Industry Experienced Weakness in CBD Demand

in 2021 Resulting In Company YOY Decline in Net Sales for

the December 2021 Quarter

Company Anticipates Regulatory Action

Against the FDA With Expected Filing of Citizens Petition

cbdMD, Inc. (NYSE American: YCBD, YCBDpA), one of the nation’s

leading and most highly trusted and recognized CBD companies, and

operator of three of the leading CBD brands -- its flagship brand

cbdMD, its animal health brand Paw CBD and its beauty and skincare

brand cbdMD Botanicals, -- today we announced our financial results

for December 31, 2021, the first quarter of our fiscal year ended

September 30, 2022 and the third full year of operations with our

cbdMD brands, after completing the acquisition of Cure Based

Development on December 21, 2018. In the three calendar years

(2019-2021), we generated $118.7 million in net sales, which

exceeds the initial contracted earn-out revenue target of $113.3

million for the 36-month period.

Despite our three-year growth, our most recent net sales for the

first quarter of fiscal 2022 decreased by 26% year-over-year, from

$12.3 million in the prior year to $9.3 million this quarter. We

believe that this trend started in early 2021 as overall CBD

consumer demand growth started to decline in the US. We believe

that this pullback has stemmed from the lack of regulatory clarity

created by the United States Food and Drug Administration “FDA”.

This product uncertainty has prohibited leading CBD brands such as

ours, access to mainstream retailers, wholesalers and sales and

marketing platforms. We believe that properly manufactured CBD

products such as ours, which adhere to the rigorous standards of

the Food Drug & Cosmetic Act, are safe and should be allowed

for sale in all these retail channels as well as product marketing

on all platforms.

In the coming days, we will be filing, in conjunction with the

Natural Products Association, a Citizens Petition which is a

process provided by the FDA for individuals and community

organizations to make requests to the FDA to amend changes in

healthcare policies. Dr. Swift, our Vice President, Scientific

& Regulatory Affairs, and formerly from the office within FDA

that is responsible for reviewing the safety data, directed the

safety studies performed on our proprietary patent pending broad

spectrum cannabinoid blend. Our dossier is not a “shot in the dark”

and we believe we know the process. The FDA says that they want

good science, and this is it. The Agency has defaulted to “being

confused” over the entirety of the marketplace for hemp and CBD. We

are not asking them to review the safety of all CBD products on the

market. We are calling on them to fulfill their mandate and review

the safety data compiled for our product based upon our conditions

of use. This data was successfully submitted to the UK and EU to

support approval of our products as Novel Foods. The process of

evaluating the safety of a dietary supplement is not unique to any

soil.

We believe it is far past time for the FDA to stop hiding behind

the improperly applied exclusion rule that they are using to deny

Americans access to a robust marketplace of hemp derived products

to help maintain their health in these trying times. We believe

that consumers from all walks of life deserve access to consumer

healthcare products, especially in these trying times. We have

shipped millions of products in the past three years without any

reported adverse events. Our science tells us that our products are

not only safe, but that they help people. Numerous studies about

the benefits of cannabinoids have been coming out over the past

several years and we believe that the real harm to the consumer is

the lack of clarity in our industry, which falls at the feet of the

FDA. While leading brands such as cbdMD go to great expense to

adhere to the existing rules applicable to all dietary supplement

manufacturers and apply the highest standards of care, other

smaller brands flood the market with substandard products and the

FDA is directly to blame for this situation. The longer FDA

continues its irresponsible absenteeism, the more space that will

be occupied by the rogue players. This is evident in the

introductions of competitive products such as Delta 8, which is now

banned for sale in over 30 states and created a negative downward

pressure on the CBD market.

In response to recent weaker sales, we have streamlined

operations by rightsizing and up-skilling our team and reducing our

marketing spend and other expenditures. Our goal is to reduce over

$10 million in SG&A costs in calendar 2022. Despite a healthy

cash balance of approximately $20 million on December 31, 2021, we

are reviewing all necessary measures to conserve cash.

Our gross profit margin for the quarter decreased to 54.4% in

the first quarter of fiscal 2022 from 72.1% in the first quarter of

fiscal 2021, partly due to a $878,000 non-cash inventory charge as

we rationalized several slower moving and expiring product lines.

Without this charge, our non-GAAP Adjusted Gross Profit would have

been 62.2% vs 72.1% in the prior year. This decline is based on

lower manufacturing and operating leverage because of the year over

year declines in sales as well as changes in our product mix.

