UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

UNDER the

Securities Exchange Act of 1934

For the month of December 10, 2024

Commission File Number: 001-39766

ORLA MINING LTD.

(Translation of registrant's name into English)

1010-1075

West Georgia Street

Vancouver,

BC

V6E

3C9

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

ORLA MINING LTD.. |

| |

|

| Date: December 10, 2024 |

|

/s/ Etienne Morin |

| |

Name: Etienne Morin

Title: Chief Financial Officer

|

| |

|

EXHIBIT INDEX

Exhibit 99.1

| News Release |  |

Orla Expands High-Grade Mineralization 800 Metres

Beyond Current Resource in Extension Drilling at Camino Rojo, Mexico

VANCOUVER, BC, Dec. 10, 2024 /CNW/ - Orla Mining

Ltd. (TSX: OLA) (NYSE: ORLA) ("Orla" or the "Company") is pleased to provide an update on exploration at the Camino

Rojo Extension, now referred to as "Zone 22".

Summary Details:

- Expanded Resource Potential: Drilling has extended mineralization

800 metres beyond the current open-pit resource, with Zone 22 remaining open at depth and along strike.

- Drilling Progress: Over 32,000 metres drilled in 2024,

with an additional 3,000 metres planned by year-end.

- High-Grade Intersections: Notable results include 31.5

g/t AuEq over 2.7m and 11.2 g/t AuEq over 4.5m, among others.

- Copper-Gold Discovery: A distinct Cu-Au-Ag mineralization

event was identified, with copper grades up to 4.95%.

- Upcoming Resource Estimate: An initial underground resource

estimate for the Camino Rojo Sulphides, incorporating historical and 2024 Caracol-hosted intersections as well as a portion of the newly

defined Zone 22 mineralization, is expected in early 2025, supporting a Preliminary Economic Assessment.

Drill Highlights:

- 31.5 g/t AuEq over 2.7m, incl. 143.4 g/t AuEq over 0.6m (Hole

CRSX24-36C)

- 11.2 g/t AuEq over 4.5m, incl. 22.4 g/t AuEq over 1.3m (Hole CRSX24-40A)

- 11.1 g/t AuEq over 2.8m, incl. 16.9 g/t AuEq over 1.5m (Hole CRSX24-40A)

- 5.68 g/t AuEq over 4.9m, incl. 27.8 g/t AuEq over 0.5m (Hole CRSX24-31)

"The existing mineralization in the upper

Caracol-host already set a strong foundation for the initial underground sulphide resource. It is now becoming clear that the future project

will be enhanced by the Zone 22 Extension, and we continue to be impressed with the drill results: high-grade, polymetallic, and favourable

metallurgy. Zone 22 remains wide-spaced drilled and open down-plunge, offering significant potential for further infill and step-out drilling

to contribute to both resource growth and upgrades."

– Sylvain Guerard, Orla's Senior Vice

President, Exploration

Mineralization 800 metres Beyond Current Defined

Resource

Recent drilling confirms both steep (dike-parallel)

and flat (manto-type) high-grade polymetallic Au-Ag-Zn-(±Pb) mineralization, extending 600 metres down-plunge and 500 metres along

strike, parallel to the dike structure. The deepest down-plunge holes, with the program ongoing, have intersected mineralization up to

800 metres down-plunge from the resource limit. This news release presents results from 13 drill holes (11,318 metres) completed since

the June 26, 2024, release (see Figures 1 and 2).

High Grade, Polymetallic

Zone 22 shows narrow, high-grade intervals with individual

grades up to 140.5 g/t Au over 0.6 m (CRSX24-36C), 393.4 g/t Ag over 1.1 m (CRSX24-39), 4.95% Cu over 1.2 m (CRSX24-36A), 13.95% Zn over

0.7 m (CRSX24-25H), and 7.23% Pb over 1.5 m (CRSX24-40A).

Twenty new significant intersections, including four

with a grade-by-thickness factor exceeding 30 g/t AuEq * m (see Figure 3), were found outside the current resource. Intersections range

from 0.5 to 6.8 metres, with true widths from 0.4 to 4.9 metres. One of the deepest high-grade intersections was at approximately 1,300

metres vertical depth, returning 31.5 g/t AuEq over 2.7 m, including 143.4 g/t AuEq over 0.6 m (Hole CRSX24-36C).

Copper – Gold Mineralization Event

In addition to polymetallic (Au-Ag-Zn) sulphide replacement

and skarn-style mineralization characteristic of Zone 22, 2024 drilling at Camino Rojo identified a distinct Cu-Au-Ag mineralization event.

This mineralization is associated with a newly identified felsic dike and was primarily intersected in the deepest down-plunge extension

area by holes CRSX24-36A and CRSX24-40. Significant Cu-Au-Ag intervals with narrow high-grade copper intersections were drilled in this

area, which remain open at depth and along strike, including:

- CRSX24-36A: 1.59% Cu, 1.01 g/t Au, and 63.5 g/t Ag (3.90 g/t AuEq)

over 6.6m, including 4.95% Cu, 3.08 g/t Au, and 63.5 g/t Ag (12.1 g/t AuEq) over 1.2m.

- CRSX24-40: 0.91% Cu, 0.93 g/t Au, and 24.7 g/t Ag (2.45 g/t AuEq)

over 15m, including 4.67% Cu, 2.69 g/t Au, and 105 g/t Ag (10.2 g/t AuEq) over 0.5m.

