Kasei Holdings Plc Issue of Equity and Warrants

14 February 2023 - 3:41AM

UK Regulatory

TIDMKASH

13 February 2023

KASEI HOLDINGS PLC

("Kasei" or the "Company")

Issue of Equity and Warrants

Equity Issue

Kasei Holdings PLC (AQSE: KASH) is pleased to announce that it has raised a

total of GBP 500,000.04 (gross) from Aalto Capital AB, through the issue of

4,166,667 new ordinary shares (the 'Placing Shares') under this equity issue.

The Company will use the proceeds from the equity issue to further advance its

investment strategy.

Admission

Application has been made for the 4,166,667 Placing Shares to be admitted to

trading on Aquis Stock Exchange ('Admission'). Admission is expected to occur

at 8:00 am on or around 17th February 2023.

Total Voting Rights

Following Admission, the Company's issued share capital will comprise

33,228,351 ordinary shares of £0.01 each, with each share carrying the right to

one vote.

Issue of Warrants

The Company also announces that it has granted Aalto Capital AB a total of

4,166,667 warrants to subscribe for new ordinary shares of £0.01 each

('Warrants'). The Warrants are exercisable at £0.12 per ordinary share, and for

a period of 3 years from the date of issue.

Following the issue of the Warrants, the Company has a total of 4,782,901

warrants in issue.

TR-1: Standard form for notification of major holdings

NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer and to the

FCA in Microsoft Word format if possible) i

1a. Identity of the issuer or the underlying KASEI HOLDINGS PLC

issuer of existing shares to which voting

rights are attached ii:

1b. Please indicate if the issuer is a non-UK issuer (please mark with an "X"

if appropriate)

Non-UK issuer

2. Reason for the notification (please mark the appropriate box or boxes with

an "X")

An acquisition or disposal of voting rights X

An acquisition or disposal of financial instruments

An event changing the breakdown of voting rights

Other (please specify) iii:

3. Details of person subject to the notification obligation iv

Name Aalto Capital AB

City and country of registered office (if Stockholm

applicable)

4. Full name of shareholder(s) (if different from 3.) v

Name

City and country of registered office (if

applicable)

5. Date on which the threshold was crossed or 13 February 2023

reached vi:

6. Date on which issuer notified (DD/MM/YYYY): 13 February 2023

7. Total positions of person(s) subject to the notification obligation

% of voting % of voting rights Total of both in Total number of

rights attached through financial % (8.A + 8.B) voting rights

to shares (total instruments held in issuer

of 8. A) (total of 8.B 1 + (8.A + 8.B) vii

8.B 2)

Resulting 12.54% 0 12.54% 4,166,667

situation on the

date on which

threshold was

crossed or reached

Position of 0 0 0

previous

notification (if

applicable)

8. Notified details of the resulting situation on the date on which the

threshold was crossed or reached viii

A: Voting rights attached to shares

Class/type of Number of voting rights ix % of voting rights

shares

ISIN code (if Direct Indirect Direct Indirect

possible) (DTR5.1) (DTR5.2.1) (DTR5.1) (DTR5.2.1)

GB00BN950D98 4,166,667 12.54%

SUBTOTAL 8. A 4,166,667 12.54%

B 1: Financial Instruments according to DTR5.3.1R (1) (a)

Type of financial Expiration Exercise/ Number of voting rights % of voting

instrument date x Conversion Period xi that may be acquired if rights

the instrument is

exercised/converted.

Warrants 13/02/2026 In next 3 years 4,166,667 11.41%

SUBTOTAL 8. B 1

B 2: Financial Instruments with similar economic effect according to DTR5.3.1R

(1) (b)

Type of Expiration Exercise/ Physical or cash Number of % of voting

financial date x Conversion Settlement xii voting rights rights

instrument Period xi

SUBTOTAL 8.B.2

9. Information in relation to the person subject to the notification obligation

(please mark the

applicable box with an "X")

Person subject to the notification obligation is not controlled by any natural

person or legal entity and does not control any other undertaking(s) holding

directly or indirectly an interest in the (underlying) issuer xiii

Full chain of controlled undertakings through which the voting rights and/or X

the

financial instruments are effectively held starting with the ultimate

controlling natural person or legal entity (please add additional rows as

necessary) xiv

Name xv % of voting rights if % of voting rights Total of both if it

it equals or is higher through financial equals or is higher

than the notifiable instruments if it than the notifiable

threshold equals or is higher threshold

than the notifiable

threshold

Aalto Capital AB 12.54% 11.41% 22.28%

10. In case of proxy voting, please identify:

Name of the proxy holder

The number and % of voting rights held

The date until which the voting rights will be

held

11. Additional information xvi

Place of completion UK

Date of completion 13 February 2023

For further information please contact:

Jai Patel info@kaseiholdings.com

Chief Investment Officer

First Sentinel

Corporate Adviser +44 7876 888 011

Brian Stockbridge brian@first-sentinel.com

About Kasei:

The Company is a technology specialist investor that focuses on

cryptocurrencies and blockchain technologies.

The Company's goal is to provide investors with broad based exposure to the

fast-growing ecosystem of digital assets, managed using traditional financial

portfolio construction techniques. The Company also intends to invest in

venture capital and private equity investments in the blockchain ecosystem.

The Company will leverage the Board's expertise, experience, and networks in

the cryptocurrency sector and management of digital assets and decentralised

finance, to drive value creation and to establish the business. The Board has a

proven capability in portfolio management to achieve significant growth.

The Company's website is located at https://kaseiholdings.com

Forward Looking Statements

This news release may contain "forward-looking" statements and information

relating to the Company. These statements are based on the beliefs of Company

management, as well as assumptions made by and information currently available

to Company management. The Company does not undertake to update forward-looking

statements or forward-looking information, except as required by law.

The information contained within this announcement is deemed by the Company to

constitute inside information as stipulated under the Market Abuse Regulations

(EU) No. 596/2014. Upon the publication of this announcement via a Regulatory

Information Service, this inside information is now considered to be in the

public domain.

END

(END) Dow Jones Newswires

February 13, 2023 11:41 ET (16:41 GMT)

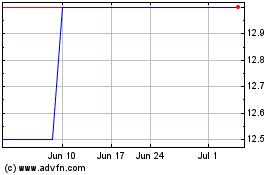

Kasei (AQSE:KASH)

Historical Stock Chart

From Dec 2024 to Jan 2025

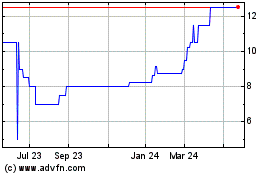

Kasei (AQSE:KASH)

Historical Stock Chart

From Jan 2024 to Jan 2025