Our loss from operations increased to approximately $25.1

million compared to $1.75 million from the prior year’s quarter. A

significant part of this loss was due to the fact that we performed

an updated intangible valuation which resulted in a $4.285 million

non-cash reduction to our trade name and a $13.848 million non-cash

reduction to goodwill. Our non-GAAP adjusted operating loss was

approximately $4.7 million, compared to a $523,840 non-GAAP

adjusted operating loss from the prior year’s quarter. This

increase in our non-GAAP adjusted operating loss mainly due to the

decrease in sales and a large marketing spend. As noted above, we

have taken steps to reduce our operating cost during the current

fiscal quarter and have pulled back on our low performing marketing

spends. We reported fourth quarter fiscal 2021 e-commerce, direct

to consumer (DTC) net sales of $7.1 million, a 26% decrease from

$9.7 million in the fourth quarter of fiscal 2020, but only a 2%

sequential decline over the September 2021 quarter. Finally, we

recorded a $5.95 million non-cash gain related to the quarter

reduction of our contingent liability associated with the original

acquisition of the cbdMD business.

We will host a conference call at 4:15 p.m., Eastern Time, on

Thursday, February 10, 2022, to discuss our December 31, 2021,

first quarter financial results and business progress.

CONFERENCE CALL DETAILS

Title:

cbdMD First Quarter 2022 Earnings Call

Event Date:

Thursday, February 10, 2022 - 4:15 PM

Eastern Time

Event Link:

Webcast URL

https://www.webcaster4.com/Webcast/Page/2206/44450

Webcast Replay Expiration:

Friday, February 10, 2023

Participant Numbers:

Toll Free: 888-506-0062

International: 973-528-0011

Entry code (not required): 623328

Replay Number:

Toll Free: 877-481-4010

International: 919-882-2331

Replay Passcode: 44450

About cbdMD, Inc.

cbdMD, Inc. is one of the leading and most highly trusted and

most recognized cannabidiol (CBD) brands with a comprehensive line

of U.S. produced, THC-free1 CBD products as well as our new Full

Spectrum products. Our cbdMD brand currently includes over 130 SKUs

of high-grade, premium CBD products including CBD tinctures, CBD

gummies, CBD topicals, CBD capsules, CBD bath bombs, CBD bath

salts, CBD sleep aids and CBD drink mixes. Our Paw CBD brand of pet

products includes over 45 SKUs of veterinarian-formulated products

including tinctures, chews, topicals products in varying strengths,

and our CBD Botanicals brand of beauty and skincare products

features 15 SKUs, including facial oil and serum, toners,

moisturizers, clear skin, facial masks, exfoliants and body care.

To learn more about cbdMD and their comprehensive line of U.S.

grown, THC-free1 CBD oil and Full Spectrum products, please visit

www.cbdmd.com, follow cbdMD on Instagram and Facebook, or visit one

of the 6,000 retail outlets that carry cbdMD products.

Forward-Looking Statements

This press release contains certain forward-looking statements

that are based upon current expectations and involve certain risks

and uncertainties within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995. Such forward-looking statements can

be identified using words such as ''should,'' ''may,'' ''intends,''

''anticipates,'' ''believes,'' ''estimates,'' ''projects,''

''forecasts,'' ''expects,'' ''plans,'' and ''proposes.'' These

forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties, and other factors, some of

which are beyond our control and difficult to predict. You are

urged to carefully review and consider any cautionary statements

and other disclosures, including the statements made under the

heading "Risk Factors" in cbdMD, Inc.'s Annual Report on Form 10-K

for the fiscal year ended September 30, 2021 as filed with the

Securities and Exchange Commission (the "SEC") on December 17, 2021

and our other filings with the SEC. All forward-looking statements

involve significant risks and uncertainties that could cause actual

results to differ materially from those in the forward-looking

statements, many of which are generally outside the control of

cbdMD, Inc. and are difficult to predict. cbdMD, Inc. does not

undertake any duty to update any forward-looking statements except

as may be required by law. The information which appears on our

websites and our social media platforms, including, but not limited

to, Instagram and Facebook, is not part of this press release.

1 THC-free is defined as below the level of detection using

validated scientific analytical methods.

Non-GAAP Financial Measures

This press release includes a financial measure that excludes

the impact of certain items and therefore has not been calculated

in accordance with U.S. generally accepted accounting principles

("GAAP"). cbdMD, Inc. has included adjusted loss from operations

because management uses this measure to assess operating

performance in order to highlight trends in our business that may

not otherwise be apparent when relying on financial measures

calculated in accordance with GAAP. The adjusted operating loss has

not been prepared in accordance with GAAP. This non-GAAP financial

measure should not be considered as an alternative to, or more

meaningful than, net loss from operations as an indicator of our

operating performance. Further, this non-GAAP financial measure, as

presented by cbdMD, Inc., may not be comparable to similarly titled

measures reported by other companies. cbdMD, Inc. has attached to

this press release a reconciliation of this non-GAAP financial

measure to its most directly comparable GAAP financial measure.