Drill Hole Detailed Highlights

| Hole ID |

From

(m) |

Core Length

(m) |

Au

g/t |

Ag

g/t |

Zn

% |

Cu

% |

Pb

% |

AuEq g/t |

| CRSX24-25H |

1,026.5 |

0.8 |

13.1 |

27.3 |

13.95 |

0.10 |

0.04 |

20.4 |

| CRSX24-31 |

705.8 |

0.5 |

10.0 |

64.4 |

7.29 |

0.11 |

0.74 |

14.7 |

| and |

712.5 |

0.7 |

25.9 |

60.2 |

1.52 |

0.06 |

1.21 |

27.8 |

| and |

827.1 |

4.9 |

4.54 |

6.6 |

2.08 |

0.03 |

0.01 |

5.68 |

| incl. |

|

0.5 |

24.6 |

15.3 |

6.03 |

0.06 |

0.01 |

27.8 |

| and |

944.0 |

2.9 |

5.65 |

26.6 |

1.43 |

0.04 |

0.13 |

6.76 |

| incl. |

|

1.5 |

9.34 |

44.5 |

1.16 |

0.06 |

0.23 |

10.6 |

| and |

1,001.3 |

3.9 |

1.83 |

8.3 |

2.23 |

0.17 |

0.01 |

3.24 |

| incl. |

|

0.6 |

7.75 |

4.8 |

12.30 |

0.09 |

<0.005 |

14.0 |

| and |

1,108.0 |

0.5 |

26.8 |

20.7 |

12.20 |

0.11 |

0.03 |

33.2 |

| CRSX24-35B |

1,053.1 |

0.5 |

11.8 |

37.6 |

0.83 |

0.20 |

0.08 |

12.9 |

| CRSX24-36A |

1,276.6 |

6.6 |

1.01 |

63.5 |

0.09 |

1.59 |

<0.005 |

3.90 |

| incl. |

|

1.2 |

3.08 |

202.0 |

0.16 |

4.95 |

<0.005 |

12.1 |

| and |

1,292.2 |

4.6 |

1.89 |

44.7 |

0.39 |

0.38 |

0.23 |

3.18 |

| and |

1,478.8 |

2.4 |

5.35 |

8.5 |

2.17 |

0.34 |

<0.005 |

6.96 |

| incl. |

|

0.5 |

22.0 |

15.1 |

4.57 |

0.61 |

<0.005 |

25.2 |

| CRSX24-36C |

1,064.4 |

0.5 |

8.70 |

309.0 |

7.27 |

0.18 |

4.43 |

17.6 |

| and |

1,444.7 |

2.7 |

30.7 |

3.8 |

1.32 |

0.08 |

0.01 |

31.5 |

| incl. |

|

0.6 |

140.5 |

9.2 |

5.24 |

0.16 |

0.03 |

143.4 |

| CRSX24-37 |

1,024.9 |

0.5 |

25.1 |

34.4 |

2.68 |

0.03 |

0.03 |

26.9 |

| and |

1,087.0 |

0.6 |

24.3 |

5.9 |

7.17 |

0.08 |

0.01 |

28.0 |

| CRSX24-38A |

949.4 |

0.6 |

14.6 |

18.9 |

8.98 |

0.13 |

0.03 |

19.4 |

| and |

971.2 |

0.5 |

61.5 |

60.2 |

5.92 |

0.48 |

0.07 |

65.8 |

| CRSX24-38B |

889.4 |

0.5 |

18.1 |

48.1 |

5.13 |

0.14 |

0.06 |

21.4 |

| and |

903.7 |

0.5 |

12.2 |

46.8 |

9.77 |

0.09 |

0.09 |

17.7 |

| and |

918.5 |

0.5 |

7.38 |

72.1 |

5.36 |

0.12 |

0.31 |

11.1 |

| and |

951.9 |

0.5 |

13.5 |

22.9 |

0.99 |

0.08 |

0.28 |

14.5 |

| and |

1,110.8 |

5.3 |

3.61 |

2.7 |

0.83 |

0.06 |

0.01 |

4.13 |

| incl. |

|

1.0 |

15.3 |

6.5 |

3.71 |

0.11 |

0.03 |

17.3 |

| CRSX24-39* |

1,103.9 |

0.5 |

10.0 |

105.0 |

1.76 |

0.30 |

0.12 |

12.5 |

| and |

1,347.3 |

2.2 |

8.99 |

192.0 |

0.70 |

0.36 |

0.28 |

12.1 |

| incl. |

|

1.0 |

19.4 |

159.0 |

1.54 |

0.47 |

0.23 |

22.7 |

| and |

1,576.4 |

2.0 |

0.83 |

393.4 |

8.77 |

0.08 |

2.40 |

10.6 |

| CRSX24-40 |

1,411.2 |

15.0 |

0.93 |

24.7 |

0.06 |

0.91 |

<0.005 |

2.45 |

| incl. |

|

0.5 |

2.69 |

105.0 |

0.15 |

4.67 |

<0.005 |

10.2 |

| CRSX24-40A |

1,140.8 |

4.5 |

5.17 |

215.1 |

4.59 |

0.14 |

3.33 |

11.2 |

| incl. |

|

0.8 |

11.0 |

386.0 |

5.30 |

0.12 |

6.35 |

20.4 |

| incl. |

|

1.3 |

9.88 |

370.0 |

11.55 |

0.20 |

6.62 |

22.4 |

| and |

1,171.8 |

2.8 |

2.99 |

268.5 |

6.77 |

0.16 |

4.29 |

11.1 |

| incl. |

|

1.5 |

4.26 |

373.0 |

11.4 |

0.17 |

7.23 |

16.9 |

Metal prices used in gold equivalent calculation: Au = $1,750/oz, Ag = $21 / oz, Zn = $1.20/lb, Pb = $0.90/lb, Cu = $3.50/lb. See "Gold Equivalent Calculation" below for additional information. All prices in USD. All composites are in Zone 22.

*CRSX24-39 was drilled down plunge to test continuity of system |

Significance of Results

The latest 2024 drill results confirm that the Camino

Rojo mineralized system remains open at depth, along the dike structure, and beyond the current resource limits. Recent drilling has intercepted

high-grade Au-Ag-Zn massive sulphide mineralization which is narrower and higher grade than typical Caracol-hosted mineralization (see

Figure 4). Additionally, new Cu-Au-Ag skarn-related mineralization has been discovered, suggesting potential overprinting of Au-Ag-Zn

zones, which may lead to areas of enriched polymetallic mineralization.

The Au-Ag-Zn mineralization primarily follows the

main dike structure and secondary parallel structures with steep geometry and sub-horizontal components extending 100-150 metres on either

side of the dike and approximately 500 metres along strike (see Figure 5). Initial metallurgy results suggest compatibility with cyanide

processing and flotation methods (see June 26, 2024 news release). Further metallurgical test work on both mineralization styles is planned

for 2025.

In the CRSX24-40 series drillholes, approximately

900 metres down-plunge, a quartz-feldspar porphyry dike hosting chalcopyrite veins was identified. Associated higher-grade copper mineralization

in this area reaches up to 4.95% Cu, along with Au-Ag, suggesting that drilling is approaching a higher-temperature zone with the potential

to vector into a stronger, more mineralized part of the system, with this Cu-Au-Ag mineralization remaining open at depth and along strike.

Exploration Planning

Four rigs are operating through the end of the year

to target the down-plunge extension 0.5 to 1 kilometre beyond current resources. In the first half of 2025, Orla plans to release an initial

underground resource estimate for the Sulphides Project, incorporating historical and 2024 Caracol-hosted intersections as well as a portion

of the newly defined Zone 22 mineralization. Additional 2025 drilling is planned to further delineate, expand, and upgrade Zone 22 resources.

This release presents drilling since the June 26,

2024 update (Orla Mining Reports Positive Drilling Intersections and Metallurgical Results at Camino Rojo Sulphide Extension).

Figure 1: Plan View Showing Location of Reported Drill

Holes (CNW Group/Orla Mining Ltd.)

Figure 2: Camino Rojo Long Section Overview (CNW Group/Orla

Mining Ltd.)

Figure 3: Camino Rojo Long Section Drill Result Highlights

(CNW Group/Orla Mining Ltd.)

Figure 4: Camino Rojo Cross Section Drill Intersection

Highlights for Fence CRSX24-31 (CNW Group/Orla Mining Ltd.)

Figure 5: Camino Rojo Cross Section Drill Intersection

Highlights for Fence CRSX24-36 (CNW Group/Orla Mining Ltd.)

Additional Technical Information

All mineralized interval lengths reported are down-hole

intervals, with true width estimates ranging from 60-91% for the reported interval for all composites >5 grade-by-thickness factor

(Au g/t*m). See Table 1 in the Appendix of this news release for estimated true widths of individual composites. A standard sampling length

of 1.5 metre is used with a minimum of 0.5 metres when required based on geological contacts. Drill core is mainly HQ diameter, with reduction

to NQ where necessary due to drilling depth. The reported composites were not subject to "capping" of high grades. Orla believes

that applying a top cut would have a negligible effect on overall grades. Composites for the sulphide drilling were calculated using 2.0

g/t AuEq cut-off grade and maximum 3 metres consecutive waste

Qualified Persons Statement

The scientific and technical information in this news

release has been reviewed and approved by Mr. Sylvain Guerard, P Geo., SVP Exploration of the Company, who is the Qualified Person as

defined under the definitions of National Instrument 43-101 ("NI 43-101").

To verify the information related to the 2024 drilling

program at the Camino Rojo property, Mr. Guerard has visited the property in the past year; discussed logging, sampling, and sample shipping

processes with responsible site staff; discussed and reviewed assay and QA/QC results with responsible personnel; and reviewed supporting

documentation, including drill hole location and orientation and significant assay interval calculations.

Quality Assurance / Quality Control –2024

Drill Program

All gold results at Camino Rojo were obtained by ALS

Minerals (Au-AA23) using fire assay fusion and an atomic absorption spectroscopy finish. All samples are also analyzed for multi-elements,

including silver, copper, lead and zinc using a four-acid digestion with ICP-AES finish (ME-ICP61) method at ALS Laboratories in Canada.

If samples were returned with gold values in excess of 10 ppm or base metal values in excess of 1% by ICP analysis, samples are re-run

with gold (Au-GRA21) by fire assay and gravimetric finish or base metal by (OG62) four acid overlimit methods. Drill program design, Quality

Assurance/Quality Control and interpretation of results were performed by qualified persons employing a Quality Assurance/Quality Control

program consistent with NI 43-101 and industry best practices. Standards were inserted at a frequency of one in every 50 samples, and

blanks were inserted at a frequency of one in every 50 samples for Quality Assurance/Quality Control purposes by the Company as well as

the lab. ALS Minerals and ALS Laboratories are independent of Orla. There are no known drilling, sampling, recovery, or other factors

that could materially affect the accuracy or reliability of the drilling data at Camino Rojo.

For additional information on the Company's previously

reported drill results, see the Company's press releases dated February 4, 2021 (Orla Mining Provides Exploration Update), September

12, 2022 (Orla Mining Advances Exploration & Growth Pipeline), January 31, 2023 (Orla Mining Continues to Intersect Wide,

Higher-Grade Sulphide Zones and Expose Deeper Potential at Camino Rojo, Mexico), February 7, 2024 (Orla Mining Concludes 2023 Camino

Rojo Sulphides Infill Program with Strong Results), and June 26, 2024 (Orla Mining Reports Positive Drilling Intersections and

Metallurgical Results at Camino Rojo Sulphide Extensions).

