As filed with the Securities and Exchange

Commission on February 2, 2024

Registration No. 333-263425

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 2 TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

ETF Managers Group Commodity Trust I

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation

or organization)

6221

(Primary Standard Industrial Classification

Code Number)

36-4793446

(I.R.S. Employer Identification No.)

c/o ETF Managers Capital LLC

350 Springfield Avenue,

Suite 200

Summit, NJ 07901

Phone: (908) 897-0518

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

|

Christian W. Magoon

Chief Executive Officer

Amplify Investments LLC

3333 Warrenville Road

Suite 350

Lisle, IL 60532

Phone: (855) 267-3837

(Name, address, including zip code, and

telephone

number, including area code, of agent for service) |

Matthew J. Bromberg

Chief Executive Officer

ETF Managers Capital LLC

350 Springfield Avenue,

Suite 200

Summit, NJ 07901

Phone: (908) 897-0518

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

|

Copy to:

Eric D. Simanek, Esq.

Eversheds Sutherland (US) LLP

700 Sixth Street, N.W.

Washington, D.C. 2001

(202) 220-8412

Approximate date of commencement of proposed sale

to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☐ |

If an emerging growth company,

indicate by check mark if the registrant has elected to not use the extended transition period for complying with any new or revised financial

reporting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The registrant hereby amends this Registration Statement on such

date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states

that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until

this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PROSPECTUS

Breakwave Dry Bulk Shipping ETF

*Principal U.S. Listing Exchange: NYSE Arca, Inc.

The Breakwave Dry Bulk Shipping ETF (the “Fund”), a series

of the Amplify Commodity Trust (the “Trust”), is an exchange traded fund that issues shares that trade on the NYSE Arca, Inc.

stock exchange (“NYSE Arca”). The Fund’s investment objective is to provide investors with exposure to the daily change

in the price of dry bulk freight futures by tracking the performance of a portfolio (the “Benchmark Portfolio”) consisting

of exchange-cleared futures contracts on the cost of shipping dry bulk freight (“Freight Futures”). The Fund seeks to achieve

its investment objective by investing substantially all of its assets in the Freight Futures currently constituting the Benchmark Portfolio.

The Benchmark Portfolio is maintained by Breakwave Advisors LLC (“Breakwave”), which also serves as the Fund’s commodity

trading advisor.

The Fund and the Trust are managed and controlled by their sponsor

and investment manager, Amplify Investments LLC (the “Sponsor”). Effective [ ], ETF Managers Capital LLC, as the prior sponsor

and commodity pool operator (“ETFMC” or the “Former Sponsor”) of the Trust, transferred the roles of the Former

Sponsor to the Sponsor. The Fund is obligated to pay the Sponsor a management fee (the “Sponsor Fee”), calculated daily

and paid monthly, equal to the greater of (i) 0.15% per year of the Fund’s average daily net assets; or (ii) $125,000. The Fund

also pays Breakwave a license and service fee in an amount equal to 1.45% per year of the value of the Fund’s average daily net

assets (the “CTA Fee” and, together with the Sponsor Fee, the “Management Fee”). The Fund is responsible for

paying all of the routine operational, administrative and other ordinary expenses of the Fund, (collectively, “Other Expenses”).

Breakwave has agreed to waive its CTA Fee and the Sponsor has agreed to assume the Fund’s Other Expenses (excluding brokerage fees,

interest expenses, and extraordinary expenses) so that the Fund’s total annual expenses (“Total Expenses”) (i.e., the

Management Fee plus Other Expenses) do not exceed 3.50% per annum through December 31, 2024 (the “Expense Cap”). The Fund

may also be responsible for brokerage fees, interest expense, and certain non-recurring or extraordinary fees and expenses. Breakwave

may, during the term of the waiver, recoup any fees waived pursuant to the contract; however, the Fund will only make

repayments to Breakwave if such repayment does not cause the Fund’s expense ratio after the repayment is taken into account, to

exceed either (i) the expense cap in place at the time such amounts were waived, or (ii) the Fund’s current expense cap. Such recoupment

is limited to three years from the date the amount is initially waived.

The Fund is an exchange traded fund. This means that most investors

who decide to buy or sell shares of the Fund shares place their trade orders through their brokers and may incur customary brokerage commissions

and charges. Shares trade on the NYSE Arca under the ticker symbol “BDRY” and are bought and sold throughout the trading day

at bid and ask prices like other publicly traded securities.

Shares trade on the NYSE Arca after they are initially purchased by

“Authorized Participants,” institutional firms that purchase shares in blocks of 25,000 shares called “Baskets”

(referred to herein as a “Creation Basket” or “Redemption Basket,” as applicable) through the Fund’s distributor,

Foreside Fund Services, LLC (the “Marketing Agent”). The price of a basket is equal to the net asset value of 25,000 shares

on the day that the order to purchase the basket is accepted by the Marketing Agent. The net asset value is calculated by taking the current

market value of the Fund’s total assets (after close of NYSE Arca) subtracting any liabilities and dividing that total by the total

number of outstanding shares. Authorized Participants may then offer to the public, from time to time, shares from any Creation Basket

they create at a per-share market price. The offering of the Fund’s shares is a “best efforts” offering, which means

that neither the Marketing Agent nor any Authorized Participant is required to purchase a specific number or dollar amount of shares.

The Fund pays a distribution fee equal to 0.01% of average Fund net assets, with a minimum of $10,000 per year. Authorized Participants

will not receive from the Fund, the Sponsor or any of their affiliates any fee or other compensation in connection with the sale of shares.

Investors who buy or sell shares during the day from their broker may

do so at a premium or discount relative to the NAV of the Fund’s total net assets due to supply and demand forces at work in the

secondary trading market for shares that are closely related to, but not identical to, the same forces influencing the prices of the Freight

Futures in which the Fund invests and cash or other cash equivalents that the Fund holds. Investing in the Fund involves significant risks.

See “Risk Factors Involved with an Investment in the Fund” beginning on page 6.

The Fund is not a mutual fund registered under the Investment Company

Act of 1940 (“1940 Act”) and is not subject to regulation under such act. See “The Fund is not a registered investment

company so shareholders do not have the protections of the 1940 Act” on page 16.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED

OR DISAPPROVED OF THE SECURITIES OFFERED IN THIS PROSPECTUS, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION

TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Fund is a commodity pool and the Sponsor is a commodity pool operator

subject to regulation by the CFTC and the National Futures Association (“NFA”) under the Commodity Exchange Act, as amended.

The Sponsor is registered with the CFTC as a commodity pool operator and is a member of the NFA.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE

MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

The date of this prospectus is [__], 2024

COMMODITY FUTURES TRADING COMMISSION RISK DISCLOSURE

STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS

YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT COMMODITY INTEREST TRADING CAN QUICKLY LEAD TO LARGE LOSSES

AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN

THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR

MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL

TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE

TO BE CHARGED THIS POOL AT PAGE 37 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT

OF YOUR INITIAL INVESTMENT, AT PAGE 4.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS

NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU

SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING THE DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGE 6.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE

FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO

A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS.

FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS

IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

Table of Contents

Prospectus

Summary

This is only a summary of the prospectus and, while it contains

material information about the Breakwave Dry Bulk Shipping ETF (the “Fund”) and its shares, it does not contain or summarize

all of the information about the Fund and the shares contained in this prospectus that is material and/or which may be important to you.