cbdMD, INC. CONDENSED CONSOLIDATED BALANCE SHEETS

DECEMBER 31, 2021 AND SEPTEMBER 30, 2021

(Unaudited)

December 31,

September 30,

2021

2021

Assets Current assets:

Cash and cash equivalents

$

19,696,919

$

26,411,424

Accounts receivable

1,108,818

1,113,372

Accounts receivable – discontinued operations

2,625

10,967

Marketable securities

-

33,351

Investment other securities

1,000,000

1,000,000

Inventory

4,867,208

5,021,867

Inventory prepaid

559,708

551,519

Prepaid sponsorship

895,070

1,212,682

Prepaid expenses and other current assets

1,548,181

1,147,178

Total current assets

29,678,529

36,502,360

Other assets: Property and equipment,

net

2,504,220

2,561,574

Operating lease assets

5,296,943

5,614,960

Deposits for facilities

407,708

529,583

Intangible assets, net

18,666,612

23,003,929

Goodwill

42,772,685

56,670,970

Total other assets

69,648,168

88,490,016

Total assets

$

99,326,697

$

124,992,376

CONDENSED CONSOLIDATED BALANCE SHEETS DECEMBER 31,

2021 AND SEPTEMBER 30, 2021 (continued)

(Unaudited)

December 31,

September 30,

2021

2021

Liabilities and shareholders' equity

Current liabilities: Accounts payable

$

3,673,855

$

2,978,914

Deferred revenue

1,909,139

2,727,612

Accrued expenses

1,117,236

1,151,150

Note payable

60,468

59,470

Total current liabilities

6,760,698

6,917,146

Long term liabilities: Long term

liabilities

93,489

108,985

Operating leases - long term portion

4,571,510

4,859,058

Contingent liability

3,501,000

9,856,000

Deferred tax liability

-

-

Total long term liabilities

8,165,999

14,824,043

Total liabilities

14,926,697

21,741,189

shareholders' equity: Preferred stock,

authorized 50,000,000 shares, $0.001 par value,

5,000,000 and 500,000 shares issued and outstanding, respectively

5,000

5,000

Common stock, authorized 150,000,000 shares, $0.001

par value, 58,277,970 and 57,783,340 shares issued and outstanding,

respectively

58,278

57,783

Additional paid in capital

177,835,993

176,417,269

Accumulated deficit

(93,499,271

)

(73,228,865

)

Total shareholders' equity

84,400,000

103,251,187

Total liabilities and shareholders'

equity

$

99,326,697

$

124,992,376

cbdMD, INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS FOR THE THREE MONTHS ENDED DECEMBER 31, 2021 and

2020

December 31,

December 31,

2021

2020

Gross Sales

$

9,856,767

$

13,131,946

Allowances

(534,945

)

(803,643

)

Total Net Sales

9,321,822

12,328,303

Cost of sales

4,328,310

3,430,274

Gross Profit

4,993,512

8,898,028

Operating expenses

11,955,284

10,657,973

Impairment of Goodwill and other intangible assets

18,183,285

-

(Loss) from operations

(25,145,057

)

(1,759,945

)

Realized and Unrealized gain (loss) on marketable and other

securities, including impairments

(33,350

)

542,710

Decrease (increase) of contingent liability

5,950,000

(8,500,000

)

Other income (expense)

70,737

-

Interest (expense) income

(3,234

)

(10,386

)

Loss (income) before provision for income taxes

(19,160,904

)

(9,727,621

)

Benefit for income taxes

-

332,000

Net (Loss) Income from continuing operations

(19,160,904

)

(9,395,621

)

Net (Loss) Income

(19,160,904

)

(9,395,621

)

Preferred dividends

1,000,502

100,050

Net (Loss) Income attributable to cbdMD, Inc.

common shareholders

$

(20,161,406

)

$

(9,495,671

)

Net (Loss) Income per share:

Basic earnings per share

(0.35

)

(0.18

)

Diluted earnings per share

(0.35

)

(0.18

)

Weighted average number of shares Basic:

57,825,367

52,130,870

Weighted average number of shares Diluted:

57,825,367

52,130,870

cbdMD, INC. CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS) FOR THE THREE MONTHS ENDED

DECEMBER 31, 2021 and 2020

December 31,

December 31,

2021

2020

Net (Loss) Income

$

(19,160,904

)

$

(9,395,621

)

Comprehensive (Loss) Income

(19,160,904

)

(9,395,621

)

Preferred dividends

(1,000,502

)

(100,050

)

Comprehensive (Loss) Income attributable to cbdMD, inc. common

shareholders

$

(20,161,406

)

