to H1

2023.

The Group is focussed on building recurring revenues and

diversifying its revenue streams. This will take time.

State launches will continue to create profitable spikes in

revenue, particularly when the larger states (e.g. California,

Texas) legalise online sports betting at some point in the

future.

The return to growth of our premium European brands will now

provide a solid platform for the business, while the exit from

non-core activities removes distraction, enabling resources to be

focussed on further growth in core verticals of sport and

gaming.

David King

Chief Executive Officer

28 September 2023

Chief Financial Officer Review

Financial Highlights

The business has delivered continuing operations revenue of

$28.8 million, with adjusted EBITDA from continuing operations down

42% to $6.9 million. Operating profit improved by 25% to $6.0

million and profit for the period increased from $0.5 million to

$4.7 million.

Cash balances reduced from $10.8 million to $7.4 million after

generated cash from continuing operations of the Group, capital

expenditure, acquisition payments, historical tax payments and

receipts for assets disposed of during the period.

Continuing operations (1)

H1 2023 H1 2022 Change 2023

vs 2022

========================================= =========== =========== ===============

Revenue ($'m) 28.8 43.3 (33)%

----------------------------------------- ----------- ----------- ---------------

Gross profit ($'m) 14.9 22.2 (33)%

----------------------------------------- ----------- ----------- ---------------

Operating profit ($'m) 6.0 4.8 25%

----------------------------------------- ----------- ----------- ---------------

Adjusted EBITDA ($'m) 6.9 11.9 (42)%

----------------------------------------- ----------- ----------- ---------------

Adjusted EBITDA margin (%) 24% 27% (3)% pts

----------------------------------------- ----------- ----------- ---------------

Statutory profit for the period ($'m) 4.7 0.5 840%

----------------------------------------- ----------- ----------- ---------------

Basic earnings per share ($) 0.023 0.020 15%

========================================= =========== =========== ===============

(1) Defined as total Group financial performance less

discontinued operations. For H1 2023, the Group classified the

Personal Finance and Blueclaw verticals as discontinued.

Continuing Operations Revenue

Revenue from continuing operations for H1 2023 was $28.8 million

(H1 2022: $43.3 million), a 33% decline compared to the previous

financial period. The decline in revenues was driven by the North

America Sports vertical. Both our owned sites and our Media

Partners declined as a result of the scale of new state launches in

H1 2022 (New York, Louisiana and Ontario) which were significantly

larger in population size against state launches in H1 2023 (Ohio

and Massachusetts) driving higher revenues in the prior period. In

Europe, we continued to rebuild our sites, driving new customer

acquisition and creating new tail revenues. Total Europe revenues

delivered growth of 3%.

We continued to grow new customer volumes with Real Money

Players from core websites (including Media Partners) of 80,000 in

H1 2023 (H1 2022: 116,000), a decrease of 31% period-on-period also

impacted by state launches.

The Group's operations are reported on the basis of two core

operating verticals, Sports and Gaming (Casino and Bingo), and two

geographies, North America and Europe. The Group has excluded the

sub-affliliate business from prior period comparatives for all the

following revenue tables.

Revenue split by type

H1 2023 H1 2022 Change 2023

vs 2022 (%)

($m) ($m)

================================= ============ ============ ================

CPA 16.4 28.5 (42)%

--------------------------------- ------------ ------------ ----------------

Revenue share / hybrid and

other (2) 12.4 13.9 (11%)

--------------------------------- ------------ ------------ ----------------

Total 28.8 42.4 (32)%

================================= ============ ============ ================

(2) Other defined as Fixed Deals, Sponsorship Deals, Display

Advertising

The US market has continued largely as a CPA led market whereas

the Europe market continues to operate with a mixture of fixed,

hybrid and revenue share deals. As a result, CPA revenues accounted

for 57% of core revenues declining from 67% in the prior period.

Revenue share has increased to 43% of total revenue due to the

overall decline in US revenues as a percentage of total revenues.

As the US market continues to develop, we have started to see some

hybrid and revenue share deals offered and expect this to grow as a

proportion of revenues over time.

Revenue split by category (3)

H1 2023 H1 2022 Change 2023

vs 2022 (%)

($m) ($m)

================ ============ ============ ================

Sport (4) 21.4 34.0 (37)%

---------------- ------------ ------------ ----------------

Gaming 7.4 8.4 (14)%

---------------- ------------ ------------ ----------------

Total 28.8 42.4 (32)%

================ ============ ============ ================

(3) H1 2022 excludes revenue from the sub-affiliate network.

(4) Includes the North America Sports, Media Partnerships and

Europe Sports verticals.

In H1 2023, 74% of revenues came from Sport in line with the

Group's focus on being sports led in the US, while also rebuilding

its Europe casino assets and launching a new casino brand in the

US.

Revenue split by geography

H1 2023 H1 2022 Change 2023

vs 2022 (%)

($m) ($m)

============================= ============ ============ ================

North America (Sport) 16.2 30.2 (46)%

----------------------------- ------------ ------------ ----------------

Europe (Sport) 5.2 3.8 37%

----------------------------- ------------ ------------ ----------------

Sport 21.4 34.0 (37)%

----------------------------- ------------ ------------ ----------------

North America (Gaming) 0.4 0.4 0%

----------------------------- ------------ ------------ ----------------

Europe (Gaming) 7.0 8.0 (13)%

----------------------------- ------------ ------------ ----------------

Gaming 7.4 8.4 (12)%

============================= ============ ============ ================

Sport revenues decreased by 37% period-on-period to $21.4

million (H1 2022: $34.0 million) as a result of North America

Sports revenues reducing with smaller state launches

period-on-period.

