BlueScope Unsure How Long Steel-Market Boom Will Last -- Commodity Comment

16 August 2021 - 9:27AM

Dow Jones News

By Rhiannon Hoyle

Australia's BlueScope Steel Ltd. reported a sharp jump in annual

profit--to 1.19 billion Australian dollars (US$877 million) in the

year through June, from A$96.5 million the 12 months

earlier--underpinned by strong steel demand and prices. Here are

some remarks from its earnings filings.

On Australian steel markets:

"Increased volumes were driven by strength across building and

construction, with activity levels supported by focused sales and

marketing initiatives, various government stimulus and

infrastructure programs, redirected discretionary spending, and

recovery work following recent storm/flood events. FY 2021 steel

sales of Colorbond steel, Truecore steel, Tru-Spec steel and

Galvanised were the highest on record for the ASP

business--assisted by both specific sales initiatives and broader

segment demand growth."

On U.S. markets:

"Strong production and despatch levels continued throughout FY

2021--with North Star despatching at full capacity other than

during scheduled maintenance outages in November 2020 and June

2021. U.S. automotive sales rebounded strongly after the Covid-19

production shuts and demand shock in the June 2020 quarter, with

the annualized sales run-rate averaging 17 million units for 2H FY

2021. Construction spending increased in FY 2021 over FY 2020.

Driven by increased customer activity levels, consolidation and

rationalization of supply and low service centre inventories,

benchmark Midwest steel spreads improved significantly from late 1H

FY 2021, reaching record highs during 2H FY2021."

On the outlook:

"At the beginning of 1H FY 2022, order and despatch rates in key

markets remain robust. Spot steel spreads in North America are

materially higher than both 2H FY2021 and longer-term averages. In

light of these unusually strong conditions, the company expects

underlying Ebit in 1H FY2022 to be in the range of A$1.8 billion to

A$2.0 billion. While in the medium term we see supportive industry

and end-use demand trends, it is uncertain how long the current

robust conditions will be sustained."

On growth plans:

"BlueScope has a wide range of growth opportunities across its

footprint, leveraging sector trends, allowing the company to deploy

capital in a disciplined and efficient manner to support growth and

future earnings. BlueScope has identified over A$500 million of

growth projects across its footprint, building on the strength of

its portfolio of assets and leveraging key macro and sectoral

trends, such as the improving industry conditions across China and

the U.S., the supportive investment environment provided by low

interest rates and government stimulus, shifts in preferences

towards lower density regional housing and online shopping, and

recognition of the critical nature of steel in underpinning the

transition to a clean energy future."

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

August 15, 2021 19:14 ET (23:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

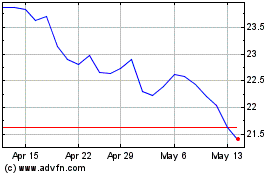

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Nov 2024 to Dec 2024

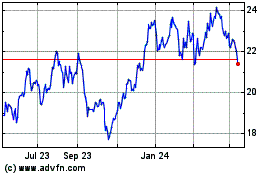

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Dec 2023 to Dec 2024