AKWEL: FIRST-HALF 2024 NET INCOME OF €20.2M

20 September 2024 - 1:45AM

UK Regulatory

AKWEL: FIRST-HALF 2024 NET INCOME OF €20.2M

Champfromier,

Thursday, September 19, 2024

FIRST-HALF 2024 NET INCOME OF

€20.2M

-

Recurring operating margin of 4.6% of sales

-

Net cash position of €106 million at June 30,

2024

AKWEL (FR0000053027, AKW, PEA eligible), a

systems supplier to the automotive and truck industries,

specializing in fluid management, mechanisms and structural parts

for electric vehicles, announces its half-year results for 2024,

approved by the Board on September 18, 2024. The audit reports are

currently being issued.

|

Consolidated data - In M€ |

30.06.2024 |

30.06.2023 |

30.06.2023

retired (1) |

% change

/ retired |

|

Sales figures |

528,8 |

533,2 |

545,8 |

-3,1 % |

|

Gross operating surplus |

49,2 |

49,0 |

49,8 |

-1,3 % |

|

Current operating income |

24,4 |

30,2 |

31,1 |

-21,6 % |

|

Operating margin before non-recurring items |

4,6 % |

5,7 % |

5,7 % |

-1.1 pts |

|

Operating income |

28,9 |

30,0 |

30,6 |

-5,4 % |

|

Net financial income |

0,0 |

(2,5) |

0,1 |

- |

|

Net income (pdg) |

20,2 |

19,2 |

22,2 |

-9,0 % |

|

Net margin |

3,8 % |

3,6 % |

4,1 % |

-0.2 pts |

(1) restated in

accordance with IAS 21 for Turkish

subsidiaries.

CONSOLIDATED SALES DOWN

-3.1%

In the first half of 2024, AKWEL sales totaled

€528.8 million, down -3.1% as reported and -2.8% on a like-for-like

basis, after a positive currency impact of €2.0 million. The

Group's sales declined more sharply in France (-13.5%) and Europe

excluding France (-1.6%), and remained more buoyant in North

America (+4.4%) and Asia (+0.5%).

LOWER OPERATING

PROFITABILITY

While the upward pressure on energy and raw

materials costs is less severe than in 2023, the ability to pass on

increases to customers proved more complex in the first half. In

addition, pressure on labor costs remains very high, particularly

in Turkey and Mexico, and is weighing on the Group's operating

profitability.

Against this backdrop, EBITDA fell by -1.3% to

€49.2 million, while operating income recurring fell by -21.6% to

€24.4 million, giving an operating margin on sales of 4.6%. After a

tax charge of €8.9 million, net income (Group share) for the first

half came to €20.2 million, giving a net margin of 3.8%.

Capital expenditure for the half-year was

€23.8m, compared with €22.9m in the first half of 2023, and working

capital remained stable. After payment of the dividend and

repayment of €11.1 million in borrowings, the Group's net cash

position, including liabilities on rental bonds, stood at €106.0

million at June 30, 2024, compared with €105.0 million at December

31.

FULL-YEAR OUTLOOK

In view of the Group's first-half performance,

the declining outlook for the global market, and over-stocking by

certain automakers, AKWEL anticipates a slight decline in sales for

the current financial year, including a drop in the SCR series

business before a scheduled end to production in 2025 (excluding

the SCR spare parts business).

In a changing automotive market, marked by many

uncertainties, the major investments made by the Group have given

AKWEL an agile industrial base with enhanced technical

capabilities. It is now in a position to adapt to the uncertain

evolution of the balance between electric and hybrid powertrains on

the one hand, and internal combustion engines on the other.

SHARE CAPITAL REDUCTION

AKWEL is also planning to cancel 190,800 of its

own shares, representing 0.7% of the share capital at

August 31, 2024, following the share buyback program

implemented in 2023.

Next press release: Q3 2024 sales, November 07, 2024,

after close of trading.

|

AKWEL is an independent, family-owned group listed on Euronext

Paris, and a systems supplier to the automotive and truck

industries, specializing in fluid management, mechanisms and

structural parts for electric vehicles. The Group draws on

first-rate industrial and technological know-how in the application

and transformation of materials (plastic, rubber, metal) and in

mechatronics integration.

Present in 20 countries on five continents, AKWEL employs 9,600

people worldwide.

Euronext Paris - Compartment B - ISIN: FR0000053027 - Reuters:

AKW.PA - Bloomberg: AKW:FP

|

|

Contact

AKWEL

Benoit Coutier - Chief Financial Officer - Tel: +33 4 50 56 98

68

EKNO - Press relations

Jean-Marc Atlan - jean-marc.atlan@ekno.fr - Tel.: +33 6 07 37 20

44

CALYPTUS - Investor

Relations

Mathieu Calleux - akwel@calyptus.net - Tel.: +33 1 53 65 68 68

- 2024-09-19_AKWEL_HY_2024_EN

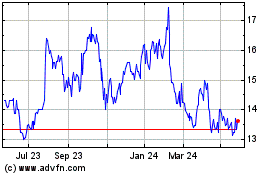

Mgi Coutier (EU:AKW)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mgi Coutier (EU:AKW)

Historical Stock Chart

From Jan 2024 to Jan 2025