TIDMPREM

RNS Number : 1440O

Premier African Minerals Limited

29 September 2023

29 September 2023

Premier African Minerals Limited

('Premier' or 'the Company')

Unaudited Interim Results for the six months ended 30 June

2023

Chief Executive Statement

Dear Shareholders,

I believe this will be the last time that I potentially report

Interim Results that do not include details of cash generative

operations. The six months to 30 June 2023 have been difficult and

this has been widely reported in various announcements over the

past 4 months. The plant did not achieve name plate throughput

production as per the original design and our relationship with

Canmax Technologies Co. Ltd (" Canmax ") came under severe duress.

That said, the outcome in the past month has the hallmarks of

setting aside all that disappointment and with the completion of

the installation of the RHA mill and restarting operations in the

latter part of September 2023, we expect to meet the production

target for shipments in November 2023. At the same time, this use

of the RHA mill only allows for up to 50% of target production and

the supply of a new mill to meet full design throughput is expected

ex works in Q4 of 2023. This is expected to be installed and

commissioned in early Q1 of 2024 following a two-week installation

shutdown that we plan to coincide with the festive break.

The first six months activity of 2023 (the " Period ") has been

extensively reported as post financial year end events in our

annual financial statements that were released just a few months

ago.

Our interim financial statements for the period to 30 June 2023

are attached. Of particular note is the substantially improved

financial position of the company.

Financial and Statutory Information

The Group incurred an operating loss of US$7.166 million for the

six months ended 30 June 2022. The loss was principally due to the

on-going overheads and administration costs associated with the

construction, installation and optimisation of the Zulu Lithium

mine in Zimbabwe. Cash at hand on 30 June 2023 was $0.231

million.

Premier received continued financial support from its

shareholders and Canmax throughout the period.

These interim statements to 30 June 2023 have not been reviewed

by the auditors.

Mr. George Roach

Chief Executive Officer

29 September 2023

Forward Looking Statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identified by their use of terms and phrases such as "believe",

"could", "should", "envisage", "estimate", "intend", "may", "plan",

"will" or the negative of those, variations, or comparable

expressions, including references to assumptions. These forward

looking statements are not based on historical facts but rather on

the Directors' current expectations and assumptions regarding the

Company's future growth, results of operations, performance, future

capital, and other expenditures (including the amount, nature, and

sources of funding thereof), competitive advantages, business

prospects and opportunities. Such forward looking statements

reflect the Directors' current beliefs and assumptions and are

based on information currently available to the Directors. A number

of factors could cause actual results to differ materially from the

results discussed in the forward looking statements including risks

associated with vulnerability to general economic and business

conditions, competition, environmental and other regulatory

changes, actions by governmental authorities, the availability of

capital markets, reliance on key personnel, uninsured and

underinsured losses, and other factors, many of which are beyond

the control of the Company. Although any forward looking statements

contained in this announcement are based upon what the Directors

believe to be reasonable assumptions, the Company cannot assure

investors that actual results will be consistent with such forward

looking statements.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018.

The person who arranged the release of this announcement on

behalf of the Company was George Roach.

For further information please visit

www.premierafricanminerals.com or contact the following:

Premier African Minerals Tel: +27 (0) 100 201

George Roach Limited 281

Michael Cornish / Beaumont Cornish Limited Tel: +44 (0) 20 7628

Roland Cornish (Nominated Adviser) 3396

--------------------------- ---------------------

Tel: +44 (0) 20 3003

Douglas Crippen CMC Markets UK Plc 8632

--------------------------- ---------------------

Toby Gibbs/Rachel Shore Capital Stockbrokers Tel: +44 (0) 20 7408

Goldstein Limited 4090

--------------------------- ---------------------

CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL

POSITION

EXPRESSED IN US DOLLARS

31 December

Six months Six months

to to 2022

EXPRESSED IN US DOLLARS 30 June 30 June

2023 2022 (Audited)