Europe Sports revenues improved to $5.2 million in H1 2023 (H1

2022: $3.8 million). In Europe, our primary site Freebets.com grew

by 37% period-on-period. Europe Sports includes the continuing

sub-affiliate network which has been significantly rationalized

during the period.

Gaming revenues declined by 12% to $7.4 million (H1 2022: $8.4

million) as tail revenues declined in Europe gaming markets against

the prior period. Our marquee brands Nettikasinot and WhichBingo

grew by 5% and 38% respectively in H1 2023, period-on-period.

Europe remains the main Gaming region for the Group, with revenues

of $7.0 million (H1 2022: $8.0 million), accounting for more than

90% of Gaming revenue in both H1 2023 and H1 2022.

Our US Gaming revenues are driven by gaming pages provided on

our Sports websites, in particular Crossing Broad. US Gaming

revenues were flat period-on-period at $0.4 million (H1 2022: $0.4

million).

Revenue split by Partnership and owned and operated

("O&O")

H1 2023 H1 2022 Change 2023

vs 2022 (%)

($m) ($m)

================================ ============ ============ ================

North America Partnership 12.2 20.5 (40)%

-------------------------------- ------------ ------------ ----------------

Total Partnership 12.2 20.5 (40)%

-------------------------------- ----------------

North America O&O 4.4 10.1 (56)%

-------------------------------- ----------------

Europe O&O 12.2 11.8 3%

-------------------------------- ------------ ------------ ----------------

Total O&O 16.6 21.9 (27)%

------------ ------------ ----------------

Total revenue 28.8 42.4 (32)%

================================ ============ ============ ================

Revenue from the North America region decreased by 45% to $16.6

million (H1 2022: $30.6 million) and accounted for 58% of the Group

continuing revenues (H1 2022: 72%). Media Partnership revenue was

down 40% to $12.2 million (H1 2022: $20.5 million). During 2022, we

signed partnership agreements with new partners Cleveland.com and

Masslive.com to support the state launches in Ohio and

Massachusetts.

Revenue from the Europe region improved by 3% to $12.2 million

(H1 2022: $11.8 million). Tail revenues in casino declined

period-on-period relating to closed websites, offset by growth in

new RMPs revenues in both sports and casino.

Gross profit (5) and gross margin

H1 2023 H1 2022 Change 2023

vs 2022 (%)

($m) ($m)

================================= ============ ============ ================

Gross profit from continuing

operations ($'m) 14.9 22.2 (33)%

--------------------------------- ------------ ------------ ----------------

Gross profit margin (%) 48% 51% (3) % pts

================================= ============ ============ ================

(4) Gross profit is calculated as revenue less the costs

associated with generating revenue. Cost of revenue includes direct

costs, marketing costs, Media Partnership revenue share costs, and

staff costs. Note, these costs are part of operating, and sales and

marketing expenses as defined in the consolidated financial

statements.

The Group's gross profit from continuing operations for H1 2023

was down 33% to $14.9 million, with a gross margin of 48% (H1 2022:

$22.2 million, 51% gross margin). The 3% reduction in gross margin

period-on-period was largely due to a decline in North America

gross margin which reduced from 48% to 31%, offset by improvements

in Europe Sports and Europe Gaming to 70% and 76% respectively.

Revenue shares payments to Media Partners, which form part of the

reported sales and marketing expenses, were $8.1 million in H1 2023

(H1 2022: $12.4 million).

Earnings

The Group recognised an operating profit from continuing

operations of $6.0 million (H1 2022: $4.8 million) and EBITDA from

continuing operations of $9.5 million (H1 2022: $8.4 million).

EBITDA from continuing operations included items which affect

comparability and so, the Group excludes these items from its

Adjusted EBITDA metrics. These are detailed below:

Reconciliation of operating profit for continuing operations to

Adjusted EBITDA

H1 2023 H1 2022 Change 2023

vs 2022 (%)

($m) ($m)

========================================== ============ ============ ================

Operating profit from continuing

operations 6.0 4.8 25%

------------------------------------------ ------------ ------------ ----------------

Depreciation and Amortisation 3.5 3.6

------------------------------------------ ------------ ------------ ----------------

EBITDA from continuing operations

($'m) 9.5 8.4 13%

------------------------------------------ ------------ ------------ ----------------

Share-based payments 0.4 0.5

------------------------------------------ ------------ ------------ ----------------

Impairment reversal (4.0) -

------------------------------------------ ------------ ------------ ----------------

Reorganisation costs 1.0 3.0

------------------------------------------ ------------ ------------ ----------------

Adjusted EBITDA from continuing

operations ($'m) 6.9 11.9 (42)%

------------------------------------------ ------------ ------------ ----------------

Adjusted EBITDA margin from continuing

operations 24% 27% (3) % pts

------------------------------------------ ------------ ------------ ----------------

Adjustments to earnings

The Group incurred $0.4 million of share-based payment charges

(H1 2022: $0.5 million).