Historical drill results at Camino Rojo were completed

by Goldcorp. Inc. ("Goldcorp"), a prior owner of the project. The Company's independent qualified person, Independent Mining

Consultants, Inc. was of the opinion that the drilling and sampling procedures for Camino Rojo drill samples by Goldcorp (and prior to

its acquisition by Goldcorp, Canplats Resources Corporation) were reasonable and adequate for the purposes of the Camino Rojo Report (as

defined below), and that the Goldcorp QA/QC program met or exceeded industry standards. For additional information, see the Company's

technical report entitled "Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project –

Municipality of Mazapil, Zacatecas, Mexico" dated January 11, 2021 (the "Camino Rojo Report"), which is available on

SEDAR+ and EDGAR under the Company's profile at www.sedarplus.ca and www.sec.gov, respectively.

Gold Equivalent Calculations

The following metal prices in USD were used for the

gold metal equivalent calculations: $1,750/oz gold, $21/oz silver, $0.90/lb lead, $1.20/lb zinc, and $3.50/lb copper. Metal recoveries

on the Sulphide Extension, based on the total recovery for the sulphide portion of the existing resource estimate, were 86% for gold,

76% for silver, 60% for lead, and 64% for zinc, and based on a preliminary study of similar carbonate replacement deposits were assumed

to be 85% for copper. Metal recoveries on the Camino Rojo Extension, based on a preliminary metallurgical study, were 88% for gold and

92% for zinc, and based on a preliminary study of similar carbonate replacement deposits were assumed to be 85% for silver, 85% for lead

and 85% for copper.

The following equations were used to calculate gold

equivalence:

- Camino Rojo Sulphide AuEq = Au (g/t) + [ Ag (g/t) * 0.0106] +

[ Pb (%) * 0.2460] + [ Zn (%) * 0.3499] + [ Cu (%) * 1.3555]

- Camino Rojo Extension AuEq = Au (g/t) + [ Ag (g/t) * 0.0116] +

[ Pb (%) * 0.3406] + [ Zn (%) * 0.4916] + [ Cu (%) * 1.3247]

Analyzed metal equivalent calculations are reported

for illustrative purposes only. The metal chosen for reporting on an equivalent basis is the one that contributes the most dollar value

after accounting for the recoveries used above.

About Orla Mining Ltd.

Orla's corporate strategy is to acquire, develop,

and operate mineral properties where the Company's expertise can substantially increase stakeholder value. The Company has two material

gold projects: (1) Camino Rojo, located in Zacatecas State, Mexico and (2) South Railroad, located in Nevada, United States. Orla is operating

the Camino Rojo Oxide Gold Mine, a gold and silver open-pit and heap leach mine. The property is 100% owned by Orla and covers over 139,000

hectares which contains a large oxide and sulphide mineral resource. Orla is also developing the South Railroad Project, a feasibility-stage,

open pit, heap leach gold project located on the Carlin trend in Nevada. Orla has also entered into a definitive agreement with a subsidiary

of Newmont Corporation to acquire the Musselwhite Mine, located in Ontario, Canada. This transaction is subject to certain conditions

and is expected to close in the first quarter of 2025. The technical reports for the Company's material projects are available on Orla's

website at www.orlamining.com, and on SEDAR+ and EDGAR under the Company's profile at www.sedarplus.ca and www.sec.gov,

respectively.

Forward-looking Statements

This news release contains certain "forward-looking

information" and "forward-looking statements" within the meaning of Canadian securities legislation and within the meaning

of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended,

the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission,

all as may be amended from time to time, including, without limitation, statements regarding: the potential mineralization at Camino

Rojo based on the 2024 drill program, including the potential for additional gold, silver, copper and zinc mineralization, the enhancement

of the project by the Zone 22 Extension and resource growth and upgrades; the timing of the underground mineral resource estimate at Camino

Rojo; the Company's proposed transaction for the Musselwhite Mine and the closing thereof; and other statements regarding the Company's

future drill and metallurgical programs, including the expected benefits and results thereof. Forward-looking statements are statements

that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking

statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve

a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without

limitation, assumptions regarding: the future price of gold and silver; anticipated costs and the Company's ability to fund its programs;

the Company's ability to carry on exploration, development, and mining activities; tonnage of ore to be mined and processed; ore grades

and recoveries; decommissioning and reclamation estimates; currency exchange rates remaining as estimated; prices for energy inputs, labour,

materials, supplies and services remaining as estimated; the Company's ability to secure and to meet obligations under property agreements,

including the layback agreement with Fresnillo plc; that all conditions of the Company's credit facility will be met; the timing and results

of drilling programs; mineral reserve and mineral resource estimates and the assumptions on which they are based; the discovery of mineral

resources and mineral reserves on the Company's mineral properties; the obtaining of a subsequent agreement with Fresnillo to access the

sulphide mineral resource at the Camino Rojo Project and develop the entire Camino Rojo Project mineral resources estimate; that political

and legal developments will be consistent with current expectations; the timely receipt of required approvals and permits, including those

approvals and permits required for successful project permitting, construction, and operation of projects; the timing of cash flows; the

costs of operating and exploration expenditures; the Company's ability to operate in a safe, efficient, and effective manner; the Company's

ability to obtain financing as and when required and on reasonable terms; that the Company's activities will be in accordance with the

Company's public statements and stated goals; and that there will be no material adverse change or disruptions affecting the Company or

its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future

events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown

risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not

limited to: uncertainty and variations in the estimation of mineral resources and mineral reserves; the Company's dependence on the Camino

Rojo oxide mine; risks related to the Company's indebtedness; risks related to exploration, development, and operation activities; foreign

country and political risks, including risks relating to foreign operations; risks related to the Company's proposed transaction with

Newmont Corporation for the Musselwhite Mine, including shareholder, regulatory and other approvals; risks related to the Cerro Quema

Project; delays in obtaining or failure to obtain governmental permits, or non-compliance with permits; environmental and other regulatory

requirements; delays in or failures to enter into a subsequent agreement with Fresnillo plc with respect to accessing certain additional

portions of the mineral resource at the Camino Rojo Project and to obtain the necessary regulatory approvals related thereto; the mineral

resource estimations for the Camino Rojo Project being only estimates and relying on certain assumptions; loss of, delays in, or failure

to get access from surface rights owners; uncertainties related to title to mineral properties; water rights; risks related to natural

disasters, terrorist acts, health crises, and other disruptions and dislocations; financing risks and access to additional capital; risks

related to guidance estimates and uncertainties inherent in the preparation of feasibility studies; uncertainty in estimates of production,

capital, and operating costs and potential production and cost overruns; the fluctuating price of gold and silver; unknown labilities

in connection with acquisitions; global financial conditions; uninsured risks; climate change risks; competition from other companies

and individuals; conflicts of interest; risks related to compliance with anti-corruption laws; volatility in the market price of the Company's

securities; assessments by taxation authorities in multiple jurisdictions; foreign currency fluctuations; the Company's limited operating

history; litigation risks; the Company's ability to identify, complete, and successfully integrate acquisitions; intervention by non-governmental

organizations; outside contractor risks; risks related to historical data; the Company not having paid a dividend; risks related to the

Company's foreign subsidiaries; risks related to the Company's accounting policies and internal controls; the Company's ability to satisfy

the requirements of Sarbanes-Oxley Act of 2002; enforcement of civil liabilities; the Company's status as a passive foreign investment

company for U.S. federal income tax purposes; information and cyber security; the Company's significant shareholders; gold industry concentration;

shareholder activism; other risks associated with executing the Company's objectives and strategies; as well as those risk factors discussed

in the Company's most recently filed management's discussion and analysis, as well as its annual information form dated March 19, 2024,

which are available on www.sedarplus.ca and www.sec.gov. Except as required by the securities disclosure laws and regulations applicable

to the Company, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or

opinions, or other factors, should change.

Cautionary Note to U.S. Readers

This news release has been prepared in accordance

with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current

standards of the United States securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral

reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated

mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents

incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with Canadian National

Instrument 43-101 — Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy

and Petroleum (the "CIM") — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council,

as amended (the "CIM Definition Standards").

For United States reporting purposes, the United

States Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization

Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the

Exchange Act, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements

and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace

the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required

to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer

that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Corporation is not required

to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101

and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference

herein may not be comparable to similar information disclosed by United States companies subject to the United States federal securities

laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization

Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred

mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral

reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101.

While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral

resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into

a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these

terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves.

Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred

mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further,

"inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically.

Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher

category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not

form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar"

to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly,

there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable

mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources"

under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC

Modernization Rules or under the prior standards of SEC Industry Guide 7.

