B2Gold Corp. (TSX: BTO, NYSE AMERICAN: BTG, NSX: B2G) (“B2Gold” or

the “Company”) is pleased to provide a construction update on the

Goose Project, located in the 100% owned Back River Gold District

in Nunavut, Canada. B2Gold acquired the Back River Gold District as

part of the acquisition of Sabina Gold & Silver (“Sabina”) in

April 2023.

Goose Project Construction Update

Highlights

- Goose Project remains on

schedule for mill completion in Q1 2025: The 2023 winter

ice road season was completed, with B2Gold receiving all critical

materials necessary to maintain the schedule to complete

construction of the mill in the first quarter of 2025. Currently,

camp construction is underway, generators are being installed, and

construction workshops are being erected.

- Total initial capital

expenditure estimate of C$800 million, in line with B2Gold

expectations since the Sabina acquisition announcement, reflects

scope changes to further optimize the Goose Project:

B2Gold has updated the construction budget to de-risk the project

and construct a reliable and low operating cost mine. In addition,

the Company has made the decision to accelerate underground mining

development to increase annual gold production over the first five

years of the mine plan, including the mining of the Umwelt crown

pillar (discussed below). The cost to accelerate underground mining

is estimated at an additional C$90 million.

- Accelerated underground

mining development to increase average gold production in the first

five years to over 300,000 ounces per year: Mining is

underway in the Echo open pit, which will be mined out prior to

process commissioning to provide tailings storage capacity.

Underground mining has exceeded 1,500 meters of horizontal

development and the initial ventilation raise will reach the

surface shortly.

- Underground mining is now

scheduled to mine and backfill the full Umwelt crown pillar earlier

in the mine life, which is expected to contribute over 150,000

ounces of gold production to the life of mine plan:

Geotechnical and mine design and engineering is underway with the

goal of mining and backfilling the crown pillar prior to completion

of the Umwelt open pit using long-hole stoping methods to increase

production rates and reduce operating costs. The crown pillar zone

contains over 150,000 ounces of gold, which will be mined and

processed earlier in the mine life than prior mine plans.

- First winter ice road

successfully brought all required materials to complete building

envelopes in 2023: Concrete, steel, and consumables

required for construction were successfully transported to the

Goose Project site on the winter ice road and are staged at the

construction site. Construction equipment including cranes,

generators, welders, lifts, and tooling are in operation and being

used for camp and workshop construction. Completion of the 2023

winter ice road successfully de-risked the development of future

winter ice roads.

- Site construction is

ongoing, led by Kieran Loughran, who has successfully managed five

construction projects for B2Gold and its predecessor company Bema

Gold: Mr. Loughran and the B2Gold in-house construction

team have successfully built the following projects on-time and

on-budget over the past three decades: the Julietta and Kupol mines

in Russia, the La Libertad mine in Nicaragua, the Otjikoto mine in

Namibia, and the Fekola mine in Mali. The B2Gold in-house

construction team is complemented by key personnel previously

working on the project with Sabina.

