Aéroports de Paris SA - 2023 first 9-months revenue

FINANCIAL RELEASE1

Tremblay-en-France, 25 October 2023

Aéroports de Paris SA2023 first nine

months consolidated revenue up 21.8%, Full-year

forecasts & financial targets confirmed

2023 first nine months consolidated

revenue up

+21.8% compared to the

same period in 2022, to €4,121M.

-

Aviation and International & airport developments segments are

driven by the continued recovery of traffic in Paris (+18.4%,

91.4% of 2019 level) and abroad, especially in TAV airports

(+24.1%, at 97.8% of 2019 traffic level).

-

Retail & Services segment record a solid growth, benefiting of

traffic recovery in Paris, the strong increase in Extime Paris

Sales/Pax2, at 29.7 euros for the first nine months of 2023, and a

larger number of opened sales points compared to the same

period in 2022.

-

Real Estate segment is increasing, notably supported by additional

rental income from assets taken over in full ownership during

2022.

-

2023 full-year traffic assumptions, forecasts and financials

targets are confirmed.

|

Unless otherwise indicated, changes are expressed in comparison

with the first nine months of 2022.Operational and financial

indicators definitions appear in Appendix 1. CONSOLIDATED

REVENUE – KEY FIGURES |

|

|

9M 2023 |

9M 2022 |

Change 2023/2022 |

|

Revenue3 |

€4,121M |

€3,384M |

+€737M |

+21.8% |

|

of which Aviation |

€1,447M |

€1,224M |

+€223M |

+18.2% |

|

of which Retail and

Services |

€1,297M |

€1,020M |

+€277M |

+27.1% |

|

of which Real Estate |

€242M |

€225M |

+€18M |

+7.9% |

|

of which Intl. &

airport development |

€1,231M |

€978M |

+€254M |

+25.9% |

|

OPERATIONAL INDICATORS |

|

|

|

|

|

|

9M 2023 |

in % of 20194 |

Change 2023/20224 |

|

Group traffic5 |

254.7 Mpax |

97.9% |

+48.6 MPax |

+23.9% |

|

Paris Aéroport traffic |

75.6 Mpax |

91.4% |

+11.7 Mpax |

+18.4% |

|

|

9M 2023 |

9M 2022 |

Change 2023/2022 |

9M 2019 |

Change 2023/2019 |

|

Extime Paris Sales / Pax |

€29.7 |

€26.1 |

+€3.6 |

+13.7% |

€22.7 |

+€7.1 |

+31.2% |

Augustin de Romanet, Chairman and CEO of Groupe

ADP, stated:

" Traffic recovery in Paris continued during the

3rd quarter of 2023, reaching over the first nine months of the

year 91.4% of the traffic over the same period in 2019, compared to

90.0% as of June-end. Since the beginning of the year, our network

of airports welcomed 254.7 million passengers, up +23.9% compared

to the first nine months of 2022. Consolidated revenue for the

first nine months of the year reached 4,121 million euros, up

+21.8% compared to the same period in 2022. All segments are

performing as expected and we can confirm our 2023 full-year

forecasts and financial targets. I would like to thank again

Groupe ADP's teams, whose commitment and expertise in

hospitality ensure the best experience for passengers traveling

through our airports. We remain focused on preparing to host the

Paris Olympic and Paralympic Games in 2024 and on the industrial

and environmental transformation undertaken with our 2025 Pioneers

strategic roadmap."

Comments on group news

Progress on the GIL & GAL merger

project

Following the agreement between Groupe ADP and

GMR Enterprises to form an airport holding company listed on the

Indian Stock Exchanges by the first half of 2024 (see press release

of March 19th 2023), several steps were achieved during the 3rd

quarter of 2023:

-

on August 2nd, 2023, Securities and Exchange Board of India (SEBI)

issued no objection on the merger application, which is thus

formally approved by the Stock Exchanges where GIL is currently

listed: BSE Limited and National Stock Exchange of India

Limited.

-

the merger application has been filed for approval with the

National Company Law Tribunal (NCLT)

on September 5th, 2023.

