Is the Korea ETF About To Breakout? - ETF News And Commentary

09 April 2013 - 11:30PM

Zacks

The on-going political turmoil in the Korean peninsula has

weighed heavily on investors. If anything, many consider the

nation’s relationship with North Korea to be one of the primary

concerns for investing in South Korea.

All in all, it has been tough going for investors with South

Korean exposure following the North Korean leader’s latest round of

provocative statements. In fact, over the past few weeks, the

Korean equity market, the KOSPI Composite Index, has slumped around

4.16%.

On the other hand the ETF that tracks the performance of the

Korean equity markets, the iShares MSCI South Korea Capped

ETF (EWY) has slumped close to 7.21%. This is because the

South Korean won has also lost around 3.1% versus the U.S. dollar,

which in turn has further brought down the effective rate of return

for the Korean ETF compared to the actual loss for the Korean

equities (read Three Country ETFs Struggling in 2013).

Apart from this, the South Korean economy has been facing

macro-economic headwinds over the past few quarters. This is

primarily due to the sluggish overseas demand as the nation is

highly dependent on exports.

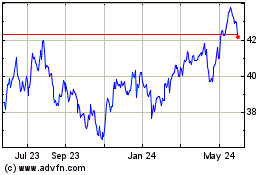

Beyond these fundamental issues, there are also technical

problems, as we can see in the chart of the Korean ETF below:

The chart above is the two year weekly price chart of EWY. As we

can see, the ETF has been channeled gradually into a narrowed,

constricted trading range, forming the shape of a triangle.

This is a classic scenario which only explains the concrete

headwinds that the South Korean economy has been witnessing. It

occurs sometime due to economics, other times due to politics (see

ETF to Short This Week?).

Nevertheless, the ETF has not been able to find any specific

trend as the 50, 100 and 200 Moving Average lines have almost had

an identical slope. Furthermore, with time, the three trendlines

have come very close to each other. This also signifies that the

ETF has been witnessing flat trading action leading to massive

compression in its prices.

Also, the volumes chart signifies that all through fiscal 2012

into 2013, the trading activity has remained sluggish with

diminishing volumes.

What’s Next?

While the facts above surely seem to be unappealing to most

investors, it could well be the calm before the storm. This is

because the triangle pattern in the above chart has almost come to

an end. And the compressing price action that the ETF has been

witnessing for quite some time could well breakout (read Time to

Buy Emerging Market ETFs?).

Furthermore, in a situation like this we could well expect a big

price move either way (upside or downside), especially after a

prolonged compression. However, the odds are slightly tilted in

favor of a move to the downside.

The ETF has very recently broken below the support line as well

as all of the moving average lines. The catalyst for the same is

recent political issues with the North. Still, it will be important

to notice whether the current weakness could be the trigger for the

ETF to make the big move downward that some are expecting.

Bottom Line

One way to establish an assertion regarding this would be to

play the wait and see game and observe its price action in the

subsequent weeks. A further downward move from current levels would

indicate more weakness going ahead (see 3 ETF Strategies for the

Second Quarter).

However, if it does manage to rebound from here onwards, it

could well be a big move on the upside. Either way, the bottom line

remains in that after a period of prolonged choppiness, the ETF is

poised for an established trend which would mark the future course

of direction for EWY.

Therefore, investors should be ready for a big move either way,

and especially so if we see the situation in North Korea reach new

heights (see more in the Zacks ETF Rank Guide).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHARS-S KOREA (EWY): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

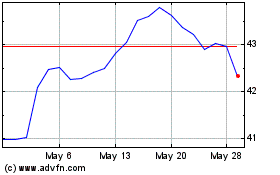

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Nov 2024 to Dec 2024

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Dec 2023 to Dec 2024