TIDMTECH

RNS Number : 3242U

TechFinancials Inc.

29 July 2022

TechFinancials, Inc

("TechFinancials" or the "Company")

29 July 2022

Audited Annual Report for the year ended 31 December 2021

Financial Highlights

-- No Revenues in 2021 following cessation of operations.

-- Pre-tax loss attributable to shareholders of US$0.553 million

(2020: profit of US$1.0 million)

-- Cash position of US$0.92 million as at 31 December 2021 (2020: US$1.4 million)

-- Basic earnings per share ('EPS') (US$0.0064) (2020: (US$0. 016 ))

-- In October 2021, the Company's sold its subsidiary Cedex Holdings Limited ("Cedex")

-- In June 2021, the Company stuck off Footies Ltd. ("Footies)

-- In 2021, the Company acquired shares to take minority

holdings in a number of companies listed on the LSE and AIM

Operational Highlights

Operational Cost Reduction

-- The Company decided to close all its subsidiaries and

initiated the strike-off of its entities in Israel in 2021. The

strike off of both TechFinancials Israel 2014 Ltd and Softbox

Technologies Ltd was initiated in H2 2021 and concluded in March

2022.

-- The Company sold Cedex Holdings Limited in October 2021.

Investment Activities

-- The Company invested small amounts in several listed entities

in 2021. This activity resulted in profit of $86k .

-- As of today, the Company has only one legal entity -

TechFinancials Inc, and as results the costs of operating the

company is now minimal.

-- In November 2020, the Company signed with RenewSenses Ltd.,

an Israeli start-up, a Simple Agreement for Future Equity ("SAFE")

following which the Company invested in RenewSenses a total amount

of US$ 152k. This was accounted for as a financial asset through

profit and loss.

As of December 31, 2021, RenewSenses has failed to raise

additional capital for its operations and in the beginning of 2022,

it was forced to make all employees redundant. As a result of the

conditions that existed at year end (inability of raise funds), the

financial asset fair valued was revalued to a nil balance and a

total loss of $152k recognized.

Chairman's Statement

2021 was a year in which the Company focused on reducing costs

and consolidating its assets. We initiated the closure of all our

subsidiaries and sold Cedex.

The Board decided to invest some amounts in listed companies and

was able to generate good returns from these investments. The

Company will continue to look for new ways to increase its

value.

Dividend s

The Board will not be recommending a final dividend to the

shareholders of the Company for the year ended 2021 (2020:

$nil).

Outlook and current trading

The year was a turning point for the Group, where we initiated

the closure of all our subsidiaries and consolidated all our

assets, while seeking new investment opportunities to increase the

value of the Company.

The Group will continue to look for investment opportunities to

maximize the Company's value, leveraging its available cash.

I would like to thank our shareholders for their continued

support in what has been a difficult year.

We look forward to updating the market on our progress in due

course.

Eitan Yanuv

Independent Non-Executive Chairman

29 July 2022

The directors of the Company accept responsibility for the

contents of this announcement.

For further information:

TechFinancials, Inc. Tel: +972 54 5233

943

Asaf Lahav, Executive Director

Eitan Yanuv, Non-Executive Chairman

Peterhouse Capital Limited (Aquis Tel: +44 (0) 20 7469

Stock Exchange Advisor and Broker) 0930

Guy Miller and Mark Anwyl

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2021

2021 2020

--------------------------------------------- -------------------------------------------

US$'000 US$'000

Revenue - 619

Cost of sales - (35)

--------------------------------------------- -------------------------------------------

Gross profit - 584

Expenses:

Research and

development - ( 384 )

Selling and marketing - ( 33 )

Administrative ( 233 ) ( 207 )

Impairment of goodwill - -

--------------------------------------------- -------------------------------------------

(233) (624)

Operating (Loss)

Income (233) (40)

Bank fees (9) (20)

Foreign exchange income (30) -

(loss)

Profit on disposal of 86 -

traded securities

--------------------------------------------- -------------------------------------------

Financing income

(expenses 47 (60)

Other Income (expenses)

Other non-operational

income/ (expenses) - 441

Impairment loss on the (152) -

financial asset held

at FVTPL

(Loss)/ Profit before

taxation (338) 381

Taxation (4) 70

--------------------------------------------- -------------------------------------------

(Loss) / Profit for

the year from

continuing

operations (342) 451

Gain (loss) from

discontinued

operations (181) 566

Capital loss from a ____________________(30) ____________________-

sale of subsidiary

(Loss) / Gain for the

year from discontinued

operations, net (211) 566

Other comprehensive - -

income

Total comprehensive

Income (553) 1,017

============================================= ===========================================

(Loss) / Profit

attribute

able to:

Owners of the Company (553) 997

Non-controlling

interest - 20

--------------------------------------------- -------------------------------------------

