California Pilot Program Providing Commuters With Tax-Free Transit Benefits Becomes Permanent

27 September 2016 - 8:00PM

Business Wire

Employers in the San Francisco Bay Area must

Provide Tax-Free Transit Benefits

California’s Governor has signed into law SB 1128, making

permanent a pilot that provides employees in the Bay Area with

tax-free transit benefits. Under the program, employers in the Bay

Area with at least 50 full-time employees must provide their

workers with the option of tax-free transit and vanpool

benefits.

The legislation defines a “full-time employee” as one who

performed an average of at least 30 hours of work per week during

the previous calendar month. The number of full-time employees is

the average number of full-time employees per week, on payroll,

during the most recent 3-month period.

Transit benefits stem from a Federal law which allows employees

to be provided, or withhold, up to $255/month for transit or

vanpool expenses so long those funds are provided or withheld by

employer. Employers that do not currently have a commuter benefit

program in place will be pleasantly surprised at how easy this

benefit is to provide to employees. There are no required plan

documents and no defined open enrollment periods. By offering

commuter benefits, employers can save up to 7.65% on average in

payroll taxes, and employees can save up to 40% on their commuting

costs by using pre-tax money.

The pilot program has been incredibly successful expanding

commuting options to those in the Bay Area and this legislation had

a wide-range of support.

Meltem Korkmazel, COO of Edenred Commuter Benefit Solutions,

states: “The results of the pilot were incredible and now that this

pilot has been made permanent, the results will become more and

more visible: Higher transit and vanpool participation, less

roadway congestion and cleaner air.”

Under the Bay Area Commuter Benefits Program, all public,

private, and non-profit employers with 50 or more full-time

employees in the covered counties are required to do the

following:

- Register through www.511.org;

- Designate a Commuter Benefits

Coordinator;

- Provide one of three pre-approved

commuter benefits options or an alternative commuter benefit

option, approved by the Air District;

- Notify covered employees of the

commuter benefit option selected and provide instructions on how to

utilize this benefit;

- Maintain records documenting

compliance, for 3 years.

Once covered by the Bay Area Commuter Benefits Program, an

employer must provide commuter benefits to any “covered employee,”

not just full-time employees. Covered employees are employees who

performed an average of at least 20 hours of work per week during

the previous calendar month.

Information on implementing a transit benefit program can be

found at www.commuterbenefits.com, or by contacting us at

1-800-531-2828.

-----

About Commuter Benefit Solutions, by

Edenred

Edenred Commuter Benefit Solutions is the nation’s only

comprehensive commuter benefit solutions provider and number one

resource for commuter savings. Since 1985, Edenred has served

Fortune 100 and Fortune 500 companies, top third party benefit

administrators and the nation’s largest metropolitan area transit

authorities. With its premier solution offerings; Commuter Check, a

nationwide commuter benefits program for employers; and

WiredCommute, a private label program for third party

administrators, Edenred is able to provide a one-stop total

solution experience. Edenred’s mission is to make tax-free commuter

benefits a staple in employee benefits packages nationwide.

-------

About Edenred

Edenred, which invented the Ticket Restaurant® meal voucher and

is the world leader in prepaid corporate services, designs and

manages solutions that improve the efficiency of organizations and

purchasing power to individuals.

By ensuring that allocated funds are used specifically as

intended, these solutions enable companies to more effectively

manage their:

- Employee benefits (Ticket Restaurant®,

Ticket Alimentación, Ticket CESU, Childcare Vouchers, etc.)

- Expense management process (Ticket Car,

Ticket Clean Way, Repom, etc.)

- Incentive and rewards programs (Ticket

Compliments, Ticket Kadéos, etc.)

The Group also supports public institutions in managing their

social programs.

Listed on the Euronext Paris stock exchange, Edenred operates in

42 countries, with more than 6,000 employees, nearly 660,000

companies and public sector clients, 1.4 million affiliated

merchants and 41 million beneficiaries. In 2014, total issue volume

amounted to €17.7 billion, of which almost 60% was generated in

emerging markets.

Ticket Restaurant® and all other tradenames of Edenred products

and services are registered trademarks of Edenred SA.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160927005453/en/

Edenred Commuter Benefit SolutionsKerrie LePage,

857-228-1422Media Relationskerrie.lepage@commuterbenefits.com

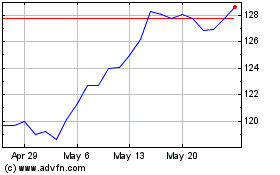

iShares MSCI Denmark ETF (AMEX:EDEN)

Historical Stock Chart

From Jan 2025 to Feb 2025

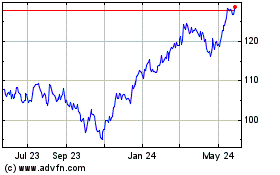

iShares MSCI Denmark ETF (AMEX:EDEN)

Historical Stock Chart

From Feb 2024 to Feb 2025