- Global offering composed of a reserved offering for specialized

investors and a public offering for retail investors via the

PrimaryBid platform

- Issue price of new shares of €3.00 per share

- Closing of the PrimaryBid Offering on May 16, 2024 at 11pm

(CEST) and of the Reserved Offering on May 17, 2024 before market

opening, subject to early closing.

- Cash runway extended to mid-August 2024 post global

offering

- Residual financing needs over the next 12 months, post global

offering, estimated at €30 million

Regulatory News:

NOT FOR DISTRIBUTION IN THE UNITED STATES OF

AMERICA, SOUTH AFRICA, CANADA, AUSTRALIA OR JAPAN

CARMAT (FR0010907956, ALCAR), designer and developer of the

world’s most advanced total artificial heart, aiming to provide a

therapeutic alternative for people suffering from advanced

biventricular heart failure (the “Company” or

“CARMAT”), today announces the launch of a global offering

of approximately €15 million via the issuance of new shares

at a fixed price of €3.00 per share aimed at specialized

investors as defined below and retail investors (via the PrimaryBid

platform) (the "Global Offering").

Stéphane Piat, Chief Executive Officer of CARMAT, said:

“This new financing comes at a crucial time, as our sales are

beginning to grow significantly. The progress we have made both on

the commercial front, with in particular the training of new

centers which continue to refer an increasing number of patients to

us, and in the EFICAS study, which is getting pace, demonstrate the

strong demand for our therapy, interest in which is gradually

spreading within the medical community. Taken together, these

promising advances enable us to anticipate substantial sales growth

over the coming months, with estimated sales of around €14 million

for 2024. We are also delighted by the renewed support of our two

largest shareholders, which is a testimony of their great

confidence in our development trajectory, and by the opportunity

given to individual investors to participate in this Global

Offering. The commercial success of Aeson® is taking shape, and we

are moving closer to our ultimate goal which is to give a large

number of patients, access to our unique therapy, that, unlike

other mechanical circulatory support systems, is physiological, and

which has ultimately the potential to become the first destination

therapy technology in the field of advanced biventricular heart

failure.”

Reasons for the Global

Offering

Prior to the Global Offering, the Company's financial resources

allow it to finance its activities until the end of May 2024, and

based on its current business plan, the Company estimates its

financing needs over the next 12 months, at around €45 million.

The main purpose of the Global Offering is to strengthen

CARMAT's equity and finance its short-term working capital

requirements. The net proceeds of the Global Offering, should it be

100% completed, will enable CARMAT to continue its operations until

mid-August 2024, and in particular to pursue the development of its

production and sales, as well as its EFICAS clinical trial in

France.

CARMAT anticipates that the Global Offering will only partially

finance the Company's needs over the next 12 months, with

additional post-Global Offering financial requirements expected to

be around €30 million; and that it will therefore have to secure

additional fundings from the second half of 2024.

Recent Progress

Since the start of 2024, CARMAT has been implanting Aeson® at a

rate of around 3 implants per month.

Sales momentum is particularly strong in the EFICAS study

conducted in France, with 9 implants in the first 4 months of 2024,

in line with the target of around 30 implants in 2024. By the end

of April, 20 implants had already been performed since the start of

the study, which is now being carried out in 10 centers in France,

with interim clinical results exceeding the Company's

expectations1, confirming the study is on track for completion in

the 1st half of 2025.

On the commercial front, 6 new hospitals have already been

trained in 2024, bringing to 39 the number of centers ready to

perform Aeson® implants in 14 different countries, in line with the

target of around 50 centers trained by the end of the year. To

date, 12 of these 39 centers have already performed at least one

commercial implant of Aeson® and 25 have already referred patients

for possible implants, confirming the strong interest shown by the

medical community in the therapy.

In addition to the three countries already commercially active

(Germany, Italy and Poland), 5 others are now fully activated and

ready for implants (Switzerland, Austria, Slovenia, Greece and

Israel). CARMAT also anticipates activating several other European

countries in 2024, either through direct sales or through

distributors with whom distribution contracts have already been

signed or are in the process of being signed.

Based on these encouraging indicators, the Company anticipates

substantial gradual sales growth over the year, and sales of around

€14 million by 2024.