As previously announced, the NCLT's final

decision, following approval by the shareholders and creditors of

both companies, is expected in the 1st half 2024, and would lead to

the completion of the merger transaction.

TAV Airports sells part of its stake in

Medina airport

As indicated in the 2023 half-year results

release, the Board of Directors of TAV Airports approved the sale

of 24% of the capital of Tibah Airports Development, a company

operating Medina airport in Saudi Arabia, in which TAV Airports

held a total stake of 50% and which is accounted for by the equity

method in the Group's financial statements.

Following this decision, the equity-accounted

shares concerned, together with the balance attributable to these

securities of the shareholder loan granted to Tibah, by TAV

Airports, for the part concerned, have been reclassified as assets

held for sale within the meaning of IFRS 5 at 30 June, 2023.

TAV Airports announced on 5 September 2023 that

the financial close of the transaction had taken place and the

share sale has been executed. This transaction translates into TAV

Airports' accounts, fully consolidated in the group's consolidated

accounts, into a gain of 83 million euros, composed of:

- A 38 million euros gain recorded

in the income from associates & JVs, reflecting the

capital gain on the disposal of shares;

- A 45 million euros gain recorded

in the financial result, reflecting the provision reversal on

the shareholder loan granted to Tibah;

After minority interests, the impact on the

consolidated net result attributable to the group is estimated at

38 million euros.

New tax applicable to ADP

SA

Groupe ADP took note of the finance bill for

2024. The bill plans to introduce a new tax applicable to certain

French transport infrastructure companies, including Aéroports de

Paris SA (see press release of 27 September 2023).

French competition authority's decision

on Extime Food & Beverage Paris

Groupe ADP takes note of the decision of the

French Competition Authority authorizing the creation of a

full-function joint venture – Extime Food & Beverage

Paris -, jointly controlled by Aéroports de Paris and Select

Service Partner, dedicated to the management of catering outlets at

Paris-Charles de Gaulle and Paris-Orly Airports (see press release

of 11 September 2023).

Detail of consolidated revenue – First nine months of 2023

|

|

9M 2023 |

9M 2022 |

Change 2023/2022 |

|

Revenue |

€4,121M |

€3,384M |

+€737M |

+21.8% |

|

Aviation |

€1,447M |

€1,224M |

+€223M |

+18.2% |

|

Retail and services |

€1,297M |

€1,020M |

+€277M |

+27.1% |

|

of which Extime Duty Free Paris |

€551M |

€438M |

+€112M |

+25.7% |

|

of which Relay@ADP |

€88M |

€70M |

+€18M |

+26.0% |

|

Real estate |

€242M |

€225M |

+€18M |

+7.9% |

|

International and airport developments |

€1,231M |

€978M |

+€254M |

+25.9% |

|

of which TAV Airports |

€979M |

€750M |

+€229M |

+30.6% |

|

of which AIG |

€217M |

€191M |

+€26M |

+13.5% |

|

Other activities |

132M€ |

€122M |

+€9M |

+7.6% |

|

Inter-sector eliminations |

(€228M) |

(€184M) |

-€43M |

+23.6% |

Evolution of revenue by segment

Analysis by segment

Aviation – Parisian platforms

|

(in millions of euros) |

9M 2023 |

9M 2022 |

Change 2023/2022 |

|

Revenue |

1,447 |

1,224 |

+€223M |

+18.2% |

|

Airport fees |

870 |

734 |

+€136M |

+18.5% |

|

Passenger fees |

551 |

448 |

+€103M |

+22.9% |

|

Landing fees |

192 |

172 |

+€20M |

+11.9% |

|

Parking fees |

127 |

114 |

+13M€ |

+11.0% |

|

Ancillary fees |

181 |

149 |

+€32M |

+21.7% |

|

Revenue from airport safety and security services |

368 |

316 |

+€52M |

+16.4% |

|

Other income |

28 |

24 |

+€3M |

+13.2% |

Over the first nine months of 2023,

the aviation segment revenue, which relates

solely to the airport activities carried out

by Aéroports de Paris as operator of the Parisian

platforms, was up +18.2%, to 1,447 million euros.