Notes $ 000 $ 000 $ 000

ASSETS

Non-current assets

Intangible assets 4 5,031 4,686 4,739

Investments 5 501 8,342 501

Property, plant and equipment 6 43,390 4,345 35,997

Loans receivable 7 243 859 -

49,165 18,232 41,237

------------ ------------ ------------

Current assets

Inventories 1,039 21 11

Trade and other receivables 728 373 180

Cash and cash equivalents 231 10,228 9,627

1,998 10,622 9,818

------------ ------------ ------------

TOTAL ASSETS 51,163 28,854 51,055

------------ ------------ ------------

LIABILITIES

Non-current liabilities

Provisions - rehabilitation 362 748 360

362 748 360

------------ ------------ ------------

Current liabilities

Trade and other payables 38,152 3,989 33,725

Borrowings 8 196 180 180

38,348 4,169 33,905

------------ ------------ ------------

TOTAL LIABILITIES 38,710 4,917 34,265

------------ ------------ ------------

NET ASSETS 12,453 23,937 16,790

------------ ------------ ------------

EQUITY

Share capital 9 74,305 70,951 70,951

Share based payment and warrant

reserve 3,708 2,366 3,708

Revaluation reserve 711 711 711

Foreign currency translation

reserve (13,288) (13,213) (13,150)

Accumulated loss (40,041) (24,253) (32,713)

Total equity attributed to

the owners of the parent company 25,395 36,562 29,507

Non-controlling interest (12,942) (12,625) (12,717)

TOTAL EQUITY 12,453 23,937 16,790

------------ ------------ ------------

CONDENSED CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE

INCOME

EXPRESSED IN US DOLLARS

31 December

Six months Six months

to to 2022

30 June 30 June

Continuing operations Notes 2023 2022 (Audited)

EXPRESSED IN US DOLLARS $ 000 $ 000 $ 000

Revenue - - -

Cost of sales excluding depreciation - - -

and amortisation expense

Gross profit / (loss) - - -

Administrative expenses (7,166) (4,890) (4,622)

------------ ------------ ------------

Operating profit / (loss) (7,166) (4,890) (4,622)

Depreciation and amortisation 6 (141) (15) (54)

Other Income 9 - 3 34

Loss on disposal of property,

plant and equipment (11) - -

Finance charges (231) (36) -

Impairment loss for investments

and loans receivable - - (1,161)

------------ ------------ ------------

(383) (48) (1,181)

Profit / (Loss) before income

tax (7,549) (4,938) (5,803)

Income tax expense 10 - - -

------------ ------------ ------------

Profit / (Loss) from continuing

operations (7,549) (4,938) (5,803)

Profit / (Loss) for the year (7,549) (4,938) (5,803)

------------ ------------ ------------

Other comprehensive income:

Items that are or may be reclassified

subsequently to profit or loss:

Fair Value adjustment on investments - - (7,841)

(142) (559) (7,710)

------------ ------------ ------------

Total comprehensive income

for the year (7,691) (5,497) (13,513)

------------ ------------ ------------

Loss attributable to:

Owners of the Company (7,328) (4,683) (5,492)

Non-controlling interests (221) (255) (444)

(7,549) (4,938) (5,936)

------------ ------------ ------------

Total comprehensive income

attributable to:

Owners of the Company (7,465) (5,076) (13,134)

Non-controlling interests (225) (421) (512)

------------ ------------ ------------

Total comprehensive income

for the year (7,690) (5,497) (13,646)

------------ ------------ ------------

Loss per share attributable to owners of the parent

(expressed in US cents)

Basic loss per share 11 (0.035) (0.041) (0.042)

Diluted loss per share 11 (0.035) (0.041) (0.042)

ONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN EQUITY

EXPRESSED IN US DOLLARS

Share Share Revaluation Foreign Retained Total Non-controlling Total

capital option reserve currency earnings attributable interest("NCI") equity

and translation to owners

warrant reserve of parent

reserve

$ 000 $ 000 $ 000 $ 000 $ 000 $ 000 $ 000 $ 000

At 1 January

2022 56,113 2,366 711 (13,217) (19,512) 26,461 (12,205) 14,256

Loss for the

period - - - - (4,683) (4,683) (255) (4,938)

Other

comprehensive

income

for the

period - - - (559) - (559) (166) (725)

--------- --------

Total

comprehensive

income

for the

period - - - (559) (4,683) (5,242) (421) (5,663)

Transactions

with Owners

Issue of

equity shares 15,782 - - - - 15,782 - 15,782

Share issue

costs (944) - - - - (944) - (944)