Appendix: Drill Results

Table 1: Camino Rojo Sulphide Extension Composite

Drill Results (Composites 2g/t AuEq cog)

| HOLE-ID |

From

(m) |

To

(m) |

Core Length

(m) |

Estimated True Width (m) |

Au g/t |

Ag g/t |

Zn

% |

Cu

% |

Pb

% |

AuEq g/t

(Au+Ag+Cu+Pb+Zn) |

AuEq GXM |

Including

5.0g/t AuEq COG |

Including

10g/t AuEq HG |

Litho |

| CRSX24-25H |

742.50 |

744.00 |

1.5 |

1.3 |

2.09 |

1.2 |

0.02 |

<0.005 |

<0.005 |

2.12 |

3.18 |

|

|

Indidura |

| CRSX24-25H |

871.00 |

872.40 |

1.4 |

1.2 |

0.03 |

231.0 |

0.05 |

0.04 |

<0.005 |

2.79 |

3.91 |

|

|

Indidura |

| CRSX24-25H |

927.70 |

928.80 |

1.1 |

1.0 |

1.78 |

13.2 |

3.70 |

0.11 |

0.03 |

3.90 |

4.29 |

|

|

Cuesta de Cura |

| CRSX24-25H |

1026.45 |

1027.30 |

0.8 |

0.7 |

13.05 |

27.3 |

13.95 |

0.10 |

0.04 |

20.38 |

17.32 |

0.8m @ 20.38g/t AuEq

( 13.05g/t Au, 27.3g/t Ag, 0.1% Cu, 0.04% Pb, 13.95% Zn) |

0.8m @ 20.38g/t AuEq

( 13.05g/t Au, 27.3g/t Ag, 0.1% Cu, 0.04% Pb, 13.95% Zn) |

Cuesta de Cura |

| CRSX24-25H |

1128.55 |

1130.00 |

1.5 |

1.3 |

0.62 |

34.2 |

0.04 |

0.78 |

<0.005 |

2.07 |

3.00 |

|

|

Cuesta de Cura |

| CRSX24-25H |

1134.00 |

1135.50 |

1.5 |

1.3 |

6.33 |

19.4 |

0.04 |

0.50 |

<0.005 |

7.24 |

10.86 |

1.5m @ 7.24g/t AuEq

( 6.33g/t Au, 19.4g/t Ag, 0.5% Cu, <0.005% Pb, 426ppm Zn) |

|

Cuesta de Cura |

| CRSX24-25H |

1145.20 |

1147.20 |

2.0 |

1.8 |

2.86 |

1.6 |

0.40 |

0.02 |

0.02 |

3.11 |

6.23 |

|

|

La Peña |

| CRSX24-25H |

1212.15 |

1212.90 |

0.8 |

0.7 |

3.12 |

15.8 |

7.36 |

0.11 |

0.03 |

7.07 |

5.30 |

|

|

La Peña |

| CRSX24-25H |

1292.00 |

1293.50 |

1.5 |

1.3 |

2.20 |

4.8 |

<0.005 |

0.01 |

<0.005 |

2.28 |

3.41 |

|

|

Cupido |

| CRSX24-31 |

705.80 |

706.30 |

0.5 |

0.4 |

10.00 |

64.4 |

7.29 |

0.11 |

0.74 |

14.72 |

7.36 |

|

0.5m @ 14.72g/t AuEq

( 10g/t Au, 64.4g/t Ag, 0.1% Cu, 0.74% Pb, 7.29% Zn) |

Indidura |

| CRSX24-31 |

712.50 |

713.20 |

0.7 |

0.5 |

25.90 |

60.2 |

1.52 |

0.06 |

1.21 |

27.84 |

19.49 |

0.7m @ 27.84g/t AuEq

( 25.9g/t Au, 60.2g/t Ag, 0.06% Cu, 1.21% Pb, 1.52% Zn) |

0.7m @ 27.84g/t AuEq

( 25.9g/t Au, 60.2g/t Ag, 0.06% Cu, 1.21% Pb, 1.52% Zn) |

Indidura |

| CRSX24-31 |

747.00 |

748.00 |

1.0 |

0.7 |

2.12 |

27.5 |

0.96 |

0.02 |

0.23 |

3.02 |

3.02 |

|

|

Indidura |

| CRSX24-31 |

779.00 |

779.80 |

0.8 |

0.6 |

5.86 |

17.1 |

0.55 |

0.03 |

0.37 |

6.50 |

5.20 |

|

|

Indidura |

| CRSX24-31 |

805.50 |

807.25 |

1.8 |

1.3 |

1.99 |

4.3 |

0.20 |

0.01 |

0.01 |

2.15 |

3.77 |

|

|

Indidura |

| CRSX24-31 |

827.10 |

831.95 |

4.9 |

4.3 |

4.54 |

6.6 |

2.08 |

0.03 |

0.01 |

5.68 |

27.56 |

4.9m @ 5.68g/t AuEq

( 4.54g/t Au, 6.6g/t Ag, 0.03% Cu, 0.01% Pb, 2.08% Zn) |

0.5m @ 27.83g/t AuEq

( 24.6g/t Au, 15.3g/t Ag, 0.06% Cu, 0.01% Pb, 6.03% Zn) |

827.1 - 827.5 Indidura

827.5 - 831.95 Cuesta de Cura |

| CRSX24-31 |

835.50 |

837.00 |

1.5 |

1.1 |

2.38 |

25.7 |

2.07 |

0.08 |

0.01 |

3.81 |

5.71 |

|

|

Cuesta de Cura |

| CRSX24-31 |

944.00 |

946.85 |

2.9 |

2.1 |

5.65 |

26.6 |

1.43 |

0.04 |

0.13 |

6.76 |

19.27 |

1.5m @ 10.59g/t AuEq

( 9.34g/t Au, 44.5g/t Ag, 0.06% Cu, 0.23% Pb, 1.16% Zn) |

1.5m @ 10.59g/t AuEq

( 9.34g/t Au, 44.5g/t Ag, 0.06% Cu, 0.23% Pb, 1.16% Zn) |

Cuesta de Cura |

| CRSX24-31 |

996.70 |

997.60 |

0.9 |

0.8 |

5.26 |

3.3 |

1.33 |

0.02 |

<0.005 |

5.97 |

5.38 |

|

|

Cuesta de Cura |

| CRSX24-31 |

1001.30 |

1005.20 |

3.9 |

3.4 |

1.83 |

8.3 |

2.23 |

0.17 |

0.01 |

3.24 |

12.64 |

0.6m @ 13.97g/t AuEq

( 7.75g/t Au, 4.8g/t Ag, 0.09% Cu, <0.005% Pb, 12.3% Zn) |

0.6m @ 13.97g/t AuEq

( 7.75g/t Au, 4.8g/t Ag, 0.09% Cu, <0.005% Pb, 12.3% Zn) |

Cuesta de Cura |

| CRSX24-31 |

1108.00 |

1108.50 |

0.5 |

0.4 |

26.80 |

20.7 |

12.20 |

0.11 |

0.03 |

33.20 |

16.60 |

0.5m @ 33.2g/t AuEq

( 26.8g/t Au, 20.7g/t Ag, 0.11% Cu, 0.03% Pb, 12.2% Zn) |

0.5m @ 33.2g/t AuEq

( 26.8g/t Au, 20.7g/t Ag, 0.11% Cu, 0.03% Pb, 12.2% Zn) |

La Peña |

| CRSX24-35B |

1000.00 |

1001.50 |

1.5 |

1.3 |

2.62 |

0.5 |

0.02 |

<0.005 |

<0.005 |

2.64 |

3.96 |

|

|

Cuesta de Cura |

| CRSX24-35B |

1041.35 |

1048.10 |

6.8 |

4.9 |

1.63 |

18.5 |

1.20 |

0.06 |

0.03 |

2.53 |

17.06 |

|

|

Cuesta de Cura |

| CRSX24-35B |

1053.05 |

1053.55 |

0.5 |

0.4 |

11.80 |

37.6 |

0.83 |

0.20 |

0.08 |

12.93 |

6.46 |

|

0.5m @ 12.93g/t AuEq

( 11.8g/t Au, 37.6g/t Ag, 0.2% Cu, 0.08% Pb, 0.82% Zn) |

Cuesta de Cura |

| CRSX24-35B |

1058.70 |

1059.20 |

0.5 |

0.4 |

6.10 |

41.1 |

1.72 |

0.31 |

0.04 |

7.84 |

3.92 |

|

|

Cuesta de Cura |

| CRSX24-36A |

1051.40 |

1051.90 |

0.5 |

0.4 |

4.68 |

38.0 |

1.92 |

0.04 |

0.05 |

6.14 |

3.07 |

|

|

Cuesta de Cura |

| CRSX24-36A |

1276.60 |

1283.15 |

6.6 |

5.1 |

1.01 |

63.5 |

0.09 |

1.59 |

<0.005 |

3.90 |

25.53 |

1.2m @ 12.06g/t AuEq

( 3.08g/t Au, 202g/t Ag, 4.95% Cu, <0.005% Pb, 0.16% Zn) |

1.2m @ 12.06g/t AuEq

( 3.08g/t Au, 202g/t Ag, 4.95% Cu, <0.005% Pb, 0.16% Zn) |

La Peña |

| CRSX24-36A |

1292.20 |

1296.85 |

4.6 |

3.6 |

1.89 |

44.7 |

0.39 |

0.38 |

0.23 |

3.18 |

14.78 |

1.2m @ 7.83g/t AuEq

( 4.94g/t Au, 119g/t Ag, 0.44% Cu, 0.84% Pb, 1.32% Zn) |

|

La Peña |

| CRSX24-36A |

1303.75 |

1304.30 |

0.5 |

0.5 |

2.71 |

59.3 |

0.09 |

1.80 |

<0.005 |

5.83 |

3.21 |

|

|

La Peña |

| CRSX24-36A |

1478.80 |

1481.15 |

2.4 |

2.0 |

5.35 |

8.5 |

2.17 |

0.34 |

<0.005 |

6.96 |

16.35 |

0.5m @ 25.23g/t AuEq

( 22g/t Au, 15.1g/t Ag, 0.61% Cu, <0.005% Pb, 4.57% Zn) |

0.5m @ 25.23g/t AuEq

( 22g/t Au, 15.1g/t Ag, 0.61% Cu, <0.005% Pb, 4.57% Zn) |

Cupido |

| CRSX24-36C |

1064.35 |

1064.85 |

0.5 |

0.4 |

8.70 |

309.0 |

7.27 |

0.18 |

4.43 |

17.61 |

8.80 |

0.5m @ 17.61g/t AuEq

( 8.7g/t Au, 309g/t Ag, 0.18% Cu, 4.43% Pb, 7.27% Zn) |

0.5m @ 17.61g/t AuEq

( 8.7g/t Au, 309g/t Ag, 0.18% Cu, 4.43% Pb, 7.27% Zn) |

Cuesta de Cura |

| CRSX24-36C |

1213.20 |

1219.25 |

6.0 |

4.4 |

1.91 |

17.7 |

0.65 |

0.21 |

0.04 |

2.74 |

16.56 |

1.5m @ 6.02g/t AuEq

( 5.02g/t Au, 28.5g/t Ag, 0.22% Cu, 0.06% Pb, 0.74% Zn) |

|

1213.2 - 1216.4 Cuesta de Cura

1216.4 - 1219.25 La Peña |

| CRSX24-36C |

1223.00 |

1227.00 |

4.0 |

3.6 |

0.93 |

20.8 |

0.03 |

0.63 |

<0.005 |

2.02 |

8.10 |

|

|

La Peña |

| CRSX24-36C |

1256.85 |

1258.05 |

1.2 |

1.1 |

0.65 |

36.6 |

1.11 |

0.78 |

0.02 |

2.65 |

3.18 |

|

|

La Peña |

| CRSX24-36C |

1303.60 |

1306.50 |

2.9 |

2.6 |

3.63 |

9.4 |

0.01 |

0.23 |

<0.005 |

4.05 |

11.76 |

1.4m @ 6.17g/t AuEq

( 6g/t Au, 3.9g/t Ag, 0.09% Cu, <0.005% Pb, 0.01% Zn) |

|

La Peña |

| CRSX24-36C |

1388.80 |

1389.35 |

0.5 |

0.4 |

5.41 |

3.6 |

0.03 |

0.21 |

0.01 |

5.75 |

3.16 |

|

|

Cupido |

| CRSX24-36C |

1437.70 |

1440.00 |

2.3 |

2.1 |

2.27 |

1.5 |

0.61 |

0.02 |

<0.005 |

2.61 |

6.00 |

|

|

Cupido |

| CRSX24-36C |

1444.70 |

1447.40 |

2.7 |

1.9 |

30.74 |

3.8 |

1.32 |

0.08 |

0.01 |

31.54 |

85.16 |

2.7m @ 31.54g/t AuEq

( 30.74g/t Au, 3.8g/t Ag, 0.08% Cu, 0.01% Pb, 1.32% Zn) |

0.6m @ 10.43g/t AuEq

( 9.51g/t Au, 8.1g/t Ag, 0.2% Cu, <0.005% Pb, 1.14% Zn)