You should read this entire prospectus, including “Risk Factors Involved with an Investment in the Fund” beginning on page

6, before making an investment decision about the shares. For a glossary of defined terms, see Appendix A.

The Fund is a series of Amplify Commodity Trust (the “Trust”),

a Delaware statutory trust formed on July 23, 2014. The Trust is a series trust formed pursuant to the Delaware Statutory Trust Act, and

the Trust is currently organized into two separate series, the Breakwave Tanker Shipping ETF (“BWET”), which commenced operations

on May 3, 2023, and the Fund. The Fund is a commodity pool that continuously issues common shares of beneficial interest that may be purchased

and sold on the NYSE Arca, Inc. stock exchange (“NYSE Arca”). The Fund is managed and controlled by Amplify Investments LLC

(the “Sponsor”), a Delaware limited liability company. The Sponsor is registered with the Commodity Futures Trading Commission

(“CFTC”) as a commodity pool operator (“CPO”) and is a member of the National Futures Association (“NFA”).

Breakwave Advisors LLC (“Breakwave”) is registered as a “commodity trading advisor” (“CTA”) with the

CFTC and serves as the Fund’s commodity trading advisor.

The principal office of the Sponsor, Trust and Fund is located

at 3333 Warrenville Road, Suite 350, Lisle, IL 60532. The telephone number for each is (855) 267-3837.

Effective [ ], ETF Managers Capital LLC,

as the prior sponsor and commodity pool operator (“ETFMC” or the “Former Sponsor”) of the Trust, entered into

an agreement (the “Transfer Agreement”) to resign as Sponsor to the Trust and transfer its role as the Trust’s sponsor

to the Sponsor. Under the terms of the Transfer Agreement, the Former Sponsor no longer has any involvement in the operations, management

or marketing of the Fund. Breakwave will continue to serve as the Fund’s commodity trading advisor. The Sponsor, Former Sponsor,

Breakwave and the Trust do not believe that the change of Trust sponsor will have any impact on a shareholder’s investment in the

Fund.

Breakeven Point

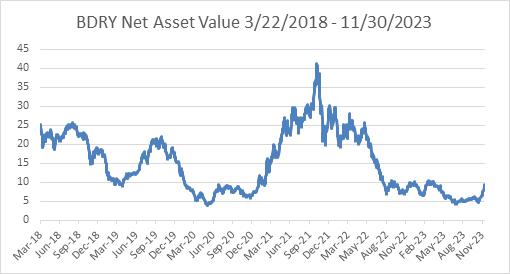

In order for a hypothetical investment in shares to break even over

the next 12 months, assuming a selling price of $9.33 (the closing price per share as of November 30, 2023), the investment would have

to generate a 0.00% return or $0.00.

The Fund’s Investment Objective and Strategy

The Fund’s investment objective is to provide investors with

exposure to the daily change in the price of dry bulk freight futures, before expenses and liabilities of the Fund, by tracking the performance

of a portfolio (the “Benchmark Portfolio”) consisting of a three-month strip of the nearest calendar quarter of futures contracts

on specified indexes (each a “Reference Index”) that measure rates for shipping dry bulk freight (“Freight Futures”).

Each Reference Index is published each United Kingdom business day by the London-based Baltic Exchange Ltd. (the “Baltic Exchange”)

and measures the charter rate for shipping dry bulk freight in a specific size category of cargo ship – Capesize, Panamax or Supramax.

The three Reference Indexes are as follows:

| |

● |

Capesize: the Capesize 5TC Index; |

| |

|

|

| |

● |

Panamax: the Panamax 4TC Index; and |

| |

|

|

| |

● |

Supramax: the Supramax 10TC Index. |

The value of the Capesize 5TC Index is disseminated at 11:00 a.m.,

London Time and the value of the Panamax 4TC Index and the Supramax 10TC Index each is disseminated at 1:00 p.m., London Time. The Reference

Index information disseminated by the Baltic Exchange also includes the components and value of each component in each Reference Index.

Such Reference Index information also is widely disseminated by Reuters and/or other major market data vendors.

The Fund seeks to achieve its investment objective by investing substantially

all of its assets in the Freight Futures currently constituting the Benchmark Portfolio. The Benchmark Portfolio includes all existing

positions to maturity and settle them in cash. During any given calendar quarter, the Benchmark Portfolio will progressively increase

its position to the next calendar quarter three-month strip, thus maintaining constant exposure to the Freight Futures market as positions

mature.

The Benchmark Portfolio maintains long-only positions in Freight Futures.

The Benchmark Portfolio includes a combination of Capesize, Panamax and Supramax Freight Futures. More specifically, the Benchmark Portfolio

includes 50% exposure in Capesize Freight Futures contracts, 40% exposure in Panamax Freight Futures contracts and 10% exposure in Supramax

Freight Futures contracts. The Benchmark Portfolio does not include and the Fund will not invest in swaps, non-cleared dry bulk freight

forwards or other over-the-counter derivative instruments that are not cleared through exchanges or clearing houses. The Fund may hold

exchange-traded options on Freight Futures. The Benchmark Portfolio is maintained by Breakwave and will be rebalanced annually. The Freight

Futures currently constituting the Benchmark Portfolio, as well as the daily holdings of the Fund are available on the Fund’s website

at www.drybulketf.com.

When establishing positions in Freight Futures, the Fund is required

to deposit initial margin with a value of approximately 10% to 40% of the notional value of each Freight Futures position at the time

it is established. These margin requirements are established and subject to change from time to time by the relevant exchanges, clearing

houses or the Fund’s futures commission merchant (“FCM”). On a daily basis, the Fund is obligated to pay, or entitled

to receive, variation margin in an amount equal to the change in the daily settlement level of its Freight Futures positions. Any assets

not required to be posted as margin with the FCM are held at the Fund’s custodian in cash or cash equivalents, as discussed below.

The Fund holds cash or cash equivalents such as U.S. Treasuries or

other high credit quality, short-term fixed-income or similar securities for direct investment or as collateral for the U.S. Treasuries

and for other liquidity purposes and to meet redemptions that may be necessary on an ongoing basis. The Fund may also realize interest

income from its holdings in U.S. Treasuries or other market rate instruments.

The Fund was created to provide investors with a cost-effective and convenient way to gain exposure to daily

changes in the price of Freight Futures. The Fund is intended to be used as a

diversification opportunity as part of a complete portfolio, not a complete investment program.

Principal Investment Risks of an Investment in the Fund

An investment in the Fund involves risk. As with any investment, you

could lose all or part of your investment in the Fund, and the Fund’s performance could trail that of other investments. The Fund

is subject to the principal risks noted below which may adversely affect the Fund’s NAV, trading price, total return and ability

to meet its investment objective. Some of the risks you may face are summarized below. A more extensive discussion of these risks appears

beginning on page 6.

Investment Risk

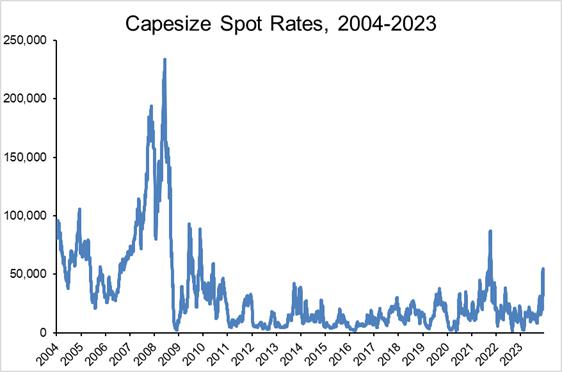

Investments in Freight Futures typically fluctuate in value with changes

in spot charter rates. Charter rates for dry bulk vessels are volatile and have declined significantly since their historic highs and

may remain at low levels or decrease further in the future.

