false

0001662684

0001662684

2024-11-25

2024-11-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 25, 2024

KULR

TECHNOLOGY GROUP, INC.

(Exact

name of the registrant as specified in its charter)

| Delaware |

|

001-40454 |

|

81-1004273 |

(State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

555

Forge River Road, Suite 100, Webster,

Texas 77598

(Address of principle executive offices) (Zip

code)

Registrant’s telephone number, including

area code: (408) 663-5247

N/A

(Former name or address if changed since last

report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14A-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14D-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered: |

| Common

Stock |

|

KULR |

|

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure |

On November 25, 2024, KULR

Technology Group, Inc. (the “Company” or “KULR”) issued a press release announcing has been awarded a contract

by the U.S. Navy to advance its Internal Short Circuit (ISC) technology to activate at higher temperatures.

A copy of the press release

is attached herewith as Exhibit 99.1.

By filing this Current Report

on Form 8-K and furnishing the information contained herein, the Company makes no admission as to the materiality of any information in

this report that is required to be disclosed solely by reason of Regulation FD. The Company uses, and will continue to use, its website,

press releases, and various social media channels, including its Twitter account (twitter.com/kulrtech), its LinkedIn account (linkedin.com/company/kulr-technology-corporation),

its Facebook account (facebook.com/KULRTechnology), its TikTok account (tiktok.com/Kulr_tech), its Instagram account (instagram.com/Kulr_tech),

and its YouTube account (youtube.com/channel/UC3wZBPINQd51N6p35Mo5uQg), as additional means of disclosing public information to

investors, the media and others interested in the Company. It is possible that certain information that the Company posts on its website,

disseminated in press releases and on social media could be deemed to be material information, and the Company encourages investors, the

media and others interested in the Company to review the business and financial information that the Company posts on its website, disseminates

in press releases and on the social media channels identified above, as such information could be deemed to be material information.

The information in this Item

7.01 disclosure, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section.

In addition, the information in this Item 7.01 disclosure, including Exhibits 99.1, shall not be incorporated by reference into the filings

of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in such filing.

Exhibit

No. |

|

Description |

| 99.1 |

|

Press Release dated November 25, 2024 |

| 104 |

|

Cover Page Interactive Data File - The cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on behalf of the undersigned hereunto

duly authorized.

| |

KULR TECHNOLOGY GROUP, INC. |

| |

|

| Date: November 25, 2024 |

By: |

/s/ Michael Mo |

| |

|

Michael Mo |

| |

|

Chief Executive Officer |

Exhibit 99.1

KULR Awarded U.S. Navy Contract to Develop High-Temperature

Internal Short Circuit Cells for Enhanced Battery Safety in Critical Applications

HOUSTON / GLOBENEWSWIRE / November 25, 2024 / KULR Technology Group,

Inc. (NYSE American: KULR) (the "Company" or "KULR"), a provider of advanced thermal management solutions, has

been awarded a contract by the U.S. Navy to advance its Internal Short Circuit (ISC) technology to activate at higher temperatures. This

development, vital for both military and commercial applications, will support a wide range of safety-critical uses, with particular importance

for aviation by enabling the simulation of extreme conditions that better reflect the stringent safety standards of the Federal Aviation

Administration (FAA) and European Union Aviation Safety Agency (EASA).

KULR’s ISC devices, originally developed in collaboration with

NASA and the National Renewable Energy Laboratory (NREL), induce controlled thermal runaway in lithium-ion cells, offering safer and more

accurate testing than conventional methods. With the capability to activate at elevated temperatures, the new ISC devices provide deeper

insights into battery behavior under worst-case scenarios, allowing for a precise evaluation of resilience and safety for high-stress

environments.

Advantages of High-Temperature ISC Activation

High-temperature ISC activation supports critical advancements in aviation

safety by:

| · | Accurately Simulating Extreme Conditions: Higher temperature activation mirrors real-world operational stresses, offering precise

data on thermal runaway behavior essential for electric and hybrid-electric aircraft. |

| · | Achieving Greater Consistency with Safety Standards: The advanced ISC testing helps align battery safety development with the

rigorous safety expectations of FAA and EASA as electric aviation progresses toward certification. |

| · | Enhancing Military and Commercial Safety: The technology provides both the U.S. Navy and commercial aviation sectors with tools

to rigorously evaluate battery resilience, bolstering mission safety and reliability. |

“Our work with the U.S. Navy on high-temperature ISC technology

will enhance safety protocols and provide essential data as electric aviation moves closer to regulatory certification and market entry,”

said Michael Mo, CEO of KULR Technology. “With these advancements, KULR is well-positioned to support safer, more resilient battery

systems across the aviation industry.”

This contract further strengthens KULR's role as a critical partner

in battery safety advancements. Combined with our growing capability to evaluate large-format cells and battery packs during thermal runaway,

KULR is uniquely positioned to support the aviation sector in meeting safety standards and advancing safely to market. For more information

on KULR’s ISC technology and its applications, please visit kulrtechnology.com.

About KULR Technology Group

Inc.

KULR Technology Group Inc. (NYSE American: KULR) delivers cutting edge energy storage solutions for space, aerospace, and defense by leveraging

a foundation of in-house battery design expertise, comprehensive cell and battery testing suite, and battery fabrication and production

capabilities. The Company’s holistic offering allows delivery of commercial-off-the-shelf and custom next generation energy storage

systems in rapid timelines for a fraction of the cost compared to traditional programs. For more information, please visit www.kulrtechnology.com.

Safe Harbor Statement

This press release does not constitute an offer to sell or a solicitation

of offers to buy any securities of any entity. This release contains certain forward-looking statements based on our current expectations,

forecasts and assumptions that involve risks and uncertainties. Forward-looking statements in this release are based on information available

to us as of the date hereof. Our actual results may differ materially from those stated or implied in such forward-looking statements,

due to risks and uncertainties associated with our business, which include the risk factors disclosed in our Form 10-K filed with the

Securities and Exchange Commission on April 12, 2024, as may be amended or supplemented by other reports we file with the Securities and

Exchange Commission from time to time. Forward-looking statements include statements regarding our expectations, beliefs, intentions,

or strategies regarding the future and can be identified by forward-looking words such as “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “should,” and

“would” or similar words. All forecasts are provided by management in this release are based on information available at this

time and management expects that internal projections and expectations may change over time. In addition, the forecasts are entirely on

management’s best estimate of our future financial performance given our current contracts, current backlog of opportunities and

conversations with new and existing customers about our products and services. We assume no obligation to update the information included

in this press release, whether as a result of new information, future events or otherwise.

Investor Relations:

KULR Technology Group, Inc.

Phone: 858-866-8478 x 847

Email: ir@kulrtechnology.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

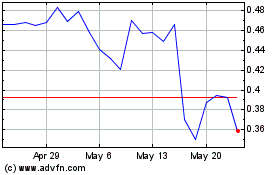

KULR Technology (AMEX:KULR)

Historical Stock Chart

From Oct 2024 to Nov 2024

KULR Technology (AMEX:KULR)

Historical Stock Chart

From Nov 2023 to Nov 2024