- The implementation of this agreement would lead to a

significant extension of the maturity date of each of three

tranches of the loan

- Extension of the maturity date of the first tranche of the loan

(for an amount, in principal and interest, of approximately €15

million) to July 31, 2026

- Extension of the maturity date of the two other tranches to

August 2027 and October 2028, respectively

- An equitization of the loan would reduce repayments in cash

and therefore optimize the Company’s cash

- Equitization of the first tranche of the loan via the set-up of

a trust (fiducie-gestion): issuance of warrants to the trustee thus

enabling it to subscribe to Company’s shares, which would then be

sold on the market, with the net proceeds being used to repay this

tranche1

- Similar equitization of the second and third tranches, unless

the EIB decides not to do it

- The signing of the final contract relating to this agreement

in principle could take place by the end of the first quarter of

2024

Regulatory News:

CARMAT (FR0010907956, ALCAR, eligible for PEA-PME equity saving

plans), designer and developer of the world’s most advanced total

artificial heart, aiming to provide a therapeutic alternative for

people suffering from advanced biventricular heart failure (the

“Company” or “CARMAT”), today announces that it has

reached an agreement in principle with the European Investment Bank

(EIB) on the terms of repayment of the loan entered into with the

latter in December 2018, to extend its repayment schedule and limit

the cash flows associated with its repayment.

This agreement in principle covers all three tranches of the

loan and, should it be implemented, would allow CARMAT, to avoid

having to repay this loan before July 31, 20262. As a reminder, the

first tranche of the loan (total amount of c. €15 million3 in

principal and interest) was initially due to be repaid on January

31, 2024, and the second and third tranches in 2025 and 2026,

respectively.

This agreement in principle is not binding, its implementation

requiring the negotiation and execution of a final agreement by the

parties. This execution is subject to final approval by the EIB,

and to reaching a rescheduling agreement regarding the

State-Guaranteed Loans entered into by the Company with BNP Paribas

and Bpifrance, for a total of €10 million in principal (the

“Conditions Precedent”). The Company hopes to transform this

agreement in principle into a final agreement by the end of the

first quarter of 2024, it being specified that – in order to

facilitate these discussions – the Company has been granted a

standstill regarding the principal of these loans by the EIB, BNP

Paribas and Bpifrance until February 22, 2024.

Given this agreement and its cash position, the Company can

finance its activities, according to its current business plan,

until the end of January 2024.

As a reminder, in this respect the Company estimates its

financing needs to approximately €50 million until the end of

20244. The Company is therefore continuing to work very actively on

other initiatives to, in the very short term, strengthen its

capital and alleviate its cash constraints, and thus be in a

position to continue its activities beyond the end of January

2024.

Stéphane Piat, Chief Executive Officer of CARMAT,

comments: “This agreement in principle with the EIB on new

repayment terms for the loan is a positive signal for the

Company.

Subject to the fulfilment of the conditions precedent, this

agreement will enable us to avoid any repayment under this loan, at

least until July 31, 2026, and to dedicate our financial resources

to our growth over the next few years. I would like to thank the

EIB for its commitment by our side, which it has renewed today.

The Company's management and teams are more determined than ever

to continue moving forward to make Aeson® the reference therapy for

advanced biventricular heart failure, to enable CARMAT to become

the leader in this segment, and to offer a solution to the very

large number of patients who are currently at a therapeutic

impasse”.

Agreement in principle with the EIB on

new terms for the repayment of its loan

The envisaged new terms for the loan repayment

Under the terms of a contract entered into on December 17, 2018,

the Company took out a loan with the EIB for €30 million paid in 3

tranches of €10 million on January 31, 2019 (the “first

tranche”), May 4, 2020 (the “second tranche”) and

October 29, 2021 (the “third tranche” and, with the other

tranches, the “tranches”), each Tranche (principal plus

accrued interest) to be repaid 5 years after the Company received

it5.

Under the terms of an agreement in principle reached with the

EIB, and subject to the lifting of the aforementioned Conditions

Precedent, the maturity of the various tranches of the loan entered

into with the EIB would be extended as follows:

- Tranche 1: maturity extended from January

31, 2024, to July 31, 2026 - Tranche 2: maturity extended from May

4, 2025, to August 4, 2027 - Tranche 3: maturity extended from

October 29, 2026, to October 29, 2028

The amounts borrowed would continue to bear interest until their

new maturity dates at fixed rates indicated in the initial

contract. Moreover, the initial royalty agreement associated with

this loan would be modified to begin with respect to 2024 sales and

for a duration of 15 years (versus a duration of 13 years in the

initial contract).

The other terms and conditions of the loan would remain, in

substance, unchanged (this would notably be the case regarding the

events of default or regarding early repayment clauses). The loan

would remain unsecured.