At 30 June

2022 70,951 2,366 711 (13,213) (24,253) 36,057 (12,626) 23,431

Loss for the

period - - - - (809) (809) (189) (998)

Other

comprehensive

income

for the

period - - - 63 (7,651) (7,588) 98 (7,490)

--------- -------- ------------ ------------ --------- ------------- --------

Total

comprehensive

income

for the

period - - - 63 (8,460) (8,397) (91) (8,488)

Transactions

with Owners

Issue of

equity shares - - - - - - - -

Share issue

costs - - - - - - - -

Share based

payments - 1,342 - - - 1,342 - 1,342

--------- -------- ------------ ------------ --------- ------------- ---------------- --------

At 31 December

2022 70,951 3,708 711 (13,150) (32,713) 29,002 (12,717) 16,285

Profit /

(Loss) for

the period - - - - (7,328) (7,328) (221) (7,549)

Other

comprehensive

income

for the

period - - - (138) - (138) (4) (142)

--------- -------- ------------ ------------ --------- ------------- ---------------- --------

Total

comprehensive

income

for the

period - - - (138) (7,328) (7,466) (225) (7,691)

Transactions

with Owners

Issue of

equity shares 4,298 - - - - 4,298 - 4,298

Share issue

costs (944) - - - - (944) - (944)

At 30 June

2023 74,305 3,708 711 (13,288) (40,041) 24,890 (12,942) 11,948

--------- -------- ------------ ------------ --------- ------------- ---------------- --------

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS

EXPRESSED IN US DOLLARS

31 December

Six months Six months

to to 2022

30 June 30 June

2023 2022 (Audited)

$ 000 $ 000 $ 000

Net cash outflow from operating

activities (936) (1,222) 30,116

------------ ------------ ------------

Investing activities

Acquisition of property plant

and equipment (11,295) (4,328) (35,912)

Acquisition of intangible assets (292) - (53)

Loans advanced (243) - (302)

Net cash used in investing

activities (11,830) (4,328) (36,267)

------------ ------------ ------------

Financing activities

Proceeds from borrowings granted 16 - -

Net proceeds from issue of

share capital 3,354 14,838 14,838

Net cash from financing activities 3,370 14,838 14,838

------------ ------------ ------------

Net decrease in cash and cash

equivalents (9,396) 9,288 8,687

Cash and cash equivalents at

beginning of year 9,627 940 940

Net cash and cash equivalents

at end of year 231 10,228 9,627

------------ ------------ ------------

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1. GENERAL INFORMATION

Premier African Minerals Limited ("Premier" or "the Company"),

together with its subsidiaries (the "Group"), was incorporated and

domiciled in the Territory of the British Virgin Islands under the

BVI Business Companies Act, 2004. The address of the registered

office is Craigmuir Chambers, PO Box 71, Road Town, Tortola,

British Virgin Islands. Premier's shares were admitted to trading

on the London Stock Exchange's AIM market on 10 December 2012.

The Group's operations and principal activities are the mining,

development and exploration of mineral reserves, primarily on the

African continent. The presentational currency of the condensed

consolidated interim financial statements is US Dollars ("$").

2. BASIS OF PREPARATION

These unaudited condensed consolidated interim financial

statements for the six months ended 30 June 2023 were approved by

the Board and authorised for issue on 29 September 2023.

These interim financial statements have been prepared in

accordance with the recognition and measurement principles of the

International Financial Reporting Standards ("IFRS") as endorsed by

the UK.

The accounting policies applied in the preparation of these

consolidated interim financial statements are consistent with the

accounting policies applied in the preparation of the consolidated

financial statements for the year ended 31 December 2022.

The figures for the six months ended 30 June 2023 and 30 June

2022 are unaudited and do not constitute full accounts. The

comparative figures for the year ended 31 December 2022 are

extracts from the 2022 audited accounts. The independent auditor's

report on the 2022 accounts was unqualified.

Going Concern

The Directors have prepared cash flow forecasts for the next 12

months, taking into account working capital, Zulu revenue and

expenditure forecasts for the rest of the Group including overheads

and other exploration costs. As previously announced, certain

contractors also agreed to collectively accept payment of a limited

number of future invoices until the end of December 2023 in new

ordinary shares of the Company at the closing middle market price

on the day prior to settlement which is included in the

forecasts.