$

(9,495,671

)

cbdMD, INC. CONDENSED CONSOLIDATED

STATEMENT OF CASH FLOWS FOR THE THREE MONTHS ENDED DECEMBER

31, 2021 and 2020

December 31,

December 31,

2021

2020

Cash flows from operating activities:

Net (Loss) Income

$

(19,160,904

)

$

(9,395,621

)

Adjustments to reconcile net (income) loss to net

cash used by operating activities:

Stock based compensation

505,466

248,894

Restricted stock expense

508,754

15,279

Marketing stock amortization

220,000

-

Issuance of stock / warrants for service

-

35,712

Inventory and materials impairment

878,142

-

Depreciation and amortization

340,701

232,658

Impairment of Goodwill and other intangible assets

18,183,285

-

Increase/(Decrease) in contingent liability

(5,950,000

)

8,500,000

Realized and unrealized loss of Marketable and other securities

33,350

(542,709

)

Termination benefit

-

305,326

Amortization of operating lease asset

318,017

304,080

Changes in operating assets and liabilities:

Accounts receivable

4,554

(110,072

)

Deposits

121,875

24,000

Inventory

(723,483

)

219,859

Prepaid inventory

(8,189

)

(48,184

)

Prepaid expenses and other current assets

(303,391

)

(310,268

)

Accounts payable and accrued expenses

(127,254

)

(1,500,755

)

Operating lease liability

(321,462

)

(237,952

)

Deferred revenue / customer deposits

3,723

(22,701

)

Collection on discontinued operations accounts receivable

8,342

422,417

Deferred tax liability

-

(332,000

)

Cash used by operating activities

(5,468,475

)

(2,192,038

)

Cash flows from investing activities:

Proceeds from sale of other investment securities

-

540,000

Purchase of property and equipment

(231,030

)

(93,294

)

Cash provided (used) by investing activities

(231,030

)

446,706

Cash flows from financing activities:

Proceeds from issuance of preferred stock

-

15,798,115

Note payable

(14,498

)

(13,564

)

Preferred dividend distribution

(1,000,502

)

(100,050

)

Deferred issuance costs

-

-

Cash provided by financing activities

(1,015,000

)

15,684,500

Net increase (decrease) in cash

(6,714,505

)

13,939,168

Cash and cash equivalents, beginning of period

26,411,424

14,824,644

Cash and cash equivalents, end of period

$

19,696,919

$

28,763,812

Supplemental

Disclosures of Cash Flow Information:

2021

2021

Cash Payments for: Interest expense

$

3,234

$

3,672

Non-cash financial activities: Issuance

of Contingent earnout shares:

$

405,000

$

-

Warrants issued to representative

$

-

$

254,950

cbdMD, Inc. SUPPLEMENTAL FINANCIAL

INFORMATION RECONCILIATION OF NON-GAAP ADJUSTED INCOME

(LOSS) FROM OPERATIONS

Three Months

Three Months

Ended

Ended

December 31,

December 31,

2021

2020

GAAP (loss) from operations

$

(25,145,057

)

$

(1,759,945

)

Adjustments: Depreciation

340,701

232,806

Employee and director stock compensation (1)

1,014,220

264,174

Other non-cash stock compensation for services (2)

-

35,713

Inventory adjustment (3)

878,142

-

Write down of legacy accounts receivable (4)

-

-

Impairment of Goodwill and other intangible assets (5)

18,183,285

-

Accrual for severance

-

403,412

Accrual / expenses for discretionary bonus

150,000

300,000

Non-GAAP adjusted (loss) from operations

$

(4,728,709

)

$

(523,840

)

(1) Represents non-cash expense related to options,

warrants, restricted stock expenses that have been amortized during

the period. (2) Represents non-cash expense related to options,

warrants, restricted stock expenses that have been amortized during

the period. (3) Represents an operating expense related to

inventory loss related to regulatory changes impacting labels and

packaging and obsolete/expired inventory. (4) Write down of legacy

accounts receivable. (5) Represents non-cash goodwill impairment of

$13,898,285 and impairment of the cbdMD trademark of $4,285,000.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220210005813/en/

PR: cbdMD, Inc. Robert Pettway Director of Paid Media

rpettway@cbdmd.com (423) 503-5225

Investors: cbdMD, Inc. John Weston Director of Investor

Relations john.weston@cbdmd.com (704) 249-9515

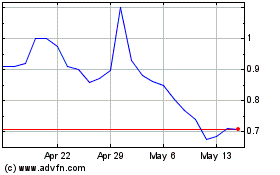

cbdMD (AMEX:YCBD)

Historical Stock Chart

From Oct 2024 to Nov 2024

cbdMD (AMEX:YCBD)

Historical Stock Chart

From Nov 2023 to Nov 2024