The recent conflict between Russia and Ukraine can potentially have

a significant impact on dry bulk shipping. Russia and Ukraine combined, accounts for more than a quarter of global grain exports which

are traditionally transported by dry bulk vessels. A prolonged stoppage of exports out of the broader region will lead to lower demand

for dry bulk vessels and, as a result, lead to lower freight rates. In addition, Russia has traditionally been a major coal exporter to

Europe, a commodity that is also primarily transported by sea, and thus, the recent sanctions might lead to lower coal volumes out of

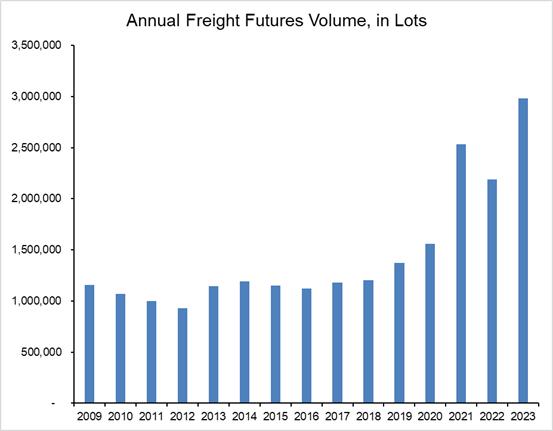

Russia. As volatility of spot charter rates increases, higher trading volumes in Freight Futures would be expected as market participants

tend to increase their hedging requirements.

Futures and Options Market Risk

Futures and options contracts have expiration dates. Before or upon

the expiration of a contract, the Fund may be required to enter into a replacement contract that is priced higher or that have less favorable

terms than the contract being replaced (see “Negative Roll Risk,” below). The Freight Futures market settles in cash against

published indices, so there is no physical delivery against the futures contracts.

Negative Roll Risk

Similar to other futures contracts, the Freight Futures curve shape

could be either in “contango” (where the futures curve is upward sloping with next futures price higher than the current one)

or “backwardation” (where each the next futures price is lower than the current one). Contango curves are generally characterized

by negative roll cost, as the expiring contract value is lower that the next prompt contract value, assuming the same lot size. That means

there could be losses incurred when the contracts are rolled each period and such losses are independent of the Freight Futures price

level. See the section titled “Impact of Futures Roll on Total Returns and Fund Allocation” below for more information.

Tax Risk

The Trust is organized as a Delaware statutory trust but taxed as a

partnership in accordance with the provisions of the governing trust agreement and applicable state law and, therefore, has a more complex

tax treatment than conventional mutual funds. Because the Fund expects to be treated as a partnership for U.S. federal income tax purposes,

the Fund will furnish shareholders each year with tax information on IRS Schedule K-1 (Form 1065) and each U.S. shareholder, and potentially

each non-U.S. shareholder is required to report on its U.S. federal income tax return, and may be subject to U.S. withholding tax with

respect to, its allocable share of income, gain, loss and deduction of the Fund. In addition, payments to each non-U.S. shareholder may

be subject to U.S. withholding tax. The tax reporting of a partnership interest can be complex and shareholders may be advised to consult

a tax expert.

Market Trading Risk

Shares of the Fund trade on the NYSE Arca and are bought and sold throughout

the trading day at bid and ask prices like other publicly traded securities. Such secondary market trading creates risk for investors

in Fund shares, including, but not limited to, the potential lack of an active market for Fund shares, losses from trading in secondary

markets, and periods of high volatility and disruption in the process through which shares of the Fund are sold and redeemed. During periods

of unusual volatility or market disruptions, market prices of Fund shares may deviate significantly from the market value of the Fund’s

portfolio investments or the NAV of Fund shares. Any of these factors may lead to the Fund’s shares trading at a premium or discount

to its NAV.

Liquidity Risk

The Freight Futures trade off-exchange, without dedicated market makers.

As such, liquidity relies purely on the willingness of various market participants to engage voluntarily on a principal-to-principal basis

in trading. As a result, periods of limited pricing or no pricing might exist. During such periods, the Fund’s shares could trade

at a significant premium or discount to its NAV. In addition, a lack of liquidity could prevent the Fund from implementing its investment

strategy, rolling its positions or achieving its targeted weights among futures contracts.

Management Risk

The investment strategy used by the Sponsor or its implementation may

not produce the intended results.

Concentration Risk

The Fund invests solely in Freight Futures. Such concentration may

result in a high degree of volatility in the net asset value of the Fund under specific market conditions and over time.

Other Risks

The Fund pays fees and expenses that are incurred regardless of whether

it is profitable. In order for an investor making an investment in shares of the Fund to break even over the 12-month period following

the date of this prospectus, assuming a selling price of $9.33 (the closing price per share as of November 30, 2023), the investment would

have to generate a 0.00% return or $0.00 for the investor not to lose money.

Unlike mutual funds, commodity pools or other investment pools that

manage their investments in an attempt to realize income and gains and distribute such income and gains to their investors, the Fund generally

does not distribute cash to shareholders. You should not invest in the Fund if you will need cash distributions from the Fund to pay taxes

on your share of income and gains of the Fund, if any, or for any other reason.

You will have no rights to participate in the management of the Fund

and will have to rely on the duties and judgment of the Sponsor to manage the Fund.

The Fund is subject to actual and potential inherent conflicts involving

the Sponsor and its principals, various commodity futures brokers and Authorized Participants. The Sponsor’s officers, directors

and employees do not devote their time exclusively to the Fund. The Sponsor’s directors, officers or employees may serve in the

same or different functions with other entities that may compete with the Fund for their services, including other commodity pools that

the Sponsor or its trading principal manages or may manage in the future. These persons could have a conflict between their responsibilities

to the Fund and to those other entities.

There can be no assurance that the Fund will grow to or maintain an

economically viable size, in which case the Sponsor may liquidate the Fund. Investors could lose part or all their investment.

While certain of the Sponsor’s principals have experience

with investing in commodity interests, the Sponsor has been formed for the purpose of sponsoring the Trust and serving as the Fund’s

commodity pool operator and has never operated a commodity pool or traded other commodity accounts. If the experience of

the Sponsor and its management is not adequate or suitable, the operation and performance of the Fund may be adversely affected.

Breakeven Analysis

The breakeven analysis below indicates the approximate dollar returns

and percentage required for the redemption value of a hypothetical initial investment in a single share of the Fund to equal the amount

invested twelve months after the investment was made. For purposes of this breakeven analysis, the price of $9.33 per share, which was

the price per share as of the close of trading on November 30, 2023, is assumed. You should note that you may pay brokerage commissions

on purchases and sales of the Fund’s shares, which are not reflected in the table; however, the Fund’s brokerage fees and

commissions are included (those costs associated with rolling futures).