0.6m @ 143.41g/t AuEq

( 140.5g/t Au, 9.2g/t Ag, 0.16% Cu, 0.03% Pb, 5.24% Zn) |

Cupido |

| CRSX24-37 |

825.00 |

826.50 |

1.5 |

1.2 |

1.92 |

1.8 |

0.14 |

0.02 |

<0.005 |

2.03 |

3.05 |

|

|

Indidura |

| CRSX24-37 |

891.58 |

892.80 |

1.2 |

1.0 |

2.85 |

10.9 |

0.74 |

0.15 |

0.01 |

3.53 |

4.31 |

|

|

Cuesta de Cura |

| CRSX24-37 |

927.55 |

928.55 |

1.0 |

0.9 |

5.49 |

63.8 |

3.06 |

0.12 |

0.13 |

7.94 |

7.94 |

1m @ 7.94g/t AuEq

( 5.49g/t Au, 63.8g/t Ag, 0.12% Cu, 0.13% Pb, 3.06% Zn) |

|

Cuesta de Cura |

| CRSX24-37 |

961.00 |

962.50 |

1.5 |

1.2 |

6.52 |

9.5 |

3.29 |

0.03 |

0.02 |

8.30 |

12.45 |

1.5m @ 8.3g/t AuEq

( 6.52g/t Au, 9.5g/t Ag, 0.03% Cu, 0.02% Pb, 3.29% Zn) |

|

Cuesta de Cura |

| CRSX24-37 |

981.00 |

982.50 |

1.5 |

1.2 |

1.29 |

16.3 |

1.31 |

0.01 |

0.03 |

2.15 |

3.23 |

|

|

Cuesta de Cura |

| CRSX24-37 |

996.50 |

998.20 |

1.7 |

1.3 |

4.83 |

2.4 |

0.87 |

0.02 |

<0.005 |

5.31 |

9.02 |

1.7m @ 5.31g/t AuEq

( 4.83g/t Au, 2.4g/t Ag, 0.02% Cu, <0.005% Pb, 0.87% Zn) |

|

Cuesta de Cura |

| CRSX24-37 |

1024.90 |

1025.40 |

0.5 |

0.4 |

25.10 |

34.4 |

2.68 |

0.03 |

0.03 |

26.87 |

13.44 |

0.5m @ 26.87g/t AuEq

( 25.1g/t Au, 34.4g/t Ag, 0.03% Cu, 0.03% Pb, 2.68% Zn) |

0.5m @ 26.87g/t AuEq

( 25.1g/t Au, 34.4g/t Ag, 0.03% Cu, 0.03% Pb, 2.68% Zn) |

Cuesta de Cura |

| CRSX24-37 |

1034.15 |

1034.75 |

0.6 |

0.5 |

2.63 |

41.8 |

5.22 |

0.24 |

0.02 |

6.01 |

3.60 |

|

|

Cuesta de Cura |

| CRSX24-37 |

1061.00 |

1062.50 |

1.5 |

1.2 |

2.37 |

3.3 |

0.03 |

<0.005 |

<0.005 |

2.43 |

3.64 |

|

|

Cuesta de Cura |

| CRSX24-37 |

1075.80 |

1078.60 |

2.8 |

2.4 |

1.04 |

12.5 |

1.84 |

0.07 |

0.01 |

2.18 |

6.11 |

|

|

Cuesta de Cura |

| CRSX24-37 |

1086.95 |

1087.60 |

0.6 |

0.6 |

24.30 |

5.9 |

7.17 |

0.08 |

0.01 |

28.00 |

18.20 |

0.6m @ 28g/t AuEq

( 24.3g/t Au, 5.9g/t Ag, 0.08% Cu, 0.01% Pb, 7.17% Zn) |

0.6m @ 28g/t AuEq

( 24.3g/t Au, 5.9g/t Ag, 0.08% Cu, 0.01% Pb, 7.17% Zn) |

Cuesta de Cura |

| CRSX24-37 |

1119.80 |

1121.40 |

1.6 |

1.2 |

0.40 |

2.9 |

4.23 |

0.03 |

<0.005 |

2.55 |

4.08 |

|

|

La Peña |

| CRSX24-37 |

1201.50 |

1203.00 |

1.5 |

1.2 |

8.96 |

13.0 |

0.02 |

0.03 |

0.01 |

9.16 |

13.75 |

1.5m @ 9.16g/t AuEq

( 8.96g/t Au, 13g/t Ag, 0.03% Cu, 0.01% Pb, 0.02% Zn) |

|

La Peña |

| CRSX24-37 |

1271.95 |

1276.05 |

4.1 |

3.5 |

2.42 |

29.4 |

0.05 |

0.11 |

0.07 |

2.95 |

12.09 |

1.1m @ 7.51g/t AuEq

( 7.26g/t Au, 2.3g/t Ag, 0.16% Cu, 0.01% Pb, <0.005% Zn) |

|

La Peña |

| CRSX24-37 |

1313.05 |

1314.00 |

1.0 |

0.7 |

0.27 |

2.9 |

11.85 |

0.11 |

<0.005 |

6.27 |

5.95 |

|

|

Cupido |

| CRSX24-38A |

890.20 |

892.00 |

1.8 |

1.6 |

2.28 |

10.0 |

0.68 |

0.02 |

0.03 |

2.76 |

4.97 |

|

|

Cuesta de Cura |

| CRSX24-38A |

899.35 |

902.55 |

3.2 |

2.3 |

3.42 |

22.9 |

2.46 |

0.05 |

0.05 |

4.98 |

15.93 |

1.2m @ 8.35g/t AuEq

( 5.93g/t Au, 24.4g/t Ag, 0.07% Cu, 0.04% Pb, 4.12% Zn) |

|

Cuesta de Cura |

| CRSX24-38A |

949.35 |

950.00 |

0.6 |

0.6 |

14.60 |

18.9 |

8.98 |

0.13 |

0.03 |

19.41 |

12.62 |

0.6m @ 19.41g/t AuEq

( 14.6g/t Au, 18.9g/t Ag, 0.12% Cu, 0.03% Pb, 8.98% Zn) |

0.6m @ 19.41g/t AuEq

( 14.6g/t Au, 18.9g/t Ag, 0.12% Cu, 0.03% Pb, 8.98% Zn) |

Cuesta de Cura |

| CRSX24-38A |

971.15 |

971.65 |

0.5 |

0.4 |

61.50 |

60.2 |

5.92 |

0.48 |

0.07 |

65.77 |

32.88 |

0.5m @ 65.77g/t AuEq

( 61.5g/t Au, 60.2g/t Ag, 0.48% Cu, 0.07% Pb, 5.92% Zn) |

0.5m @ 65.77g/t AuEq

( 61.5g/t Au, 60.2g/t Ag, 0.48% Cu, 0.07% Pb, 5.92% Zn) |

Cuesta de Cura |

| CRSX24-38A |

1047.00 |

1047.65 |

0.7 |

0.5 |

5.47 |

9.8 |

0.01 |

0.08 |

<0.005 |

5.70 |

3.71 |

|

|

Cuesta de Cura |

| CRSX24-38A |

1132.65 |

1133.90 |

1.3 |

1.1 |

3.96 |

8.5 |

4.31 |

0.11 |

0.01 |

6.32 |

7.90 |

|

|

Cuesta de Cura |

| CRSX24-38A |

1158.05 |

1158.85 |

0.8 |

0.6 |

3.60 |

10.5 |

5.65 |

0.20 |

0.01 |

6.77 |

5.42 |

|

|

Cuesta de Cura |