The forecasts assume that the Company will commence generating

revenue later this calendar year, which the directors believe can

be met. In the event that revenue generation is delayed for any

reason, the Company may require further funding and, if the Company

is unable to obtain additional finance for the Group's working

capital and capital expenditure requirements, a material

uncertainty may exist which could cast significant doubt on the

ability of the Group to continue as a going concern and therefore

be unable to realise its assets and settle its liabilities in the

normal course of business.

3. SEGMENTAL REPORTING

Segmental information is presented in respect of the information

reported to the Directors. The segmental information reports the

revenue generating segments of RHA Tungsten Private Limited

("RHA"), that operates the RHA Tungsten Mine, and Zulu Lithium

Private Limited ("Zulu"). The RHA segment derives income primarily

from the production and sale of wolframite concentrate. All other

segments are primarily focused on exploration and on administrative

and financing segments. Segmental results, assets and liabilities

include items directly attributable to a segment as well as those

that can be allocated on a reasonable basis.

As at the reporting date, the company has significant holdings

in Zimbabwe. As indicated in the audited annual financial

statements, the Zimbabwean government mandated that with effect of

1 March 2019 the only functional currency is the RTGS Dollar. Since

the introduction of RTGS Dollars the Zimbabwean inflation rate has

gone into hyperinflationary percentages. Hyperinflationary

accounting requires a restatement of the local currency assets and

liabilities to reflect the effect of the hyperinflation before

translating the local currency to the reporting currency. Refer to

the audited annual financial statements of 31 December 2022 for

more detailed information.

Exploration

RHA Tungsten Zulu Lithium

Mine Zimbabwe Zimbabwe Total

Unallocated and RHA and Zulu continuing

By operating segment Corporate Mauritius* Mauritius operations

June 2023 $ 000 $ 000 $ 000 $ 000

Result

Revenue - - 6 -

Operating loss / (income) 1,343 46 6,061 7,450

------------ --------------- -------------- ------------

Other income - - 5 5

Fair value movement on

investment - - - -

Finance charges 232 - - 232

Impairment of investments

and

loans receivable - - - -

------------ --------------- --------------

Loss before taxation 1,575 46 6,066 7,687

------------ --------------- -------------- ------------

Assets

Exploration and evaluation

assets 468 - 4,563 5,031

Investments 501 - - 501

Property, plant and equipment 84 - 43,306 43,390

Loans receivable 243 - - 243

Inventories - - 1,039 1,039

Trade and other receivables 4 5 719 728

Cash 137 6 88 231

Total assets 1,437 11 49,715 51,163

------------ --------------- -------------- ------------

Liabilities

Other financial liabilities - - - -

Borrowings (196) - - (196)

Trade and other payables (37,729) (7) (416) (38,152)

Provisions - (362) - (362)

------------ --------------- --------------

Total liabilities (37,925) (369) (416) (38,710)

------------ --------------- -------------- ------------

Net (liabilities) /assets (36,488) (358) 49,299 12,453

Other information

Depreciation and amortisation 5 - 136 141

Property plant and equipment

additions 70 - 35,981 36,051

Costs capitalised to intangible

assets 345 - - 345

Exploration

RHA Tungsten Zulu Lithium

Mine Zimbabwe Zimbabwe Total

Unallocated and RHA and Zulu continued

By operating segment Corporate Mauritius* Mauritius operations

June 2022 $ 000 $ 000 $ 000 $ 000

Result

Revenue - - - -

Operating loss / (income) 1,756 47 2,976 4,779

------------ --------------- -------------- ------------

Other income - - (3) (3)

Finance charges - 18 - 18

Reversal of Impairment

of Zulu - - - -

------------ --------------- --------------

Loss before taxation 1,756 65 2,973 4,794

------------ --------------- -------------- ------------

Assets

Exploration and evaluation

assets 108 - 4,563 4,671

Investments 8,312 - - 8,312

Inventories - 1 20 21

Trade and other receivables 26 3 341 370

Cash 10,005 13 164 10,182

Total assets 19,353 17 9,391 28,761

------------ --------------- -------------- ------------

Liabilities

Borrowings (180) - - (180)