This breakeven analysis refers to the redemption of Baskets by Authorized

Participants and is not related to any gains an individual investor would have to achieve in order to break even. The breakeven analysis

is an approximation only.

| Assumed initial selling price

per share |

|

$ |

9.33 |

|

| |

|

|

|

|

| Management, License and Service Fees(1) |

|

$ |

0.16 |

|

| |

|

|

|

|

| Creation Basket fee(2) |

|

$ |

(0.01 |

) |

| |

|

|

|

|

| Estimated Brokerage Fee(3) |

|

$ |

0.07 |

|

| |

|

|

|

|

| Other Fund Fees and Expenses(4) |

|

$ |

0.14 |

|

| |

|

|

|

|

| Interest Income(5) |

|

$ |

(0.49 |

) |

| |

|

|

|

|

| Amount of trading income required for the Fund’s

NAV to break even |

|

$ |

0.00 |

|

| |

|

|

|

|

| Percentage of initial selling price per share(6) |

|

|

0.00 |

% |

| (1) |

The Fund is obligated to pay the Sponsor a Sponsor Fee, payable monthly, equal to the greater of (i) 0.15% per year of the Fund’s average daily net assets; or (ii) $125,000. The Fund also pays Breakwave a license and service fee, paid monthly in arrears, for the use of the Benchmark Portfolio in an amount equal to 1.45% per annum of the value of the Fund’s average daily net assets. Average daily net assets are calculated daily by taking the average of the total net assets of the Fund over the calendar year – i.e., the sum of daily total net assets divided by the number of calendar days in the year. On days when markets are closed, the total net assets are the total net assets from the last day when the market was open. The amount presented is based on the Fund’s total assets as of November 30, 2023 and incorporates the Sponsor’s and Breakwave’s contractual agreements to waive their fees and/or assume Fund expenses (excluding brokerage fees, interest expense, and extraordinary expenses) to cap Total Annual Fund Expenses at 3.50% (see note 6 below). |

| (2) |

Authorized Participants are required to pay a Creation Basket fee of $300 for each order they place to create one or more Baskets. An order must be at least one Basket, which is 25,000 shares. This breakeven analysis assumes a hypothetical investment in a single share so the Creation Basket fee is $0.01 (300/25,000). |

| (3) |

Brokerage commissions represent the cost of rolling the futures four times in 12 months, in line with the roll methodology of the Fund. Each time, a 0.10% commission applies to the nominal amount. In addition, exchange and FCM clearing fees are included, based on the nominal amount, and lot estimates based on futures prices as of December 19, 2023. |

| (4) |

Other Fund Fees and Expenses include, among others, legal, printing, accounting, distribution, custodial, administration, bookkeeping, and transfer agency costs. This amount is based on estimated expenses calculated on an annualized basis. The Former Sponsor has paid all of the expenses related to the organization of the Fund and offering of the shares in this prospectus. |

| (5) |

The Fund earns interest on its investments and funds it deposits with the futures commission merchant and the custodian, U.S. Treasuries, and money market funds at an estimated interest rate of 5.3%. This is a rate based on the rate of interest earned on three-month Treasury bills as of October 31, 2023. The actual rates may vary. |

| (6) |

Breakwave has agreed to waive its fee and the Sponsor has agreed to assume the Fund’s Other Expenses (which term excludes

brokerage fees, interest expenses, and extraordinary expenses) so that the Fund’s total annual expenses do not exceed 3.50%

per annum through December 31, 2024. Breakwave may, during the term of the waiver, recoup any fees waived pursuant

to the contract; however, the Fund will only make repayments to Breakwave if such repayment does not cause the Fund’s expense

ratio after the repayment is taken into account, to exceed either (i) the expense cap in place at the time such amounts were waived,

or (ii) the Fund’s current expense cap. Such recoupment is limited to three years from the date the amount is initially waived.

After December 31, 2024, the expense limitation may be terminated and Fund shareholders may incur expenses higher than 3.50% annually,

perhaps significantly higher. The percentage of initial selling price per share in the table represents the estimated approximate

percentage of selling price per share net of any expenses or Management Fees waived or assumed by Breakwave or the Sponsor. The Fund

may also be responsible for brokerage fees, interest expense, and certain non-recurring or extraordinary fee and expenses. |

Risk

Factors Involved with an Investment in the Fund

You should consider carefully the risks described below before

making an investment decision. You should also refer to the other information included in this prospectus and in our periodic and current

reports filed with the Securities and Exchange Commission that are incorporated by reference. Such information includes the Fund’s

and the Trust’s financial statements and the related notes. See “Incorporation By Reference and Availability of Certain Information.”

An investment in the Fund involves risks. You could lose all or part

of your investment in the Fund, and the Fund’s performance could trail that of other investments. The Fund is subject to the principal

risks noted below which may adversely affect the Fund’s NAV, trading price, yield, total return and ability to meet its investment

objective.

Risks Associated with the Freight Futures

The value of the Shares of the Fund relates directly to the value

of, and realized profit or loss from, the Freight Futures and other assets held by the Fund, and fluctuations in price could materially

affect the Fund’s shares.

The NAV of the Fund’s shares relates directly to the value of

the Freight Futures, cash and cash equivalents held by the Fund and the portfolio’s average term established and maintained through

the Fund’s investment in Freight Futures. Fluctuations in the prices of these assets could materially adversely affect the value

and performance of an investment in the Fund’s shares. Past performance is not necessarily indicative of futures results; all or

substantially all of an investment in the Fund could be lost. The primary types of investment-related risk are discussed below.

The Fund and its assets are subject to the risks inherent in

dry bulk freight shipping industry.

Investments in freight futures typically fluctuate in value with changes

in spot charter rates. Charter rates for dry bulk vessels are volatile and have declined significantly since their historic highs and

may remain at low levels or decrease further in the future. As such, any decrease in spot dry bulk freight rates could lead to declines

in the value of Freight Futures which could have a negative impact on the Fund’s performance. Charter rates will vary with the supply

and demand for dry bulk freight. Geopolitical events and government actions will affect the supply and demand for dry bulk freight and,

thus, the spot charter rate. Factors that affect dry bulk freight rates include, but are not limited to:

| |

● |

Global economic growth; |

| |

|

|

| |

● |

Supply of dry bulk vessels; |

| |

|

|

| |

● |

Demand for dry bulk commodity transportation; |

| |

|

|

| |

● |

Russia-Ukraine war |

| |

|

|

| |

● |

Currency exchange rates; |

| |

|

|

| |

● |

Wars and geopolitical conflicts; |

| |

|

|

| |

● |

Closures of waterways and canals; |

| |

|

|

| |

● |

New routes and expansion of existing waterways and canals; |

| |

|

|

| |

● |

Weather and other environmental conditions; and |

| |

|

|

| |

● |

Industry and environmental regulations. |

The ongoing conflict between Russia and Ukraine, and the recent

conflict in the Middle East, has significantly increased economic risks as it relates to growth and, as a result, demand for dry bulk

commodities.

As of the date of this prospectus, the ongoing conflict between Russia

in Ukraine has developed into a war, posing an increasing risk for global economic growth. Major economic sanctions against Russia are

having a considerable impact on oil and gas prices, given the dependence of the EU on oil and gas exports out of Russia combined with

limited spare capacity of such commodities globally. Energy prices have increased significantly, leading to major inflationary pressures

in the major developed countries that rely heavily on oil and gas exports out of Russia. In addition, the combined Russia/Ukraine region

account for approximately one quarter of global grain production, one of the main cargoes transported by dry bulk vessels, while coal

and iron ore exports out of the region have also been reduced. The above factors can have a material negative impact on demand for dry

bulk transportation, while slower economic growth could also negatively affect demand for dry bulk commodities in the rest of the world,

leading to lower dry bulk freight rates.

