First Quarter 2024 Revenue

Very strong start to the

year

Sustaining momentum

Gaining market share

April 11, 2024

- Sustained momentum: Q1 2024

organic growth at +5.3%, above expectations

- Solid performance across

all regions:

– Continued strong growth in

the U.S. at +5% driven by data and

media– Europe at

+6% on top of a strong

comparable in Q1 2023– China

accelerating at +7%

-

8th consecutive

quarter delivering highest growth in the

sector1, leading

to market share gains

- Confirming 2024 guidance,

continuing to grow twice as fast as the industry

average1

Q1 2024

|

|

|

|

|

€3,711m |

|

|

€3,230m |

|

|

+5.3% |

|

|

+4.9% |

|

|

|

1 Based on consensus.

Arthur Sadoun, Chairman and CEO of Publicis Groupe:

“Publicis had a very strong start to 2024,

sustaining growth momentum despite ongoing macroeconomic

tensions.

We accelerated on our organic growth this

quarter, delivering +5.3%, ahead of expectations.

There were three clear drivers of this

performance.

First, our ability to capture a disproportionate

part of the increasing demand for data-led marketing

transformation, boosted by AI, in a soon-to-be-cookieless world.

This translated into the double-digit growth of our combined

Epsilon and Publicis Media offer.

Second, continued new business tailwinds, coming

after we topped the league tables once again, and as we have for

the past five years.

Last but not least, the impact of a clear

rebound in the tech sector, where we saw double-digit growth this

quarter.

Looking at the rest of our business, Publicis

Sapient recorded sequential improvement, with positive growth in

the U.S. despite continued client cautiousness affecting the entire

IT consultancy sector.

Creative further showed its resilience, posting

single-digit growth driven by new business and

production.

All of our regions performed well, with the

notable acceleration of Asia fueled by strong growth in

China. After

extracting ourselves from the pack in 2023, we clearly carried that

momentum into Q1. We expect this to be our 8th consecutive quarter

of delivering the highest growth in the industry, leading to

material market share gains.

Now, looking at the rest of the year, we are

focused on maintaining this dynamic.

In what is a still-challenging environment, our

leadership in personalization at scale, our new business wins and

our platform organization, make us confident in confirming our 2024

guidance.

We once again expect to grow twice as fast as

the industry average, while delivering the best financial

KPIs.

I would like to take this opportunity to thank

our clients for their trust and our people for their outstanding

efforts.”

* *

*

NET REVENUE IN Q1 2024

Publicis Groupe’s net revenue in Q1 2024 was

3,230 million euros, up +4.9% from 3,079 million euros in 2023.

Exchange rates had a negative impact of 29 million euros.

Acquisitions, net of disposals, accounted for an increase in net

revenue of 18 million euros. Organic growth reached +5.3%.

Breakdown of Q1 2024 Net revenue by region

|

EUR |

Net revenue |

Reported |

Organic |

|

million |

Q1 2024 |

Q1 2023 |

Growth |

Growth |

| North

America |

2,008 |

1,938 |

+3.6% |

+4.8% |

| Europe |

793 |

743 |

+6.7% |

+6.1% |

| Asia

Pacific |

266 |

250 |

+6.4% |

+6.2% |

| Middle East

& Africa |

90 |

88 |

+2.3% |

+4.0% |

|

Latin America |

73 |

60 |

+21.7% |

+7.8% |

|

Total |

3,230 |

3,079 |

+4.9% |

+5.3% |

North America net revenue was

up +3.6% on a reported basis in Q1 2024, including a negative

impact of the U.S. dollar to Euro exchange rate. Organic growth was

at +4.8%. In the U.S., organic growth came at

+5.0%, with Media and Epsilon accretive this quarter, confirming

the strength of our integrated offer in this geography where our

model is the most advanced. Media posted a double-digit increase,

and Epsilon’s high-single-digit growth was fueled by Digital Media

and Data activities. Publicis Sapient grew +2.2% organically after

+8% in Q1 last year, sequentially improving from Q4 2023. Creative

activities were broadly stable.

Net revenue in Europe was up by

+6.7% on a reported basis and +6.1% organically. Organic growth in

the U.K. was slightly positive, with double-digit

growth in Media and Creative offsetting a negative Publicis Sapient

which was up against a high comparable of very strong growth in Q1

2023. Organic growth in France was +9.4% and

largely driven by high-single digit growth in Media and

double-digit growth at Publicis Sapient again this quarter.

Germany posted +4.9% organic growth led by

double-digit growth in Media. Central & Eastern

Europe was very strong, at +21.2% organically, benefitting

from global wins ramping up in Media and Production.