Trade and other payables (3,975) (8) - (3,983)

Provisions - (380) - (380)

------------ --------------- --------------

Total liabilities (4,155) (388) - (4,543)

------------ --------------- -------------- ------------

Net assets 15,198 (371) 9,391 24,218

Other information

Depreciation and amortisation - - 15 15

Property plant and equipment

additions - - 347 347

Costs capitalised to intangible

assets (12) - - (12)

Exploration

RHA Tungsten Zulu Lithium

Mine Zimbabwe Zimbabwe Total

By operating Unallocated and RHA and Zulu continued

segment Corporate Mauritius* Mauritius operations

December 2022 $ 000 $ 000 $ 000 $ 000

Result

Revenue - - - -

Operating

loss /

(income) 3,774 213 689 4,676

----------------------- ------------------------- ------------------------- -----------------------

Other income - - (34) (34)

Finance

charges - - - -

Impairment of

investments

and

loans

receivable 1,161 - - 1,161

Loss before

taxation 4,935 213 655 5,803

Assets

----------------------- ------------------------- -------------------------

Exploration

and

evaluation

assets 176 - 4,563 4,739

----------------------- ------------------------- ------------------------- -----------------------

Investments 501 - - 501

Property,

plant and

equipment 63 - 35,934 35,997

Loans - - - -

receivable

Inventories - - 11 11

Trade and

other

receivables 65 3 112 180

Cash 9,238 12 377 9,627

Total assets 10,043 15 40,997 51,055

----------------------- ------------------------- ------------------------- -----------------------

Liabilities

Other - - - -

financial

liabilities

Borrowings (180) - - (180)

Trade and

other

payables (33,792) - 67 (33,725)

Provisions - (360) - (360)

----------------------- ------------------------- -------------------------

Total

liabilities (33,972) (360) 67 (34,265)

----------------------- ------------------------- ------------------------- -----------------------

Net assets (23,929) (345) 41,064 16,790

Other

information

Depreciation

and

amortisation 7 - 47 54

Property

plant and

equipment

additions 70 - 35,981 36,051

Costs

capitalised

to

intangible

assets 53 - - 53

* Represents 100% of the results and financial position of RHA

whereas the Group owns 49%.

4. INTANGIBLE EXPLORATION AND EVALUATION ASSETS

Exploration

& Evaluation

assets Total

$ 000 $ 000

Opening carrying value 1 January

2022 4,686 4,686

Expenditure on Exploration and - -

evaluation

Reversal of Impairment - -

Closing carrying value 30 June

2022 4,686 4,686

Expenditure on Exploration and

evaluation 53 53

Closing carrying value 31 December

2022 4,739 4,739

Expenditure on Exploration and

evaluation 292 292

Closing carrying value 30 June

2023 5,031 5,031

-------------- -------

5. INVESTMENTS

Vortex Manganese Total

/

( Circum Namibian

Minerals Holdings

)

$ 000 $ 000 $ 000

Available-for-sale:

Closing carrying 31 December

2021 6,263 2,079 8,342

Shares acquired - - -

Closing carrying 30 June 2022 6,263 2,079 8,342

Shares acquired - - -

Impairment of investments (5,762) (2,079) (7,841)

Closing carrying 31 December

2022 501 - 501

Shares acquired - - -

Closing carrying 30 June 2023 501 - 501

--------- ---------- --------

Reconciliation of movements in

investments

Carrying value at 31 December

2020 6,263 2,079 8,342

Acquisition at fair value - - -

Carrying value at 30 June 2022 6,263 2,079 8,342

Acquisition at fair value - - -

Impairment of investments (5,762) (2,079) (7,841)

Carrying value at 31 December

2022 and 30 June 2023 501 - 501

--------- ---------- --------

During the six months ended 30 June 2022, Premier sold its

shares in Circum Minerals Limited ("Circum"), together with other

minority shareholders, to Vortex Limited ("Vortex") in exchange for

an equal value investment in Vortex. Premier's investment in Vortex

/ Circum was designated as FVOCI. As such the investment is

required to be measured at fair value at each reporting date. As

Vortex / Circum is unlisted there are no quoted market prices. The

fair value of Vortex shares was derived using the previous issue

price of Circum shares and validating it against the most recent

placing price on 11 May 2021. The shares are considered to be level

3 financial assets under the IFRS 13 categorisation of fair value

measurements. Premier continues to hold 5 010 333 shares in Vortex

/ Circum currently valued in total at $0.501 million.