The ongoing conflict between Russia and Ukraine is having a profound

impact on global commodities prices including grain and coal, two of the most important commodities for dry bulk shipping. Given the importance

of the region in export volumes for both grains and coal, a prolong stoppage could lead to significantly lower freight rates and thus

a decline in freight futures prices and a decline in the value of the Fund. Although coal supplies could potentially be sourced from elsewhere

partly mitigating the negative impact of the lost volumes, global grain production capacity is limited, and thus the impact of the lost

volumes could not be easily mitigated. In addition, the recent geopolitical turmoil has led to an increase in government protectionism

when it comes to commodities, and if such a trend continues, it could lead to lower bulk commodities trading globally over the long term.

The impact of such a scenario on dry bulk shipping will be negative, leading to lower spot rates and as a result lower freight futures

prices and a decline in the value of the Fund.

Most recently, Hamas attacked Israel, with Israel then declaring

war on Hamas in the Gaza Strip. This conflict has stoked fears of oil supply instability in the Middle East and globally. While not

having an immediate impact on global oil production or tanker trade patterns, escalation or expansion of hostilities, interventions by

other groups or nations, the imposition of economic sanctions on any of the oil producing nations, disruption of shipping transit in the

Straits of Hormuz or other significant trade routes such as the Red Sea and the Suez Canal, or similar outcomes could lead to oil supply

instability as well as dry bulk trade disruptions. The conflict is ongoing and, should it escalate and expand to other oil producing nations

in the region, may have a profound negative impact on oil prices and cause shipping blockages and route divergences, which could, as a

result, hamper the supply and demand for freight and negatively impact spot rates for dry bulk and dry bulk Freight Futures.

The People’s Republic of China (“China”) accounts

for a sizable part of dry bulk demand, and changes in the economic and political environment in China and policies adopted by the government

to regulate its economy may have a material adverse effect on dry bulk charter rates and as a result, Freight Futures.

The economy of China, which has been in a state of transition from

a planned economy to a more market oriented economy, differs from the economies of most developed countries in many respects, including

the level of government involvement, its state of development, its growth rate, control of foreign exchange, protection of intellectual

property rights and allocation of resources.

Although the majority of productive assets in China are still owned

by the government at various levels, in recent years, the Chinese government has implemented economic reform measures emphasizing utilization

of market forces in the development of the economy of China and a high level of management autonomy. The economy of China has experienced

significant growth in the past 20 years, but growth has been uneven both geographically and among various sectors of the economy. Economic

growth has also been accompanied by periods of high inflation. The Chinese government has implemented various measures from time to time

to control inflation and restrain the rate of economic growth.

The Chinese government has carried out economic reforms to achieve

decentralization and utilization of market forces to develop the economy of China. These reforms have resulted in significant economic

growth and social progress. There can, however, be no assurance that the Chinese government will continue to pursue such economic policies

or, if it does, that those policies will continue to be successful. Any such adjustment and modification of those economic policies may

have an adverse impact on the economy of China and, thus, the demand for dry bulk freight. Further, the Chinese government may from time

to time adopt corrective measures to control the growth of the economy which may also have an adverse impact on the economy. Political

changes, social instability and adverse diplomatic developments in China could result in the imposition of additional government restrictions

including expropriation of assets, confiscatory taxes or nationalization of some or all of the property held by companies in China. To

the extent a Fund invests in Chinese securities, its investments may be impacted by the economic, political, diplomatic, and social conditions

within China. Moreover, investments may be impacted by geopolitical developments such as China’s posture regarding Hong Kong and

Taiwan, international scrutiny of China’s human rights record to include China’s treatment of some of its minorities, and

competition between the United States and China. These domestic and external conditions may trigger a significant reduction in international

trade, the institution of tariffs, sanctions by governmental entities or other trade barriers, the oversupply of certain manufactured

goods, substantial price reductions of goods and possible failure of individual companies and/or large segments of China’s export

industry. Events such as these and their consequences are difficult to predict and could have a negative impact on the Fund’s performance,

including the loss incurred from a forced sale when trade barriers or other investment restrictions cause a security to become restricted.

Also, China generally has less established legal, accounting and financial reporting systems than those in more developed markets, which

may reduce the scope or quality of financial information relating to Chinese issuers.

China has experienced security concerns, such as terrorism and strained

international relations, as well as major health crises. These health crises include, but are not limited to, the rapid and pandemic spread

of novel viruses commonly known as SARS, MERS, and COVID-19 (Coronavirus). Such health crises could exacerbate political, social, and

economic risks previously mentioned and could reduce consumer demand or economic output, result in market closures, travel restrictions

or quarantines, and generally have a significant impact on the Chinese economy. Any adverse effects on the Chinese economy may negatively

affect demand for dry bulk freight and, thus, the value of the charter rates. In particular, any curtailing in coal usage or steel production

in China could have a material impact on dry bulk demand, and thus, dry bulk freight rates. Any changes in the charter rates could affect

the value of Freight Futures.

Illiquidity in the freight futures markets could make it impossible

for the Fund to realize profits, losses or roll positions

The Freight Futures market depends on the willingness of market participants

to engage in a principal-to-principal trading and lacks the structure of other markets where market makers are obligated to provide liquidity

at all times. As a result, periods of limited liquidity or no liquidity at all can occur. During such periods, the Fund might not be able

to execute its investment strategy, roll positions, rebalance the portfolio to desired weightings, or honor creation and redemption requests.

Freight Futures can be volatile, which could result in large

fluctuation in the price of Fund shares and should be monitored consistently by investors.

Futures contracts have a high degree of price variability and are subject

to occasional rapid and substantial changes. Because the Fund will invest substantially all of its assets in Freight Futures, you could

lose a substantial part of your investment in the Fund.

Movement in the price of freight and Freight Futures will be outside

of the Sponsor’s control and may not be anticipated by the Sponsor. The Fund is exposed to Freight Futures and thus, might experience

greater than expected volatility. The Fund is not a diversified investment vehicle, and therefore may be subject to greater volatility

than a diversified portfolio or a more diversified commodity pool.

Natural Disaster/Epidemic Risk.

Natural or environmental disasters, such as earthquakes, fires, floods,

hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics (for

example, the novel coronavirus COVID-19), have been and can be highly disruptive to economies and markets and have recently led, and may

continue to lead, to increased market volatility and significant market losses. Such natural disaster and health crises could exacerbate

political, social, and economic risks previously mentioned, and result in significant breakdowns, delays, shutdowns, social isolation,

and other disruptions to important global, local and regional supply chains affected, with potential corresponding results on the operating

performance of the Fund and its investments. A climate of uncertainty and panic, including the contagion of infectious viruses or diseases,

may adversely affect global, regional, and local economies and reduce the availability of potential investment opportunities, and increases

the difficulty of performing due diligence and modeling market conditions, potentially reducing the accuracy of financial projections.

Under these circumstances, the Fund may have difficulty achieving its investment objective which may adversely impact performance. Further,

such events can be highly disruptive to economies and markets, significantly disrupt the operations of individual companies (including,

but not limited to, the Sponsor and third party service providers), sectors, industries, markets, securities and commodity exchanges,

currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s

investments. These factors can cause substantial market volatility, exchange trading suspensions and closures and can impact the ability

of the Fund to complete redemptions and otherwise affect Fund performance and Fund trading in the secondary market. A widespread crisis

may also affect the global economy in ways that cannot necessarily be foreseen at the current time. How long such events will last and

whether they will continue or recur cannot be predicted. Impacts from these events could have significant impact on the Fund’s performance,

resulting in losses to your investment.

Risk that Current Assumptions and Expectations Could Become Outdated

As a Result of Global Economic Shocks.

