NAB Confirms Discussions with Nippon Life Over Deal

15 October 2015 - 1:00PM

Dow Jones News

MELBOURNE, Australia—National Australia Bank Ltd. confirmed it

is discussing a possible life-insurance tie-up with Nippon Life

Insurance Co. as it seeks to lift returns to close the gap with

Australia's other top banks.

The two companies have entered a nonbinding memorandum of

understanding but discussions are ongoing and nothing has yet been

decided, NAB said Thursday. A potential deal is uncertain and would

be subject to regulatory approvals, it added.

NAB Chief Executive Andrew Thorburn said the bank had been

exploring a potential strategic partnership with Nippon Life and a

long-term deal for the creation of life-insurance products, as part

of a broader look at options to improve returns in NAB's wealth

division, which houses its insurance business.

The major Japanese life-insurer aims to strike a deal this month

to buy NAB's insurance operation, spending between 200 billion and

300 billion yen (US$2.5 billion), Kyodo news agency reported late

Wednesday, citing unnamed sources. A spokeswoman for NAB declined

to provide further comment beyond its Thursday statement.

Since taking the helm at NAB just over a year ago, Mr. Thorburn

has sped up the bank's efforts to tighten its focus on its core

Australia and New Zealand businesses and shed underperforming

assets. That has come even as major lenders in Australia have been

forced to raise billions of dollars to boost capital buffers to

meet regulatory demands.

After years lagging behind the earnings growth and share-price

performance of its peers, NAB in May moved to raise 5.5 billion

Australian dollars (US$3.98 billion) through a rights issue to ease

its exit from its U.K. banking operations by the end of the year

and to shore up its capital reserves. That came after it last year

sold a large portfolio of higher-risk commercial real-estate loans

in the U.K. In July, NAB sold its remaining stake in regional U.S.

lender Great Western Bancorp Inc., which it floated on the New York

Stock Exchange last year.

NAB said Thursday it would provide an update on the talks with

Nippon Life if there were any material developments.

A sale of its insurance business would come amid consolidation

moves by insurers in the Asia-Pacific region. Nippon Life last

month agreed to buy smaller Mitsui Life Insurance Co. Sumitomo Life

Insurance Co. a month earlier agreed to buy U.S. life insurer

Symetra Financial Corp. for US$3.73 billion, and Dai-ichi Life

Insurance Co. closed a deal earlier this year to buy Protective

Life Corp. in the U.S. for US$5.6 billion.

On Thursday, NAB rival Australia & New Zealand Banking Group

Ltd. said it was selling its New Zealand medical-insurance business

to health insurer nib Holdings Ltd. in a deal worth about A$22.6

million. The same day, Insurance Australia Group Ltd. abandoned

plans to invest further in China but said it would seek growth

opportunities in other Asian markets and in its core businesses in

Australia and New Zealand.

Write to Robb M. Stewart at robb.stewart@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 14, 2015 21:45 ET (01:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

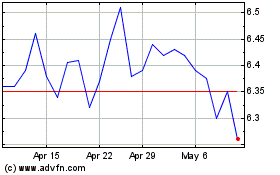

Insurance Australia (ASX:IAG)

Historical Stock Chart

From Jan 2025 to Feb 2025

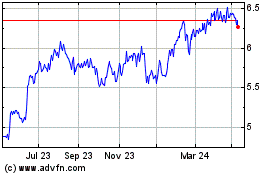

Insurance Australia (ASX:IAG)

Historical Stock Chart

From Feb 2024 to Feb 2025