Due to the agreement for the sale of the Europe Gaming assets,

the Group reversed $4.0 million of previous impairment charges to

reflect the recoverable amount for those assets.

In addition, the Group incurred $1.0 million of reorganisation

costs in H1 2023 (H1 2022: $3.0 million) relating to the

continuation of the Group's restructuring plan and integration and

other costs activity relating to prior period acquisitions.

Adjusting for these one-off items:

-- Adjusted EBITDA from continuing operations was $6.9 million

(H1 2022: $11.9 million), with a margin of 24% (H1 2022: 27%).

-- Group adjusted EBITDA including Personal Finance and Blueclaw

was $6.5 million (H1 2022: $10.6 million).

The Group completed the sale of Personal Finance assets and the

restructuring of non-core activities in H1 2023 removing marginal

and loss-making activity, while allowing resources to be focused on

the core business.

Sales and marketing costs

Direct costs associated with our revenue streams decreased to

$10.6 million from $15.5million. This includes the revenue shares

payments to our Media Partners in the US amounting to $8.1 million

(H1 2022: $12.4 million). Excluding revenue shares payments to

Media Partners, sales and marketing costs were $2.5 million (H1

2022: $3.1 million), a decrease of 19%. These costs relate largely

to content and SEO expenses.

Operating costs

Operating costs of $12.7 million include $1.0 million of

reorganisation costs and $0.4 million of share-based payment

charges (H1 2022: $19.4 million including $3.0 million of

reorganisation costs and $0.5 million of share-based payment

charges), include staff costs, technology investment and other

operating costs.

Staff costs

Staff costs from continuing operations was $8.0 million (H1

2022: $11.3 million). The period-on-period reduction related to

moving activities from Israel, and recruiting new staff

predominantly in the UK, Europe and the US. In addition, the

restructuring program removed a management layer and closed

non-core activities during 2022 and early 2023. This has also been

reflected in the reduction in total Group employee numbers

(including Personal Finance) to 167 from 193.

Technology investment

The Group has continued to invest in its technology in H1 2023,

incurring $1.6 million of operating costs in this area (H1 2022:

$2.8 million). The Group upgraded its site infrastructure in 2022

and continues to replace legacy technology for data platforms and

finance billing systems.

Other operating costs

Other operating costs were $3.1 million (H1 2022: $5.3 million).

These include all other operating costs including administrative

expenses, professional service costs and redundancy costs.

Earnings per share (EPS)

H1 2023 H1 2022 Change 2023

vs 2022 (%)

($m) ($m)

========================================= ============ ============ ================

Basic and diluted EPS from continuing

operations ($) 0.023 0.020 15%

----------------------------------------- ------------ ------------ ----------------

Adjusted basic and diluted EPS

($) 0.018 0.002 800%

========================================= ============ ============ ================

Basic and diluted EPS remained the same (H1 2022: same) due to

the significant number of weighted average number of shares. In H1

2023, the Group recognised a basic and diluted EPS from continuing

operations of $0.023 (H1 2022: $0.020).

Including the discontinued operations of Personal Finance

(before it was sold) and Blueclaw, the Group recognised an earnings

per share of $0.018 (H1 2022: $0.002).

Finance costs

Net financial income amounted to $0.2 million credit (H1 2022:

$1.7 million cost). This includes a $0.3 million foreign exchange

gain due to re-translation of monetary balances to USD, the

presentational currency of the Group (H1 2022: $1.5 million loss).

Excluding this forex impact, net financial costs were $0.1 million

(H1 2022: $0.2 million) relating to bank charges and lease finance

costs.

The Group does not hold any external debt financing as at 30

June 2023 (H1 2022: $Nil), but is currently exploring opportunities

to introduce a revolving credit facility for working capital

purposes.

Tax

The Group has a tax-presence in the regions where the Group is

incorporated, which are Jersey (where the parent company is

incorporated), UK, US, Cyprus, Canada and Israel. The Group

structure consists of a UK branch with a shared service centre in

Cyprus, both of which support the intellectual property based in

Israel and Cyprus and the growing operations in the US.

The Group recognised a tax charge of $0.6 million in H1 2023 for

its continuing operations (H1 2022: $2.2 million credit). A

deferred tax credit of $3.2 million was released for the impairment

of the Personal Finance assets in discontinued operations.

The Group recognised an income tax provision of $4.7 million (H1

2022: $7.7 million). The reduction in the income tax liability is

due mainly to settlements of historical agreements with local tax

authorities. In H1 2023, the Group paid $2.8 million to tax

authorities in respect of the tax years 2016 to 2020 in the

jurisdictions it operates (H1 2022: $0.9 million).

The Group understands the importance of the tax contribution we

make, and we have a tax strategy which supports this commitment.

The Group is committed to paying all of its taxes in full and on

time, in all the jurisdictions in which the Group operates.