| CRSX24-38A |

1165.80 |

1166.30 |

0.5 |

0.5 |

6.36 |

11.7 |

4.48 |

0.08 |

0.01 |

8.81 |

4.40 |

|

|

La Peña |

| CRSX24-38B |

889.35 |

889.85 |

0.5 |

0.4 |

18.10 |

48.1 |

5.13 |

0.14 |

0.06 |

21.38 |

10.69 |

0.5m @ 21.38g/t AuEq

( 18.1g/t Au, 48.1g/t Ag, 0.14% Cu, 0.07% Pb, 5.13% Zn) |

0.5m @ 21.38g/t AuEq

( 18.1g/t Au, 48.1g/t Ag, 0.14% Cu, 0.07% Pb, 5.13% Zn) |

Cuesta de Cura |

| CRSX24-38B |

903.70 |

904.20 |

0.5 |

0.4 |

12.20 |

46.8 |

9.77 |

0.09 |

0.09 |

17.69 |

8.85 |

0.5m @ 17.69g/t AuEq

( 12.2g/t Au, 46.8g/t Ag, 0.09% Cu, 0.09% Pb, 9.77% Zn) |

0.5m @ 17.69g/t AuEq

( 12.2g/t Au, 46.8g/t Ag, 0.09% Cu, 0.09% Pb, 9.77% Zn) |

Cuesta de Cura |

| CRSX24-38B |

918.50 |

919.00 |

0.5 |

0.4 |

7.38 |

72.1 |

5.36 |

0.12 |

0.31 |

11.11 |

5.56 |

|

0.5m @ 11.11g/t AuEq

( 7.38g/t Au, 72.1g/t Ag, 0.12% Cu, 0.31% Pb, 5.36% Zn) |

Breccia |

| CRSX24-38B |

930.05 |

930.55 |

0.5 |

0.4 |

5.98 |

33.8 |

2.35 |

0.02 |

0.50 |

7.73 |

3.86 |

|

|

Cuesta de Cura |

| CRSX24-38B |

951.90 |

952.40 |

0.5 |

0.4 |

13.50 |

22.9 |

0.99 |

0.08 |

0.28 |

14.45 |

7.22 |

|

0.5m @ 14.45g/t AuEq

( 13.5g/t Au, 22.9g/t Ag, 0.08% Cu, 0.28% Pb, 0.99% Zn) |

Cuesta de Cura |

| CRSX24-38B |

1110.80 |

1116.08 |

5.3 |

4.3 |

3.61 |

2.7 |

0.83 |

0.06 |

0.01 |

4.13 |

21.79 |

1m @ 17.3g/t AuEq

( 15.25g/t Au, 6.5g/t Ag, 0.11% Cu, 0.03% Pb, 3.71% Zn) |

1m @ 17.3g/t AuEq

( 15.25g/t Au, 6.5g/t Ag, 0.11% Cu, 0.03% Pb, 3.71% Zn) |

1110.8 - 1111.8 Breccia

1111.8 - 1113.6 FG Intrusives - hdb-bi-pl

1113.6 - 1114.73 Breccia

1114.73 - 1116.08 Cuesta de Cura |

| CRSX24-38B |

1268.15 |

1268.65 |

0.5 |

0.4 |

4.93 |

38.3 |

1.12 |

0.07 |

0.04 |

6.02 |

3.01 |

|

|

Cupido |

| CRSX24-39 |

1103.89 |

1104.40 |

0.5 |

0.4 |

9.99 |

105.0 |

1.76 |

0.30 |

0.12 |

12.52 |

6.38 |

|

0.5m @ 12.52g/t AuEq

( 9.99g/t Au, 105g/t Ag, 0.3% Cu, 0.12% Pb, 1.76% Zn) |

Cuesta de Cura |

| CRSX24-39 |

1133.40 |

1134.85 |

1.4 |

0.9 |

2.33 |

285.0 |

2.17 |

0.51 |

0.75 |

7.63 |

11.06 |

1.4m @ 7.63g/t AuEq

( 2.33g/t Au, 285g/t Ag, 0.51% Cu, 0.74% Pb, 2.17% Zn) |

|

Cuesta de Cura |

| CRSX24-39 |

1191.35 |

1198.05 |

6.7 |

4.2 |

1.47 |

8.3 |

0.56 |

0.17 |

<0.005 |

2.06 |

13.82 |

|

|

Cuesta de Cura |

| CRSX24-39 |

1347.25 |

1349.45 |

2.2 |

1.0 |

8.99 |

192.0 |

0.70 |

0.36 |

0.28 |

12.14 |

26.70 |

1m @ 22.66g/t AuEq

( 19.35g/t Au, 159g/t Ag, 0.47% Cu, 0.23% Pb, 1.54% Zn) |

1m @ 22.66g/t AuEq

( 19.35g/t Au, 159g/t Ag, 0.47% Cu, 0.23% Pb, 1.54% Zn) |

Breccia |

| CRSX24-39 |

1576.40 |

1578.40 |

2.0 |

1.1 |

0.83 |

393.4 |

8.77 |

0.08 |

2.40 |

10.62 |

21.25 |

1.5m @ 12.92g/t AuEq

( 0.71g/t Au, 500g/t Ag, 0.1% Cu, 3.04% Pb, 10.65% Zn) |

1.5m @ 12.92g/t AuEq

( 0.71g/t Au, 500g/t Ag, 0.1% Cu, 3.04% Pb, 10.65% Zn) |

La Peña |

| CRSX24-40 |

1235.00 |

1237.00 |

2.0 |

1.8 |

2.99 |

11.2 |

0.56 |

0.02 |

0.02 |

3.43 |

6.86 |

|

|

La Peña |

| CRSX24-40 |

1240.30 |

1241.50 |

1.2 |

1.1 |

2.41 |

1.4 |

0.05 |

0.12 |

<0.005 |

2.61 |

3.14 |

|

|

La Peña |

| CRSX24-40 |

1266.00 |

1267.50 |

1.5 |

1.1 |

3.52 |

19.7 |

0.03 |

0.01 |

0.03 |

3.79 |

5.69 |

|

|

FG Intrusives - hdb-bi-pl |

| CRSX24-40 |

1386.50 |

1391.40 |

4.9 |

3.8 |

1.89 |

3.9 |

0.05 |

0.13 |

<0.005 |

2.13 |

10.42 |

|

|

Cupido |

| CRSX24-40 |

1405.25 |

1406.55 |

1.3 |

1.0 |

0.88 |

33.5 |

0.06 |

1.34 |

<0.005 |

3.07 |

3.99 |

|

|

Cupido |

| CRSX24-40 |

1411.20 |

1426.15 |

15.0 |

11.6 |

0.93 |

24.7 |

0.06 |

0.91 |

<0.005 |

2.45 |

36.57 |

|

0.5m @ 10.17g/t AuEq

( 2.69g/t Au, 105g/t Ag, 4.67% Cu, <0.005% Pb, 0.15% Zn) |

Cupido |

| CRSX24-40 |

1442.90 |

1447.30 |

4.4 |

3.4 |

1.21 |

12.6 |

0.03 |

0.84 |

<0.005 |

2.49 |

10.97 |

|

|

Cupido |

| CRSX24-40 |

1483.20 |

1485.85 |

2.6 |

2.1 |

1.48 |

19.6 |

0.05 |

0.74 |

<0.005 |

2.71 |

7.19 |

|

|

Cupido |

| CRSX24-40 |

1519.30 |

1521.00 |

1.7 |

1.3 |