Given this agreement, the amounts (principal and interest)

payable at maturity date regarding each of the tranches would be

approximately €18 million at the end of July 2026 for the first

tranche, €17 million in early August 2027 for the second tranche

and €13 million at the end of October 2028 for the third tranche

(namely an aggregate of €48m, including principal and interests, to

be reimbursed).

However, in order to reduce the cash payments due with respect

to the EIB loan, an equitization operation would be launched with

the EIB6 to enable the loan to be gradually transformed into CARMAT

shares in accordance with the terms detailed below in the paragraph

entitled “Terms of the equitization of the EIB loan”. It is

specified that if, on the new maturity date for each tranche, this

equitization did not enable the EIB to be repaid in full (principal

plus interest) for that tranche, the balance would be repaid by

CARMAT to the EIB on that date from its own cash resources.

Based on the number of CARMAT shares traded on Euronext Growth

in 2023, the expected duration of the equitization of the first

tranche (i.e. 27 months) and assuming a CARMAT share price of

€6.707, the Company anticipates that the entirety of this tranche

would be equitized by July 31, 2026, and thus that the amount it

would need to pay the EIB in cash to reimburse this tranche in full

would be nil8. Regarding the second and the third tranche, the

maturity dates being further away and the equitization periods

being potentially shorter (around 12 and 15 months, respectively),

the degree of certainty regarding the portion of each tranche that

could be equitized is lower. However, the Company thinks that it is

reasonable to estimate – based on the same assumptions – that the

second and third tranches of the loan could be equitized for up to

€10 and 13 million respectively, so that the Company would only

have to pay in cash approximately €7 million9 with respect to the

second tranche in August 2027 and less than €1 million with respect

to the third tranche in October 2028. It should however be noted,

that the EIB could unilaterally decide in due time not to proceed

with the equitization of the second and/or third tranches: in such

a case, the Company would have to repay in cash to the EIB the

total amount of each tranche (i.e. around €18 million for the

second tranche and €13 million for the third tranche), at the new

maturity date of each of these tranches.

Envisaged terms of the equitization of the loan

According to the agreement in principle reached between the

Company and the EIB’s teams, an equitization operation of the first

tranche of the loan10 would be launched to enable the loan to be

gradually transformed into CARMAT shares under the terms described

below via a trust (fiducie-gestion) created for the requirements of

this operation and managed by a trustee independent of either the

Company or the EIB (the “trust”). This equitization would

successively cover the three tranches of the loan, but the EIB

could unilaterally decide in due time not to proceed with the

equitization of the second and/or third tranches, of which the

market would be informed.

The EIB would transfer its receivable (principal plus interests)

with respect to the first tranche of the loan to the Trust11. For

technical reasons, this receivable would immediately be assigned by

the Trust to the Company to enable the latter to extinguish it by

confusion of the qualities of creditor and debtor. This assignment

of the receivable to the Company would not be the subject of a

payment in cash, but would give rise to the creation of a vendor

loan (crédit-vendeur) on the Company to the benefit of the trustee,

acting on behalf of the trust (the “vendor loan”).

The trustee, acting on behalf of the trust, would gradually

transform the above receivable into CARMAT shares by exercising the

warrants (the “Warrants”) issued to it by the Company for free,

which could only be exercised via the offsetting of the

receivable12. The shares thus issued for each exercise would then

be gradually divested on the market taking into consideration

market volumes13; and the net proceeds of their divestment would

then be paid by the trust to the EIB until the sums due to it with

respect to the first tranche had been fully repaid.

Should the net proceeds of these share divestments not enable

the EIB to be fully repaid with respect to this tranche by July 31,

2026 (the new maturity date for the first tranche), the Company

would repay the balance due from its cash resources on that date14.

A partial repayment of the sum due to the EIB by the Company with

respect to the first tranche would therefore be possible.

A mechanism identical to that used for the first tranche would

then be put in place for equitizing the second and third tranches

of the loan, unless the EIB decided to waive it, which the market

would be informed of.

Envisaged terms of the issue and exercise of the Warrants and

divestment of the underlying CARMAT shares

The Company would, on the day of the implementation of the

equitization, issue, for free and with shareholders’ preferential

subscription rights waived, a certain number of warrants to the

trustee, acting on behalf of the Trust15.

Each Warrant would give the holder the right to subscribe to one

Company share at an exercise price at least equal to the lowest

volume-weighted average daily share price over the trading sessions

during which the Trust would not have sold its Company shares among

the last fifteen consecutive trading sessions immediately preceding

their exercise date. Any warrants not exercised would become null

and void once the receivables to be equitized were fully repaid to

the EIB. The Warrants would not be admitted to trading on the

Euronext Growth market in Paris, nor on any other financial

market.