Summary balance sheet and cash flow metrics

H1 2023 H1 2022 Change 2023

vs 2022 (%)

($m) ($m)

================================== ============ ============ ================

Free cash flow (6) ($'m) 0.5 6.1 (92)%

---------------------------------- ------------ ------------ ----------------

Cash from operations (7) ($'m) 3.2 9.6 (67)%

---------------------------------- ------------ ------------ ----------------

Normalised Capital expenditure

(8) ($'m) 2.7 3.2 (9)%

---------------------------------- ------------ ------------ ----------------

Acquisition-related payments

($'m) 3.4 9.9 (66)%

================================== ============ ============ ================

(6) Defined as cash from operations excluding one-off tax

payments or refunds, less capital expenditure.

(7) Includes working capital and trading from discontinued

operations.

(8) Defined as reported capex less acquisition-related capital

expenditure.

Cash and working capital

Cash balances (including short-term deposits) at 30 June 2023

was $7.4 million (FY 2022: $10.8 million). After adjustment for

forex movements, overall cash balances decreased due to

acquisition-related payments and tax payments detailed below.

The Group recognised free cash inflows of $0.5 million in H1

2023 after adjusting for one-off cash items compared to an inflow

of $6.1 million in H1 2022. The main driver of the reduction in

free cash outflows related to a decline in underlying trading and

working capital outflows driven by lower trade creditor balances.

Cash flow from operating activities was $3.2 million (H1 2022: $9.6

million).

Whilst the Group did not acquire any businesses in H1 2023, it

continued to invest in its assets, mainly in its domains and

websites, spending $2.7 million on capital expenditure (H1 2022:

$3.2 million).

The Group's acquisition program between Q4 2020 and 2021

resulted in it committing to future acquisition and earn out

payments as part of the acquisition consideration, to be

substantially funded from the Group's free cashflow.

During H1 2023, the Group paid out $3.4 million of deferred

acquisition and earnout payments (H1 2022: $9.9 million), including

settling all existing obligations with the previous owners of

Blueclaw Media Ltd. This final settlement was paid in January 2023

and the Group has no further obligations in this matter.

In H2 2023, the Group expects to make a further $4.0 million of

deferred consideration payments and in 2024, the Group expects a

further $7.5 million dependent on whether earn-out targets are

met.

The cash flows above included the cash flow from operations and

working capital balances for the Personal Finance and Blueclaw

businesses.

Caroline Ackroyd

Chief Financial Officer

28 September 2023

Glossary of financial terms

Although the Group is not subject to the Guidelines on

Alternative Performance Measures issued by the European Securities

and Markets Authority, we have provided additional information on

the metrics used by the Group. The Directors use the metrics listed

below as they are critical to understanding the financial

performance and financial health of the Group. As they are not

defined by IFRS, they may not be directly comparable with other

companies who use similar measures.

Profit measures

Metric Closest equivalent Definition

IFRS measure

========================= ====================== ================================================

Continuing operations Revenue Group revenue less discontinued operations

revenue revenue.

For H1 2023, the Group classified the

Personal Finance and Blueclaw verticals

as discontinued.

------------------------- ---------------------- ------------------------------------------------

Adjusted EBITDA Operating Profit Earnings before Interest, Taxes, Depreciation

(1) and Amortisation, and excluding any

share-based payments, impairment and

reorganisation costs.

------------------------- ---------------------- ------------------------------------------------

Adjusted EBITDA from Operating Profit As above but excluding discontinued

continuing operations (1) operations

------------------------- ---------------------- ------------------------------------------------

Adjusted Basic and Basic and diluted Based on profit for the period from

diluted earnings per earnings per continuing operations.

share from continuing share

operations

========================= ====================== ================================================

(1) Operating profit is not defined under IFRS. However, it is a

generally accepted profit measure.

Cash flow measures

Metric Closest equivalent Definition

IFRS measure

===================== ======================= ================================================

Free cash flow No direct equivalent Cash from operations excluding one-off

tax payments or refunds, excluding

acquisition costs, less capital expenditure.

--------------------- ----------------------- ------------------------------------------------

Normalised capital No direct equivalent Reported capital expenditure excluding

expenditure acquisition-related capital expenditure.

===================== ======================= ================================================

Consolidated statement of profit or loss and other comprehensive

income

Six months Six months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

$ 000 $000 $ 000

Unaudited Unaudited Audited

Continuing operations Notes

Revenue 1 3a 28,792 43,275 70,935

Expenses:

Operating (12,659) (19,353) (34,629)

Sales and marketing (10,625) (15,505) (22,824)

Depreciation and amortisation (3,499) (3,600) (7,313)

Impairment reversal 3d 4,000 - -

----------

Operating profit 6,009 4,817 6,169

Finance expenses (152) (1,733) (1,751)

Finance income 309 2 5

Other income 682 33 566

Profit before taxes on income 6,848 3,119 4,989

Tax (charge) / credit (605) 2,198 (1,604)

---------- ---------- ------------

Profit for the period from continuing

operations 6,243 5,317 3,385

Discontinued operations

Loss for the period from discontinued

operations (net of tax) 3b (1,516) (4,813) (12,824)

---------- ---------- ------------

Net profit / (loss) for the period

attributable to the owners of the

Company 4,727 504 (9,439)

Other comprehensive expenses that

may be reclassified to profit or

loss in subsequent periods:

Impairment of equity investment 3e (242) - -

Exchange differences on translation

of foreign operations 130 (377) (372)

---------- ---------- ------------

Other comprehensive expenses (112) (377) (372)

Total comprehensive income / (loss)

for the period attributable to

the owners of the Company 4,615 127 (9,811)

========== ========== ============

Earnings / (loss) per share attributable

to the owners of the Company (in

$):

Basic and diluted earnings per

share from continuing operations 0.023 0.020 0.013

Basic and diluted earnings / (loss)

per share 0.018 0.002 (0.036)

1 Total Group revenue including discontinued operations is

$29,423,000 (30 June 2022: $44,528,000; 31 December 2022:

$73,738,000). See Note 3a for further details.

