TIDMARBB

RNS Number : 5932P

Arbuthnot Banking Group PLC

20 October 2021

20 October 2021

Arbuthnot Banking Group PLC

Third Quarter Trading Update

Arbuthnot Banking Group PLC ("Arbuthnot", "ABG" or "the Group")

today issues an update on trading for the three months to 30

September 2021.

Highlights

-- Momentum has continued in the Group's business, with customer

loans and leased assets totalling GBP1,973m as at 30 September

2021, an increase of 24% year to date (31 Dec 2020: GBP1,588m) and

a 6% increase since 30 June 2021

-- Customer deposits of GBP2,806m at 30 September 2021, an

increase of 19% in the first 9 months (31 Dec 2020: GBP2,365m) and

an increase of 6% since 30 June 2021

-- Assets Under Management GBP1,313m increased by 14% year to

date (31 Dec 2020: GBP1,147m) and an increase of 7% since 30 June

2021

-- The Group's employees have returned to fully operational offices

Group Performance

Following the relaxation of social distancing guidance in July

the Group has now returned to fully operational offices. The

business places a high value on the importance of face to face

interactions and on the benefits it brings in building a strong

business and the development of its staff. The Group is therefore

pleased to welcome its staff back to the office while at same time

embracing the new hybrid working practices.

In the third quarter the Group continued on its growth

trajectory from the first half as market activity increased in late

summer with new loan originations for the 9 months to 30 September

totalling GBP541m.

At the end of the third quarter lending balances have grown to

GBP1,973m from the previous year end balance of GBP1,588m and

deposits have increased 19% since the year end to finish the

quarter at GBP2,806m. Assets Under Management (AUM) finished the

quarter at GBP1,313m, a 14% year to date increase from 31 December

2020.

The global microchip shortage remains a challenge that is

slowing the rate of growth at both Asset Alliance and Renaissance

Asset Finance as vehicle supply is constrained.

The Group is currently operating with strong levels of capital

and liquidity, and along with a workforce that delivered high

performance over the previous 18 months with no staff furloughed,

means the Group is positioned well to capitalise on opportunities

across all of its businesses.

As previously noted while profitability levels are being

restored the Group continues to be hampered by the record low

interest rate environment, but despite this the Group remains on

course to meet market expectations in its full year results.

Business Division Highlights

Banking

Momentum continued in the third quarter across the banking

business, with good growth in both Private and Commercial Banking.

Deposits increased by GBP167m in the quarter, with net year to date

growth of GBP441m to finish the third quarter at GBP2,806m. The

overall cost of deposits has also continued to decline as older

higher priced deposits have matured and been replaced with new

deposits at lower current rates.

Net loan growth for the quarter was GBP96.7m resulting in net

loan growth of GBP253m for the 9 months to 30 September 2021,

equating to 22% growth from the year end. It is expected that the

loan book growth momentum will marginally slow in the fourth

quarter as more capital consumptive lending matures and is

refinanced away. This is planned as part of the Group's

repositioning strategy, as the Bank intends to recycle its loan

book into more capital efficient lending.

Following accreditation for the Recovery Loan Scheme (RLS), a

strong credit approved RLS pipeline has developed with expected

drawdowns in Q4 2021 and Q1 2022.

The banking book continues to perform in line with our credit

risk appetite.

Wealth Management

Wealth Management has seen further positive gross inflow

momentum in the nine months to September up 102% on the same period

for the previous year at GBP193.2m. Total AUMs have increased 14%

in the 9 months to GBP1,313m at the quarter end. The Wealth

Management pipeline continues to build positively, with several

larger value mandates developing.

Renaissance Asset Finance ("RAF")

RAF finished the quarter with lending balances of GBP96.1m, a 5%

increase since the year end with no erosion of margin on new

business written.

RAF continues to experience increased demand for its asset

finance facilities with new business advances in the quarter of

GBP13.5m and GBP36.7m issued year to date. Its current pipeline of

new business proposals and acceptances are at record levels as

confidence returns to the economy although issues in the supply

chain are affecting the availability of assets to finance and

causing delays in deal originations.

