TRUMP Token Takedown—Did Insiders Plan The Crash?

13 March 2025 - 2:30PM

NEWSBTC

The official TRUMP token, designed to commemorate US President

Donald Trump’s second presidency, was an instant hit upon launch.

The token surged from less than $10 on January 18th to a high of

$74.59 on January 20th before quickly surrendering some gains

within hours. Although the token remained competitive days after

the president’s inauguration, by trading above $30, it quickly

faded under pressure. TRUMP dipped below $20 on February 2nd, and

it’s now trading at $10. Related Reading: $931 Million

Bitcoin On The Move: Mt. Gox Sparks Market Jitters Observers say

that the broader crypto market and TRUMP’s token are crashing.

However, TRUMP’s crash is not without controversy—10x Research has

disclosed that there was “insider play” before the coin’s massive

drop. While most traders lost billions of dollars during its crash,

a sizeable number of early investors cashed in for huge profits.

Early Investors Cash Out Before Listing In Major Exchanges

According to 10x Research, most early investors cashed in just

before major exchanges listed the coin, as its value moved past $60

and briefly hit $70. The coin’s rapid surge in price was welcomed

by everyone, with the early investors getting the best seats in the

house. After its quick rise, TRUMP suffered a massive drop. From

the low $20s, it’s now trading at $10, leaving retail and small

traders with losses. The $TRUMP Dump: When the Hype Fades, Reality

Hits 👇1-4) A clear example is the $TRUMP coin, where insiders and

those with early access at the Washington crypto ball could buy in

before the public, while exchanges rushed to list the token as it

soared past $60. After briefly… pic.twitter.com/PVzLcVbL0m — 10x

Research (@10x_Research) March 11, 2025 Losses related to the TRUMP

price drop are reminiscent of previous bearish cycles, including

the 2021 NFTs boom and bust. With the TRUMP token, the value

significantly dropped within the week. By looking at the bigger

picture, TRUMP token shed more than 80% since its peak last

January. And on-chain data suggests that early investors quickly

liquidated their positions, with retail and small traders used as

pawns. Solana Chain Takes A Hit The Solana ecosystem is one of the

biggest losers in the token’s crash. Aside from TRUMP, a few other

Solana-based tokens faced selling pressure, including Raydium’s RAY

token, which dropped by 60% in the last month. Even Solana’s native

token, SOL, dropped by over 40% over the same period. The drop in

value for SOL-based tokens suggests that the interest in meme coins

or speculative tokens is waning. Pump.fun Also Sees Dramatic Shift

Pump.fun, another leading meme coin platform, has also witnessed a

dramatic drop in network activity. Over the past year, this

platform processed 8.4 million meme coin launches, peaking days

ahead of Trump’s inauguration. Related Reading: XRP Cycle Top

Forecast—Analyst Pinpoints The Timeline From Christmas season to

early January, up to 1.7 million meme tokens were launched on

Pump.fun. However, the daily launches on Pump.fun have dropped.

Also, participation rates have fallen on this platform, reflecting

declining interest on this asset class. Feature image from

Newsweek, chart from TradingView

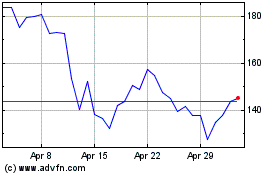

Solana (COIN:SOLUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Solana (COIN:SOLUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025