1.53 |

26.2 |

0.06 |

0.96 |

<0.005 |

3.14 |

5.33 |

|

|

Cupido |

| CRSX24-40A |

1140.75 |

1145.22 |

4.5 |

2.7 |

5.17 |

215.1 |

4.59 |

0.14 |

3.33 |

11.24 |

50.23 |

2.8m @ 17g/t AuEq

( 8.07g/t Au, 299.4g/t Ag, 0.13% Cu, 5.17% Pb, 7.16% Zn) |

0.8m @ 20.35g/t AuEq

( 10.95g/t Au, 386g/t Ag, 0.12% Cu, 6.35% Pb, 5.3% Zn)

1.3m @ 22.36g/t AuEq

( 9.88g/t Au, 370g/t Ag, 0.2% Cu, 6.62% Pb, 11.55% Zn) |

Cuesta de Cura |

| CRSX24-40A |

1171.75 |

1174.50 |

2.8 |

1.7 |

2.99 |

268.5 |

6.77 |

0.16 |

4.29 |

11.11 |

30.55 |

1.5m @ 16.87g/t AuEq

( 4.26g/t Au, 373g/t Ag, 0.17% Cu, 7.23% Pb, 11.4% Zn) |

1.5m @ 16.87g/t AuEq

( 4.26g/t Au, 373g/t Ag, 0.17% Cu, 7.23% Pb, 11.4% Zn) |

Cuesta de Cura |

| CRSX24-40C |

1084.20 |

1085.50 |

1.3 |

0.9 |

0.43 |

32.6 |

7.84 |

0.24 |

0.05 |

5.00 |

6.50 |

|

|

Cuesta de Cura |

| CRSX24-40C |

1162.08 |

1164.50 |

2.4 |

1.7 |

0.82 |

12.7 |

1.13 |

0.38 |

<0.005 |

2.03 |

4.92 |

|

|

Cuesta de Cura |

| CRSX24-40C |

1193.70 |

1194.40 |

0.7 |

0.6 |

4.21 |

30.5 |

0.92 |

0.03 |

0.79 |

5.32 |

3.73 |

|

|

La Peña |

| Criteria: Cut off grade 2g/t AuEq, minimum length 1.5m, maximum consecutive internal waste 3m, if Au grade x length > 3 the composite will be added |

| Price Assumptions: Au = 1750usd oz, Ag = 21usd oz, Cu = 3.5usd lb, Zn = 1.2usd lb |

| Note: CRSX24-39 was drilled down plunge to test continuity of mineralized system. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 2: Camino Rojo Sulphide Composite Drill

Results (Composites 1g/t Au cog)

| HOLE-ID |

From

(m) |

To

(m) |

Core Length

(m) |

Estimated True Width

(m) |

Au g/t |

Ag g/t |

Zn

% |

Cu

% |

Pb

% |

AuEq g/t

(Au+Ag+Cu+Pb+Zn) |

Au GXM |

Including

2.0g/t Au COG |

Including

10g/t Au HG |

Litho |

| CRSX24-25H |

662.40 |

666.50 |

4.1 |

3.2 |

11.88 |

18.3 |

0.11 |

0.03 |

0.04 |

12.17 |

48.72 |

4.1m @ 11.88g/t Au

( 18.3g/t Ag, 0.03% Cu, 0.04% Pb, 0.11% Zn) |

0.8m @ 20.8g/t Au

(17.1g/t Ag, 0.02% Cu, 0.03% Pb, 0.02% Zn)

0.6m @ 35g/t Au

(30.8g/t Ag, <0.005% Cu, 0.04% Pb, 0.01% Zn) |

Caracol |

| CRSX24-25H |

683.50 |

686.50 |

3.0 |

2.3 |

1.47 |

3.4 |

0.43 |

0.01 |

0.04 |

1.67 |

4.40 |

|

|

Caracol |

| CRSX24-25H |

698.50 |

700.00 |

1.5 |

1.2 |

1.39 |

2.0 |

0.10 |

0.01 |

<0.005 |

1.46 |

2.08 |

|

|

Caracol |

| CRSX24-35 |

452.30 |

453.80 |

1.5 |

1.1 |

3.73 |

10.1 |

<0.005 |

<0.005 |

<0.005 |

3.84 |

5.60 |

1.5m @ 3.73g/t Au

(10.1g/t Ag, <0.005% Cu, <0.005% Pb, <0.005% Zn) |

|

Caracol |

| CRSX24-35 |

527.50 |

532.00 |

4.5 |

3.2 |

1.25 |

69.0 |

0.66 |

0.01 |

0.43 |

2.34 |

5.64 |

1.5m @ 2.45g/t Au

(198g/t Ag, 0.03% Cu, 1.25% Pb, 1.56% Zn) |

|

Caracol |

| CRSX24-35 |

548.50 |

551.50 |

3.0 |

2.1 |

3.00 |

53.1 |

0.89 |

0.01 |

0.39 |

3.98 |

8.99 |

3m @ 3.98g/t AuEq

(53g/t Ag, 0.01% Cu, 0.39% Pb, 0.89% Zn) |

|

Caracol |

| CRSX24-35 |

568.50 |

571.50 |

3.0 |

2.1 |

1.34 |

27.4 |

0.82 |

0.01 |

0.28 |

1.99 |

4.01 |

|

|

Caracol |

| CRSX24-35 |

579.00 |

580.50 |

1.5 |

1.1 |

1.77 |

39.3 |

0.80 |

0.02 |

0.37 |

2.58 |

2.65 |

|

|

Caracol |

| CRSX24-35 |

604.50 |

606.00 |

1.5 |

1.1 |

2.86 |

71.2 |

1.23 |

0.01 |

1.04 |

4.32 |

4.29 |

1.5m @ 2.86g/t Au

(71.2g/t Ag, 0.01% Cu, 1.03% Pb, 1.23% Zn) |

|

Caracol |

| CRSX24-36C |

703.50 |

704.00 |

0.5 |

0.4 |

5.92 |

105.0 |

0.03 |

0.05 |

0.04 |

7.12 |

2.96 |

|

|

Caracol |

| CRSX24-37 |

561.50 |

566.00 |

4.5 |

3.6 |

3.12 |

5.6 |

0.27 |

0.01 |

0.04 |

3.29 |

14.03 |

1.5m @ 7.4g/t Au

(3g/t Ag, <0.005% Cu, <0.005% Pb, 0.11% Zn) |

|

Caracol |

| CRSX24-37 |

576.00 |

577.50 |

1.5 |

1.2 |

9.31 |

95.7 |

1.31 |

0.05 |

1.69 |

11.27 |

13.97 |

1.5m @ 11.27g/t AuEq

(95.7g/t Ag, 0.05% Cu, 1.69% Pb, 1.3% Zn) |

|

Caracol |

| CRSX24-37 |

591.50 |

681.60 |

90.1 |

71.7 |

2.28 |

9.8 |

0.25 |

0.01 |

0.07 |

2.51 |

205.52 |

40m @ 2.78g/t Au

(11.7g/t Ag, 0.02% Cu, 0.12% Pb, 0.25% Zn)