Loans under forbearance measures have fallen dramatically from

their peak in May 2020 and continue to fall having reduced by 40%

in the third quarter. Forbearance cases are now almost completely

confined to the London purpose-built taxi market which accounts for

almost all of RAF loan balances under forbearance. However this

segment too has improved, falling by over 30% in the third quarter

as the general economic activity has increased, resulting in taxi

operators reporting improved business conditions.

Arbuthnot Commercial Asset Based Lending ("ACABL")

As business activity has increased in the economy, ACABL has

experienced strong growth in demand for its products with a net

increase in its loan book of GBP64.3m since the year end equating

to 74% growth, and finishing the quarter with a net loan book of

GBP151.6m. The growth in loan balances is due to both new business

and existing clients increasing their borrowings towards

pre-pandemic levels.

At the quarter end, total facilities were GBP342m spread across

72 clients and 30 different sectors.

Following the accreditation of the Bank by the British Business

Bank for the Recovery Loan Scheme earlier in the year, ACABL has

written three RLS loans totalling GBP1.7m with further loans in the

pipeline.

Arbuthnot Specialist Finance ("ASF")

After playing a crucial role in the launch and establishment of

ASF the two founding managing directors have left the business to

pursue new ventures. The Group is very grateful for their hard work

in building this business and wish them good luck in their future

projects. Day to day management of the business is now overseen by

senior management from the Commercial Banking team, who are

continuing to focus on building an agile, responsive proposition

for the bridging loan market.

The specialist finance portfolio has grown to GBP9m of drawn

balances at the end of the third quarter. New business flow reduced

in the summer months, however the business is now experiencing a

steady flow of new opportunities.

Asset Alliance Group Holdings ("AA")

Following the acquisition of Asset Alliance in the first half of

the year the business's underlying performance has been in line

with expectations. However the global chip shortage has led to

reduced availability of new vehicles. This has two significant

impacts on the business. Firstly, AA has strong demand and is

robustly funded and is positioned to increase its fleet, but this

growth has been delayed due to production issues in the truck

manufacturing industry. Secondly, due to the fact that the fleet

continues to age, maintenance costs associated with trucks that are

past their normal replacement age have increased significantly.

At the quarter end AA had client assets on lease totalling

GBP132m.

Mortgage Portfolios

After the Tay portfolio was sold in February 2021, mortgage

portfolio balances (represented entirely by the Santiago portfolio

acquired in August 2019) were GBP191m at the quarter end.

The portfolio continues to perform in line with expectations

with active forbearance and arrears balances following the COVID

payment holidays reduced to pre-pandemic levels.

The Directors of the Company accept responsibility for the

contents of this announcement.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

ENQUIRIES:

020 7012

Arbuthnot Banking Group 2400

Sir Henry Angest, Chairman and Chief Executive

Andrew Salmon, Group Chief Operating Officer

James Cobb, Group Finance Director

Grant Thornton UK LLP (Nominated Adviser and AQSE 020 7383

Corporate Adviser) 5100

Colin Aaronson

Samantha Harrison

George Grainger

020 7260

Numis (Joint Broker) 1000

Stephen Westgate

020 7408

Shore Capital (Joint Broker) 4090

Hugh Morgan

Daniel Bush

020 7379

Maitland/AMO 5151

Sam Cartwright

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBKLLFFBLXFBX

(END) Dow Jones Newswires

October 20, 2021 02:00 ET (06:00 GMT)

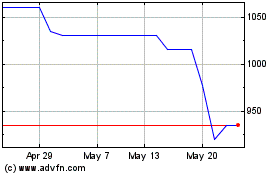

Arbuthnot Banking (AQSE:ARBB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Arbuthnot Banking (AQSE:ARBB)

Historical Stock Chart

From Mar 2024 to Mar 2025