TIDMWTG

RNS Number : 7649L

Polygon Global Partners LLP

14 September 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH

JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

14 September 2021

LAPSE OF THE MANDATORY CASH OFFER

BY

POLYGON GLOBAL PARTNERS LLP

TO ACQUIRE THE ENTIRE ISSUED SHARE CAPITAL OF

WATCHSTONE GROUP PLC

OFFER UPDATE - LAPSE OF THE OFFER

On 1 July 2021, Polygon Global Partners LLP ("Polygon")

announced the terms of its mandatory cash offer to acquire the

entire issued and to be issued ordinary share capital of Watchstone

Group plc ("Watchstone"), which it subsequently increased on 31

August 2021 ("Offer"). The full terms of the Offer and the

procedures for acceptance were set out in the offer document

("Offer Document") and form of acceptance ("Form of Acceptance")

published by Polygon on 31 August 2021.

As at 1:00 p.m. (London time) on 14 September 2021, being the

Fourth Closing Date of the Offer, Polygon has received valid

acceptances in respect of a total of 876,846 Watchstone Shares,

representing approximately 1.90 per cent. of the issued share

capital of Watchstone. So far as Polygon is aware, none of these

acceptances have been received from persons acting in concert with

Polygon.

As at 1:00 p.m. (London time) on 14 September 2021, neither

Polygon nor, so far as Polygon is aware, any person acting in

concert with Polygon:

-- has any interest in, or right to subscribe in respect of, or

any short position in relation to Watchstone relevant securities,

including any short position under a derivative, any agreement to

sell or any delivery obligation or right to require another person

to take delivery of Watchstone relevant securities;

-- has any outstanding irrevocable commitment or letter of

intent with respect to Watchstone relevant securities;

-- has borrowed or lent any Watchstone relevant securities

(including any financial collateral arrangements), save for any

borrowed shares which have been either on-lent or sold,

save for the following Watchstone relevant securities held by

Polygon and persons acting in concert with Polygon:

Name Watchstone Shares Percentage of Watchstone

Shares

Polygon (through the

Polygon Funds) 13,811,500 30.00%

------------------ -------------------------

W.H. Ireland ([2]) 7,621 0.02%

------------------ -------------------------

TOTAL 13,819,121 30.02%

------------------ -------------------------

Accordingly, as at 1.00 p.m. on 14 September 2021, Polygon has

received acceptances in respect of Watchstone Shares which,

together with Watchstone Shares acquired before or during the

Offer, result in Polygon and any person acting in concert with it

holding 14,688,346 Watchstone Shares, representing 31.90 per cent.

of Watchstone's issued share capital, all of which may count

towards satisfaction of the Acceptance Condition to the Offer.

Watchstone Shareholders are reminded that, as a summary and

subject to the fuller description in the Offer Document, the Offer

was subject to Polygon receiving valid acceptances and/or agreeing

to acquire Watchstone Shares carrying 50 per cent. of the voting

rights then normally exercisable at a general meeting of

Watchstone.

As such, the Acceptance Condition has not been satisfied and the

Offer has now lapsed.

As the Offer has lapsed, it is no longer open to acceptances and

any accepting Watchstone Shareholders cease to be bound by their

acceptances.

The percentages of Watchstone Shares referred to in this

announcement are based upon a figure of 46,038,333 Watchstone

Shares in issue at close of business on 13 September 2021.

In respect of Watchstone Shares held in certificated form, the

Form of Acceptance, share certificate(s) and/or other document(s)

of title will be returned by post (or by such other method as may

be approved by the Panel) within 14 days of the Offer lapsing to

the person or agent whose name and address outside the Restricted

Jurisdictions is set out in the relevant box on the Form of

Acceptance or, if none is set out, to the first-named or sole

holder of his registered address outside the Restricted

Jurisdictions. No such documents will be sent to an address in any

Restricted Jurisdiction.

In respect of Watchstone Shares held in uncertificated form,

Computershare, the Receiving Agent, will, immediately (or within

such longer period as the Panel may permit, not exceeding 14 days

after the lapsing of the Offer), give instructions to Euroclear to

transfer all Watchstone Shares held in escrow balances and in

relation to which it is the escrow agent for the purposes of the

Offer to the original available balances of the Watchstone

Shareholders concerned.

Polygon will now be subject to Rule 35.1 of the Code save that

Polygon reserves the right to make a further off for the entire

issued and to be issued share capital of Watchstone, with the

consent of the Panel, in the event that: (i) such further offer is

recommended by the Watchstone Board; or (ii) a third party

announces a firm intention to make an offer for Watchstone; or

(iii) in the other circumstances set out in the Note on Rule 35.1

and 35.2 of the Code.