The accompanying notes are an integral part of the consolidated

financial statements.

Consolidated statement of financial position

30 June 30 June 31 December

2023 2022 2022

$ 000 $ 000 $ 000

Notes Unaudited Unaudited Audited

Assets

Non-current assets

Intangible assets and goodwill 3d 112,999 118,955 108,581

Property and equipment 2,024 2,616 2,277

Other financial assets 3e - 221 242

Long-term deposits 76 75 75

---------- ---------- -----------

115,099 121,867 111,175

Current assets

Short-term deposits 103 1,601 342

Trade receivables 3,611 5,787 5,699

Other receivables 6,803 3,863 3,454

Cash and cash equivalents 7,331 16,131 10,411

----------

17,848 27,382 19,906

----------

Total assets 132,947 149,249 131,081

========== =========== ===========

Equity and liabilities

Equity

Share capital 1 - - -

Share premium 122,071 122,071 122,071

Capital reserve 828 146 500

A ccumulated deficit (17,581) (12,365) (22,308)

---------- ----------- -----------

Total equity 105,318 109,852 100,263

Non-current liabilities

Lease liabilities 1,008 1,202 1,177

Deferred taxes 2,919 1,338 36

Deferred consideration 3,919 7,795 3,884

Contingent consideration - 401 -

---------- ---------- -----------

7,846 10,736 5,097

Current liabilities

Trade payables 1,452 2,540 3,655

Deferred consideration 3,992 8,897 3,969

Consideration payable on intangible

assets - 3,000 3,000

Other liabilities and accounts payables 9,337 6,162 10,241

Income tax provision 4,658 7,725 4,505

Current maturities of lease liabilities 344 337 351

---------- ---------- -----------

19,783 28,661 25,721

---------- ---------- -----------

Total liabilities 27,629 39,397 30,818

---------- ---------- -----------

Total equity and liabilities 132,947 149,249 131,081

========== ========== ===========

1 Less than $1,000.

The accompanying notes are an integral part of the consolidated

financial statements. The financial statements were approved by the

Board of Directors on 27 September 2023 and were signed on its

behalf by:

David King Caroline Ackroyd

Chief Executive Chief Financial

Officer Officer

Consolidated statement of changes in equity

Capital

reserve

from the

Capital translation Other

reserve from of a capital

Share Share share-based foreign reserves Accumulated Total

capital (1) premium transactions operation (4) deficit equity

$000 $000 $000 $000 $000 $000 $000

As at 1

January 2023 - 122,071 3,514 (388) (2,626) (22,308) 100,263

Profit for the

period - - - - - 4,727 4,727

Other

comprehensive

income /

(expense) - - - 130 (242) - (112)

------------ ----------- ------------ ----------- ----------- ----------- --------

Total

comprehensive

income - - - 130 (242) 4,727 4,615

Cost of

share-based

payments - - 440 - - - 440

As at 30 June

2023 (2) - 122,071 3,954 (258) (2,868) (17,581) 105,318

============ =========== ============ =========== =========== =========== ========

As at 1

January 2022 - 122,071 2,656 (16) (2,626) (12, 869 ) 109, 216

Profit for the

period - - - - - 504 504

Other

comprehensive

expense - - - (377) - - (377)

------------ ----------- ------------ ----------- ----------- ----------- --------

Total

comprehensive

income - - - (377) - 504 127

Cost of

share-based

payments - - 509 - - - 509

------------ ----------- ------------ ----------- ----------- ----------- --------

As at 30 June

2022 (2) - 122,071 3,165 (393) (2,626) (12,365) 109,852

------------ ----------- ------------ ----------- ----------- ----------- --------

As at 1

January 2022 - 122,071 2,656 (16) (2,626) (12, 869 ) 109, 216

Loss for the

year - - - - - (9,439) (9,439)

Other

comprehensive

expense - - - (372) - - (372)

------------ ----------- ------------ ----------- ----------- ----------- --------

Total

comprehensive

loss - - - (372) - (9,439) (9,811)

Cost of

share-based

payments - - 858 - - - 858

------------ ----------- ------------ ----------- ----------- ----------- --------

As at 31

December 2022

(3) - 122,071 3,514 (388) (2,626) (22,308) 100,263

============ =========== ============ =========== =========== =========== ========

1 Less than $1,000.

2 Unaudited.

3 Audited.

4 Other capital reserves relate to transactions with

non-controlling interests and financial assets at fair value

through other comprehensive income.

The accompanying notes are an integral part of the consolidated

financial statements.