Goose Project Initial Capital

Build-Up

|

Category |

|

ApproximateAmount |

B2Gold Commentary |

|

Initial Capital Expenditure (“Capex”) Estimate –

March 2021 Feasibility Study |

C$M |

$610 |

- Initial capex

estimate from March 2021 NI 43-101 Feasibility Study for the Goose

Project

|

|

Inflationary Impacts through Sabina Acquisition Closing (April

2023) |

C$M |

$130 |

- Total inflation of

~20%, in line with industry inflationary pressures from 2021 to

2023

|

|

Last Sabina Internal Capex Estimate – April

2023 |

C$M |

$740 |

|

|

B2Gold In-House Construction and Purchasing Teams |

C$M |

($70) |

- Savings due to the

use of B2Gold’s in-house construction and purchasing teams

|

|

B2Gold Design Changes and Consumables Pricing |

C$M |

$130 |

- Additional

equipment, steel, and tankage to ensure reliable and low cost

operation

- Inflation of fuel

and consumables to market prices

|

|

Updated Initial Capex Estimate |

C$M |

$800 |

- Updated

initial capex to execute a de-risked Goose Project based on the

March 2021 Feasibility Study

|

|

Accelerated Underground Mining |

C$M |

$90 |

- Underground mining

accelerated to increase gold production over first five years of

the mine life

- Accelerates mining

of the Umwelt crown pillar, which contributes over 150,000 ounces

of gold production to the life of mine plan

|

|

Total Project Cost Estimate |

C$M |

$890 |

- Total

project costs required to execute an improved Goose

Project

|

|

Less: Project Costs Incurred Through April 2023 |

C$M |

($340) |

- Project costs

incurred by Sabina through April 2023

|

|

Remaining Project Costs to be Incurred by B2Gold |

C$M |

$550 |

- Project costs to be

incurred by B2Gold through Q1 2025

|

In addition, B2Gold will undertake a build up of

working capital over the next 24 months in order to materially

de-risk the execution of the production ramp-up phase. Areas of

focus for working capital include:

- Accelerated purchase and additional

storage of diesel fuel to manage the requirements of operations in

2025;

- Critical inventory of consumables

and spares for mining and processing to avoid the requirement for

air transport; and

- Development of open pit and

underground ore stockpiles to provide a consistent and

uninterrupted feed to the process plant.

B2Gold Goose Project Capital

Changes

Utilization of B2Gold In-House Construction and

Purchasing Team

Since closing of the acquisition of Sabina in

April 2023, B2Gold has worked to integrate its in-house

construction team with the Sabina team, as well as rescope the

external contractors working on the Goose Project. Through these

integration efforts and based on prior experience at B2Gold’s

current operations, the Company estimates that moving to an

owner-operated construction model versus a fixed priced EPC

contract for the construction of the process plant will save money

and result in a mill with higher availability and lower sustaining

capital requirements. Using an owner-operated team also allows for

flexibility in construction and the ability to refocus construction

activities as needed.

In addition, the B2Gold in-house purchasing team

has identified significant savings by purchasing certain mobile

equipment versus the ‘lease to own’ purchase model utilized by

Sabina, and through lower negotiated pricing for certain reagents

and consumables required for project construction and

commissioning.

B2Gold Design Changes and Consumables

Pricing

Through the due diligence period of the

acquisition of Sabina and now managing the Goose Project, the

B2Gold team has identified various items that will be added to the

original Sabina scope in order to further de-risk the construction

phase and maximize the long-term value of the asset. These items

include, among others:

- Emulsion explosives plant and

mining support fleet;

- Additional power generation

capacity and expanded site power distribution;

- Additional shipping redundancy

costs to further de-risk the timing of mill completion in Q1

2025;

- Secondary steel including

platforms, grating, and handrails to meet project and safety

requirements;

- Information Technology and

Enterprise Resource Planning improvements;

- Improved on-site assay lab;

and

- Additional fuel tanks at the Marine

Laydown Area and at the Goose Project to provide extended on-site

operating reserves (and to support potential project

expansions).

In addition, the Company has used current market

pricing for costing of various consumables utilized during the

construction phase, mainly related to fuel and diesel.

Goose Project Update Life of Mine

Plan

The B2Gold technical team continues to analyze

ways to optimize the Goose Project life of mine plan. Areas of

optimization currently being studied include:

- Mining of the Umwelt crown

pillar

- The crown pillar between the Umwelt

open pit and underground mining areas contains over 150,000 ounces

of gold and was only partially included in prior production

schedules.

- Geotechnical and mine design and

engineering is underway with the goal of mining and backfilling the

crown pillar prior to completion of the Umwelt open pit.

- Underground mining

method

- Development mining is effective in

complex high grade deposits, but with relatively high mining

costs.

- The B2Gold engineering team has

determined that most of the Umwelt underground mine can be mined

effectively with long-hole stoping, which is expected to reduce

costs and increase ore production rates.