In substance, the trustee acting on behalf of the Trust would be

responsible for:

- exercising the Warrants in strict accordance with the terms

laid out in the Trust agreement and paying their exercise price by

set-off against the receivable the trustee, acting on behalf of the

Trust, holds against the Company with respect to the Vendor Loan;

then

- progressively divesting, on the market, the new shares

resulting from the exercise of the Warrants, mainly taking into

consideration market volumes. The objective of the broker appointed

to do this would be to divest a daily volume of shares limited to

12.5%16 of the daily volume of CARMAT shares traded.

The new shares issued through the exercise of the Warrants would

carry dividend rights. They would benefit from the same rights as

those attached to the Company’s existing ordinary shares and would

be admitted to trading on the Euronext Growth market in Paris on

the same listing line as existing CARMAT shares under ISIN code

FR0010907956.

The trustee would pay the EIB every two months – until each

tranche’s new maturity date (i.e. July 31, 2026 for the first

tranche, for example) or, should this date come first, until the

date on which all the sums due to the EIB with respect to the First

Tranche were paid – the net proceeds of the divestment on the

market of the Company shares issued upon exercise of the

Warrants.

Dilution associated with the envisaged Equitization

Purely for indicative purposes, assuming (i) the warrants were

exercised on the basis of an exercise price equal to the lowest

average volume-weighted Company share price observed over the last

fifteen trading sessions prior to December 31, 2023 (i.e. 5.77

euros), and (ii) that the underlying shares are sold at the closing

price of the Company's shares on the day before that date, 2.7

million warrants would have to be exercised in order to repay in

full the sums owed to the EIB under the first tranche (namely

€18m), resulting in dilution of 11% for shareholders (and 7.2

million warrants would have to be exercised (i.e. dilution of 29%)

in order to repay in full the sums owed to the EIB under the three

tranches, namely €48m). For information purposes only, assuming (i)

that the BSAs are exercised on the basis of a theoretical exercise

price equal to half of the aforementioned exercise price (i.e. 2.89

euros) and (ii) that the underlying shares are sold at the closing

price of the Company's shares on the day before that same date, 5,4

million warrants would have to be exercised in order to repay in

full the sums owed to the EIB under the first tranche (namely

€18m), resulting in dilution of 22% for shareholders (and 14.4

million warrants would have to be exercised (i.e. dilution of 58%)

in order to repay in full the sums owed to the EIB under the three

tranches, namely €48m). This dilution example does not in any way

prejudge the final number of shares to be issued, nor their

exercise or divestment price, which would be set depending on the

prevailing share price at the time of the exercising of the

Warrants and the divestment of the underlying shares.

Costs associated with the envisaged Equitization

The Company expects the costs associated with the Equitization

operation to be in line with market practice for capital increases

by listed companies in France, it being specified that the Trustee

would not receive any variable remuneration.

Conflicts of interest

The implementation of the Equitization would not create, to the

best of the Company’s knowledge, any conflicts of interest for its

executives and corporate officers.

Prospectus

The Equitization would not be subject to a prospectus requiring

an approval from the French Financial Market Authority (AMF).

This press release does not constitute a prospectus within the

meaning of Regulation (EU) 2017/1129 of the European Parliament and

of the Council of June 14, 2017, as amended, nor an offer to the

public.

Name: CARMAT

ISIN code: FR0010907956 Ticker: ALCAR

Disclaimer

This press release and the information contained herein do not

constitute an offer to sell or subscribe to, or a solicitation of

an offer to buy or subscribe to, shares in CARMAT (the “Company”)

in any country. This press release may contain forward‐looking

statements that relate to the Company’s objectives and prospects.

Such forward‐looking statements are based solely on the current

expectations and assumptions of the Company’s management and

involve risk and uncertainties including, without limitation, the

Company’s ability to successfully implement its strategy, the rate

of development of CARMAT’s production and sales, the pace and

results of ongoing and future clinical trials, new products or

technological developments introduced by competitors, changes in

regulations and risks associated with growth management. The

Company’s objectives as mentioned in this press release may not be

achieved for any of these reasons or due to other risks and

uncertainties.

The significant and specific risks pertaining to the Company are

those described in the Universal Registration Document (“Document

d’Enregistrement Universel”) filed with the Autorité des Marchés

Financiers (AMF, the French stock market authorities) under number

D. 23-0323. Readers' attention is drawn in particular to the

financing risk of the Company, whose cash runway currently extends

until end-January 2024. Readers and investors’ attention is also

drawn to the fact that other risks, unknown or not deemed to be

significant or specific, may or could exist.

