Sachem Capital Corp. Announces Withdrawal of Public Debt Offering

28 June 2024 - 7:00AM

Sachem Capital Corp. (NYSE American: SACH) today announced that it

is withdrawing its previously announced debt offering. The company

had intended to offer USD-denominated unsecured, unsubordinated

notes due five years from the date of issuance. The company has

concluded that current market conditions regarding pricing were

excessive and restrictive and, thus, not in the best interest of

the company and its shareholders.

John Villano, CEO of Sachem Capital Corp.,

commented: “We want to assure our shareholders and noteholders that

Sachem has ample liquidity through its existing credit facilities

and liquid mortgage portfolio to continue to execute on the

business consistent with past practice. In addition, Sachem will

continue its disciplined underwriting and loan origination

processes to maximize risk adjusted returns for shareholders and to

protect our capital. Our decision to withdraw our previously

announced debt offering was based solely on our determination that

the proposed pricing of the offering was unfavorable to the

long-term interests of Sachem’s business.”

This press release does not constitute an offer

to sell or the solicitation of an offer to buy the securities in

this offering or any other securities nor will there be any sale of

the Notes or any other securities referred to in this press release

in any state or jurisdiction in which such offer, solicitation or

sale would be unlawful prior to the registration or qualification

under the securities laws of such state or jurisdiction.

About Sachem Capital

Corp.Sachem Capital Corp. is a mortgage REIT that

specializes in originating, underwriting, funding, servicing, and

managing a portfolio of loans secured by first mortgages on real

property. It offers short-term (i.e., three years or less) secured,

nonbanking loans to real estate investors to fund their

acquisition, renovation, development, rehabilitation, or

improvement of properties. The Company’s primary underwriting

criteria is a conservative loan to value ratio. The properties

securing the loans are generally classified as residential or

commercial real estate and, typically, are held for resale or

investment. Each loan is secured by a first mortgage lien on real

estate and is personally guaranteed by the principal(s) of the

borrower. The Company also makes opportunistic real estate

purchases apart from its lending activities.

Investors:Email:

investors@sachemcapitalcorp.com

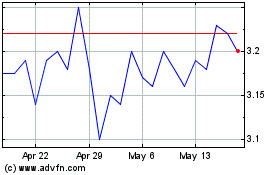

Sachem Capital (AMEX:SACH)

Historical Stock Chart

From Nov 2024 to Dec 2024

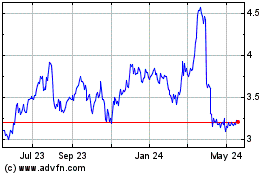

Sachem Capital (AMEX:SACH)

Historical Stock Chart

From Dec 2023 to Dec 2024