Profit (Loss) for the

period (553) 1,017

2021 2020

Cents USD Cents USD

Basic 17 (0.64) 1.16

====================================== ======================================

Diluted N/A 1.16

====================================== ======================================

From continuing operations

- Basic (0.40) 0.50

====================================== ======================================

From continuing operations

- Diluted N/A 0.50

====================================== ======================================

From discontinued operations

- Basic (0.24) 0.66

====================================== ======================================

From discontinued operations

- Diluted N/A 0.66

====================================== ======================================

Consolidated Statement of Financial Position

As at 31 December 2021

31 December 31 December

------------- -------------

2021 2020

------------- -------------

US$'000 US$'000

Non-current assets

Financial asset held at FVPL - 152

- 152

------------- -------------

Current assets

Trade receivables, net and other

receivables - 13

Short-term investments 26 -

Cash 920 1,419

------------- -------------

946 1,432

------------- -------------

Total Assets 946 1,584

Current liabilities

Trade and other payables 89 88

Income tax payable - 86

------------- -------------

89 174

------------- -------------

Non-current liabilities

Shareholders loan 84 84

Equity

Share capital 61 61

Share premium account 12,022 12,022

Share-based payment reserve 798 798

Accumulated profits / (losses) (12,108) (11,555)

------------- -------------

Equity attributable to owners

of the Company 773 1,326

Total Equity and Liabilities 946 1,584

The Financial Statements were approved by the Board of Directors

and authorised for issue on 29 July 2022 and are signed on its

behalf by:

................................................

Director

Consolidated statements of changes in equity

For the year ended 31 December 2021

Share

based

Share Share payment Revaluation Non -controlling

capital Premium reserve reserve interests

Accumulated

(Note (Note (Note, (Note, profits/ (Notes

14) 14) 15) 9) (losses) Total 1 8) Total

--------- --------- --------- ------------ ------------ -------- ----------------- --------

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------- --------- --------- ------------ ------------ -------- ----------------- --------

Balance

at 1 January

2020 61 12,022 934 (12,459) 588 (249) 309

Total comprehensive

income (expense)

for the

year - - - - 997 997 20 1,017

Gain on

revaluation

of cryptocurrency

digital

assets in

the year - - - 577 577 577

Disposal

of cryptocurrency

digital

assets in

the year - - - (577) (577) (577)

Purchase

of NCI in

Footies

during the

year - - - - (229) (229) 229 -

Share based

payment - - 6 (6) - - -

Transfer

of Share

based payment

reserve

on lapsed

options - - (142) 142 - - -

Balance

at 31 December

2020 61 12,022 798 - (11,555) 1,326 - 1,326

====== ========== ======= ======== ============ ======= ====== =========

Total comprehensive

income for

the year - - - - (553) (553) (553)

Balance

at 31 December

2021 61 12,022 798 - (12,108) 773 - 773

====== ========== ======= ===== ============ ====== ==== =======

Consolidated statements of cash flows

For the year ended 31 December 2021

The consolidated statements of cash flows

for the Group for the years ended 31 Years ended 31

December 2021 are set out below: December

-------------------

2021 2020

-------- ---------

US$'000 US$'000

-------- ---------

Cash Flows from operating activities

(Loss) / Profit before tax period (549) 946

Adjustment for:

Amortisation of intangible assets - 75

Impairment of intangible assets, net - 37

Gain on bargain purchase (309)

Depreciation of property and equipment - 4

Profit on disposal of traded securities (86) -

Share option charge - 6

Foreign exchange differences 82 (70)

Waiver of loan due to NCI - (51)

Loss on disposal of subsidiary 30 -

Capital loss on disposal of property

and equipment - 12

Gain from revaluation of intangible assets - (577)

Impairment of investment 152 -

Operating cash flows before movements

in working capital:

Decrease in trade and other receivables 13 589

Increase (decrease in trade and other

payables 48 (1,445)

R&D tax credit received - 163

Income tax paid (93) (109)

-------- ---------

Net cash used for operating activities (403) (729)

-------- ---------

Cash flows from investing activities

Decrease in restricted bank deposits - (71)

Consideration from sale of intangible

assets - 974

Net cash acquired on acquisition (note

A) - 649

Net cash on disposal of a subsidiary (75) -

Purchase of traded securities (102) -

Sale of traded securities 163 -

Funds advanced under SAFE agreement - (152)

-------- ---------

Net cash generated from (used in) investing

activities (14) 1,400

-------- ---------

Net increase (decrease) in cash and

cash equivalents (417) 671

Cash and equivalents at beginning of

period 1,419 672

(Effect of changes in exchange rates

on Cash (82) 76

-------- ---------

Cash and equivalents at end of period 920 1,419

======== =========

The comparative cashflow has been restated to correct the

allocation of cashflow movements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXEKLFLLDLLBBD

(END) Dow Jones Newswires

July 29, 2022 11:35 ET (15:35 GMT)

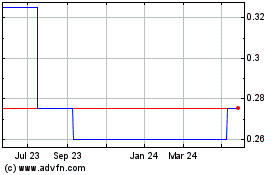

TechFinancials (AQSE:TECH)

Historical Stock Chart

From Oct 2024 to Nov 2024

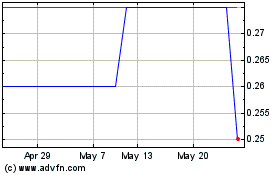

TechFinancials (AQSE:TECH)

Historical Stock Chart

From Nov 2023 to Nov 2024