Capitalised terms defined in the Offer Document have the same

meanings given in this announcement, a copy of which is available

on Polygon's website at:

https://www.polygoninv.com/uk-regulatory-disclosures/

If you require assistance, please telephone the Receiving Agent

on 0370 707 4040 (if calling from within the UK) or +44 370 707

4040 (if calling from outside the UK) between 9:00 a.m. to 5:00

p.m. (London time) Monday to Friday.

Enquiries:

finnCap (Financial Adviser to Polygon)

Henrik Persson, Kate Bannatyne and Tim Harper Tel: (+44) 020 7220 0500

Important notices about financial advisers

finnCap, which is authorised and regulated in the United Kingdom

by the FCA, is acting as financial adviser to Polygon and for no

one else in connection with the Increased Offer and will not be

responsible to anyone other than Polygon for providing the

protections afforded to its clients nor for providing advice in

relation to the Increased Offer or any other matters referred to in

this Announcement.

This Announcement is for information purposes only and is not

intended to and does not constitute, or form part of, an offer to

sell or an invitation to purchase any securities or a solicitation

of an offer to buy, otherwise acquire, subscribe for, sell or

otherwise dispose of any securities pursuant to the Offer or

otherwise, nor shall there be any purchase, sale, issuance or

exchange of securities or such solicitation in any jurisdiction in

which such offer, solicitation, sale issuance or exchange is

unlawful.

Overseas jurisdictions

The release, publication or distribution of this Announcement in

jurisdictions other than the United Kingdom may be restricted by

the laws of those jurisdictions and therefore persons into whose

possession this Announcement comes should inform themselves about

and observe such restrictions. Further details in relation to the

Overseas Shareholders are contained in the Offer Document. Any

failure to comply with any such restrictions may constitute a

violation of the securities laws of any such jurisdiction. To the

fullest extent permitted by applicable law, the companies and

persons involved in the Offer disclaim any responsibility or

liability for the violation of such restrictions by any person.

Unless otherwise determined by Polygon or required by the Code,

and permitted by applicable law and regulation, the Offer will not

be made available, directly or indirectly, in, into or from a

Restricted Jurisdiction where to do so would violate the laws in

that jurisdiction. Accordingly, copies of this Announcement and all

documents relating to the Offer are not being, and must not be,

directly or indirectly, mailed or otherwise forwarded, distributed

or sent in, into or from a Restricted Jurisdiction where to do so

would violate the laws in that jurisdiction, and persons receiving

this Announcement and all documents relating to the Offer

(including custodians, nominees and trustees) must not mail or

otherwise distribute or send them in, into or from such

jurisdictions where to do so would violate the laws in that

jurisdiction.

The availability of the Offer to Watchstone Shareholders who are

not resident in the United Kingdom may be affected by the laws of

the relevant jurisdictions in which they are resident. Persons who

are not resident in the United Kingdom should inform themselves of,

and observe, any applicable requirements.

The Offer shall be subject to the applicable requirements of the

Takeover Code, the Panel, the London Stock Exchange, the Financial

Conduct Authority, the AQSE Growth Market and AIM Rules.

Publication of this Announcement on website

A copy of this Announcement will be available, free of charge,

subject to certain restrictions relating to persons resident in

Restricted Jurisdictions on the Polygon website at

https://www.polygoninv.com/uk-regulatory-disclosures/ by no later

than 12:00 p.m. on the Business Day following this

Announcement.

For the avoidance of doubt, the contents of these websites and

any websites accessible from hyperlinks on these websites are not

incorporated into and do not form part of this Announcement.

Right to receive documents in hard copy form

Any person entitled to receive a copy of documents,

announcements and information relating to the Offer is entitled to

receive such documents in hard copy form free of charge. A person

may also request that all future documents, announcements and

information in relation to the Offer are sent to them in hard copy

form.

A hard copy of this Announcement may be requested by contacting

finnCap Ltd at (+44) 020 7220 0500.

Rounding

Certain figures included in this Announcement have been

subjected to rounding adjustments. Accordingly, figures shown for

the same category presented in different tables may vary slightly

and figures shown as totals in certain tables may not be an

arithmetic aggregation of the figures that precede them.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

OLADKQBNPBKDNCD

(END) Dow Jones Newswires

September 14, 2021 11:37 ET (15:37 GMT)

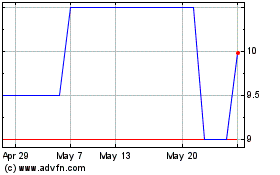

Watchstone (AQSE:WTG)

Historical Stock Chart

From Oct 2024 to Nov 2024

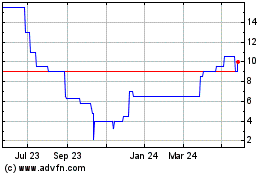

Watchstone (AQSE:WTG)

Historical Stock Chart

From Nov 2023 to Nov 2024