The onset of the novel coronavirus (COVID-19) has caused significant

shocks to global financial markets and economies, with many governments taking extreme actions to slow and contain the spread of COVID-19.

These actions have had, and likely will continue to have, a severe economic impact on global economies as economic activity in some instances

has essentially ceased. Financial markets across the globe are experiencing severe distress at least equal to what was experienced during

the global financial crisis in 2008. In March 2020, U.S. equity markets entered a bear market in the fastest such move in the history

of U.S. financial markets. Contemporaneous with the onset of the COVID-19 pandemic in the United States, oil experienced shocks to supply

and demand, impacting the price and volatility of oil. The global economic shocks being experienced as of the date hereof may cause

the underlying assumptions and expectations of the Fund to become outdated quickly or inaccurate, resulting in significant losses.

Risks Associated with the Fund’s Operations

Execution Risk

The Fund seeks to invest its assets to the fullest extent possible

in Freight Futures to achieve its investment objective of providing investors exposure to the daily change in Freight Futures, before

Fund liabilities and expenses. However, changes in the NAV may not replicate the performance of Freight Futures due to a variety of reasons,

including but not limited to:

| |

● |

the Fund may not be able to purchase or sell the exact amount of Freight Futures required to meet its investment objective; |

| |

|

|

| |

● |

regulatory or other extraordinary circumstances may limit the Fund’s ability to create or redeem Baskets; |

| |

|

|

| |

● |

the Fund will pay certain of its fees and expenses, including brokerage fees and expenses, extraordinary expenses, the Management Fee (as described below), and a significant increase in the Fund’s liabilities and expenses could lead to underperformance of the Fund relative to daily percentage changes in the Freight Futures; |

| |

|

|

| |

● |

the Fund will employ no leverage and thus, will invest less than its available capital in Freight Futures, which could lead to underperformance compared to the performance of the Freight Futures market; |

| |

|

|

| |

● |

an imperfect correlation between the performance of Freight Futures held by the Fund and the Fund’s NAV; |

| |

|

|

| |

● |

bid-ask spreads; |

| |

|

|

| |

● |

market illiquidity or disruption; |

| |

|

|

| |

● |

rounding of Fund share prices; |

| |

|

|

| |

● |

the amount of Freight Futures liquidated to satisfy redemption requests; |

| |

|

|

| |

● |

time differences between the trading of the Fund’s shares and the Freight Futures market; |

| |

|

|

| |

● |

early and unanticipated closings of the markets on which the holdings of the Fund trade, resulting in the inability of the Fund to execute intended portfolio transactions. |

The market price at which investors buy or sell shares may be

significantly more or less than NAV.

The market price at which investors buy or sell shares may be significantly

less or more than NAV. The Fund’s per share NAV will change throughout the day as fluctuations occur in the market value of the

Fund’s portfolio assets. The public trading price at which an investor buys or sells shares during the day from their broker may

be different from the NAV of the shares. Price differences may relate primarily to supply and demand forces at work in the secondary trading

market for the Fund’s shares that are closely related to, but not identical to, the same forces influencing the prices of the freight

futures, cash and cash equivalents that constitute the Fund’s assets.

The NAV of the Fund’s shares may also be influenced by non-concurrent

trading hours between the NYSE Arca and the market for Freight Futures. While the Fund’s shares trade on the NYSE Arca from 9:30

a.m. to 4:00 p.m. E.T., the trading hours for the freight market do not coincide during all of this time. As a result, trading spreads

and the resulting premium or discount on the shares may widen and, therefore, increase the difference between the price of the shares

and the NAV of the shares.

An absence of “backwardation” or the presence of

“contango” in the prices of Freight Futures may decrease the value of the shares.

As the Fund’s Freight Futures near expiration, they will be replaced

by contracts that have a later expiration. For example, a contract purchased and held in January 2024 may specify a March 2024 expiration.

As that contract nears expiration, it may be replaced by selling the January 2024 contract and purchasing the contract expiring in April

2024. This process is referred to as “rolling.” Backwardation exists when the price for commodity contracts with shorter-term

expirations are higher than the price for contracts with longer-term expirations. In these circumstances, absent other factors, the sale

of the January 2024 contract would be consummated at a price that is higher than the price at which the April 2024 contract is purchased.

Once the Fund purchased the April 2024 contract and assuming no other changes to the prevailing spot price for shipping dry bulk freight

nor the price relationship between the spot dry bulk freight price and futures contracts, hypothetically the value of the April 2024 contract

would increase over time, thereby creating a gain for the Fund.

Conversely, contango exists when the price for commodity contracts

with longer-term expirations are higher than the price for contracts with shorter-term expirations. In these circumstances, absent other

factors, the sale of the January 2024 contract would be consummated at a price that is lower than the price at which the April 2024 contract

is purchased. Once the Fund purchased the April 2024 contract and assuming no other changes to the prevailing spot price for shipping

dry bulk freight nor the price relationship between the spot dry bulk freight price and futures contracts, hypothetically the value of

the April 2024 contract would increase over time, thereby creating a loss for the Fund.

See the section titled “Impact of Futures Roll on Total Returns

and Fund Allocation” below for more information.

The investment objective of the Fund is not intended to correlate

with any spot price of a Reference Index or any other freight indices, and this could cause the price of the Fund’s shares to substantially

vary from changes in the spot price of freight.

The investment objective of the Fund is to provide investors with exposure

to the daily change of near-dated Freight Futures and not on the spot freight rates. Freight Futures reflect the market participants’

expectation of average levels of freight rates and not any particular price level in the future. Positive changes in the spot charter

rates might not necessarily transform to positive changes in Freight Futures, as market participants might view such increases as temporary.

On the other hand, futures prices might deviate from the price of spot rates as participants anticipate different spot levels in the future.

The absence of physical delivery in the freight futures market and thus the absence of carry trade means that freight futures price levels

are generally more disconnected from spot rates compared to other commodity markets.

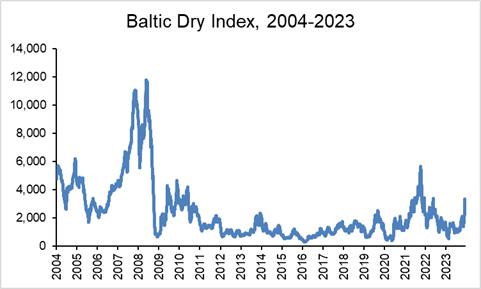

Weak correlation between the Fund’s NAV and the spot price of

freight or spot-related indices such as the Baltic Dry Index (as discussed below) may result. Investors may not be able to effectively

hedge the risk of losses in freight-related transactions or indirectly invest in spot freight rates.

The NAV may be overstated or understated due to the valuation

method employed when a settlement price for Freight Futures is not available on the date of NAV calculation.

The NAV will include, in part, any unrealized profits or losses on

open Freight Futures. Under normal circumstances, the NAV will reflect the settlement price of open Freight Futures on the date the NAV

is being calculated. However, a Freight Futures contract may not be trading on a day when the Fund is accepting creation and redemption

orders. As a result, the Fund may attempt to calculate the fair value of such Freight Futures. In such situation, the Sponsor may use

the settlement price on the most recent date which the Freight Futures would have traded as the basis of determining the market value

of such contract for such day, or use an alternative fair value methodology. Accordingly, if the Sponsor implements fair value methodologies

to calculate the value of Freight Futures for any reason, there is the risk that the calculation of NAV on the applicable day will be

overstated or understated, which may adversely affect an investment in the Fund’s shares.