Premier's investment in MN Holdings Limited ('MNH') is

classified as an FVOCI as such is required to be measured at fair

value at the reporting date. As MNH is unlisted there are no quoted

market prices. The Fair value of the MNH shares as at 30 June 2023

and 31 December 2022 was based on most recent unaudited financial

statements of MNH. These financial statements showed significant

operating losses. Accordingly, Premier's investment in MNH has been

fully impaired as at 31 December 2022.

6. PROPERTY, PLANT AND EQUIPMENT

Mine Development Plant Land and Capital Total

and Equipment Buildings Work-in-Progress

$ 000 $ 000 $ 000 $ 000 $ 000

Cost

At 1 January 2022 895 2,812 41 - 3,748

Foreign Currency Translation

effect - 4,229 - 4,229

Additions - - - -

At 30 June 2022 895 7,041 41 - 7,977

Foreign Currency Translation

effect (122) (3,790) 219 - (3,693)

Transfer from Capital - - - - -

Work in Progress

Additions - 206 15 34,956 35,177

At 31 December 2022 773 3,457 275 34,956 39,461

Foreign Currency Translation

effect 8,140 3,711 1,394 - 13,245

Additions - 4,328 - 6,967 11,295

At 30 June 2023 8,913 11,496 1,669 41,923 64,001

----------------- --------------- ----------- ------------------ --------

Accumulated Depreciation

and Impairment Losses

At 1 January 2022 895 2,687 27 - 3,609

Foreign Currency Translation

effect - 22 1 - 23

Charge for the year - - - - -

At 30 June 2022 895 2,709 28 - 3,632

Exchange differences (122) (32) (14) - (168)

Charge for the year - - - - -

At 31 December 2022 773 2,677 14 - 3,464

Foreign Currency Translation

effect 8,140 7,562 1,430 - 17,132

Charge for the year - 15 - - 15

At 30 June 2023 8,913 10,254 1,444 - 20,611

----------------- --------------- ----------- ------------------ --------

Net Book Value

At 30 June 2022 - 4,332 13 - 4,345

At 31 December 2022 - 780 261 34,956 35,997

At 30 June 2023 - 1,242 225 41,923 43,390

7. LOANS RECEIVABLE

31 December

Six months Six months

to to 2022

30 June 30 June

2023 2022 (Audited)

$ 000 $ 000 $ 000

Outback Investments (Pty) Ltd - 414 -

Otjozondu Mining (Pty) Ltd - 445 -

Vortex Limited 243 - -

243 859 -

------------ ------------ ------------

Reconciliation of movement in

loans receivable

As at 1 January - - -

Loans advanced 243 859 859

Repayment - - -

Accrued interest - - -

Impairment of loans advanced - - (859)

Total 243 859 -

------------ ------------ ------------

Current 243 859 -

Non-current - - -

243 859 -

------------ ------------ ------------

The above loans to Outback Investments (Pty) Ltd and Otjozondu

Mining (Pty) Ltd were made to a subsidiary and a related party of

MN Holdings (Pty) Ltd ("MNH") and were held at amortised cost. The

loans were fully impaired as at 31 December 2022.

The purpose of the Outback Investments Pty Ltd loan was to

enable MNH to lease and acquire the remaining extent of the

Ebenezer No 377 Farm which contains untreated tailings facilities

from the Purity Mining Project as announced on the 8(th) of July

2019. The loan will be forgiven following the uninterrupted use of

the farmland for the treatment of the tailing facilities for a

period of up to 10 years. During this period Premier has rights to

these tailings facilities. The loan is interest free. The loan is

only repayable upon default by Outback Investments.

The loan to Otjozondu Mining (Pty) Ltd was to assist with

funding the day-to-day operations and is in accordance with the

announcement dated of 31 August 2021. Premier provided a loan of

$265,000 which bears interest of 20% and is repayable in

instalments of $25,000 per shipment of manganese shipped from

Namibia. The balance of $180,000 has been provided interest free as

it is linked to the loan from Neil Herbert, further details of

which are set out in note 8 below.