Consolidated statement of cash flows

Six months Six months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

$ 000 $ 000 $ 000

Notes Unaudited Unaudited Audited

Cash flows from operating activities

Cash generated from operations 3g 3,202 9,622 14,647

Interest paid - (257) (310)

Interest received 5 - 5

Income tax paid (2,767) - (876)

Income tax received - 1,684 2,287

----------- ------------

Net cash inflow from operating activities 440 11,049 15,753

----------- ----------- ------------

Cash flows from investing activities

Proceeds on disposal of property

and equipment - 19 83

Proceeds from sale of discontinued

operation 3c 2,050 - -

Purchase of property and equipment (15) (331) (62)

Purchase of and additions to systems,

software and licences (2,656) (2,892) (6,701)

Acquisition of and additions to domains,

websites and other intangible assets - (3,000) (3,000)

Short-term and long-term deposits

(net) 238 565 1,824

----------- ----------- ------------

Net cash outflow from investing

activities (383) (5,639) (7,856)

----------- ------------

Cash flows from financing activities

Payment of principal portion of lease

liabilities (142) (246) (401)

Payment of deferred consideration (371) (6,853) (15,371)

Payment of consideration on intangible

assets (3,000) (3,000) (3,000)

----------- ----------- ------------

Net cash outflow from financing

activities (3,513) (10,099) (18,772)

----------- ----------- ------------

Net decrease in cash and cash equivalents (3,456) (4,689) (10,875)

Net foreign exchange difference 376 (1,617) (1,151)

Cash and cash equivalents at 1 January 10,411 22,437 22,437

----------- -----------

Cash and cash equivalents at 30

June / 31 December 7,331 16,131 10,411

=========== =========== ============

The accompanying notes are an integral part of the consolidated

financial statements.

Notes to the consolidated financial statements

1. General

a. General information

XLMedia PLC ("the Group") is a global digital media company

listed on the London Stock Exchange Alternative Investment Market

("AIM"). The Group was incorporated in Jersey and its registered

office is IFC 5, St. Helier, JE1 1ST, Jersey (registration number

114467).

The financial information presented in this report for the six

months ended 30 June 2023 ("interim condensed consolidated

financial statements") do not comprise statutory accounts as

defined by the Companies (Jersey) Law 1991 and does not include all

of the information and disclosures required for full financial

statements.

The comparative financial information contained in the interim

condensed consolidated financial statements in respect of the year

ended 31 December 2022 has been extracted from the Group's annual

financial statements ("annual consolidated financial statements").

The report of the auditors on those annual consolidated financial

statements was unqualified. Copies of those annual consolidated

financial statements are available at the Company's registered

office is IFC 5, St. Helier, JE1 1ST, Jersey and can also be

downloaded or viewed via the Group's website.

These interim condensed consolidated financial statements are

unaudited and has not been reviewed by the Group's independent

auditors, Kost Forer Gabbay & Kasierer. This information was

approved by the Board of Directors on 27 September 2023 and can be

viewed via the Group's website www.xlmedia.com

b. Definitions

In these financial statements, the following terms will be

used:

EUR - E uro

GBP - British Pound Sterling

- International Financial Reporting Standards as

IFRS adopted by the European Union

NIS - New Israeli Shekel

Related parties - As defined by IAS 24 'Related Party Disclosures'

Subsidiaries - Entities controlled (as defined in IFRS 10 'Consolidated

Financial Statements') by the Group and whose financial

statements are consolidated into the Group. For

a list of the main subsidiaries, see Note 23 in

the Group's annual financial statements as of 31

December 2022

US - United States

UK - United Kingdom

- U.S. dollar, all values are rounded to the nearest

USD/$ thousand ($000), except when otherwise indicated

2. Significant accounting policies

a. Basis of presentation of the interim condensed consolidated

financial statements

These financial statements have been prepared in a condensed

format as of 30 June 2023, and for the six months then ended. The

interim condensed consolidated financial statements have been

prepared in accordance with IAS 34 'Interim Financial Reporting',

as adopted by the European Union, and the AIM Rules for

Companies.

These interim consolidated financial statements should be read

in conjunction with the Group's annual consolidated financial

statements for the year ended 31 December 2022, which were prepared

in accordance with International Financial Reporting Standards

("IFRS") adopted by the European Union, and issued by the

International Accounting Standards Board ("IASB"), in accordance

with the requirements of the Companies (Jersey) Law 1991.

b. The initial adoption of amendments to existing financial

reporting and accounting standards

The accounting policies adopted in the preparation of the

interim condensed consolidated financial statements are consistent

with those followed in the preparation of the Group's annual

consolidated financial statements for the year ended 31 December

2022.

Whilst several amendments apply for the first time in the six

months ended 30 June 2023, they do not have an impact on the

interim condensed consolidated financial statements of the Group.

The Group has not early adopted any standard, interpretation or

amendment that has been issued but is not yet effective.

3. Supplementary information

a. Revenue and operating segments

An operating segment is a part of the Group that conducts

business activities from which it can generate revenue and incur

costs, and for which discrete financial information is available.

Identification of segments is based on internal reporting to the

chief operating decision maker ("CODM"). The CODM, who is

responsible for allocating resources and assessing performance of

the operating segments, has been identified as the Chief Executive

Officer ("CEO"). The Group does not divide its operations into

different segments, and the CODM operates and manages the Group's

entire operations as one segment, which is consistent with the

Group's internal organisation and reporting system.