Revenue from airport fees

(passenger fees, landing fees and aircraft parking fees)

up +18.5%, to 870 million euros due to:

- the +22.9% increase in passenger

fee revenue, linked to the growth of passenger traffic (+18.4%) and

the increase of international share of traffic (see

geographical breakdown traffic in page 8);

- the +11.9% increase

in landing fee revenue, linked to the increase in aircrafts

movements (+10.8%);

- the +11.0% increase

in parking fee revenue, linked to the increase in aircrafts

movements (+10.8%).

Revenue from ancillary fees was

up +21.7%, to 181 million euros, linked to the increase of

passenger traffic.

As a reminder, the tariffs applicable for the

Parisian platforms are presented on the company's website, and

their evolution since the 2022 tariff period is presented in

Appendix 2 of this release.

Revenue from airport safety and security

services was up +16.4%, to 368 million euros. As these

revenues are determined by the partially fixed costs of

these activities, they are growing at a lower rate than passenger

traffic.

Other income, mostly consisting

in re-invoicing to the French Air Navigation Services Division of

leasing for the use of terminals and other work services for

third parties was up +13.2%, to 28 million euros.

Retail and services – Parisian platforms

|

(in millions of euros) |

9M 2023 |

9M 2022 |

Change 2023/2022 |

|

Revenue |

1,297 |

1,020 |

+€277M |

+27.1% |

|

Retail activities |

837 |

643 |

+€194M |

+30.1% |

|

Extime Duty Free Paris |

551 |

438 |

+€112M |

+25.7% |

|

Relay@ADP |

88 |

70 |

+€18M |

+26.0% |

|

Other Shops and Bars and restaurants |

124 |

82 |

+€42M |

+50.8% |

|

Advertising |

38 |

23 |

+€15M |

+63.9% |

|

Other products |

36 |

29 |

+€7M |

+22.5% |

|

Car parks and access roads |

131 |

110 |

+€21M |

+18.9% |

|

Industrial services revenue |

151 |

114 |

+€38M |

+33.0% |

|

Rental income |

119 |

104 |

+€15M |

+14.2% |

|

Other income |

59 |

49 |

+€10M |

+19.7% |

Over the first nine months of 2023,

Retail and services segment revenue, which

includes only Parisian activities was up +27.1%, to 1,297

million euros.

Revenue from retail activities

consists in revenue received from airside and landside shops, bars

and restaurants, banking and foreign exchange activities, and

car rental companies, as well as revenue from advertising.

Over the first nine months of 2023, retail

activities revenue was up +30.1%, to 837 million euros, due

to:

- the increase in revenue from Extime

Duty Free Paris (up +25.7%, to 551 million euros) and from

Relay@ADP (up +26.0%, to 88 million euros) driven by the increase

in traffic and in the number of outlets open compared to the

same period in 2022, especially with the reopening of Terminal 1 at

Paris-Charles de Gaulle;

- the increase in

revenue from Other Shops and Bars and restaurants, was up +50.8%,

to 124 million euros, driven by the increase in the number of

outlets open compared to the same period in 2022;

- the increase in

revenue from advertising, was up +63.9%, to 38 million euros driven

by the increase in traffic.

Revenue from car

parks was up +18.9%, to 131 million euros, linked

to the increase in passenger traffic.

Revenue from industrial

services (supply of electricity and water) was up +33.0%,

to 151 million euros.

Rental revenue (leasing of

spaces within terminals) was up +14.2%, to 119 million euros.

Other revenue (primarily

constituted of internal services) was up +19.7%,

to 59 million euros.

Real Estate – Parisian platforms

|

(in millions of euros) |

9M 2023 |

9M 2022 |

Change 2023/2022 |

|

Revenue |

242 |

225 |

+€18M |

+7.9% |

|

External revenue |

208 |

190 |

+€18M |

+9.4% |

|

Land |

96 |

91 |

+€5M |

+5.3% |

|

Buildings |

73 |

64 |

+€9M |

+13.8% |

|

Others |

39 |

35 |

+€4M |

+12.0% |

|

Internal revenue |

35 |

35 |

- |

-0.5% |

Over the first nine months of 2023,

revenue from the Real Estate segment, consisting

of Parisian activities only, was up +7.9%, to 242 million

euros.