8. BORROWINGS

31 December

Six months Six months

to to 2022

30 June 30 June

2023 2022 (Audited)

$ 000 $ 000 $ 000

Loan - joint venture partner -

Li3 Lithium Corp 16 - -

Loan - Neil Herbert 180 180 180

196 180 180

------------ ------------ ------------

31 December

Six months Six months

to to 2022

30 June 30 June

2023 2022 (Audited)

$ 000 $ 000 $ 000

Reconciliation of movement in

borrowings

As at 1 January 180 180 180

Investment by joint venture partner

- Li3 Lithium Corp 16 - -

Loans received - - -

Accrued interest - - -

------------ ------------

Total 196 180 180

------------ ------------ ------------

Current 196 180 180

Non-current - - -

196 180 180

------------ ------------ ------------

Borrowings comprise loans from a related party and a non-related

party.

Neil Herbert, a former director of the Company, made available a

loan of US$180,000 to the Company in August 2021. Under the terms

of the Director Loan, the loan is both unsecured and will not

attract any interest and is repayable in full by the Company on the

signing of a new off-take agreement at Otoconium. The purpose of

the Director Loan was to provide funding to Premier to allow an

amendment to the Otoconium Loan while Premier, acting collectively

with Otoconium, looked to secure the best possible off-take funding

package.

At 30 June 2023 the off-take funding had not been secured and

Mr. Herbert has agreed to the deferment of the repayment of the

loan until such off-take agreement has been secured.

Premier entered into a joint venture agreement with Li3 Lithium

Corp (Li3) for the purpose of prospecting for additional lithium

bearing ore in Zimbabwe. The net investment by Li3 represents the

net amount due to Li3 after apportioning all expenses and amounts

invested by both Premier and Li3.

9. SHARE CAPITAL

Authorised share capital

The total number of voting rights in the Company on the 30 June

2023 was 22,836,049,123.

Issued share capital

Number

of Shares Value

'000 $ 000

----------- -------

As at 1 January 2022 19,418,009 59,432

Shares issued for direct Investment 3,000,000 15,782

----------- -------

As at 30 June 2022 22,418,009 75,214

Shares issued for direct Investment - -

As at 31 December 2022 22,418,009 75,214

Exercise of options 161,877 687

Shares issued for direct Investment 190,216 2722

Shares issued for direct Investment 65,947 889

As at 30 June 2023 22,836,049 79,512

----------- -------

Reconciliation to balances as stated in the consolidated

statement of financial position

Issued Share Issue Share

Capital

Share Capital Costs (Net of

Costs)

$ '000 $ '000 $ '000

As at 31 December 2021 -

Audited 59,432 (3,319) 56,113

Shares issued 15,782 (944) 14,838

As at 30 June 2022 75,214 (4,263) 70,951

Shares issued - - -

As at 31 December 2022 -

Audited 75,214 (4,263) 70,951

Shares issued 4,298 (944) 3,354

As at 30 June 2023 79,512 (5,207) 74,305

----------------- ------------- ----------

10. OTHER INCOME

31 December

Six months Six months

to to 2022

30 June 30 June

2023 2022 (Audited)

$ 000 $ 000 $ 000

(Loss) / Profit on disposal of

PPE (11) 3 -

Reversal of prescribed debt - - -

(11) 3 -

------------ ------------ ------------

11. FOREIGN EXCHANGE GAINS AND LOSSES

As indicated in note 3. Segmental Reporting, the company has

significant holdings in Zimbabwe. With effect from the 1(st) of

March 2019, the Zimbabwean government mandated that the only

functional currency is RTGS Dollar. Since the introduction of RTGS

Dollar the currency has devalued from the introductory rate of

RTGS Dollar 1: US$ 1 to RTGS Dollar 5,739.7961 at 30 June 2023

(RTGS Dollar 370.9646 at 30 June 2022). This currency has continued

to devalue. As defined in IAS29, the Zimbabwean economy is

considered to be hyperinflationary. As most of the group's

Zimbabwean assets have been impaired the result in liabilities are

adjusted for the hyperinflationary effect. This leads to a net gain

on translation into the reporting currency. For further information

refer to the audited financial statement of 31 December 2022.