Freight Futures may not uniformly change across maturities.

The Fund will invest in Freight Futures with different maturity dates.

Generally, the Fund will hold futures with maturities of 1-6 months. Freight Futures prices do not change uniformly and therefore if spot

charter rates rise, the investment performance of the Fund will be impacted by the Fund’s current maturity exposure which may be

different from the expectations of the Sponsor and investors in the Fund. At any time, the Fund’s maturity exposure may not be optimal

with respect to a movement in spot charter rates or short-term freight futures which would negatively impact performance. In addition,

freight futures settle against monthly averages of spot charter rates, and as such, the timing of any positive of negative move in spot

charter rates is important in terms of pricing and trading of freight futures.

Freight Futures transactions are subject to little, if any, regulation.

Freight Futures trade on a principal-to-principal basis, and then the

transactions are cleared through major exchanges. The Freight Futures markets rely upon the integrity of market participants in lieu of

the additional regulation imposed by the CFTC on participants in the futures markets. The lack of regulation in these markets could expose

the Fund in certain circumstances to significant losses in the event of trading abuses or financial failure by participants.

The Fund may experience a loss if it

is required to sell U.S. Treasuries or cash equivalents at a price lower than the price at which they were acquired.

If the Fund is required to sell U.S. Treasuries

or cash equivalents at a price lower than the price at which they were acquired, the Fund will experience a loss. This loss may adversely

impact the price of the Fund’s shares. The value of U.S. Treasuries and other debt securities generally moves inversely with movements

in interest rates. The prices of longer maturity securities are subject to greater market fluctuations as a result of changes in

interest rates. While the short-term nature of the Fund’s investments in U.S. Treasuries and cash equivalents should minimize

the interest rate risk to which the Fund is subject, it is possible that the U.S. Treasuries and cash equivalents held by the Fund will

decline in value.

When interest rates rise, the value of fixed

income securities typically falls. In a rising interest rate environment, the Fund may not be able to fully invest at prevailing rates

until any current investments in U.S. Treasuries mature in order to avoid selling those investments at a loss. Interest rate risk is generally

lower for shorter term investments and higher for longer term investments. The risk to the Fund of rising interest rates may be greater

in the future due to the end of a long period of historically low rates and the effect of potential monetary policy initiatives and resulting

market reaction to those initiatives. When interest rates fall, the Fund may be required to reinvest the proceeds from the sale, redemption

or early prepayment of a U.S. Treasury or money market security at a lower interest rate.

The Fund will not take defensive positions to protect against

declining freight rates, which could cause a decline to the value of the Fund’s shares.

The Fund will maintain a portfolio with a targeted average tenure of

approximately 60 days, regardless of the Sponsor’s views on expected freight rate movements. The Fund will not take a defensive

position if freight rates decline or if the Sponsor expects rates to decline. The Fund’s performance will be highly sensitive to

freight rate changes and the value of the Fund’s shares will decrease as freight rates fall.

The Fund could terminate at any time and cause the liquidation

and potential loss of your investment and could upset the overall maturity and timing of your investment portfolio.

The Fund may terminate at any time, regardless

of whether the Fund has incurred losses, subject to the terms of the governing trust agreement (the “Trust Agreement”).

For example, the dissolution or resignation of the Sponsor would cause the Trust to terminate unless shareholders holding a majority of

the outstanding shares of the Trust, voting together as a single class, elect within 90 days of the event to continue the Trust and appoint

a successor Sponsor. In addition, the Sponsor may terminate the Fund if it determines that the Fund’s aggregate net assets

in relation to its operating expenses make the continued operation of the Fund unreasonable or imprudent. As of the date of this

prospectus, the Fund pays the fees, costs, and expenses of its operations. If the Sponsor and the Fund are unable to raise sufficient

funds so that the Fund’s expenses are reasonable in relation to its NAV, the Fund may be forced to terminate, and investors may

lose all or part of their investment. Any expenses related to the operation of the Fund would need to be paid by the Fund at the time

of termination.

However, no level of losses will require the

Sponsor to terminate the Fund. The Fund’s termination would result in the liquidation of its investments and the distribution

of its remaining assets to the shareholders on a pro rata basis in accordance with their shares, and the Fund could incur losses in liquidating

its investments in connection with a termination. Termination could also negatively affect the overall maturity and timing of your

investment portfolio.

Investors cannot be assured of the Sponsor’s or CTA’s

continued services, the discontinuance of which may be detrimental to a Fund.

Investors cannot be assured that the Sponsor or CTA will be able to

continue to service the Fund for any length of time. If the Sponsor or CTA discontinues its activities on behalf of the Fund, the Fund

may be adversely affected, as there may be no entity servicing the Fund for a period of time. If the Sponsor’s or CTA’s registrations

with the CFTC or memberships in the NFA were revoked or suspended, the Sponsor or CTA, as applicable, would no longer be able to provide

services and/or to render advice to the Fund. If the Sponsor or CTA were unable to provide services and/or advice to the Fund, the Fund

would be unable to pursue its investment objectives unless and until the Sponsor’s or CTA’s ability to provide services and

advice to the Fund was reinstated or a replacement for the Sponsor or CTA as commodity pool operator or commodity trading advisor, respectively,

could be found. Such an event could result in termination of the Fund.

The liquidity of the shares may be affected

by the withdrawal from participation of Authorized Participants, which could adversely affect the market price of the shares.

In the event that one or more Authorized Participants

that are actively involved in purchasing and selling Shares cease to be so involved, the liquidity of the shares will likely decrease,

which could adversely affect the market price of the shares and result in your incurring a loss on your investment.

The Fund may incur higher fees and expenses

upon renewing existing or entering into new contractual relationships.

If the Fund enters into new contractual relationships

or renews existing relationships with its service providers, it may incur higher fees and expenses and need to change its accruals or

introduce new fees and expenses. Any such change could make investors; investment less profitable.

The Fund is not actively managed and will attempt to deliver

investors exposure to daily changes in the price of Freight Futures during periods in which the prices of Freight Futures are flat or

declining as well as when they are rising.

The Sponsor will seek to hold Freight Futures during periods in which

daily changes in the price of Freight Futures are flat or declining as well as when they are rising, and will not actively manage the

Fund based on any other discretionary criteria. For example, if the Fund’s positions in Freight Futures are declining in value,

the Fund will not close out such positions, except during rebalancing periods or for creation and redemption orders in accordance with

its investment objective. Any decrease in value of the Fund’s Freight Futures positions will result in a decrease in the NAV and

likely will result in a decrease in the market price of the shares.

Several factors may affect the Fund’s ability to consistently

track the Benchmark Portfolio and achieve the Fund’s investment objective.

As with all funds that track a benchmark, the performance of the Fund

may not closely track the performance of the benchmark for a variety of reasons. For example, the Fund incurs operating expenses and portfolio

transaction costs not incurred by the benchmark. The Fund is also required to manage cash flows and may experience operational inefficiencies

the Benchmark Portfolio does not. In addition, the Fund may not be fully invested in the contents of its Benchmark Portfolio at all times

or may hold securities not included in its Benchmark Portfolio. As a result, there can be no assurance that the Fund will be able to achieve

its investment objective.

The success of the Fund depends on the ability of the CTA to

accurately implement trading systems, and any failure to do so could subject the Fund to losses on such transactions.