Terms of the Global

Offering

The Global Offering will be carried out via two distinct but

concomitant transactions:

- an offering via the issuance of new shares with waiver of

preferential subscription rights to the benefit of French or

foreign individuals, companies or investment funds investing on a

regular basis, or having invested more than €2 million during the

36 months preceding the issue in question, in the life sciences or

technology sector (in accordance with the 6th resolution of the

Company's Extraordinary General Meeting of January 5, 2024 (the

“EGM”), pursuant to Article L. 225-138 of the French

Commercial Code (the “Reserved Offering”); and

- a public offering in France of new shares aimed at retail

investors via the PrimaryBid platform, which will be carried out

according to an allocation proportional to demand within the limit

of the amount allocated to this public offer, with a reduction in

allocations in the event of excess demand where applicable,

pursuant to Article L. 225-136 of the French Commercial Code (in

accordance with the 2nd resolution of the EGM) (the “PrimaryBid

Offering”).

The amount of the Global Offering will depend exclusively on the

orders received for each of the above-mentioned components without

the possibility of reallocating the sums allocated from one to the

other. It is specified that the PrimaryBid Offering to retail

investors is ancillary to the Reserved Offering and will be capped

at the lower of (i) €8 million (excluding but including issue

premium) and (ii) 20% of the amount of the Global Offering. In any

event, the PrimaryBid Offering will not be carried out if the

capital increase under the Reserved Offering does not occur.

The price per share of the Reserved Offering will be €3.00

(representing a discount of 26.5% on CARMAT's closing price on May

15, 2024, i.e. €4.08, and a discount of 28.7% on CARMAT's average

volume-weighted average prices over the 5 trading days preceding

the determination of the issue price, i.e. €4.21). The subscription

price of the new shares under the PrimaryBid Offering will be equal

to the price of the new shares offered in the Reserved

Offering.

The definitive number of shares to be issued will be decided by

the Company's Chief Executive Officer, under and within the scope

of the sub-delegations of authority granted by the Company's Board

of Directors on the date of this press release, it being specified

that the maximum number of new shares that may be issued in

connection with the Global Offering is 20,858,530 new shares, in

accordance with the resolutions of the EGM. The definitive number

of shares to be issued will be the subject of a subsequent press

release.

The accelerated book-building process for the Reserved Offering

will begin immediately and should close before the market opens

tomorrow, subject to any early closing. The PrimaryBid Offering

will begin immediately and is expected to close at 11pm (Paris

time) today, subject to any early closing. The Company will

announce the results of the Global Offering as soon as possible

after the close of the order book, via a press release.

The Reserved Offering will be available, within the categories

of investors defined above, (i) to institutional investors in

France and outside France, with the exception of the United States,

South Africa, Canada, Australia and Japan, and (ii) to certain

institutional investors in the United States within the framework

of a private placement by the Company, and, in each case, within

the categories of investors specifically provided for in the 6th

resolution mentioned above.

Current shareholders Lohas SARL (family office of Mr. Pierre

Bastid2) and Santé Holdings SRL (family office of Dr. Antonino

Ligresti), holding respectively 11.4% and 9.9% of the share

capital, have undertaken to subscribe for an amount of €4 million

each, in the Reserved Offering.

The subscription commitments received by the Company, as

detailed above, thus represent a total amount of €8 million.

Settlement-Delivery of the new shares and their admission to

trading on the Euronext Growth® Paris multilateral trading facility

are expected to occur on May 22, 2024. The new shares will be of

the same class and fungible with the existing shares, will carry

all rights attached to the shares, and will be admitted to trading

on the Euronext Growth® Paris multilateral trading facility under

the same ISIN code FR0010907956.

Bank Degroof Petercam SA/NV and Invest Securities are acting as

global coordinators, lead managers and joint bookrunners in

connection with the Reserved Offering (together, the “Placement

Agents”). The Reserved Offering has been the subject of a

placement agreement entered into today between the Company and the

Placement Agents.

As part of the PrimaryBid Offering, investors may only be able

to subscribe via the PrimaryBid partners listed on the PrimaryBid

website (www.PrimaryBid.fr). The PrimaryBid Offering is the subject

of an engagement letter entered into between the Company and

PrimaryBid and is not subject to a placement agreement. For further

details, please visit the PrimaryBid website at

www.PrimaryBid.fr.

The Global Offering is not subject to a prospectus requiring an

approval from the French Financial Market Authority (Autorité des

Marchés Financiers) (the “AMF”)3.

