Australia's Top Miners Hit Five-Month High on China Demand Hopes

14 November 2022 - 2:50PM

Dow Jones News

By Rhiannon Hoyle

Shares in some of Australia's biggest mining stocks jumped

Monday, buoyed by hopes for improving commodity demand after China

signaled a loosening of pandemic restrictions and a reversal in its

property-sector crackdown.

Shares in BHP Group Ltd., the world's No. 1 miner by market

value and a major producer of steelmaking commodities iron ore and

metallurgical coal, were recently 5.0% higher at 44.20 Australian

dollars (US$29.65) a share.

Rival Rio Tinto Ltd., the world's top iron-ore producer and No.

2 miner overall by market value, was 4.3% higher at A$107.03 a

share.

Both stocks are at their highest price since June. Other miners

including Fortescue Metals Group Ltd. and South32 Ltd. also

rallied.

China's central bank and top banking regulator issued a

wide-ranging series of measures aimed at bolstering housing demand

and supply, according to a notice circulated Friday to the

country's financial institutions and officials involved in

policy-making.

China's property sector accounts for roughly 30% of China's

steel demand and 20%-30% of China's aluminum, zinc and copper

consumption, according to Commonwealth Bank of Australia analyst

Vivek Dhar.

Still, the outlook for commodity demand is opaque after a deep

slump in the country's real-estate market in recent times, he said

in a client note Monday.

"With homebuyer and creditor confidence so eroded, it's hard to

gauge how quickly China's property sector can recover, even if

China's Covid-zero policy has been relaxed," Mr. Dhar said. "We'd

likely need to see a more meaningful relaxation of China's

Covid-zero policy and a greater tolerance to live with Covid-19

than to eliminate it."

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

November 13, 2022 22:35 ET (03:35 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

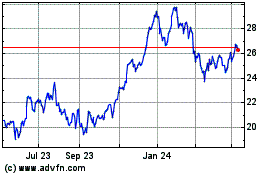

Fortescue (ASX:FMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Fortescue (ASX:FMG)

Historical Stock Chart

From Dec 2023 to Dec 2024