Toncoin Consolidates: Could A Breakout Push TON Higher?

15 December 2024 - 9:30AM

NEWSBTC

Toncoin has entered a period of consolidation, with its price

moving within a narrow range of $6.2 and $6.5 as the market weighs

its next move. As the cryptocurrency stabilizes, will Toncoin break

to the upside, setting the stage for a fresh rally, or will it

falter and dip lower, testing crucial support levels? This

consolidation phase is more than just a pause in price action; it

represents a pivotal moment that could determine TON’s next major

move. A breakout to the upside could signal renewed positive

sentiment, attracting more buyers and fueling a strong upward

trend. On the other hand, a breakdown could shift the market

sentiment to bearish, with the price heading lower to retest key

support zones. In this article, we will explore both scenarios in

detail, analyzing the key levels to watch and what a breakout in

either direction could mean for Toncoin’s future trajectory.

Toncoin Current Range: Understanding The Consolidation Phase As

Toncoin consolidates, current price action suggests the potential

for a breakout to the upside. The price has shown signs of bullish

momentum within the consolidation range, with gradual upward

movements indicating increasing buying interest. Related

Reading: Toncoin’s 90-Day Returns Turn Positive: Is A Massive Rally

On The Horizon? Furthermore, this upward pressure within the range

is often a precursor to a breakout, as market participants

accumulate positions, anticipating a rise above resistance levels.

If this momentum continues to build, it could signal that Toncoin

is preparing for a strong move on the upside once the price breaks

free from its current consolidation zone. The Relative Strength

Index (RSI) is currently trending above the 50% threshold,

indicating that Toncoin is in positive territory and buying

pressure is starting to outpace selling activity, which is often a

sign of bullish momentum. When the RSI remains above the 50% mark,

it suggests that the asset is more likely to experience upward

movement as it reflects an increasing number of buyers compared to

sellers. Typically, this level is often seen as a key

indicator for possible future gains, showing that market sentiment

is leaning toward optimism. As the RSI trends higher, the

likelihood of a breakout to the upside increases, reinforcing the

optimistic outlook for Toncoin. What Happens After A Breakout?

Possible Price Targets And Next Steps After a breakout, TON’s

direction will hinge on whether the move is upward or downward. If

the price breaks higher, it could target the $7.2 resistance level,

which could act as an initial hurdle. Breaking above this

level successfully would indicate strong bullish momentum,

potentially triggering upward movement. In this scenario, the next

key resistance level to watch would be $8.3. A move past this point

could set Toncoin on a path for additional gains, as it would

signal that the bulls are in control and the price may continue to

climb toward new highs. Related Reading: Toncoin Price Explodes

With 17% Rally — Can TON Sustain The Momentum? On the other hand,

if the breakout is to the downside, the price will likely test the

$6 support level. A breach of this level could lead to more

declines, with subsequent support zones becoming crucial.

Conclusively, increased volatility is common, so traders should

watch for confirmation signals after a breakout, such as volume and

momentum indicators, to gauge the sustainability of the move. The

broader market sentiment also plays a significant role in

determining the direction and strength of the breakout. Featured

image from Adobe Stock, chart from Tradingview.com

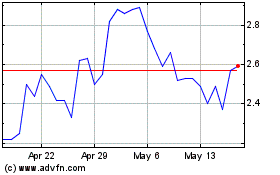

Optimism (COIN:OPUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Optimism (COIN:OPUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024