Geographic information (including continuing and discontinued

operations)

Six months Six months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

$000 $000 $000

Unaudited Unaudited Audited

North America 17,216 31,465 49,226

Europe 10,063 11,242 20,725

Rest of World 768 353 652

---------- ---------- ------------

Total revenues from identified

locations 28,047 43,060 70,603

Revenues from unidentified

locations 1,376 1,468 3,135

---------- ---------- ------------

29,423 44,528 73,738

========== ========== ============

3. Supplementary information continued

a. Revenue and operating segments continued

The table below shows the verticals which are defined as

continuing operations and discontinued operations are per IFRS 5

'Non-current Assets Held for Sale and Discontinued Operations':

Revenues by vertical

Six months Six months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

$000 $000 $000

Unaudited Unaudited Audited

North America Sports 4,082 9,620 18,065

Media Partnerships 12,154 21,386 28,398

Gaming 7,359 8,403 15,602

Europe Sports 5,197 3,866 8,870

---------- ---------- ------------

Revenue from continuing operations 28,792 43,275 70,935

---------- ---------- ------------

Blueclaw - 421 870

Personal Finance 631 832 1,933

---------- ---------- ------------

Revenue from discontinued operations 631 1,253 2,803

----------

29,423 44,528 73,738

========== ========== ============

b. Discontinued operations

For the six months ended 30 June 2023, the Group classified the

Personal Finance and the Blueclaw businesses as discontinued

operations based on strategic decisions. Revenue and expenses, and

gains and losses relating to the discontinuation of these

activities are shown as a single line item on the face of the

statement of profit or loss as "Loss for the period from

discontinued operations (net of tax)", with the comparative figures

being restated as required by IFRS 5 'Non-current Assets Held for

Sale and Discontinued Operations'.

Profit or loss

The financial results of discontinued operations were as

follows:

Six months Six months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

$000 $000 $000

Unaudited Unaudited Audited

Revenue 631 1,253 2,803

Expenses:

Operating (781) (1,916) (3,755)

Sales and marketing (234) (664) (1,219)

Impairment reversal / (charge)

(see Note 3d) 2,050 (3,486) (13,835)

Profit / (loss) before taxes

on income 1,666 (4,813) (16,006)

Tax (charge) / credit (3,182) - 3,182

----------------

Loss from discontinued operations (1,516) (4,813) (12,824)

================ ========== ============

3. Supplementary information continued

b. Discontinued operations continued

Prior to the sale of the Personal Finance business, the Group

assessed the recoverable amount of the assets and in accordance

with IAS 36 'Impairment of Assets', reversed previous impairment

charges by $2,050,000, reflecting the consideration received in the

sale (see Note 3c).

Taxation from discontinued operations in the six months ended 30

June 2023 reflects the subsequent reversal of the deferred tax

credit for the impairment charge incurred in the year ended 31

December 2022 upon sale of the Personal Finance business.

Cash flows

Six months Six months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

$000 $000 $000

Unaudited Unaudited Audited

Loss for the period (1,516) (4,813) (12,824)

Impairment (reversal) / charge (2,050) 3,486 13,835

Tax charge / (credit) 3,182 - (3,182)

Cash outflow from discontinued

operations (384) (1,327) (2,171)

========== ========== ============

Cash flows from discontinued operations also include working

capital balances to support the Personal

Finance and Blueclaw businesses. These are immaterial for

disclosure in both the six months ended 30 June 2022 and in the

year ended 31 December 2022.

c. Disposal of Personal Finance discontinued operation

On 15 December 2022, the Group announced the restructuring of

the Personal Finance business with a view to selling the Personal

Finance assets. As disclosed in Note 3b above, Personal Finance was

disclosed as a discontinued operation in the annual consolidated

financial statements for the year ended 31 December 2022.

On 30 May 2023 and 6 June 2023, the Group disposed of the assets

of the Personal Finance business for total proceeds of $2,050,000.

The disposal is detailed below:

Six months

ended 30

June 2023

$ 000

Unaudited

Consideration received 2,050

Costs of disposal (225)

Carrying value of net assets sold (2,050)

Loss on disposal after tax (225)

==========

The disposal of the Personal Finance business incurred no tax

payable. The cash generated from the disposal of the Personal

Finance business will be utilised in the day-to-day operations of

the wider business of the Group.

3. Supplementary information continued

d. Cash Generating Unit ("CGU") impairments

The Group tests goodwill and intangible assets with indefinite

useful life for impairment annually or when whenever events or

changes in circumstances indicate that the carrying amount is not

recoverable. The Directors do not believe there has been a trigger

for an impairment review of the carrying value of goodwill and

intangible assets with indefinite useful lives during the six

months ended 30 June 2023. As such, the Group concluded that the

recoverable amount for each CGU is in excess of the carrying value

recognised in the statement of financial position.

The Group has also assessed its intangible assets with

indefinite useful life for any changes in the estimates used to

determine the asset's recoverable amount. For the assets in the

Personal Finance disposal (see Note 3c) and the three European

Gaming domains and associated websites disposed of shortly after

the end of the reporting period end (see Note 3h), the Group deemed

the recoverable amount to be the consideration agreed with the

third party buyers.

