Insurance Australia Inks Quota-Share Deals with Three Reinsurers

08 December 2017 - 10:32AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Insurance Australia Group Ltd. has struck

deals with a trio of European reinsurers to swap a share of the

premiums it collects in exchange for help paying claims and

expenses, in a bid to reduce earnings volatility and bolster

capital.

The agreements, which take effect from January, build on a

larger deal Insurance Australia signed more than two years ago with

billionaire investor Warren Buffett's Berkshire Hathaway Inc.

The Australian insurer said Friday it had entered three

quota-share agreements with Germany's Munich Re AG and Hannover Re

AG and Swiss Re AG covering its businesses in Australia, New

Zealand and Thailand. The agreements, which have an average initial

period of more than five years, will see the reinsurers receive a

combined 12.5% of Insurance Australia's consolidated gross earned

premium and pay 12.5% of claims and expenses.

Insurance Australia also will receive a percentage-based fee for

access to its franchise.

The agreements will lower Insurance Australia's requirements for

natural-disaster reinsurance and reduce its exposure to volatility

in associated premium rates, the company said. It also will reduce

its regulatory capital requirement by about 435 million Australian

dollars (US$326.8 million) over a three year period, but will be

broadly earnings and return-on-equity neutral.

In tandem with the Berkshire Hathaway deal, the company had

removed earnings risk from a third of its business but retains

exposure to earnings potential from profit sharing arrangements,

Managing Director and Chief Executive Peter Harmer said.

Insurance Australia, one of Australia's largest general

insurers, in mid-2015 agreed to sell a 3.7% stake to Berkshire

Hathaway for A$500 million as part of a 10-year partnership that

sees it collect 20% of the Australian company's gross written

premiums and pay 20% of claims.

Insurance Australia's core businesses are in Australia and New

Zealand, where it competes with the likes of QBE Insurance Group

Ltd. and Suncorp Group Ltd. Underwriting more than A$11 billion in

premiums a year, it also has operations in Thailand, Vietnam and

Indonesia and interests in general-insurance ventures in Malaysia

and India.

Insurance Australia raised its target for its reported insurance

margin by 1.25 percentage points to 13.75%-15.75% for the current

financial year, which will cover six months with the new

quota-share agreements. Its natural-disasters allowance also

reduced to A$627 million from A$680 million.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

December 07, 2017 18:17 ET (23:17 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

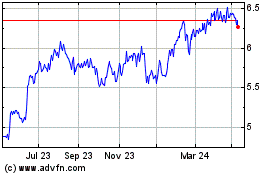

Insurance Australia (ASX:IAG)

Historical Stock Chart

From Jan 2025 to Feb 2025

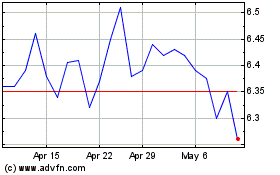

Insurance Australia (ASX:IAG)

Historical Stock Chart

From Feb 2024 to Feb 2025