Press release

Paris, April 12, 2019

First Quarter 2019 RESULTS

Total orders: + 15.2% to €471.1m

Overall backlog: + 19.8% to

€2,245.3m

Housing property portfolio: + 9.8% to 30,900

units

Financing capacity of €453.5m

(Q1 2019 vs. Q1 2018)

€471.1m (+15.2%) incl. VAT

1,771 units (-2.9%)

5.5 months vs. 5.6 months ( -0.1 months)

Key financial data

(Q1 2019 vs. Q1 2018)

Of which housing: €286.0m

(stable vs. Feb. 2018)

Gross margin:

€63.4m (19.3% of revenue)

Adjusted EBIT:

€29.6m (9.0% of revenue)

Attributable net income:

€13.7m (stable vs. Feb. 2018)

Cash net of financial debt:

€50.0m (stable vs. end 2018)

(€353.4m at end 2018)

(Q1 2019 vs. Q1 2018)

Of which Housing: €1,975.3m (+17.8%)

30,900 units (+9.8%) |

Kaufman & Broad SA announced its unaudited results for the

first quarter of the 2019 fiscal year (from

December 1, 2018 to February 28, 2019).

Nordine Hachemi, Chairman and Chief Executive Officer of Kaufman

& Broad, made the following comments:

"Kaufman & Broad's Q1 2019 results are in line

with our expectations.

Sales performance was robust, in particular thanks

to a 15.2% increase in overall orders in value terms. The increases

in the land reserve (+9.8%) and in overall Backlog (+19.8%) confirm

our strong long-term growth capacity. In particular, thanks to the

17.8% increase in Housing Backlog, we will be able to continue

closely managing our land reserve, which represents more than three

years of activity.

In addition, we have kept the take-up period for

our projects under six months, proof of our control of costs and

our careful attention to prices.

Kaufman & Broad's continued discipline is

essential in a new housing market still buoyant thanks to solid

demand, but where there should be around 115,000 new housing units

in 2019, due to exceedingly high land prices and construction costs

and an observed slowdown in building permits.

This discipline also explains our firm handle on

working capital requirement and margins, as well as a positive net

cash position of around €50m at end February 2019.

In this context, Kaufman & Broad confirms its

outlook announced last January for the full-year 2019. Total

revenue should be stable compared with 2018: the expected drop in

the first half due to the strong Commercial Property activity in

the first half of 2018 should be offset by an increase in the

second half of 2019. The gross margin ratio is expected to hold at

around 19% and the adjusted EBIT ratio should remain above

9%." |

Sales

activities

In Q1 2019, in value terms,

housing orders totaled €357.4m including VAT, a 3.5% increase

compared with 2018. In volume, 1,771 units were ordered, a -2.9%

decrease compared with 2018.

The take-up period for projects

was 5.5 months over three months, a 0.1-month improvement compared

with 2018 (5.6 months).

Housing supply, with 94% of

projects located in high-demand, low-supply areas (A, Abis, and

B1), totaled 3,261 units at the end of February 2019 (3,395 units

at end February 2018).

Breakdown of the

customer base

Orders from first-time buyers

accounted for 11% of sales in volume terms, while those from

second-time buyers accounted for 5%. Orders from investors

accounted for 30% of sales (26% for the Pinel scheme alone), while

block sales accounted for 54%, of which more than 42% is managed

housing (tourism, student, business, or senior).

In Q1 2019, the Commercial

Property segment recorded net orders of €113.8m including VAT.

Kaufman & Broad is currently

marketing or studying around 345,000 sq.m of office space and

around 70,000 sq.m of logistics and industrial space.

It is also currently building

around 40,000 sq.m in office space and 75,000 sq.m in logistics

space.

The Commercial backlog amounted to

€270.0m (excluding VAT) at the end of February 2019.

The housing backlog amounted to

€1,975.3m (excluding VAT) at February 28, 2019, i.e. 18.3 months of

business. Kaufman & Broad had 194 home programs on the market

at the same date, representing 3,261 housing units, compared with

202 programs representing 3,395 housing units at the end of

February 2018.

The housing property portfolio

represents 30,900 units, up 9.8 % compared with the end of February

2018, corresponding to potential revenue of more than three years

of business.

The group plans to launch 32 new programs in Q2 2019, including 10

in Île-de France (392 units) and 22 programs in the other

French regions (1,514 units).

Total revenue amounted to €328.1m

(excluding VAT), stable compared with 2018.

Housing revenue amounted to

€286.0m (excluding VAT), compared with €285.1m (excluding VAT) in

2018. This represents 87.2% of group revenue.

Revenue from the Apartments

business was down -1.3% compared with 2018, and amounted to €266.7m

(excluding VAT).