External revenue realized with

third parties, was up +9.4%, to 208 million euros, mainly due to

additional rents from assets returned to full ownership in 2022 and

the effect of indexation clauses on rents.

Internal revenue was stable, at

35 million euros. A one-off re-invoicing for internal services,

booked in the 3rd quarter, has offset the reduced internal use of

offices linked to the implementation of a new flex office

organization. The space thus freed up will eventually be rented out

to third parties.

International and airports developments

|

(in millions of euros) |

9M 2023 |

9M 2022 |

Change 2023/2022 |

|

Revenue |

1,231 |

978 |

+€254M |

+25.9% |

|

ADP International |

234 |

215 |

+€19M |

+9.0% |

|

of which AIG |

217 |

191 |

+€26M |

+13.5% |

|

of which ADP Ingénierie |

9 |

17 |

-€8M |

-49.2% |

|

TAV Airports |

979 |

750 |

+€229M |

+30.6% |

|

Société de Distribution Aéroportuaire Croatie |

13 |

11 |

+€2M |

+16.7% |

Over the first nine months of 2023,

revenue from International and airport

developments was up +25.9%, to

1,231 million euros, mainly due to the increase in

revenue for TAV Airports and AIG.

AIG's revenue was up +13.5%, to

217 million euros, mainly due to the effect of the +24.3% increase

in passenger traffic in Amman on revenues from aeronautical

fees.

TAV Airports' revenue was up

+30.6%, to 979 million euros, mainly due to the effect of the

traffic increase of +24.1% of TAV Airports on

revenue:

- Turkish assets of

TAV Airports, especially Ankara, for +17 million euros (+76.1%) and

Izmir, for +11 million euros (+18.2%);

- International

assets of TAV Airports, especially in Almaty, for +70 million euros

(+30.3%) and in Georgia, for +13 million euros

(+20.1%);

- Services companies

of TAV Airports, especially Havas (ground handling), for +47

million euros (+36.5%), due to the increase of flights served,

TAV OS (airport lounges) for +34 million euros (+78.5%), and

BTA (bars and restaurants) for +30 million euros (+37.1%), due to

the increase in attendance.

Other activities

|

(in millions of euros) |

9M 2023 |

9M 2022 |

Change 2023/2022 |

|

Income |

132 |

122 |

+€9M |

+7.6% |

|

of which Hub One |

120 |

116 |

+€4M |

+3.5% |

Over the first nine months of 2023,

income from the other activities

segment was up +7.6%,

to 132 million euros.