Aeson® is an active implantable medical device commercially

available in the European Union and other countries that recognize

CE marking. The Aeson® total artificial heart is intended to

replace the ventricles of the native heart and is indicated as a

bridge to transplant in patients suffering from end-stage

biventricular heart failure (INTERMACS classes 1-4) who are not

amenable to maximal medical therapy or a left ventricular assist

device (LVAD) and are likely to undergo a heart transplant within

180 days of the device being implanted. The decision to implant and

the surgical procedure must be carried out by healthcare

professionals trained by the manufacturer. The documentation

(clinician manual, patient manual and alarm booklet) should be read

carefully to understand the characteristics of Aeson® and

information necessary for patient selection and the proper use of

Aeson® (contraindications, precautions, side effects). In the

United States, Aeson® is currently exclusively available within the

framework of an Early Feasibility Study authorized by the Food

& Drug Administration (FDA).

________________________________ 1 In the event that the net

proceeds from the sale of shares would not enable the EIB to be

fully repaid on the new maturity date of the first tranche, the

Company would repay the balance in cash on that date. 2 Except in

the event of default or early repayment, where the dates remain

unchanged. 3 Principal of €10m and interests of around €5m 4 To

this amount, would have to be added €15m for the first tranche of

the EIB loan if the agreement in principle was not implemented,

notably due to the non-fulfillment of a condition precedent. 5 See

the Company’s 2022 Universal Document (Section 3.1.7) for further

details on the characteristics of this loan. 6 The equitization

would cover both the loan’s principal and interests, so that the

Company – once the equitization is launched for a tranche – would

not have to pay anything with respect to that tranche before its

new maturity date (except in the event of default or early

repayment, for which the dates remain unchanged). 7 Corresponding

to CARMAT’s share price on December 31, 2023. 8 Readers’ attention

is drawn to the fact that this figure could vary significantly,

notably depending on changes in CARMAT’s share price and the number

of CARMAT shares traded on the market. 9 Readers’ attention is

drawn to the fact that this figure could vary significantly,

notably depending on changes in CARMAT’s share price and the number

of CARMAT shares traded on the market. 10 The equitization would

concern both the loan’s principal and its interest, so that the

Company – once the equitization is launched for one tranche – would

not have to pay anything with respect to that tranche before its

new maturity date (except in the event of default or early

repayment, for which the dates remain unchanged). 11 It is

envisaged that this transfer would take place at the time of, or

soon after, the contractualization of the agreement between the EIB

and CARMAT. 12 Please note that the exercise of the warrants would

not result in any funds being received by the Company as the

exercise price of the warrants would be settled by offsetting the

receivable that the trustee, acting on behalf of the trust, has on

the Company with respect to the Vendor-Loan. 13 The broker who

would be appointed for this purpose would, in particular, aim to

sell a daily volume of sales that the Company estimates would be

limited to 12.5% of the daily volume of CARMAT shares traded. The

broker would be asked to execute orders according to the best

execution policy ("careful order"), with the aim of getting as

close as possible to the VWAP of the day. 14 Within this framework,

the Company would grant, to the benefit of the EIB, an autonomous

first-call guarantee should it not have repaid, by the date

specified in the EIB Loan contract, the sums due with respect to

the First Tranche. Conversely, it should be noted that the exercise

of the warrants and sale of the underlying shares would be

interrupted should all the sums due with respect to the First

Tranche have been repaid to the EIB. 15 Regarding the first tranche

of the EIB loan, this issue would be based on the delegation of

powers granted by the Shareholders’ Meeting of January 5, 2024,

under the terms of its eleventh resolution. It is specified that

additional warrants could be issued by the Company for the Trustee,

acting on behalf of the Trust, at a later date should the initial

number of warrants issued not be sufficient to fully implement the

Equitization. 16 The percentage is not defined in the agreement in

principle between the EIB and CARMAT; it will be the subject of a

discussion as part of the contractualization of this agreement but

– base on its discussions with the EIB – the Company does not

expect this figure to exceed 12.5%.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240111373699/en/

CARMAT Stéphane Piat Chief Executive Officer

Pascale d’Arbonneau Chief Financial Officer Tel.: +33 1 39

45 64 50 contact@carmatsas.com Alize RP Press Relations

Caroline Carmagnol Tel.: +33 6 64 18 99 59

carmat@alizerp.com NewCap Financial Communication &

Investor Relations Dusan Oresansky Quentin Massé

Tel.: +33 1 44 71 94 92 carmat@newcap.eu

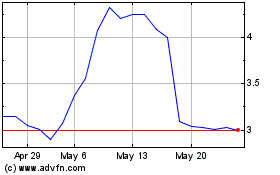

Carmat (EU:ALCAR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Carmat (EU:ALCAR)

Historical Stock Chart

From Jan 2024 to Jan 2025