The public's attention is drawn to the risk factors associated

with the Company and its activity, described in chapter 2 of the

Universal Registration Document 2023 filed with the AMF on April

30, 2024 under number D.24-0374, available free of charge on the

Company's website (www.carmatsa.com) and the AMF website

(www.amf-france.org). The occurrence of any or all of these risks

could have a negative impact on the Company's activity, financial

situation, results of operations, development or outlook.

Additionally, investors are invited to consider the risks

specific to the Global Offering: (i) the market price of the

Company's shares could fluctuate and fall below the subscription

price of the shares issued in connection with the Global Offering,

(ii) the volatility and liquidity of the Company's shares could

fluctuate significantly, (iii) divestments of the Company's shares

could occur on the market and have an unfavorable impact on the

Company's share price, (iv) the Company's shareholders could suffer

potentially significant dilution as a result of any future capital

increases made necessary by the Company's search for financing, as

well as of the forthcoming equitization4 of the loan contracted by

CARMAT with the European Investment Bank (the “EIB”), (v) as

the securities are not intended to be listed on a regulated market,

investors will not benefit from the guarantees associated with

regulated markets.

As part of the Global Offering, the Company has signed a lock-up

commitment that comes into effect on the date of signature of the

placement agreement entered into between the Company and the

Placement Agents today, and expiring on June 30, 2024, subject to

customary exceptions and to the issuance by the Company of

securities giving access to its capital in connection with the

implementation of the forthcoming “equitization” of the loan

granted by the EIB.

No lock-up commitment has been requested from the Company's

existing shareholders or from investors who have committed to

subscribe to the Reserved Offering.

This press release does not constitute a prospectus within the

meaning of Regulation (EU) 2017/1129 of the European Parliament and

of the Council of June 14, 2017, as amended, nor an offer to the

public.

***

About CARMAT

CARMAT is a French MedTech that designs, manufactures and

markets the Aeson® artificial heart. The Company’s ambition is to

make Aeson® the first alternative to a heart transplant, and thus

provide a therapeutic solution to people suffering from end-stage

biventricular heart failure, who are facing a well-known shortfall

in available human grafts. The world’s first physiological

artificial heart that is highly hemocompatible, pulsatile and

self-regulated, Aeson® could save, every year, the lives of

thousands of patients waiting for a heart transplant. The device

offers patients quality of life and mobility thanks to its

ergonomic and portable external power supply system that is

continuously connected to the implanted prosthesis. Aeson® is

commercially available as a bridge to transplant in the European

Union and other countries that recognize CE marking. Aeson® is also

currently being assessed within the framework of an Early

Feasibility Study (EFS) in the United States. Founded in 2008,

CARMAT is based in the Paris region, with its head offices located

in Vélizy-Villacoublay and its production site in Bois-d’Arcy. The

Company can rely on the talent and expertise of a multidisciplinary

team of circa 200 highly specialized people. CARMAT is listed on

the Euronext Growth market in Paris (Ticker: ALCAR / ISIN code:

FR0010907956).

For more information, please go to www.carmatsa.com and follow

us on LinkedIn.

Disclaimer

This press release does not constitute an offer to sell nor a

solicitation of an offer to buy, nor shall there be any sale of

shares in any state or jurisdiction in which such an offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

The distribution of this document may, in certain jurisdictions,

be restricted by local legislations. Persons into whose possession

this document comes are required to inform themselves about and to

observe any such potential local restrictions.

This press release is an advertisement and not a prospectus

within the meaning of Regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017 (as amended, the

“Prospectus Regulation”). Any decision to purchase shares must be

made solely on the basis of publicly available information on the

Company.

In France, the offer of Carmat shares described below will be

made in the context of (i) two capital increases reserved to one or

more specified categories of beneficiaries, pursuant to article L.

225-138 of the French commercial code and applicable regulatory

provisions and (ii) a public offering in France primarily intended

to retail investors through the PrimaryBid platform. Pursuant to

article 211-3 of the General regulations of the French financial

markets authority (Autorité des marchés financiers) (the “AMF”) and

articles 1(4) and 3 of the Prospectus Regulation, the offer of

Carmat shares will not require the publication of a prospectus

approved by the AMF.