Commercial revenue amounted to

€41.0m (excluding VAT), compared with €40.7m (excluding VAT) in

2018.

The other businesses generated

revenue of €1.1m (excluding VAT), compared with €2.2m in 2018.

Gross margin for Q1 2019 amounted

to €63.4m, stable compared with 2018. The gross margin ratio was

19.3%, comparable to Q1 2018 (19.3%).

Current operating expenses

amounted to €36.5m (11.1% of revenue), compared with €36.0m for

2018 (11.0% of revenue).

Current operating profit amounted

to €26.9m, compared with €27.4m in 2018. The current operating

margin ratio was 8.2%, compared with 8.3% in 2018.

The group's adjusted EBIT amounted

to €29.6m in 2019 (compared with €30.6m in 2018). The adjusted EBIT

margin was 9.0% (compared with 9.3% in 2018).

Attributable net income for 2019

was €13.7m, stable compared with February 2018.

Net cash amounted to €50.0m at

February 28, 2019, stable compared with the end of 2018. Cash

assets (available cash and investment securities) amounted to

€203.5m, compared with €253.4m at November 30, 2018.

The group's financing capacity was

€453.5m (€353.4m at November 30, 2018). It was reinforced by a

€250m syndicated credit with an initial maturity of 5 years, which

will replace the existing Senior and RCF credits worth €50m and

€100m respectively. By using this corporate line of credit, the

company can extend the maturity of its financial resources and

improve their cost, while becoming more flexible with regard to

future needs and opportunities, as a complement to its available

cash.

For the first time in the real

estate development sector, this facility incorporates a positive

incentive linked to several CSR indicators, a testament to the

company's concern for the environment.

The working capital requirement

amounted to €133.9m (8.6% of revenue), compared with €110.8m at

November 30, 2018 (7.1% of revenue), and €133.0m at the end of

February 2018 (9.3% of revenue). The tight control over working

capital primarily relies on the very short take-up period for the

group's programs.

At the General Meeting of

Shareholders on May 2, 2019, Kaufman & Broad SA's Board of

Directors will propose the payment of a dividend of €2.50 per

share, an increase of 19% compared with the dividend paid in 2018

for 2017 (€2.10 per share). A proposal will also be made to this

Shareholders' Meeting to give Kaufman & Broad's shareholders

the option to receive this dividend in cash, in shares, or in cash

and shares.

Over the 2019 financial year,

total revenue should be stable compared with 2018: the expected

drop in the first half due to the strong Commercial Property

activity in the first half of 2018 should be offset by an increase

in the second half. The gross margin ratio is expected to hold at

around 19% and the adjusted EBIT ratio should remain above 9%.

This press release

is available at www.kaufmanbroad.fr

Contacts

Chief Financial

Officer

Bruno Coche

01 41 43 44 73

infos-invest@ketb.com

|

Press Relations |

Media relations: Hopscotch Capital: Valerie Sicard

01 58 65 00 77 / k&b@hopscotchcapital.fr

Kaufman & Broad: Emmeline Cacitti

06 72 42 66 24 / ecacitti@ketb.com |

About Kaufman

& Broad - Kaufman & Broad has been designing,

developing, building, and selling single-family homes in

communities, apartments, and offices on behalf of third parties for

more than 50 years. Kaufman & Broad is one of the leading

French developers-builders due to the combination of its size and

profitability, and the strength of its brand.

The Kaufman &

Broad Registration Document was filed with the French Financial

Markets Authority ("AMF") under No. D.19-0228 on March 29,

2019. It is available on the AMF

(www.amf-france.org) and Kaufman & Broad

(www.kaufmanbroad.fr) websites. It contains a

detailed description of Kaufman & Broad's business activities,

results, and outlook, as well as the associated risk factors.

Kaufman & Broad specifically draws attention to the risk

factors set out in Chapter 1.2 of the Registration Document. The

occurrence of one or more of these risks might have a material

adverse impact on the Kaufman & Broad group's business

activities, net assets, financial position, results, and outlook,

as well as on the price of Kaufman & Broad's

shares.

This press release does not amount to, and cannot

be construed as amounting to a public offering, a sale offer or a

subscript ion offer, or as intended to seek a purchase or

subscription order in any country.

Backlog: In

the case of sales before completion (VEFA), this covers orders for

housing units that have not been delivered, and for which a

notarized deed of sale has not yet been signed, and orders for

housing units that have not been delivered for which a notarized

deed of sale has been signed for the portion not yet recorded in

revenue (in the case of a program for which an advance of 30% has

been received, 30% of the revenue from a housing unit for which a

notarized deal has been signed is recognized as revenue, while 70%

is included in the backlog). The backlog is a summary at a given

time, which enables the revenue yet to be recognized over the

coming months to be estimated, thus supporting the group's

forecasts - with the proviso that there is an element of

uncertainty in the transformation of the backlog into revenue,

particularly for orders that have not yet been signed.

