Paramount Gold Nevada Corp. (NYSE American: PZG) (“Paramount” or

the “Company”) announced today that it has closed the previously

announced $15 million financing with Sprott Resource and Streaming

Royalty Corp. (“Sprott Streaming”), through the issuance of a

non-dilutive Secured Royalty Convertible Note (“RCN”).

The proceeds of the financing will be used to

fund the continued permitting of the proposed Grassy Mountain Gold

Mine in eastern Oregon, for general corporate purposes and for the

repayment of the company’s outstanding debt.

Paramount CEO, Rachel Goldman commented, “With

the receipt of the Notice to Proceed from the State of Oregon, the

Grassy permitting process has taken on greater certainty and this

financing will allow us to fund our activities through to the

receipt of final permits. Sprott Streaming is an ideal financial

partner, a flexible and seasoned natural resource investor,

providing an important source of patient capital.”

The RCN will carry an interest rate of 10% per

annum, which, at Paramount’s discretion, will be payable in cash or

shares at a 7% discount to the 10-day VWAP from the scheduled date

of payment of interest. The RCN may be repaid in cash or through

the issuance of the Royalty at the earlier of the commencement of

commercial production or 5 years from the RCN closing date. The RCN

is convertible into a gross revenue royalty of 4.75% of the gold

and silver produced from the proposed Grassy Mountain Gold Mine

proportionate to the final amount of the funds that have been

advanced upon reaching commercial production. If a Royalty is

issued, Paramount has the option to buy back 50% of the Royalty by

paying either $11.25 million on the 2nd anniversary of the RCN

agreement or $12.375 million on the 3rd anniversary.

“With the closing of this financing, Paramount

will start a catalyst rich 2024 with the financial flexibility to

fund our goal of making Grassy Mountain the first modern mine in

the State of Oregon, and we welcome Sprott Streaming as a new

stakeholder supporting our journey,” Goldman added.

Caroline Donally, Managing Partner, Sprott

Streaming, commented, “We are delighted to partner with Paramount

as it progresses the high grade, feasibility study stage Grassy

Mountain Gold Mine through the permitting process in Oregon.”

About Paramount Gold Nevada

Corp.

Paramount Gold Nevada Corp. is a U.S. based

precious metals exploration and development company. Paramount’s

strategy is to create shareholder value through exploring and

developing its mineral properties and to realize this value for its

shareholders in three ways: by selling its assets to established

producers; entering joint ventures with producers for construction

and operation; or constructing and operating mines for its own

account.

Paramount holds a 100% interest in four gold

projects: Grassy Mountain; Frost; Sleeper and Bald Peak.

The Grassy Mountain Gold Project ("Grassy")

consists of approximately 8,200 acres located on private and BLM

land in Malheur County, Oregon. Grassy contains a gold-silver

deposit (100% located on private land) for which results of a

positive Feasibility Study have been released and key permitting

milestones accomplished.

Frost is comprised of 84 unpatented lode claims

covering approximately 1,730 acres located 12 miles southwest of

the Company’s proposed high-grade, underground Grassy in Malheur

County, Oregon.

The Sleeper Gold Project is in Northern Nevada,

the world’s premier mining jurisdiction. The Sleeper Gold Project,

which includes the former producing Sleeper mine, totals 2,474

unpatented mining claims (approximately 44,917 acres).

The drill ready, Bald Peak Project in Nevada,

consists of approximately 2,260 acres.

Safe Harbor for Forward-Looking

Statements

This release and related documents may include

"forward-looking statements" and “forward-looking information”

(collectively, “forward-looking statements”) pursuant to applicable

United States and Canadian securities laws. Paramount’s future

expectations, beliefs, goals, plans or prospects constitute

forward-looking statements within the meaning of the United States

Private Securities Litigation Reform Act of 1995 and other

applicable securities laws. Words such as "believes," "plans,"

"anticipates," "expects," "estimates" and similar expressions are

intended to identify forward-looking statements, although these

words may not be present in all forward-looking statements.

Forward-looking statements included in this news release include,

without limitation, statements with respect to the use of proceeds

from the Offerings. Forward-looking statements are based on the

reasonable assumptions, estimates, analyses and opinions of

management made in light of its experience and its perception of

trends, current conditions and expected developments, as well as

other factors that management believes to be relevant and

reasonable in the circumstances at the date that such statements

are made, but which may prove to be incorrect. Management believes

that the assumptions and expectations reflected in such

forward-looking statements are reasonable. Assumptions have been

made regarding, among other things: the conclusions made in the

feasibility study for the Grassy Mountain Gold Project (the “FS”);

the quantity and grade of resources included in resource estimates;

the accuracy and achievability of projections included in the FS;

Paramount’s ability to carry on exploration and development

activities, including construction; the timely receipt of required

approvals and permits; the price of silver, gold and other metals;

prices for key mining supplies, including labor costs and

consumables, remaining consistent with current expectations; work

meeting expectations and being consistent with estimates and plant,

equipment and processes operating as anticipated. There are a

number of important factors that could cause actual results or

events to differ materially from those indicated by such

forward-looking statements, including, but not limited to:

uncertainties involving interpretation of drilling results;

environmental matters; the ability to obtain required permitting;

equipment breakdown or disruptions; additional financing

requirements; the completion of a definitive feasibility study for

the Grassy Mountain Gold Project; discrepancies between actual and

estimated mineral reserves and mineral resources, between actual

and estimated development and operating costs and between estimated

and actual production; the global epidemics, pandemics, or other

public health crises, including the novel coronavirus (COVID-19)

global health pandemic, and the spread of other viruses or

pathogens and the other factors described in Paramount’s

disclosures as filed with the SEC and the Ontario, British Columbia

and Alberta Securities Commissions.

Except as required by applicable law, Paramount

disclaims any intention or obligation to update any forward-looking

statements as a result of developments occurring after the date of

this document.

Paramount Gold Nevada Corp.

Rachel Goldman, Chief Executive

OfficerChristos Theodossiou, Director of Corporate

Communications844.488.2233Twitter:

@ParamountNV

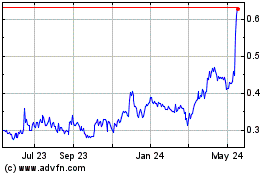

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Nov 2024 to Dec 2024

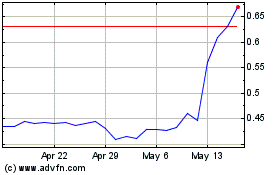

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Dec 2023 to Dec 2024