Net revenue in Asia Pacific

recorded +6.4% growth on a reported basis and +6.2% on an organic

basis. China posted a strong performance at +6.7%

organically due to new business wins in Media. South-East

Asia posted a double-digit performance fueled by Malaysia,

Indonesia, as well as Thailand. Australia posted

broadly stable organic growth on the quarter.

In Middle East & Africa,

net revenue was up +2.3% on a reported basis and +4.0% organically.

Organic growth was largely driven by Creative activities, primarily

in the UAE.

Net revenue in Latin America

was up +21.7% on a reported basis, and +7.8% organically, with

growth driven by both Media and Creative, notably in Brazil, Mexico

and Chile.

Breakdown of net revenue at March 31, 2024 by

sector

On

the basis of 3,033 clients representing 92% of Groupe net

revenue.

NET DEBT AND LIQUIDITY

Net debt totaled 445 million euros at the end of

March 2024 compared with a net cash position of 909 million euros

at year-end 2023, reflecting the seasonality in the activity. Net

debt was 442 million euros at the end of March 2023. The Groupe’s

last twelve-month average net debt amounted to 383 million euros at

the end of March 2024, down from 563 million euros in March

2023.

The Groupe’s liquidity position remains very

solid at 4.9 billion euros.

ACQUISITIONS

On January 18, 2024, Publicis

Groupe Singapore announced the acquisition of AKA

Asia, one of Singapore's leading integrated communications

agencies. Founded in 2009, AKA is a highly respected player in the

South-East Asian market, known for delivering award-winning and

innovative communication campaigns. The acquisition will expand and

diversify Publicis Groupe's capabilities in the region, while

bolstering the Groupe's strategic communications, PR and influence

offering. AKA will join the Groupe's regional Influence

practice.

On March 12, 2024, Publicis

Sapient announced the acquisition of Spinnaker

SCA, a leading supply chain services firm that provides

end-to-end supply chain strategy, planning and execution consulting

services. Founded in 2002 and based in Boulder in the U.S.,

Spinnaker SCA will become part of Publicis Sapient and bring core

capabilities and skill sets including advanced AI and ML analytics,

supply chain digital twins, warehouse and transportation management

and expanded digital services. Spinnaker SCA will further enable

Publicis Sapient to offer solutions for clients to optimize their

agile supply chains as part of their digital business

transformation.

GROUPE AI STRATEGY

On January 25, 2024, the Groupe introduced

CoreAI to infuse a layer of AI across the Groupe’s

platform organization to connect its enterprise knowledge under a

single entity. In doing so, the Groupe announced its ambition to

become the industry’s first AI-powered Intelligent System.

Sitting at the center of the Groupe, CoreAI

unifies and standardizes Publicis’ best-in-class proprietary data

and combines this with 35 years of business transformation data and

coding owned exclusively by Publicis Sapient. CoreAI makes these

assets shareable and accessible to everyone across the Groupe,

empowering them across five key disciplines: Insight, Media,

Creative and Production, Software and Operations.

Publicis plans to invest 300 million euros in

this strategy over the next three years. In 2024, the Groupe

anticipates an investment of 100 million euros with 50% dedicated

to its people, focused on upskilling, training and recruitment, and

50% to technology, through licenses, IT software and cloud

infrastructure. This investment will be fully accounted for in the

P&L. It will have no dilutive impact on the Groupe’s operating

margin in 2024 as it will be funded by internal efficiencies. It

will be slightly accretive on the operating margin in 2025.

The roll out of CoreAI’s capabilities will

continue iteratively throughout the year.

OUTLOOK

Despite ongoing macroeconomic uncertainties, and

thanks to the strength of its unique model, Publicis is confident

in its ability to deliver on all of the 2024 targets set at its

full year 2023 earnings, with organic growth between +4% to

+5%.

As detailed in February, the +4%

is rock solid and factors in continued

delays in business transformation projects, more reductions in

advertising spend and a cautious stance on year-end budget

adjustments. The higher end of the guidance at +5% is

within reach assuming a faster ramp-up of clients resuming

spend on digital business transformation projects and fewer cuts in

classic advertising.

In Q2 2024, the Groupe expects solid organic

growth within the full year range.

The Groupe also confirms its 2024 guidance on

financial ratios, which will be maintained at the industry-leading

levels, of 18% operating margin rate, including

the Groupe’s Opex investment of 100 million euros in its AI plan,

and between 1.8 and 1.9 billion euros free cash

flow before change in working capital.