Lease-before-completion (BEFA): a

lease-before-completion involves a customer leasing a building

before it is built or redeveloped.

Financing

capacity: corresponds to cash assets plus lines of credit not

yet drawn

Take-up

period: The take-up period is the number of months required for

the available housing units to be sold, if sales continue at the

same rate as in previous months, or the number of housing units

(available supply) per quarter divided by the orders for the

previous quarter, and divided by three in turn.

Adjusted

EBIT: corresponds to income from current operations restated

for capitalized "IAS 23 revised" borrowing costs, which are

deducted from gross margin.

EHU: The EHUs

(Equivalent Housing Units) are a direct reflection of business

volumes. The number of EHUs is a function of multiplying

(i) the number of housing units of a given program for which

notarized sales deeds have been signed by (ii) the ratio

between the group's property expenses and construction expenses

incurred on said program and the total expense budget for said

program.

Gross margin:

corresponds to revenue less cost of sales. The cost of sales is

made up of the price of land and any related costs plus the cost of

construction.

Property

supply: it is represented by the total inventory of properties

available for sale as of the date in question, i.e. all unordered

housing units as of this date (minus the programs that have not

entered the marketing phase).

Property

portfolio: represents all of the land for which any commitment

(contract of sale, etc.) has been signed.

Orders:

measured in volume (units) and in value terms; orders reflect the

group's sales activity. Orders are recognized in revenue based on

the time necessary for the "conversion" of an order into a signed

and notarized deed, which is the point at which income is

generated. In addition, in the case of multi-occupancy housing

programs that include mixed-use buildings (apartments, business

premises, retail space, and offices), all of the floor space is

converted into housing unit equivalents.

Take-up rate:

The take-up rate represents the percentage of the initial inventory

that is sold on a monthly basis for a property program (sales per

month divided by the initial inventory), i.e. net monthly orders

divided by the ratio between the opening inventory and the closing

inventory, divided by two.

Units: Units

are the number of housing units or equivalent housing units (for

mixed projects) for a given project. The number of equivalent

housing units is calculated as a ratio between the surface area by

type (business premises, retail space, or offices) and the average

surface area of the housing units previously obtained.

Sale-before-completion (VEFA): a sale-before-completion

is an agreement by which the vendor transfers its rights to the

land and its ownership of the existing buildings to the purchaser

immediately. The future structures will become the purchaser's

property as they are completed: the purchaser is required to pay

the price of these structures as the works progress. The seller

retains the powers of the Project Owner until the acceptance of the

work.

NOTES

Key consolidated

data

| In € million |

Q1

2019 |

Q1

2018 |

|

Revenue |

328.1 |

328.0 |

|

|

286.0 |

285.1 |

|

|

41.0 |

40.7 |

|

|

1.1 |

2.2 |

| |

|

|

| Gross margin |

63.4 |

63.4 |

| Gross

margin ratio (%) |

19.3% |

19.3% |

| Current operating

income |

26.9 |

27.4 |

| Current operating margin (%) |

8.2% |

8.3% |

| Adjusted EBIT* |

29.6 |

30.6 |

| Adjusted EBIT margin (%) |

9.0% |

9.3% |

| Attributable net

income |

13.7 |

13.7 |

|

Attributable net earnings per share (€/share)** |

0.63 |

0.65 |

* Adjusted EBIT corresponds to current operating profit

restated for capitalized "IAS 23 revised" borrowing costs, which

are deducted from the gross margin.

**Based on the number of

shares that make up Kaufman & Broad S.A.'s share capital, i.e.

21,073,535 shares at February 28, 2018 and 21,864,074 shares at

February 28, 2019

Consolidated

income statement*

| € thousands |

Q1

2019 |

Q1

2018 |

| Revenue |

328,074 |

328,031 |

| Cost of sales |

(264,664) |

(264,666) |

| Gross

margin |

63,409 |

63,365 |

| Sales expenses |

(7,597) |

(8,617) |

| Administrative

expenses |

(15,528) |

(14,768) |

| Technical and customer

service expenses |

(5,407) |

(5,376) |

| Development and

program expenses |

(8,017) |

(7,218) |

| Current operating income |

26,861 |

27,386 |

| Other non-recurring

income and expenses |

- |

- |

| Operating income |

26,861 |

27,386 |

| Cost of net financial

debt |

(1,057) |

(1,910) |

| Other financial income

and expense |

- |

- |

| Income tax |

(8,970) |

(7,146) |

| Share of income (loss)

of equity affiliates and joint ventures |

960 |

769 |

| Net

income of the consolidated entity |

17,794 |

19,099 |

| Minority

interests |

4,048 |

5,352 |

| Attributable net income |

13,747 |

13,747 |

*Not approved by the Board of Directors and not

audited.

