Bitcoin Net Taker Volume Nears In On Bullish Crossover

30 March 2023 - 2:00AM

NEWSBTC

On-chain data shows the Bitcoin net taker volume is approaching a

break above a line that has historically been a bullish signal for

the price. Bitcoin Net Taker Volume Has Been Moving Towards Zero

Line Recently As pointed out by an analyst in a CryptoQuant post,

this kind of crossover has appeared four times during the past year

or so. The “net taker volume” is an indicator that measures the

difference between the taker buy and taker sell volumes in the

market. This metric shouldn’t be confused with the taker buy/sell

ratio, which, as its name already implies, tells us about the ratio

between these two volumes, rather than their difference. When the

net taker volume has a positive value, it means the taker buy

volume is currently greater than the taker sell volume. Such a

trend suggests that bullish sentiment is more dominant in the

market right now. On the other hand, the indicator having values

less than zero implies the short volume is overwhelming the long

volume at the moment, and hence, a bearish sentiment is shared by

the majority of the investors. Now, here is a chart that shows the

trend in the 30-day moving average (MA) Bitcoin net taker volume

over the last year: Looks like the 30-day MA value of the metric

has been rising in recent days | Source: CryptoQuant As you can see

in the above graph, the quant has marked the relevant points of the

trend for the 30-day MA Bitcoin net taker volume, as well as the

corresponding pattern that the price of the asset displayed. It

seems like whenever this indicator has crossed above the zero line

from the negative zone, the value of the cryptocurrency has

followed up with riding on some upwards momentum. Related Reading:

Bitcoin Miners Transfer Large Amount To Exchanges, Sign Of Selling?

“When the indicator crosses above zero, it means that over a 30D

Moving Average, the volume through taker BUY orders is higher than

taker SELL orders,” explains the analyst. “This will result in

buying strength for Bitcoin.” In total, there were previously four

instances of this pattern during the past year or so. In some of

these occurrences, the bullish effect came with a bit of delay,

with the most prominent example of this being the crossover that

eventually lead to the current rally in the BTC price. Recently,

the 30-day MA Bitcoin taker net volume has been inside the negative

zone, meaning that sell orders have dominated the market. However,

in the last few days, the metric’s value has been rising, and it is

now once again approaching the zero level. Related Reading: Bitcoin

Mid-Term Holders Move 50,000 BTC, Bearish Signal? If the indicator

continues on this trajectory, then a crossover into the positive

zone can take place, which, if the past pattern is anything to go

by, may have a constructive effect on the price. BTC Price At the

time of writing, Bitcoin is trading around $28,300, up 1% in the

last week. BTC has sharply risen in the past day | Source: BTCUSD

on TradingView Featured image from 2 Bull Photography on

Unsplash.com, charts from TradingView.com, CryptoQuant.com

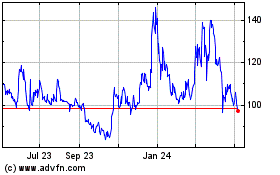

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2024 to May 2024

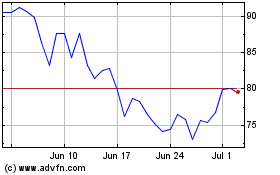

Quant (COIN:QNTUSD)

Historical Stock Chart

From May 2023 to May 2024