As such, $4,000,000 has been recognised as an impairment

reversal within continuing operations in the six months ended 30

June 2023 for the three European Gaming domains and associated

websites. For the Personal Finance assets, as these relate to a

discontinued operation, the impairment reversal of $2,050,000 has

been recognised within discontinued operations in the line "Loss

for the period from discontinued operations (net of tax)" in the

six months ended 30 June 2023.

e. Impairment of Other financial assets

On 28 February 2022, the Group converted a loan receivable from

Xineoh Technologies Inc. to shares giving the Group a 2.6% stake in

ordinary shares with no special rights. The Group elected to

designate the equity investment as at fair value through Other

Comprehensive Income.

For the six months ended 30 June 2023, the Group has reviewed

the financial performance of Xineoh Technologies Inc. and have

concluded that the carrying value of $242,000 was fully impaired.

This impairment charge has been recognised in Other Comprehensive

Income as "Impairment of equity investment".

f. Grant of Performance Stock Units

On 11 May 2023, the Group granted 6,850,000 of Performance Stock

Units ("PSUs") under the XLMedia 2020 Global Share Incentive Plan

(the "awards") to the Executive Committee members, including the

Executive Directors of the Group. The awards represent 2.61% of the

currently issued share capital of the Group.

The awards will vest on the third anniversary of the grant date

if and to the extent that the performance target will be satisfied.

The PSU award is a contingent right to acquire shares for no

consideration. It is subject to a three-year performance period,

with vesting subject to the achievement of performance measured by

reference to total shareholder return over the performance period

as compared to the FTSE AIM 100, followed by a two-year holding

period.

The following table specifies the inputs used for the fair value

measurement using the Monte Carlo simulation:

3. Supplementary information continued

f. Grant of Performance Stock Units continued

2023

May PSU

Weighted average fair values at the measurement date ($) 0.08

Shares granted 6,850,000

Expected volatility of the share price (%) 72.14

Risk-free interest rate (%) 3.56

Expected life of share options (years) 3

Weighted average share price (GBP) 0.1175

The total fair value was calculated at $650,000 at the grant

date which will be recognised on a straight line basis over the

vesting period.

g. Cash generated from operations

Six months

Six months ended Year ended

ended 30 30 June 31 December

June 2023 2022 2022

$000 $000 $000

Unaudited Unaudited Audited

Profit / (loss) for the period 4,727 504 (9,439)

Adjustments to reconcile profit /

(loss) for the period:

Depreciation and amortisation 3,499 3,600 7,313

Impairment reversal for continuing

operations (4,000) - -

Impairment (reversal) / charge for

discontinued operations (2,050) 3,486 13,835

Net finance expense 152 257 450

Loss on disposal of property and

equipment - 227 157

Loss on disposal of intangible assets 225 - -

Other income (907) - -

Cost of share-based payments 440 509 858

Tax charge / (credit) from continuing

operations 605 (2,198) 1,604

Tax charge / (credit) from discontinued

operations 3,182 - (3,182)

Exchange differences on balances

of cash and cash equivalents (309) 1,477 1,297

Working capital changes:

Decrease in trade receivables (1) 2,088 2,914 3,002

(Increase) / decrease in other receivables

(1) (3,349) 598 2,665

(Decrease) / increase in trade payables

(1) (2,203) 207 1,322

Increase / (decrease) in other liabilities

and accounts payable (1) 1,102 (1,959) (5,235)

----------

Cash generated from operations 3,202 9,622 14,647

========== ========== ============

Total working capital outflow (the sum of items marked 1 in the

table above) was $2,362,000

(30 June 2022: $1,760,000 inflow; 31 December 2022: $1,754,000

inflow).

3. Supplementary information continued

h. Subsequent events

Following IAS 10 'Events after the Balance Sheet Date', the

Group continues to disclose events that it considers material where

the non-disclosure of which could influence the economic decisions

of users of the financial statements.

On 12 July 2023, the Group sold three European Gaming domains

and associated websites, casino.se, casino.gr, and casino.pt, for a

total upfront cash consideration of $4,000,000.

The Directors considered this transaction to be an adjusting

post balance sheet event for the six months ended 30 June 2023.

Whilst the cash consideration was not received in the reporting

period, the consideration agreed has been recognised as "Other

receivables" and the recoverable amount of the intangible assets

relating to the transaction have been revalued to the consideration

agreed as this reflects the recoverable amount (see Note 3d for

more details).

The profit or loss on disposal of the assets will be recognised

fully in the consolidated financial statements for the year ended

31 December 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIGDCLDDDGXR

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

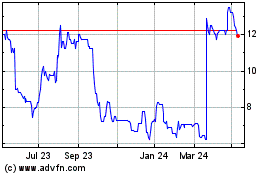

Xlmedia (LSE:XLM)

Historical Stock Chart

From Apr 2024 to May 2024

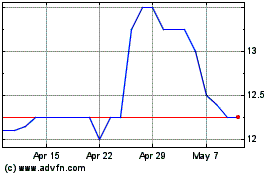

Xlmedia (LSE:XLM)

Historical Stock Chart

From May 2023 to May 2024