Evolution of traffic over the first nine months of 2023

Group6

traffic

|

|

9M 2023 |

|

Passengers |

Change 23/22 |

% of trafficcompared to 2019 |

|

Paris-CDG |

50,841,244 |

+20.4% |

87.6% |

|

Paris-Orly |

24,721,834 |

+14.5% |

100.3% |

|

Total Paris Aéroport |

75,563,078 |

+18.4% |

91.4% |

|

Antalya |

28,929,997 |

+16.8% |

98.7% |

|

Almaty |

7,045,266 |

+35.8% |

147.4% |

|

Ankara |

8,978,886 |

+39.9% |

84.8% |

|

Izmir |

8,254,545 |

+8.7% |

86.5% |

|

Bodrum |

3,490,914 |

+4.2% |

92.3% |

|

Gazipaşa |

681,086 |

+26.5% |

75.5% |

|

Medina |

6,870,292 |

+60.2% |

104.4% |

|

Tunisia |

1,909,356 |

+59.1% |

72.0% |

|

Georgia |

3,288,562 |

+23.2% |

94.2% |

|

North Macedonia |

2,357,712 |

+30.2% |

114.9% |

|

Zagreb |

2,817,488 |

+22.4% |

107.3% |

|

Total TAV Airports |

74,624,104 |

+24.1% |

97.8% |

|

New Delhi |

53,431,298 |

+26.7% |

107.2% |

|

Hyderabad |

17,943,669 |

+31.8% |

110.0% |

|

Medan |

5,618,929 |

+36.7% |

94.8% |

|

Goa |

2,527,209 |

- |

- |

|

Total GMR Airports7 |

79,521,105 |

+28.5% |

106.8% |

|

Santiago du Chili |

17,030,505 |

+26.7% |

90.9% |

|

Amman |

7,255,782 |

+24.3% |

104.9% |

|

Other airports8 |

754,443 |

+64.8% |

82.9% |

|

GROUPE ADP7 |

254,749,017 |

+23.9% |

97.9% |

Traffic at Paris Aéroport

Over the first nine months of 2023, traffic at

Paris Aéroport up +18.4% with a total of 75.6 million of

passengers, at 91.4% of traffic on the same period in 2019.

Aircrafts movements at Paris Aéroport, were up

+10.8%, to 491,650 movements, of which 335,913 movements

at Paris-Charles de Gaulle, up +12.5%, at 88.8% of 2019 level,

and 155,370 movements at Paris-Orly, up +7.4%, at 92.4% of

2019 level.

Geographical breakdown of passenger traffic

appears in the table below:

IMPORTANT NOTE: Since the traffic release of

December and 2022, the geographical breakdown at Paris Aéroports

within this release as well as in the historical data used for

variation and recovery calculations has been aligned with the

different categories applicable to airport fees. It presents

the detailed breakdown of "Europe" traffic into three categories:

"Schengen Area" traffic, "United Kingdom & UE excluding

Schengen " traffic, and "Other Europe" traffic. Traffic with

"French overseas territories", is presented separately from

"International" traffic, in which it was included until the

November 2022 traffic release. Note that the airport fees

applicable to these different categories are available on the

company website.

| |

9M 2023 |

|

Geographical breakdown |

Share of traffic 9M 2023 |

Share of traffic 9M 2022 |

Change 23/22in passengers |

% of traffic 2023compared to

2019 |

|

Mainland France |

12.3% |

14.7% |

-1.0% |

75.7% |

|

French Overseas Territories |

4.7% |

5.5% |

+1.5% |

98.7% |

|

Schengen Area |

37.2% |

37.3% |

+16.3% |

97.7% |

|

United Kingdom & EU ex. Schengen9 |

5.8% |

6.0% |

+26.2% |

91.6% |

|

Autre Europe |

2.4% |

2.4% |

+19.4% |

63.7% |

|

Europe |

45.4% |

45.7% |

+17.6% |

94.2% |

|

Africa |

13.1% |

12.4% |

+25.5% |

107.3% |

|

North America |

11.8% |

11.3% |

+24.5% |

98.3% |

|

Latin America |

2.7% |

2.9% |

9.1% |

80.2% |

|

Middle East |

5.4% |

5.2% |

+21.4% |

95.4% |

|

Asia-Pacific |

4.6% |

2.3% |

+133.8% |

65.3% |

|

Other International |

37.6% |

34.2% |

+30.5% |

93.4% |

|

PARIS AEROPORT |

100.0% |

100.0% |

+18.4% |

91.4% |

|

|

9M 2023 |

9M 2022 |

Change 23/22 |

Change 23/19 |

|

Connecting rate |

19.8% |

20.4% |

-0.7pt |

-2.6pts |

|

Seat load factor |

85.1% |

81.5% |

+3.6pts |

-1.6pt |

Reminder of traffic assumptions, forecasts and financials

targets 2023-2025

As part of the 2025 Pioneers strategic roadmap

communicated on February 16th, 2022, Groupe ADP has set out targets

up to 2025. These targets have been built assuming no new

restrictions or airport closures linked to the health crisis, the

stability of the economic model in Paris and the absence of

abnormally high volatility in terms of exchange and inflation

rates. They are also based on the consolidation scope at the end of

2021, assuming no changes by 2025.