Disclaimer

Certain information contained in this document,

other than historical information, may constitute forward-looking

statements or unaudited financial forecasts. These

forward-looking statements and forecasts are subject to risks and

uncertainties that could cause actual results to differ materially

from those projected. These forward-looking statements and

forecasts are presented at the date of this document and, other

than as required by applicable law, Publicis Groupe does not assume

any obligation to update them to reflect new information or events

or for any other reason. Publicis Groupe urges you to carefully

consider the risk factors that may affect its business, as set out

in the Universal Registration Document filed with the French

Autorité des Marchés Financiers (AMF) and which is available on the

website of Publicis Groupe (www.publicisgroupe.com), including an

unfavorable economic climate, a highly competitive industry,

risks associated with the confidentiality of personal data, the

Groupe’s business dependence on its management and employees, risks

associated with mergers and acquisitions, risks of IT system

failures and cybercrime, the possibility that our clients could

seek to terminate their contracts with us on short notice, risks

associated with the reorganization of the Groupe, risks of

litigation, governmental, legal and arbitration proceedings, risks

associated with the Groupe’s financial rating and exposure to

liquidity risks.

About Publicis Groupe - The Power of One

Publicis Groupe [Euronext Paris FR0000130577,

CAC 40] is a global leader in communication. The Groupe is

positioned at every step of the value chain, from consulting to

execution, combining marketing transformation and digital business

transformation. Publicis Groupe is a privileged partner in its

clients’ transformation to enhance personalization at scale. The

Groupe relies on ten expertise concentrated within four main

activities: Communication, Media, Data and Technology. Through a

unified and fluid organization, its clients have a facilitated

access to all its expertise in every market. Present in over 100

countries, Publicis Groupe employs around 103,000 professionals.

www.publicisgroupe.com | Twitter: @PublicisGroupe | Facebook |

LinkedIn | YouTube | Viva la Difference!

|

ContactsPublicis Groupe

|

|

Amy Hadfield |

Corporate Communications |

+ 33 1 44 43 70 75 |

amy.hadfield@publicisgroupe.com |

|

Jean-Michel Bonamy |

Investor Relations |

+ 33 1 44 43 74 88 |

jean-michel.bonamy@publicisgroupe.com |

|

Lorène Fleury |

Investor Relations |

+ 33 1 44 43 57 24 |

lorene.fleury@publicisgroupe.com |

|

Maxine Miller |

Investor Relations |

+ 33 1 44 43 74 21 |

maxine.miller@publicisgroupe.com |

Appendices

Net revenue: organic growth

calculation

|

(million euro) |

Q1 |

|

Impact of currencyat end March

2024(million euro) |

|

2023 net revenue |

3,079 |

|

GBP (2) |

9 |

|

Currency impact (2) |

(29) |

|

USD (2) |

(22) |

|

2023 net revenue at 2024 exchange rates (a) |

3,050 |

|

Others |

(16) |

|

2024 net revenue before acquisition impact (b) |

3,212 |

|

Total |

(29) |

|

Net revenue from acquisitions (1) |

18 |

|

|

|

|

2024 net revenue |

3,230 |

|

|

|

|

Organic growth (b/a) |

+5.3% |

|

|

|

(1) Acquisitions (Practia, Corra, AKA, ARBH),

net of disposals(2) EUR = USD 1.086 on average in

Q1 2024 vs. USD 1.073 on average in Q1 2023EUR = GBP 0.856 on

average in Q1 2024 vs. GBP 0.883 on average in Q1 2023

Definitions

Net revenue or Revenue less pass-through

costs: Pass-through costs mainly concern production and

media activities, as well as various expenses incumbent on clients.

These items that can be re-billed to clients do not come within the

scope of assessment of operations, net revenue is a more relevant

indicator to measure the operational performance of the Groupe’s

activities.

Organic growth: Change in net

revenue excluding the impact of acquisitions, disposals and

currencies.

Net Debt (or financial net

debt): Sum of long and short financial debt and associated

derivatives, net of treasury and cash equivalents, excluding lease

liability since 1st January 2018.

Average net debt: Average of

monthly net debt at end of month.

Find the press release here

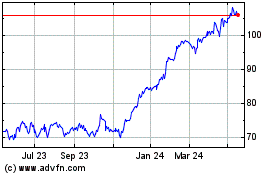

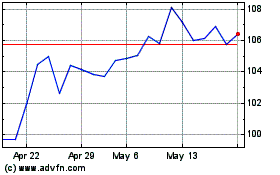

Publicis Groupe (EU:PUB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Publicis Groupe (EU:PUB)

Historical Stock Chart

From Feb 2024 to Feb 2025