6.6m @ 6.28g/t Au

(19g/t Ag, 0.03% Cu, 0.15% Pb, 1.24% Zn)

1.5m @ 7.48g/t Au

(6g/t Ag, 0.02% Cu, 0.04% Pb, 0.03% Zn)

4.5m @ 3.22g/t Au

(35.9g/t Ag, 0.01% Cu, 0.09% Pb, 0.17% Zn) |

1.5m @ 11.5g/t Au

(53.8g/t Ag, 0.01% Cu, 0.14% Pb, 0.2% Zn)

0.7m @ 12.5g/t Au

(43.5g/t Ag, 0.01% Cu, 0.1% Pb, 0.28% Zn)

1.5m @ 22.8g/t Au

(19g/t Ag, 0.03% Cu, 0.01% Pb, 0.12% Zn)

1.1m @ 13.2g/t Au

(20.7g/t Ag, 0.02% Cu, 0.05% Pb, 0.36% Zn) |

591.5 - 678.4 Caracol

678.4 - 681.6 Indidura |

| CRSX24-38B |

656.50 |

664.00 |

7.5 |

6.5 |

3.30 |

12.0 |

0.65 |

0.02 |

0.10 |

3.70 |

24.74 |

7.5m @ 3.7g/t AuEq

( 3.3g/t Au, 12g/t Ag, 0.02% Cu, 0.1% Pb, 0.65% Zn) |

1.5m @ 12.37g/t AuEq

( 10.95g/t Au, 29.5g/t Ag, 0.05% Cu, 0.19% Pb, 2.83% Zn) |

Caracol |

| CRSX24-38B |

681.35 |

683.50 |

2.1 |

1.9 |

4.42 |

7.4 |

0.11 |

<0.005 |

0.09 |

4.57 |

9.51 |

0.9m @ 9.15g/t AuEq

( 9g/t Au, 9.3g/t Ag, <0.005% Cu, 0.1% Pb, 0.05% Zn) |

|

Caracol |

| CRSX24-38B |

690.40 |

692.00 |

1.6 |

1.4 |

1.99 |

34.6 |

0.37 |

0.01 |

0.58 |

2.63 |

3.18 |

|

|

Caracol |

| CRSX24-39 |

578.00 |

596.00 |

18.0 |

12.7 |

1.03 |

11.3 |

0.29 |

0.01 |

0.15 |

1.30 |

18.53 |

1.5m @ 4.12g/t Au

(16.2g/t Ag, 0.02% Cu, 0.22% Pb, 0.84% Zn)

1.5m @ 2.31g/t Au

(31.2g/t Ag, 0.01% Cu, 0.44% Pb, 0.56% Zn)

1.5m @ 2.17g/t Au

(15g/t Ag, 0.01% Cu, 0.22% Pb, 0.24% Zn) |

|

Caracol |

| CRSX24-39 |

605.00 |

642.50 |

37.5 |

26.3 |

2.21 |

11.9 |

0.24 |

0.01 |

0.07 |

2.46 |

82.83 |

4.9m @ 9.68g/t Au

(48.1g/t Ag, 0.04% Cu, 0.16% Pb, 0.61% Zn)

7m @ 2.68g/t Au

(6.7g/t Ag, 0.02% Cu, 0.04% Pb, 0.23% Zn) |

1.9m @ 22.2g/t Au

(107g/t Ag, 0.1% Cu, 0.25% Pb, 1.03% Zn) |

605 - 606.6 Caracol

606.6 - 608.55 Breccia

608.55 - 642.5 Caracol |

| CRSX24-39 |

654.50 |

657.50 |

3.0 |

2.1 |

3.94 |

14.9 |

0.49 |

0.04 |

0.07 |

4.34 |

11.81 |

3m @ 3.94g/t Au

(14.9g/t Ag, 0.04% Cu, 0.07% Pb, 0.49% Zn) |

|

Caracol |

| CRSX24-39 |

665.00 |

673.00 |

8.0 |

5.6 |

2.97 |

8.1 |

0.17 |

0.01 |

0.09 |

3.15 |

23.80 |

8m @ 2.97g/t Au

(8.1g/t Ag, 0.01% Cu, 0.09% Pb, 0.17% Zn) |

|

Caracol |

| CRSX24-39 |

693.20 |

695.90 |

2.7 |

1.9 |

29.17 |

54.8 |

0.05 |

0.03 |

0.02 |

29.82 |

78.76 |

0.9m @ 86.3g/t Au

(161g/t Ag, 0.09% Cu, 0.06% Pb, 0.06% Zn) |

0.9m @ 86.3g/t Au

(161g/t Ag, 0.09% Cu, 0.06% Pb, 0.06% Zn) |

Caracol |

| CRSX24-40 |

551.00 |

552.00 |

1.0 |

0.8 |

2.49 |

352.0 |

1.08 |

0.01 |

0.72 |

6.79 |

2.49 |

|

|

Breccia |

| Criteria: Cut off grade 1g/t Au, minimum length 1.5m, maximum consecutive internal waste 6m, if Au grade x length > 1.5 the composite will be added |

| Price Assumptions: Au = 1750usd oz, Ag = 21usd oz, Cu = 3.5usd lb, Zn = 1.2usd lb |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 3: Camino Rojo Sulphide Extension Drill

Hole Collars

| HOLE-ID |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

Depth (m) |

| CRSX24-25H |

243501.5 |

2676087.5 |

1954.6 |

172.6 |

-72.73 |

1310.4 |

| CRSX24-31 |

243665.5 |

2676153.9 |

1953.4 |

144.7 |

-77.00 |

1247.8 |

| CRSX24-35 |

243402.0 |

2675997.3 |

1956.3 |

139.8 |

-78.00 |

650.0 |

| CRSX24-35B |

243402.0 |

2675997.3 |

1956.3 |

146.0 |

-65.90 |

1222.4 |

| CRSX24-36A |

243305.3 |

2676111.1 |

1957.9 |

181.4 |

-62.53 |

1561.1 |

| CRSX24-36C |

243305.3 |

2676111.1 |

1957.9 |

151.5 |

-67.52 |

1500.0 |

| CRSX24-37 |

243682.3 |

2676269.9 |

1953.9 |

148.0 |

-70.00 |

1352.0 |

| CRSX24-38A |

243550.9 |

2676268.3 |

1956.0 |

159.9 |

-57.10 |

1251.0 |

| CRSX24-38B |

243550.9 |

2676268.3 |

1956.0 |

160.9 |

-65.30 |

1400.1 |

| CRSX24-39 |

243796.8 |

2676271.4 |

1951.7 |

204.7 |

-61.52 |

1646.1 |

| CRSX24-40 |

243283.1 |

2676079.3 |

1957.4 |

172.9 |

-66.00 |

1587.5 |

| CRSX24-40A |

243283.1 |

2676079.3 |

1957.4 |

145.7 |

-52.11 |

1320.0 |

| CRSX24-40C |

243283.1 |

2676079.3 |

1957.4 |

169.0 |

-60.00 |

1337.2 |

SOURCE Orla Mining Ltd.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2024/10/c4283.html

%CIK: 0001680056

For further information: For further information, please contact:

Jason Simpson, President & Chief Executive Officer; Andrew Bradbury, Vice President, Investor Relations & Corporate Development,

www.orlamining.com, info@orlamining.com

CO: Orla Mining Ltd.

CNW 06:00e 10-DEC-24

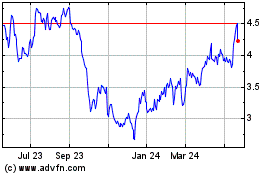

Orla Mining (AMEX:ORLA)

Historical Stock Chart

From Jan 2025 to Feb 2025

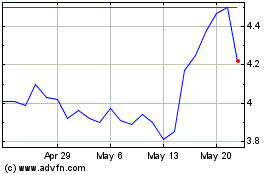

Orla Mining (AMEX:ORLA)

Historical Stock Chart

From Feb 2024 to Feb 2025