It is specified that any further changes to the

assumptions on which the group's targets are based could have an

impact on the volume of traffic and the 2025 Pioneers financial

indicators.

|

|

2023 |

2024 |

2025 |

|

Group traffic10in % of 2019

traffic |

95% - 105% |

- |

- |

|

Return to the 2019 level between 2023 and 2024 |

|

Traffic at Paris Aéroportin % of 2019 traffic

|

87% - 93% |

90% - 100% |

95% - 105% |

|

Return to the 2019 level between 2024 and 2026,above the 2019 level

from 2026 |

|

Extime Paris Sales / Pax11in

euros |

- |

- |

€29.5 |

|

ADP SA operating expensesper

passenger, in € |

- |

€17 - €20 / pax12 |

|

Group EBITDA growthcompared to 2019 |

At least equal to 2019 EBITDA (i.e. ≥ €1,772M) |

- |

- |

|

Group EBITDA margin in % of revenue |

32% to 37% |

35% to 38%12 |

|

Net income, attributable to the Groupin millions

of euros |

Positive |

|

Group investments(excl. financials

investments) |

c.1.3 billion euros per year on average between 2023 and 2025, in

current euros |

|

ADP SA investments(excl. financials investments,

regulated and non-regulated) |

c.900 million euros per year on average between 2023 and 2025, in

current euros |

|

Net Financial Debt/ EBITDA ratio incl. Selective

international growth |

- |

- |

3.5x – 4.5x12 |

|

Dividends in % of the NRAG due for the year N,

paid N+1 |

60% pay out rateMinimum of €3 per share |

Financial calendar13

-

A conference call (audiocast in English) will be held on

Wednesday 25 October 2023 at 06:00 pm

(CET). The presentation can be followed in live

via the links below, which are also posted on the Groupe ADP

website:

A live webcast of the conference will be

available at the following link: webcast

Registration to participate in the Q&A

session is available at the following link: call registration

-

Next traffic publication: October 2023 traffic

figures - Wednesday 15 November 2023, after market closing

-

2023 Full-Year results: Thursday 15 February 2023,

before markets opening.

- Next

thematic conferences:

- GMR Airports

thematic conference (virtual): Upon completion of the GIL & GAL

merger14 (expected in H1 2024)

- Real Estate

thematic conference (in person): to be scheduled in 2024

Disclaimer

This presentation does not constitute an offer

to purchase financial securities within the United States or in any

other country.

Forward-looking disclosures (including, if

applicable, forecasts and objectives) are included in this press

release. These forward-looking disclosures are based on data,

assumptions and estimates deemed reasonable at the diffusion date

of the present document but could be inaccurate and are, either

way, subject to risks. There are uncertainties about the

realization of predicted events and the achievement of forecasted

results. Detailed information about these potential risks and

uncertainties that might trigger differences between considered

results and obtained results are available in the registration

document filed with the French financial markets authority (AMF) on

April 14th, 2023 under number D.23-0284, retrievable online on the

AMF website www.amf-france.org or the Aéroports de Paris website

www.parisaeroports.fr.

Aéroports de Paris does not commit to, and is

not obligated to, update forecasted information contained in this

document to reflect facts and circumstances posterior to the

presentation date.

Definitions

The definition and accounting of Alternative

Performance Measures (APM) as well as the segmentation of group

activities presented in this press release are fully published in

the group's universal registration document.

It is available in Groupe website: AMF

Information

Investor Relations contacts: Cécile

Combeau +33 6 32 35 01 46 and Eliott Roch +33 6 98 90 85 14 -

invest@adp.fr Press contact: Justine Léger, Head

of Medias and Reputation Department +33 1 74 25 23

23Groupe ADP develops and manages airports, including

Paris-Charles de Gaulle, Paris-Orly and Paris-Le Bourget. In 2022,

the group handled through its brand Paris Aéroport 86.7 million

passengers at Paris-Charles de Gaulle and Paris-Orly, and nearly

193.7 million passengers in airports abroad. Boasting an

exceptional geographic location and a major catchment area, the

group is pursuing its strategy of adapting and modernizing its

terminal facilities and upgrading the quality of services; the

group also intends to develop its retail and real estate

businesses. In 2022, group revenue stood at €4,688 million and net

result attributable to the group at €516million.Registered office:

1, rue de France, 93 290 Tremblay-en-France. Aéroports de Paris is

a public limited company (Société Anonyme) with share capital

of €296,881,806. Registered in the Bobigny Trade and Company

Register under no. 552 016 628.

groupeadp.frAppendix 1 –

Glossary

The definition and accounting of Alternative

Performance Measures (APM) as well as the segmentation of group

activities presented in this press release are fully published in

Aéroports de Paris' universal registration document.

It is available on the group's website: AMF

information - Groupe ADP (parisaeroport.fr)

Financial indicators:

-

EBITDA is an accounting measure of the operating

performance of fully consolidated group subsidiaries. It is

comprised of revenue and other ordinary income less purchases and

current operating expenses excluding depreciation and impairment of

property, plant and equipment and intangible assets.

-

EBITDA margin is the ratio

corresponding to: EBITDA / Revenue.

-

Gross Financial debt as defined by Groupe ADP

includes long-term and short-term borrowings and debts (including

accrued interests and hedge of the fair value of liabilities

related to these debts, as well as leasing expenses) and debts

related to the minority put option (presented in other non-current

liabilities)

-

Net Financial debt as defined by Groupe ADP refers

to gross financial debt less, fair value hedging derivatives, cash

and cash equivalents and restricted bank balances.

-

Net Financial Debt/EBITDA Ratio is the ratio

corresponding to the ratio: Net Financial Debt/EBITDA, which

measures the company's ability to repay its debt, based on its

EBITDA.

Operating indicators:

-

Extime Paris Sales / Pax or Extime Paris

Sales per passengers is the ratio corresponding to: sales

from airside activities: shops, bars & restaurants, foreign

exchange & tax refund counters, commercial lounges, VIP

reception, advertising and other paid services in the airside area,

divided by the number of departing passengers at Paris Aéroport.

This indicator replaces the "Sales per pax" indicator since

2022, corresponding to the ratio: Revenue from airside areas only /

Passengers departing from Paris Airport.

-

Group traffic includes airports operated by Groupe

ADP in full ownership (including partial ownership) or under

concession, receiving regular commercial passenger traffic,

excluding airports under management contract. As of the

date of this release includes the traffic of the airports listed

below.

Historical data since 2019 is available on the

Company's website

|

Sub-group |

Airport |

Country |

|

Paris Aéroport |

Paris-Charles de Gaulle |

France |

|

Paris-Orly |

France |

|

TAV Airports

|

Antalya |

Turkey |

|

Almaty |

Kazakhstan |

|

Ankara |

Turkey |

|

Izmir |

Turkey |

|

Bodrum |

Turkey |

|

Gazipasa |

Turkey |

|

Medina |

Saudi Arabia |

|

Monastir |

Tunisia |

|

Enfidha |

Tunisia |

|

Tbilisi |

Georgia |

|

Batumi |

Georgia |

|

Skopje |

North Macedonia |

|

Ohrid |

North Macedonia |

|

Zagreb |

Croatia |

|

GMR Airports |

Delhi |

India |

|

Hyderabad |

India |

|

Medan |

Indonesia |

|

Goa |

India |

|

ADP International |

Santiago de Chile |

Chile |

|

Amman |

Jordan |

|

Antananarivo |

Madagascar |

|

Nosy Be |

Madagascar |

Appendix 2 – Evolution of tariffs at Paris Aéroport since the

2022 tariff period

As a reminder, the French Transport Regulation

Authority (ART) has, as part of its decision n°2021-068 of

September 16th, 2021, for the 2022 tariff period, i.e. from

April 1st, 2022 to March 31st, 2023, approved the tariff

proposals as follows: a +1.54% increase in passenger fee, a freeze

in the unit rate of the parking fee and the landing fee

and an average increase of +0.95% for ancillary fees with the

exception of the PRM (Person with reduced mobility) fee which will

increase by +10.0% on the Paris-Charles de Gaulle

platform and +0.94% at Paris-Orly.