- Renewable power

generation

- The Sabina team identified the

potential for wind power generation during prior ownership, and

studies are in progress to identify the best solution and to

quantify the potential operational and cost impact to the Goose

Project.

B2Gold anticipates the completion of an updated

Goose Project life of mine plan in the second half of 2023.

About B2Gold

B2Gold is a low-cost international senior gold

producer headquartered in Vancouver, Canada. Founded in 2007,

today, B2Gold has operating gold mines in Mali, Namibia and the

Philippines and numerous exploration and development projects in

various countries including Canada, Mali, Colombia, Finland and

Uzbekistan. B2Gold forecasts total consolidated gold production of

between 1,000,000 and 1,080,000 ounces in 2023.

Qualified Persons

Bill Lytle, Senior Vice President and Chief

Operating Officer, a qualified person under NI 43-101, has approved

the scientific and technical information related to operations

matters contained in this news release.

ON BEHALF OF B2GOLD CORP.

“Clive T.

Johnson” President and Chief Executive

Officer

The Toronto Stock Exchange and NYSE American LLC

neither approve nor disapprove the information contained in this

news release.

Production guidance presented in this news

release reflect total production at the mines B2Gold operates on a

100% project basis. Please see our Annual Information Form dated

March 16, 2023 for a discussion of our ownership interest in the

mines B2Gold operates.

This news release includes certain

“forward-looking information” and “forward-looking statements”

(collectively “forward-looking statement”) within the meaning of

applicable Canadian and United States securities legislation,

including: projections; outlook; guidance; forecasts; estimates;

statements regarding future or estimated financial and operational

performance, gold production and sales, revenues and cash flows,

and capital costs (sustaining and non-sustaining) and operating

costs, and including, without limitation: total consolidated gold

production of between 1,000,000 and 1,080,000 ounces in 2023; the

completion of mill construction at the Goose Project being

completed in the first quarter of 2023; the capital cost estimate

for the Goose Project being approximately C$890 million; the

underground mining now scheduled to include 150,000 ounces from the

Umwelt crown pillar; the Umwelt underground mine being mined with

long-hole stoping, which could reduce costs and increase ore

production rates; the identification of various items that will be

added to the original Sabina scope in order to de-risk the

construction phase and maximize the long-term value of the asset.

All statements in this news release that address events or

developments that we expect to occur in the future are

forward-looking statements. Forward-looking statements are

statements that are not historical facts and are generally,

although not always, identified by words such as "expect", "plan",

"anticipate", "project", "target", "potential", "schedule",

"forecast", "budget", "estimate", "intend" or "believe" and similar

expressions or their negative connotations, or that events or

conditions "will", "would", "may", "could", "should" or "might"

occur. All such forward-looking statements are based on the

opinions and estimates of management as of the date such statements

are made.

Forward-looking statements necessarily involve

assumptions, risks and uncertainties, certain of which are beyond

B2Gold's control, including risks associated with or related to:

the volatility of metal prices and B2Gold's common shares; changes

in tax laws; the dangers inherent in exploration, development and

mining activities; the uncertainty of reserve and resource

estimates; not achieving production, cost or other estimates;