The CTA will use mathematical formulas to facilitate the purchase and

sale of Freight Futures. The CTA must make accurate calculations and execute the trades dictated by such calculations. In addition, the

Fund relies on the CTA to properly operate and maintain its computer and communications systems. Execution of the formulas and operation

of the systems are subject to human error. Any failure, inaccuracy or delay in implementing any of the formulas or systems or executing

the Fund’s transactions could impair the Fund’s ability to achieve its investment objective.

The Trust is taxed as a partnership and the applicable tax laws

are complex and burdensome on investors and may cause investors to incur tax liabilities in excess of any distributions they may receive

with respect to the shares.

An investor’s tax liability may exceed the amount of distributions,

if any, on its shares. Cash or property will be distributed at the sole discretion of the Sponsor. The Sponsor has not and does not currently

intend to make cash or other distributions with respect to the shares. Investors will be required to pay U.S. federal income tax and,

in some cases, state, local, or foreign income tax, on their allocable share of the Fund’s taxable income, without regard to whether

they receive distributions or the amount of any distributions. Therefore, the tax liability of an investor with respect to its shares

is likely to exceed the amount of cash or value of property (if any) distributed.

An investor’s allocable share of taxable income or loss may differ

from its economic income or loss on its shares.

Due to the application of the assumptions and conventions applied by

the Fund in making allocations for tax purposes and other factors, an investor’s allocable share of the Fund’s income, gain,

deduction or loss may be different than its economic profit or loss from its shares for a taxable year. This difference could be temporary

or permanent and, if permanent, could result in a shareholder being taxed on amounts in excess of its economic income.

Items of income, gain, deduction, loss and credit with respect to shares

could be reallocated if the U.S. Internal Revenue Service (“IRS”) does not accept the assumptions and conventions applied

by the Fund in allocating those items, with potential adverse consequences for an investor.

The U.S. tax rules pertaining to entities taxed as partnerships are

complex and their application to large, publicly traded partnership treated entities such as the Fund is in many respects uncertain. The

Fund applies certain assumptions and conventions in an attempt to comply with the intent of the applicable rules and to report taxable

income, gains, deductions, losses and credits in a manner that properly reflects shareholders’ economic gains and losses. The IRS

could view these assumptions and conventions as not fully in compliance with all aspects of the Internal Revenue Code (the “Code”)

and applicable Treasury Regulations, however, and it is possible that the IRS could successfully challenge the Fund’s allocation

methods and require the Fund to reallocate items of income, gain, deduction, loss or credit in a manner that adversely affects investors.

If this occurs, investors may be required to file an amended tax return and to pay additional taxes plus deficiency interest.

The Fund could be treated as a corporation for U.S. federal

income tax purposes, which may substantially reduce the value of the shares.

The Fund has obtained an opinion of counsel that, under current U.S.

federal income tax laws, the Fund will be treated as a partnership that is not taxable as a corporation for U.S. federal income tax purposes,

provided that (i) at least 90 percent of the Fund’s annual gross income consists of “qualifying income” as defined in

the Code, (ii) the Fund is organized and operated in accordance with its governing agreements and applicable law and (iii) the Fund does

not elect to be taxed as a corporation for U.S. federal income tax purposes. Although the Sponsor anticipates that the Fund will satisfy

the “qualifying income” requirement for all of its taxable years, that result cannot be assured. The Fund has not requested

and will not request any ruling from the IRS with respect to its classification as a partnership not taxable as a corporation for U.S.

federal income tax purposes. If the IRS were to successfully assert that the Fund is taxable as a corporation for U.S. federal income

tax purposes in any taxable year, rather than passing through its income, gains, losses and deductions proportionately to shareholders,

the Fund would be subject to tax on its net income for the year at corporate tax rates. In addition, although the Sponsor does not currently

intend to make distributions with respect to shares, any distributions would be taxable to shareholders as dividend income. Taxation of

the Fund as a corporation could materially reduce the after-tax return on an investment in shares and could substantially reduce the value

of the shares.

The Fund is organized and operated as a Delaware statutory trust

in accordance with the provisions of the declaration of trust and applicable state law, and therefore, the Fund has a more complex tax

treatment than traditional mutual funds.

The Fund is organized and operated as a trust in accordance with the

provisions of the Trust Agreement and applicable state law. No U.S. federal income tax is paid by the Fund on its income. Instead, the

Fund will furnish shareholders each year with tax information on IRS Schedule K-1 (Form 1065) and each U.S. shareholder is required to

report on its U.S. federal income tax return its allocable share of the income, gain, loss and deduction of the Fund. This must be reported

without regard to the amount (if any) of cash or property the shareholder receives as a distribution from the Fund during the taxable

year. The tax reporting of a partnership interest can be complex and shareholders may be advised to consult a tax expert. A shareholder,

therefore, may be allocated income or gain by the Fund but receive no cash distribution with which to pay the tax liability resulting

from the allocation, or may receive a distribution that is insufficient to pay such liability.

In addition to U.S. federal income taxes, shareholders may be subject

to other taxes, such as state and local income taxes, unincorporated business taxes, business franchise taxes and estate, inheritance

or intangible taxes that may be imposed by the various jurisdictions in which the Fund does business or owns property or where the shareholders

reside. Although an analysis of those various taxes is not presented here, each prospective shareholder should consider their potential

impact on its investment in the Fund. It is each shareholder’s responsibility to file the appropriate U.S. federal, state, local

and foreign tax returns.

Other Risks

Certain of the Fund’s investments could be illiquid, which

could cause large losses to investors at any time or from time to time.

Although the Fund intends to hold positions to expiration and cash-settle

such positions, Freight Futures positions cannot always be liquidated, if needed, at the desired price. It is difficult to execute a trade

at a specific price when there is a relatively small volume of buy and sell orders in a market. A market disruption can also make it difficult

to liquidate a position. The large size of the positions that the Fund may acquire increases the risk of illiquidity both by making its

positions more difficult to liquidate and by potentially increasing losses while trying to do so.

The NYSE Arca may halt trading in the Fund’s shares, which

would adversely impact an investor’s ability to sell shares.

The Fund’s shares are listed for trading on the NYSE Arca under

the market symbol BDRY. Trading in shares may be halted due to market conditions or, in light of NYSE Arca rules and procedures, for reasons

that, in the view of the NYSE Arca, make trading in shares inadvisable. In addition, trading is subject to trading halts caused by extraordinary

market volatility pursuant to “circuit breaker” rules that require trading to be halted for a specified period based on a

specified market decline. Additionally, there can be no assurance that the requirements necessary to maintain the listing of the Fund’s

shares will continue to be met or will remain unchanged. NYSE Arca listing rules require a minimum of 50,000 shares to be outstanding

for continued listing and will be the Fund’s minimum.

The lack of an active trading market for the Fund’s shares

may result in losses on an investor’s investment in the Fund at the time the investor sells the shares.

Although the Fund’s shares are listed and traded on the NYSE

Arca, there can be no guarantee that an active trading market for the shares will be maintained. If an investor needs to sell shares at

a time when no active trading market for them exists, the price the investor receives upon sale of the shares, assuming they were able

to be sold, likely would be lower than if an active market existed.

During periods of unusual volatility or market disruptions, market

prices of Fund shares may deviate significantly from the market value of the Fund’s portfolio investments or the NAV of Fund shares.

The NAV of Fund shares will generally fluctuate with changes in the

market value of the Fund’s securities holdings. The market prices of shares will generally fluctuate in accordance with changes

in the Fund’s NAV and supply and demand of shares on the NYSE Arca. It cannot be predicted whether Fund shares will trade below,