Consolidated

balance sheet*

| € thousands |

February 28,

2019 |

November 30,

2018 |

|

| ASSETS |

|

|

|

|

Goodwill |

68,661 |

68,661 |

|

| Intangible assets |

90,473 |

90,017 |

|

| Property, plant and

equipment |

8,357 |

8,407 |

|

| Equity affiliates and

joint ventures |

6,764 |

6,185 |

|

| Other non-current

financial assets |

1,464 |

1,826 |

|

| Deferred tax

assets |

4,233 |

4,233 |

|

| Non-current assets |

179,953 |

179,330 |

|

| Inventories |

435,327 |

396,786 |

|

| Accounts

receivable |

437,846 |

406,309 |

|

| Other receivables |

170,559 |

172,172 |

|

| Cash and cash

equivalents |

203,541 |

253,358 |

|

| Prepaid expenses |

1,437 |

1,100 |

|

| Current assets |

1,248,711 |

1,229,726 |

|

| TOTAL ASSETS |

1,428,664 |

1,409,056 |

|

| |

|

|

|

| |

February 28,

2019 |

November 30,

2018 |

|

| LIABILITIES |

|

|

|

| Share capital |

5,685 |

5,685 |

|

| Additional paid-in

capital |

240,172 |

168,816 |

|

| Attributable net

income |

13,747 |

72,972 |

|

| Attributable shareholders' equity |

259,603 |

247,473 |

|

| Minority

interests |

16,532 |

14,282 |

|

| Shareholders' equity |

276,135 |

261,755 |

|

| Non-current

provisions |

33,769 |

33,402 |

|

| Non-current financial

liabilities (maturing in > 1 year) |

148,654 |

199,652 |

|

| Deferred tax

liability |

51,769 |

42,692 |

|

| Non-current liabilities |

234,192 |

275,746 |

|

| Current

provisions |

2,193 |

2,265 |

|

| Other current

financial liabilities (maturing in <

1 year) |

4,868 |

3,705 |

|

| Accounts payable |

754,374 |

705,958 |

|

| Other payables |

155,483 |

159,199 |

|

| Prepaid

income |

1,418 |

428 |

|

| Current liabilities |

918,337 |

871,555 |

|

| TOTAL LIABILITIES |

1,428,664 |

1,409,056 |

|

*Not approved by the Board of Directors and not

audited

| Housing |

Q1

2019 |

Q1

2018 |

| |

|

|

| Revenue (€m, excluding

VAT) |

286.0 |

285.1 |

|

|

266.7 |

270.1 |

|

|

19.8 |

15.0 |

| |

|

|

| Deliveries (EHUs) |

1,473 |

1,709 |

|

|

1,408 |

1,647 |

|

|

65 |

62 |

| |

|

|

| Net orders

(number) |

1,771 |

1,824 |

|

|

1,675 |

1,774 |

|

|

96 |

50 |

| |

|

|

| Net orders (€ million,

including VAT) |

357.4 |

345.3 |

|

|

325.5 |

328.5 |

|

|

31.8 |

16.8 |

| |

|

|

| Property supply at the

end of the period (in number) |

3,261 |

3,395 |

| |

|

|

| End-of-period

backlog |

|

|

|

|

1,975.3 |

1,677.2 |

|

|

1,846.6 |

1,599.7 |

|

|

128.6 |

77.5 |

|

|

18.3 |

16.1 |

| |

|

|

|

End-of-period land reserve (number) |

30,900 |

28,138 |

| Commercial |

Q1

2019 |

Q1

2018 |

| |

|

|

| Revenue (€m, excluding

VAT) |

41.0 |

40.7 |

| Net orders (€ million,

including VAT) |

113.8 |

63.5 |

|

End-of-period backlog (€ million, excluding VAT) |

270.0 |

194.2 |

K&B press release Q1

2019

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Kaufman & Broad SA via Globenewswire

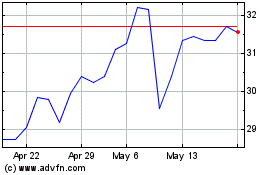

Kaufman and Broad (EU:KOF)

Historical Stock Chart

From Feb 2025 to Mar 2025

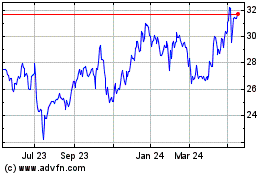

Kaufman and Broad (EU:KOF)

Historical Stock Chart

From Mar 2024 to Mar 2025