For the Paris Le Bourget airport, the ART

approved fee increases of +0.91% for landing fees and +19.9% for

parking fees.

By its decision n°2022-087 of December 8th,

2022, published on January 13th, 2023, the ART approved the airport

fees for Aéroports de Paris for the tariff period from April

1st, 2023, to March 31st, 2024. The approved proposal translates to

average rate stability for Paris-Charles de Gaulle and Paris-Orly,

with the changes in tariffs offsetting each other. These measures

involve the reduction of the parking fee by approximately -2.7%,

the increase of the fee for assistance to persons with reduced

mobility of +2.5% at Paris-Charles de Gaulle and of +10.0% at

Paris-Orly and a +7% increase in the fixed portion of the annual

fee for check-in counters, boarding desks and local luggage

handling for Paris-Orly and Paris-Charles de Gaulle.

For Paris-Le Bourget airport, the average

increase in fees is approximately +2.5%. This results from a +2.1%

increase in the landing fee, a modification of the

acoustic modulation coefficients for group 6 aircrafts, a freeze in

the fee for the provision of airport circulation permits

and a +2.5% increase in the parking fee. The applicable fees are

available on the company's website.

1 This document is voluntarily disclosed by

Aéroports de Paris. See article 10 of the AMF recommendation -

Guide de l'information périodique des sociétés cotées (DOC-2016-05,

amended on April 29, 2021).2 Sales from airside activities: shops,

bars & restaurants, foreign exchange & tax refund counters,

commercial lounges, VIP reception, advertising and other paid

services in the airside area, divided by the number of departing

passengers at Paris Aéroport.3 Before inter-sector eliminations,

see page 3 of this financial release for the details of the

consolidated revenue.4 Changes vs. 2022 and traffic % vs. 2019

hereabove are calculated on a like-for-like basis, i.e. excluding

traffic from Goa airport, which opened on January 5th, 2023 (see

Appendix 1).5 Group traffic includes traffic from airports operated

by Groupe ADP in full ownership (incl. partial ownership) or under

concession, receiving regular commercial passenger traffic,

excluding airports under management contract. Historical traffic

data since 2019 is available on the company's website.6 Group

traffic includes traffic from airports operated by Groupe ADP in

full ownership (including partial ownership) or under concession,

receiving regular commercial passenger traffic, excluding airports

under management contract. Historical data since 2019 is available

on the company's website.7 Changes vs. 2022 and traffic % vs. 2019

hereabove are calculated on a like-for-like basis, i.e. excluding

traffic from Goa airport, which opened on January 5th, 2023 (see

Appendix 1).8 Antananarivo & Nosy Be airports.9 Traffic with

Croatia was included in the EU ex. Schengen until March 2023. It

has been accounted for within the Schengen Area since April 2023

onwards.10 Group traffic includes traffic from airports operated by

Groupe ADP in full ownership (including partial ownership) or under

concession, receiving regular commercial passenger traffic,

excluding airports under management contract. Historical data since

2019 is available on the company's website.11 Sales from airside

activities: shops, bars & restaurants, foreign exchange &

tax refund counters, commercial lounges, VIP reception, advertising

and other paid services in the airside area, divided by the number

of departing passengers at Paris Aéroport.12 Excluding any impact

related to the tax proposed by the French government as part of

2024 finance bill for 2024 – see the press release from September

27th, 2023.13 Subject to change14 See press release of March 19th,

2023.

- Aéroports de Paris SA - 2023 first 9-months revenue

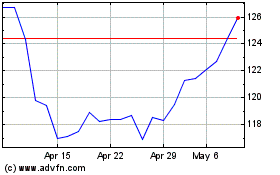

ADP Promesses (EU:ADP)

Historical Stock Chart

From Dec 2024 to Jan 2025

ADP Promesses (EU:ADP)

Historical Stock Chart

From Jan 2024 to Jan 2025