MLPs represent an attractive investment option for income-focused

investors in the current rock-bottom interest rate

environment. In addition to high yields, MLPs have relatively

stable cash flows and solid growth potential. No wonder they have

surged in popularity in recent years.

Why invest in MLPs?

Most MLPs are in involved in processing and transportation of

energy commodities such as natural gas, crude oil, and refined

products, under long term contracts.

As such they have relatively consistent and predictable cash

flows, unlike exploration and production (E&P) companies, whose

profits are highly correlated with commodity prices.

As MLPs are structured as pass-through entities—they do not pay

taxes at the entity level and are thus are able to pay out most of

their earnings to investors. (Read: 3 Excellent ETFs for Income

Investors)

Further, MLPs have low correlations with many other asset

classes including equities and commodities and thus add

diversification benefits to the portfolios.

As the energy industry continues to evolve and grow with

revolutionary developments in the field of unconventional energy,

MLPs represent a great way to benefit from the growth.

Tax Issues

MLPs come with complicated tax issues and many investors avoid

investing in them only due to daunting tax requirements. MLPs issue

complicated K-1s and further, since the pipelines run through

several states, the investors may be required to file tax returns

for all those states, in some cases.

Thankfully for the investors, some of the tax complexities can

be avoided by owning them in ETP form. The payouts by the ETPs are

reported as ordinary income on Form 1099, and therefore the K-1

forms are not required. (Read: Retire Early with these Dividend

ETFs)

MLP ETFs or ETNs?

Funds that have more than 25% of their assets invested in MLPs

are treated as C corporations for tax purposes. Further, the assets

are required to be marked to market and a deferred tax liability

for the unrealized gains needs to be recorded.

As a result, MLP ETFs have significant tracking errors. Most

popular MLP ETF Alerian MLP ETF (AMLP) has returned 22.34% since

inception, while the underlying index returned 38.37%, as of

December 31, 2012.

As a result of the adverse tax issues, AMLP’s expense ratio

before deferred taxes is 0.85% but gross expense ratio is extremely

high at 4.86% .

Despite its underperformance relative to the index, investors

have continued to pour money into the fund, which has accumulated

more than $5.7 billion in AUM so far. One advantage of investing in

AMLP is its less volatility compared with MLP ETNs. Lower

volatility results from its ability to reverse some of deferred tax

liabilities when the market is down.

ETNs typically eliminate some of these complex tax consequences

as they do actually not hold any securities. However the investors

should remember than ETNs are unsecured debt instruments and carry

credit risk. (Read: ETF ETF Investors--Beware The Coming ETN

Backlash)

|

|

SPY

|

AMLP

|

AMJ

|

MLPI

|

MLPN

|

|

Annualized Std. Dev. (%)*

|

13.85

|

11.20

|

16.37

|

15.88

|

16.82

|

|

Annualized Returns (%)**

|

10.16

|

7.66

|

13.89

|

15.53

|

12.08

|

|

12- month Yield (%)

|

2.03

|

5.72

|

4.54

|

4.40

|

4.74

|

*Based on monthly returns using 2 years’ price data

**Based on average monthly returns using 2 years’ price data

Below we have highlighted three popular MLP ETNs.

JPMorgan Alerian MLP Index ETN (AMJ)

AMJ is the most popular ETN in the MLP space with about

$5.7 billion in assets under management and daily volume over 1.2

million shares.

Launched in April 2009, this ETN is based on the Alerian MLP

Index, which tracks the performance of 50 largest companies in the

energy MLP sector.

The note charges investors 85 basis points a year in fees for

its services and pays out an attractive yield of 4.6%

currently.

The investors should note that the ETNs are subject to maximum

issuance limit and this ETN stopped issuing new notes in June 2012.

Investors who buy this ETF at a premium to its NAV incur the risk

of loss in case they sell when the premium is no longer present.

However as of now, the ETN is trading close to its NAV.

UBS ETRACS Alerian MLP Infrastructure ETN

(MLPI)

MLPI focuses on the infrastructure space within the MLP world.

The note tracks the Alerian MLP Infrastructure Index, which is

comprised of 25 energy infrastructure MLPs.

The product has attracted $748 million in AUM and trades in

volumes approaching 65,000 shares a day.

This note also charges 85 basis points a year for expenses and

pays out a yield of 4.40%.

Credit Suisse Cushing 30 MLP Index ETN

(MLPN)

MLPN tracks the Cushing 30 MLP Index, which holds MLPs owning

mid-stream energy infrastructure assets in North America. It is an

equal weighted index, rebalanced on a quarterly basis. The ETN was

launched in April 2010.

The note has so far attracted $391.2 million in assets. This

note also charges 85 basis points a year for expenses and pays out

a yield of 4.74% currently.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

JPM-ALERN MLP (AMJ): ETF Research Reports

ALERIAN-MLP (AMLP): ETF Research Reports

E-TRC UBS ALERN (MLPI): ETF Research Reports

CS-CUSHING 30 (MLPN): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

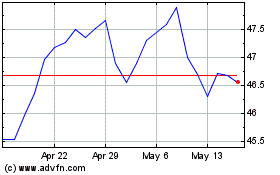

Alerian MLP (AMEX:AMLP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Alerian MLP (AMEX:AMLP)

Historical Stock Chart

From Nov 2023 to Nov 2024