actual production, development plans and costs differing materially

from the estimates in B2Gold's feasibility and other studies; the

ability to obtain and maintain any necessary permits, consents or

authorizations required for mining activities; environmental

regulations or hazards and compliance with complex regulations

associated with mining activities; climate change and climate

change regulations; the ability to replace mineral reserves and

identify acquisition opportunities; the unknown liabilities of

companies acquired by B2Gold; the ability to successfully integrate

new acquisitions; fluctuations in exchange rates; the availability

of financing; financing and debt activities, including potential

restrictions imposed on B2Gold's operations as a result thereof and

the ability to generate sufficient cash flows; operations in

foreign and developing countries and the compliance with foreign

laws, including those associated with operations in Mali, Namibia,

the Philippines and Colombia and including risks related to changes

in foreign laws and changing policies related to mining and local

ownership requirements or resource nationalization generally,

including in response to the COVID-19 outbreak; remote operations

and the availability of adequate infrastructure; fluctuations in

price and availability of energy and other inputs necessary for

mining operations; shortages or cost increases in necessary

equipment, supplies and labour; regulatory, political and country

risks, including local instability or acts of terrorism and the

effects thereof; the reliance upon contractors, third parties and

joint venture partners; the lack of sole decision-making authority

related to Filminera Resources Corporation, which owns the Masbate

Project; challenges to title or surface rights; the dependence on

key personnel and the ability to attract and retain skilled

personnel; the risk of an uninsurable or uninsured loss; adverse

climate and weather conditions; litigation risk; competition with

other mining companies; community support for B2Gold's operations,

including risks related to strikes and the halting of such

operations from time to time; conflicts with small scale miners;

failures of information systems or information security threats;

the ability to maintain adequate internal controls over financial

reporting as required by law, including Section 404 of the

Sarbanes-Oxley Act; compliance with anti-corruption laws, and

sanctions or other similar measures; social media and B2Gold's

reputation; risks affecting Calibre having an impact on the value

of the Company's investment in Calibre, and potential dilution of

our equity interest in Calibre; as well as other factors identified

and as described in more detail under the heading "Risk Factors" in

B2Gold's most recent Annual Information Form, B2Gold's current Form

40-F Annual Report and B2Gold's other filings with Canadian

securities regulators and the U.S. Securities and Exchange

Commission (the "SEC"), which may be viewed at www.sedar.com and

www.sec.gov, respectively (the "Websites"). The list is not

exhaustive of the factors that may affect B2Gold's forward-looking

statements

B2Gold's forward-looking statements are based on

the applicable assumptions and factors management considers

reasonable as of the date hereof, based on the information

available to management at such time. These assumptions and factors

include, but are not limited to, assumptions and factors related to

B2Gold's ability to carry on current and future operations,

including: the timing, extent, duration and economic viability of

such operations, including any mineral resources or reserves

identified thereby; the accuracy and reliability of estimates,

projections, forecasts, studies and assessments; B2Gold's ability

to meet or achieve estimates, projections and forecasts; the

availability and cost of inputs; the price and market for outputs,

including gold; foreign exchange rates; taxation levels; the timely

receipt of necessary approvals or permits; the ability to meet

current and future obligations; the ability to obtain timely

financing on reasonable terms when required; the current and future

social, economic and political conditions; and other assumptions

and factors generally associated with the mining industry.

B2Gold's forward-looking statements are based on

the opinions and estimates of management and reflect their current

expectations regarding future events and operating performance and

speak only as of the date hereof. B2Gold does not assume any

obligation to update forward-looking statements if circumstances or

management's beliefs, expectations or opinions should change other

than as required by applicable law. There can be no assurance that

forward-looking statements will prove to be accurate, and actual

results, performance or achievements could differ materially from

those expressed in, or implied by, these forward-looking

statements. Accordingly, no assurance can be given that any events

anticipated by the forward-looking statements will transpire or

occur, or if any of them do, what benefits or liabilities B2Gold

will derive therefrom. For the reasons set forth above, undue

reliance should not be placed on forward-looking statements.

For more information on B2Gold please visit the Company website at www.b2gold.com or contact:

Michael McDonald

VP, Investor Relations & Corporate Development

+1 604-681-8371

investor@b2gold.com

Cherry DeGeer

Director, Corporate Communications

+1 604-681-8371

investor@b2gold.com

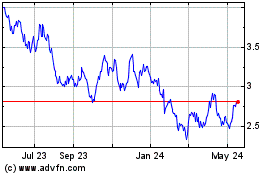

B2Gold (AMEX:BTG)

Historical Stock Chart

From Jan 2025 to Feb 2025

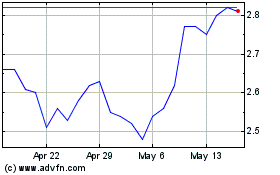

B2Gold (AMEX:BTG)

Historical Stock Chart

From Feb 2024 to Feb 2025