With respect to Member States of the European Economic Area, no

action has been taken or will be taken to permit a public offering

of the securities referred to in this press release requiring the

publication of a prospectus in any Member State. Therefore, such

securities may not be and shall not be offered in any Member State

other than in accordance with the exemptions of Article 1(4) of

Prospectus Regulation or, otherwise, in cases not requiring the

publication of a prospectus under Article 3 of the Prospectus

Regulation and/or the applicable regulations in such Member

State.

This press release and the information it contains are being

distributed to and are only intended for persons who are (x)

outside the United Kingdom or (y) in the United Kingdom and are (i)

investment professionals falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005, as amended (the “Order”), (ii) high net worth entities and

other such persons falling within Article 49(2)(a) to (d) of the

Order (“high net worth companies”, “unincorporated associations”,

etc.) or (iii) other persons to whom an invitation or inducement to

participate in investment activity (within the meaning of Section

21 of the Financial Services and Market Act 2000) may otherwise

lawfully be communicated or caused to be communicated (all such

persons in (y)(i), (y)(ii) and (y)(iii) together being referred to

as “Relevant Persons”). Any invitation, offer or agreement to

subscribe, purchase or otherwise acquire securities to which this

press release relates will only be engaged with Relevant Persons.

Any person who is not a Relevant Person should not act or rely on

this press release or any of its contents.

This press release may not be distributed, directly or

indirectly, in or into the United States. This press release and

the information contained therein does not, and will not,

constitute an offer of securities for sale, nor the solicitation of

an offer to purchase, securities in the United States or any other

jurisdiction where restrictions may apply. Securities may not be

offered or sold in the United States absent registration or an

exemption from registration under the U.S. Securities Act of 1933,

as amended (the “Securities Act”). The securities of Carmat have

not been and will not be registered under the Securities Act, and

Carmat does not intend to conduct a public offering in the United

States.

MIFID II Product Governance/Target Market: solely for the

purposes of the requirements of article 9.8 of the EU Delegated

Directive 2017/593 relating to the product approval process, the

target market assessment in respect of the shares of Carmat has led

to the conclusion in relation to the type of clients criteria only

that: (i) the type of clients to whom the shares are targeted is

eligible counterparties and professional clients and retail

clients, each as defined in Directive 2014/65/EU, as amended

(“MiFID II”); and (ii) all channels for distribution of the shares

of Carmat to eligible counterparties and professional clients and

retail clients are appropriate. Any person subsequently offering,

selling or recommending the shares of Carmat (a “distributor”)

should take into consideration the type of clients assessment;

however, a distributor subject to MiFID II is responsible for

undertaking its own target market assessment in respect of the

shares of Carmat and determining appropriate distribution

channels.

The distribution of this press release may be subject to legal

or regulatory restrictions in certain jurisdictions. Any person who

comes into possession of this press release must inform him or

herself of and comply with any such restrictions.

Any decision to subscribe for or purchase the shares or other

securities of Carmat must be made solely based on information

publicly available about Carmat. Such information is not the

responsibility of Bank Degroof Petercam SA/NV and Invest Securities

and has not been independently verified by Bank Degroof Petercam

SA/NV and Invest Securities.

_________________________________ 1 For further details, please

refer to the press release dated May 6, 2024. 2 Mr. Pierre Bastid's

subscription to the Global Offering will not be made via Lohas

SARL, which he controls and which is already a CARMAT shareholder,

but via Les Bastidons, of which he is the sole shareholder. 3 The

amount of the PrimaryBid Offering will be lower than €8 million. 4

For further details on this equitization, please refer to the press

release published by the Company on March 22, 2024 and to section

3.1.7 of CARMAT's 2023 Universal Registration Document.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240516052047/en/

CARMAT Stéphane Piat Chief Executive Officer

Pascale d’Arbonneau Chief Financial Officer Tel.: +33 1

39 45 64 50 contact@carmatsas.com

Alize RP Press Relations

Caroline Carmagnol Tel.: +33 6 64 18 99 59

carmat@alizerp.com

NewCap Financial Communication & Investor

Relations

Dusan Oresansky Jérémy Digel Tel.: +33 1 44 71 94

92 carmat@newcap.eu

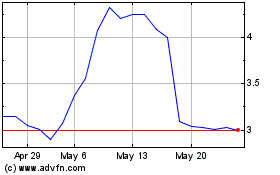

Carmat (EU:ALCAR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Carmat (EU:ALCAR)

Historical Stock Chart

From Jan 2024 to Jan 2025