12. TAXATION

There is no taxation charge for the period ended 30 June 2023

(30 June 2022 and 31 December 2022: Nil) because the Group is

registered in the British Virgin Islands where no corporate taxes

or capital gains tax are charged. However, the Group may be liable

for taxes in the jurisdictions of the underlying operations.

The Group has incurred tax losses in Zimbabwe; however, a

deferred tax asset has not been recognised in the accounts due to

the unpredictability of future profit streams.

The Group operates across different geographical regions and is

required to comply with tax legislation in various jurisdictions.

The determination of the Group's tax is based on interpretations

applied in terms of the respective tax legislations and may be

subject to periodic challenges by tax authorities which may give

rise to tax exposures.

13. LOSS PER SHARE

The calculation of loss per share is based on the loss after

taxation attributable to the owners of the parent divided by the

weighted average number of shares in issue during each period.

31 December

Six months Six months

to to 2022

30 June 30 June

2023 2022 (Audited)

(Unaudited) (Unaudited) (Audited)

$ '000 $ '000 $ '000

Net profit / (loss) attributable

to owners of the company ($'000) (7,328) (4,683) (5,492)

Weighted average number of Ordinary Shares

in calculating

basic earnings per share ('000) 20,959,445 11,455,420 13,167,281

Basic earnings / (loss) per share

(US cents) (0.035) (0.041) (0.042)

As the Group incurred a loss for the period, there is no

dilutive effect from the share options and warrants in issue or the

shares issued after the reporting date.

14. EVENTS AFTER THE REPORTING DATE

Offtake and Prepayment Agreement

On 15 August 2023, the Company agreed with Canmax to amend and

restate the Offtake and Prepayment Agreement which the parties had

previously agreed in August 2022 ("Amended Agreement"). The Amended

Agreement restored the working arrangements between Premier and

Canmax and the Force Majeure and default notices were withdrawn by

the respective parties. The major and essential elements of the

Amended Agreement remained the same as the original agreement

entered into in August 2022, save that the parties agreed:

- A revised Product supply schedule in respect of the

prepayment of US$34.6 million plus; and

- A revised hybrid pricing agreement with the payment

for SC6 supplied by Premier based on the SC6 price

and a profit share whereby Premier and Canmax will

share in the profit from production by Canmax of Lithium

Hydroxide from SC6 supplied by Premier.

Director Loan

On 21 July 2023, the Company announced that it had agreed an

unsecured GBP1.7 million Loan Facility Agreement with George Roach

("Facility"). On 9 August 2023, Premier and George Roach agreed to

vary the Facility by increasing the size of the Facility from

GBP1.7 million to GBP2 million and to waive any interest on a

repayment by Premier of the Facility in cash ("Amended Facility").

Premier and the Lender further agreed that Premier would make one

request of a draw-down under the Amended Facility in the amount of

GBP2 million.

On 18 August 2023, Premier announced that the Company had

received total net proceeds of GBP1,708,532.51 from the sales of

370,000,000 Premier Ordinary Shares by George Roach at an average

price 0.4513 pence per share, in accordance with the Facility. The

Company and George Roach agreed that no further shares would be

sold by George Roach under the Facility and that, upon settlement

of the repayment of the existing amounts outstanding under the

Facility by the issue of the new Premier Ordinary Shares, the

Facility would be terminated with immediate effect.

Funding

On 25 August 2023, the Company announced a placing and

subscription to raise GBP4 million before expenses at an issue

price of 0.35 pence per new ordinary share for the ongoing Zulu

Pilot Optimisation.

On 30 August 2023, the Company announced a conditional

subscription for new ordinary shares by Canmax to raise GBP5

million before expenses at an issue price of 0.35 pence per new

ordinary share for the ongoing Zulu Pilot Optimisation.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GUGDCUGDDGXC

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

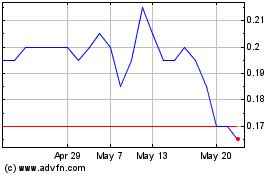

Premier African Minerals (AQSE:PREM.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Premier African Minerals (AQSE:PREM.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024